The very fast FCAS markets (raise and lower) started on 9 October 2023.

These markets provide a way for AEMO to procure contingency raise and lower services that can be delivered within 1 second.

There is more background to refresh ourselves on what Very Fast FCAS is, and why was it introduced in Very Fast Raise and Lower FCAS markets to start on 9 October 2023

Late in 2023 we looked back on the early days of the two new FCAS markets. https://wattclarity.com.au/articles/2023/12/very-fast-fcas-markets-continue-to-grow/

This article, being one year later, updates the analysis.

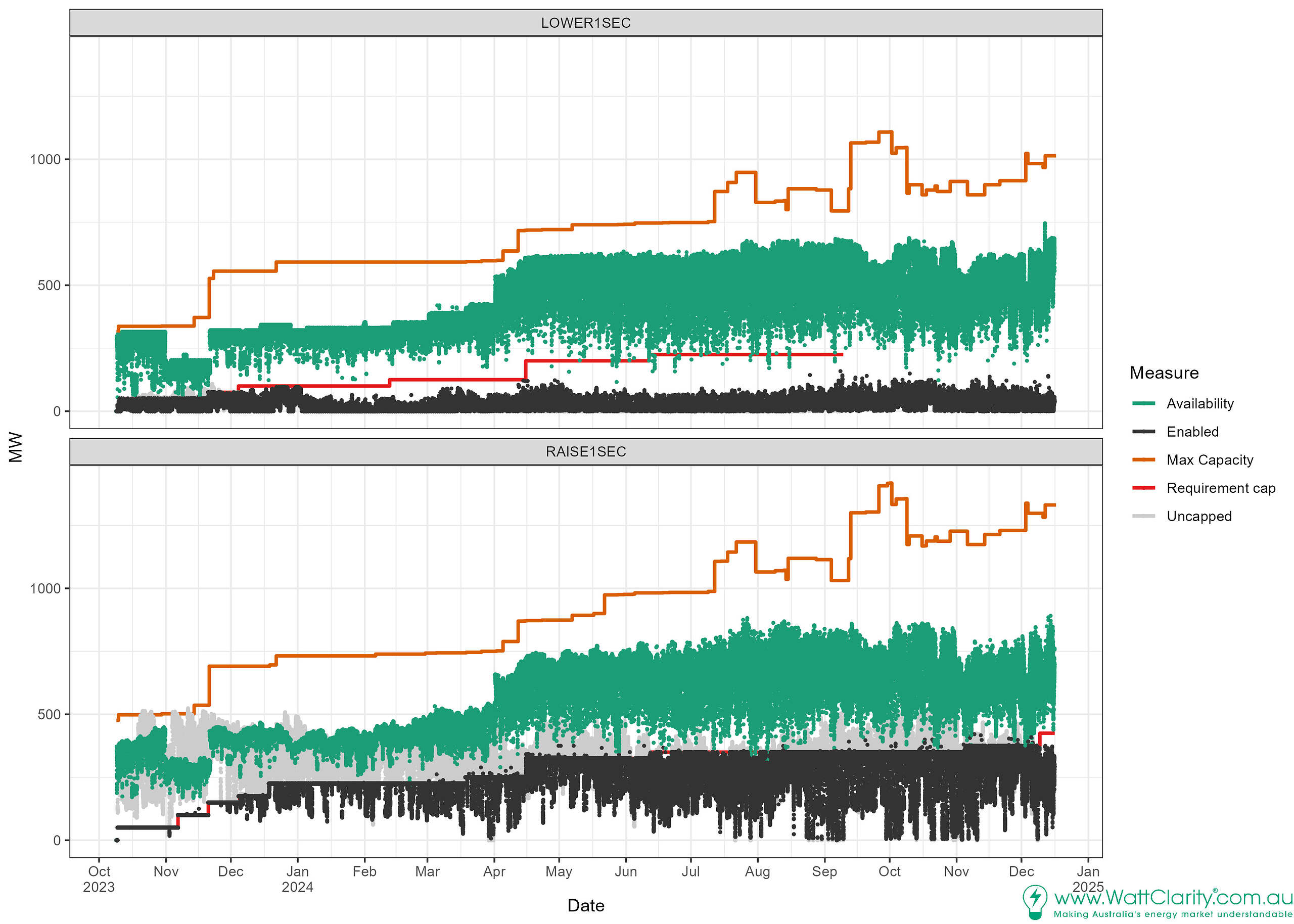

Availabilities for the Lower 1-second service were enough to do away with the cap

In market notice 118145 AEMO announced it would remove the cap on enabled amounts on September 9, 2024. The notice commented that:

“The 225 MW cap on dispatch of L1 FCAS sits well above typical dispatch volumes, and no immediate impact is expected from this change.”

The removal of the cap is represented by the red line stopping in early September, on the chart.

The cap in the Raise 1-second service was progressively raised

The cap level is the red line. It is difficult to see in the chart, often obscured by the black dispatch enablement dots. This indicates Raise 1-second enablement was often at the capped level.

AEMO conducts regular reviews of the cap levels. The level was was raised to 225 MW on the December 18, 2023.

Over 2024 the Raise 1-second cap was increased five times. It is now at 425 MW, as of December 9, 2024.

Availability decrease for SIPS is, again, evident

We observed this in 2023, and it is evident in 2024.

The Victorian Big Battery (VBB) is obliged to reserve much of its capacity for the Victorian System Integrity Protection Scheme (SIPS) between November and March.

We can observe an increase in availability at the start of April, and then a comparable reduction at the start of November (to have the capacity reserved for the scheme) in both 1-second markets.

Uncapped RAISE1SEC requirements remain high, relative to availability

The role of the requirement cap stands remains necessary for the Raise service. Without it, we’d be trying to procure more Raise 1-second FCAS than is available on many occasions.

This has been the case since market start.

I’d anticipate the need for the cap persists for a while yet. If the trend for increasing capacity and availability continues we may see it lifted late in 2025.

AEMO introduced local very fast FCAS requirements for South Australia when in island operation from 1 July 2024. The requirement volumes were uncapped due to current level of participation from VF FCAS providers in SA. On 1 July 2024, contractual arrangements for fast frequency response in South Australia ended.

Related to inertia

As indicated by the black dots in the chart, there is typically always some level of enablement.

Its worth noting that (uncapped) Raise 1-second and Lower 1-second service quantities are determined using an inertia-aware factor that accounts for peak rate-of-change-of-frequency risk. In other words, the required quantities of 1-second FCAS service relates to inertia; as inertia decreases the uncapped FCAS quantities increase.

Max capacities of BDUs overlap during transition phase

Upon the introduction of bidirectional units there was a period of overlap, different for each battery. The transition of each battery to the new bidirectional unit category has progressively seeped through the fleet. This started mid-July and has led to some temporary duplication in unit capacities in the chart, hence the larger fluctuations post July 2024.

Actual usage?

Whether the enabled volume has been used/delivered is not clear. Contingency FCAS gets used when a contingency event causes grid frequency to go outside the NOFB but, in a difference to how regulation FCAS is delivered, units enabled for contingency FCAS detect and respond to the frequency disturbance locally.

There’s some indication of when contingency FCAS is used, in AEMO’s quarterly monitoring reports. But this in generally contained the section discussing reviewable operating incidents. For now that’s about all we’ve been able to locate publicly.

Cumulative cost of enabling the 1 second services

Its important to recognise that the 1s markets are complimentary to the 6-second markets. They aren’t intended to directly replace capability in the 6-second or other contingency markets. The 1-second service acts fast to mitigate frequency excursions before the 6-second service kicks in.

With this in mind, we present costs of each service. Accumulated over a calendar year.

Relative to the other contingency FCAs categories, the cumulative cost of the 1-second Lower service wasn’t high.

The cumulative cost for the 1-second Raise service was high. By mid-year, and relative to the other Raise categories, it was looking like the Raise 1-second service would represent the highest cumulative cost in 2024. The 6-second service saw a large jump in October.

Other notable steps in the cumulative cost chart happen to be covered in the following series’ of articles:

Lower 6-second:

- 13 February 2024

- 8 May 2024

Raise 6-second (and also 60-second):

- 5 August 2024

- 11 October 2024

- 12 November 2024.

Update, Jan 2025: AEMO has decided to increment the maximum requirement volumes for the VF Raise (R1) service from 425 MW to 500 MW from 1:00pm (AEST) Monday 20 January 2025.