Frequent readers at WattClarity ® will have noted an increasing number of articles being written under the “Energy Literacy” topic. It’s an increasing focus, in the interests of helping to tame Villain #4.

Today we’ve also posted this linked Beginner’s-Level Guide to how Dispatch Works in the NEM in this category. In developing that post, recognised the need to provide some context – acknowledging that different approaches could be adopted in the dispatch process (and indeed have been over prior decades).

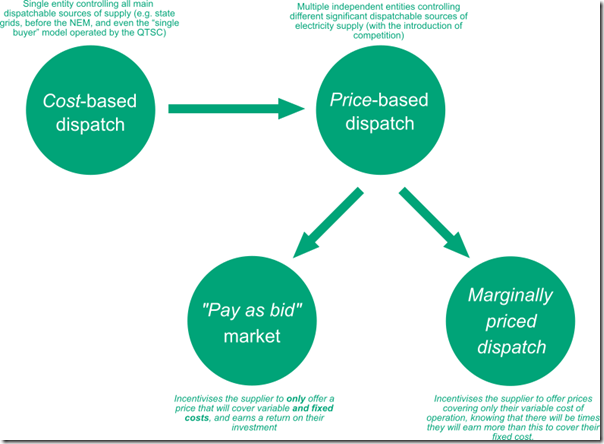

(A) “Cost-based Dispatch”, or “Price-based Dispatch”

Because of the need to balance supply and demand in real time to keep system frequency stable (at 50Hz in the NEM – see here for an explanation) there has always existed some form of centralised dispatch across our electricity grid(s) – even prior to the introduction of the National Electricity Market. Even with the (pending) explosion in the rate of adoption of energy storage mechanisms of various forms (battery storage, pumped storage hydro, or other) there will still remain the need for some form of coordinated control – which, under most future scenarios, will be a role retained by some central organisation.

Whilst the need has always been present, what’s changed is just some aspects of how the dispatch process works, starting with a shift from “cost-based” to “price-based”:

| Cost-based dispatch | Price-based dispatch |

| Prior to the introduction of the NEM, the Central Dispatcher had visibility of the cost structures of all the significant sources of electricity supply.

For instance, in the days of the Queensland Electricity Commission (QEC) all significant generators were owned by the organisation – hence the Central Dispatcher (being the QEC) had full visibility of each generator’s cost structure (particularly its short-run marginal cost), and could dispatch plant taking these into account. Even for a short period after the unbundling of the QEC had commenced (from 1995-1997), a Single Buyer (the QTSC) operated, and could use a cost-based dispatch model as it had full visibility of the costs of supply from the different generators that existed at the time (AUSTA Electric, and some independents, via the commercial contracts for supply). |

With the introduction of the NEM at the end of 1998 (and with interim markets beforehand) a separation was established between the Central Dispatcher and the individual generation entities established.

Under such an arrangement, the Central Dispatcher could not have full visibility of a generator’s cost structure. Rather, a method of price-based dispatch was established. Economic theory describes suppliers making offers* to supply and consumers making bids to consume. The intersection of these offers and bids will generally play a role in setting the price. * Unfortunately to add to general confusion, in the NEM (and in other electricity markets) the term “bid” is used to describe a generator’s offer to supply. |

The move from cost-based dispatch to price-based dispatch with the advent of the market is sometimes overlooked in discussions about generator bidding:

1) A generators bids in the market do not need to reflect their cost to supply,

2) Costs will play a significant (but not the sole) role in each supplier determining how to bid in a market.

3) So long as there is sufficient competitive tension, market forces will provide an incentive for participants to drive down their costs of operations. That is, for instance, why average wholesale prices in the NEM remained relatively steady for the first 16 years (i.e. declined in inflation-adjusted terms), up until the effect of the train wreck started to be felt around January 2015.

.

(B) Different approaches to “Price-based Dispatch”

Under a competitive market, there are generally two different types of approaches to how generators might be paid:

Option 1 = under a “pay as bid” market, generators offers to supply (if accepted) will be paid only what they bid; whereas

Option 2 = under a “marginally priced dispatch” market, generator’s offers to supply (if accepted) will be paid what they bid – and in some cases more, in cases where higher priced bids were the marginal bid.

It’s important to understand that, whilst both approaches could work, looking at bid prices offered under one type of dispatch regime and assuming that they would persist under the other is a newbie’s analytical error.

The NEM operates with marginal-bid based pricing, so it’s important to recognise the flaws in two common criticisms we’ve seen over the years in relation to dispatch (and pricing) outcomes in the NEM:

| What’s overlooked | What this means |

| Some people overlook that generators are not required, under the rules, to make offers that reflect their costs of operations (though economic theory suggests that there are incentives for them to do so) | If this is overlooked, it is easy to attribute blame to generators that are seen to have bids that don’t reflect what people assume their costs are to be.

A smaller subset of people understands the complexities of discerning what a generator’s costs actually are, given that must be confidential in a competitive market environment. This AER working paper from June 2018 contains some considerations of these difficulties. |

| Under this economic theory, generators have an incentive to bid based on their short-run marginal cost (i.e. only their variable cost), knowing that contributions to their fixed costs will also occur each time the spot price settles above the price they bid | Others might look at a generator being paid above what it bid and infer that this premium to bid price represents an inefficiency or profit (on an implicit assumption that what a generator bids reflects all of its costs, and a return on its investments). |

.

(C) Summing this up

Given the above, this means that no-one has full visibility, or knowledge, of all generator’s cost structures (though this does not stop us all guessing at times). This is the case for the AEMO, the AER, Government Departments, competitive generators, consultants, commentators and others (despite how certain they might appear at the time they are making some prognosis or other).

This fact is one of the reasons why the ACCC’s findings and conclusions in its July 2018 report “Restoring electricity affordability & Australia’s competitive advantage” are particularly important – because the ACCC is alone in being able to compel participants to reveal their cost structures (a right that the ACCC rightly recognised comes with significant responsibility to ensure that such details are treated confidentially in their reporting).

These permutations are illustrated here:

Image #1 –Different approaches to dispatch

For more of a background to electricity markets in general terms, there are many resources online such as this Wikipedia page.

Leave a comment