This article is more of an extract from the 2024 ESOO, for ease of our future reference, than any particular piece of analysis.

We’ve done this because (as noted in ‘once through the ESOO’) we’ve asked Dan Lee to prepare some analysis that might be posted later in the year to help us understand what the current state is with respect to Data Centres across the NEM, including stakeholders, locations, and electrical characteristics (including size and market participation).

Excerpt from the ESOO

Starting on p26/177 in Chapter 2, the the AEMO notes:

‘Accelerating investment in data centres is an emerging driver of growth’ (i.e. in electricity demand)

… and then:

‘Accelerating investment in data centres to cater for the projected demand for streaming services, cloud storage and artificial intelligence (AI) applications, is emerging as a significant contributor to forecast demand. While data centres will increase annual consumption, the potential flexibility of these loads and/or the provision of on-site generation means that their impact on maximum demand is uncertain.’

… and then (p27/177):

‘The expansion of data centres – specifically with the rise of larger hyperscale facilities – has the potential to be a catalyst for substantial increases in electricity consumption for New South Wales and Victoria in particular. ’

… and also

‘An increase in data centre, mining and manufacturing load is responsible for over half of forecast load growth for large industrial users over the next 10 years. Load growth related to the development of new large-scale data centres in particular outpaces projections from previous ESOOs (which have not historically identified these facilities as an explicit driver of new load growth).’

… and also (p33/177) as follows (noting LIL stands for Large Industrial Loads, now including Data Centres):

‘The LIL forecasts have been updated for the 2024 ESOO by surveying industrial facilities directly and gathering load inquiry data from network service providers (NSPs). LIL forecasts in the ESOO Central scenario are higher than was forecast in the 2023 ESOO, largely due to the reallocation of approximately 60 sites from the BMM to the LIL category. Approximately half of the reclassified loads consist of existing data centres, which have experienced substantial growth since the 2023 ESOO. The resulting increase due to this reclassification is partly offset by a reduction in the BMM consumption. The potential growth in new data centre load is separately analysed in the Accelerated Data Centre Growth sensitivity, which considered the realisation of more prospective loads (footnote 43).’

… so that means (if I have interpreted correctly ~30 Data Centre sites across the NEM currently.

For completeness, Footnote 43 reads as follows:

‘AEMO has only considered committed data centre loads in the core scenario forecasts. Anticipated loads whereby proponents may be well progressed with pursuing the connection, although have not yet achieved Final Investment Decision, have only been considered in the Accelerated Data Centre Growth sensitivity.’

Chapter 2 continues (p34/177) with the following:

‘The LIL forecasts are higher across all scenarios compared to the 2023 ESOO, due to the reclassification of load from the BMM sector. The newly-classified loads account for almost 10% (or nearly 4 TWh) of current total LIL load. Long-term growth in the ESOO Central scenario is driven by data centres, transport, mining and manufacturing. Existing and committed data centres in particular are forecast to make up just over 5% (or approximately 500 MW) of the total LIL load by 2033-34. This is balanced out by production downgrades from some manufacturing sites due to reported high domestic production costs and a growing reliance on imports.’

Exploring the potential for rapid data centre growth

Under the heading ‘Exploring the potential for rapid data centre growth’ on p35/177, the AEMO notes:

‘Data centres make up nearly 3 TWh of current load across the BMM and LIL sectors. The ESOO Central scenario forecasts around 5 TWh of data centre load by 2033-34, from existing and committed LIL projects alone. Accelerating investment in data centres to meet the potential growth in demand for streaming services, cloud storage and AI applications – specifically with the rise of larger hyperscale facilities – has the potential to be a catalyst for substantial increases in electricity consumption, particularly in Sydney and Melbourne (but potentially in more regional areas too with the right infrastructure and relevant incentives) … footnote 49.’

Assuming a flat consumption profile for the 3TWh consumption this would equate to ~340MW constant consumption. So a growth of ~2TWh to 5TWh is not insignificant, but also not of the scale of aluminium smelting (for instance).

Footnote 49 (referenced above) reads:

‘Development opportunities will depend on relevant available infrastructure, including electricity, data connectivity, water as well as labour to develop and maintain facilities and environmental and planning requirements. To date, much of the development interest is within the major capitals, particularly in Sydney and Melbourne. Supporting development in other locations, such as co-locating data centres with new electricity supply developments, may represent an opportunity for governments, data centre developers and infrastructure providers and may influence on power system requirements.’

The main text continues:

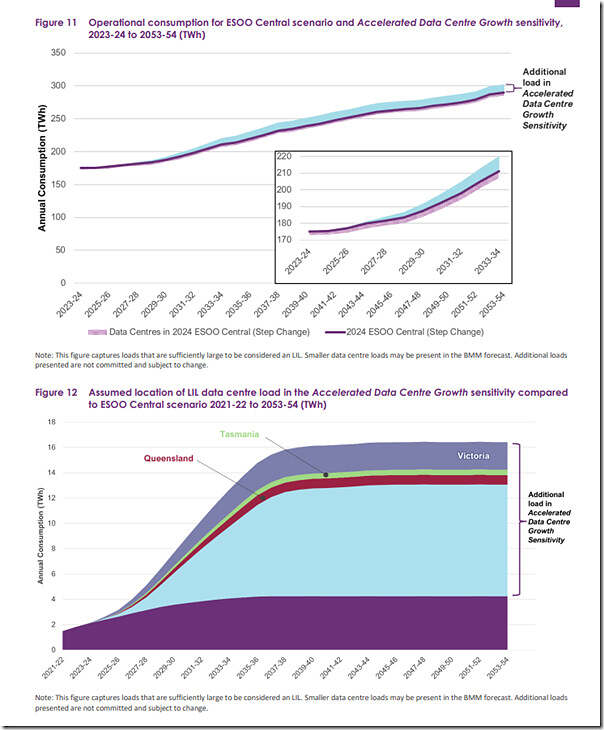

‘The 2024 ESOO explores potentially large increases in investment in data centres in a sensitivity to the Central scenario, the Accelerated Data Centre Growth sensitivity. The sensitivity was informed by 2024 Standing Information Request responses received from NSPs and other industry engagement on data centre application enquiries and non-committed loads. The sensitivity forecasts nearly 10 TWh of additional load per year by 2033-34, which is assumed to continue rising over the next 30 years (see Figure 11 below). Based on this trajectory, data centres are estimated to make up nearly 15% of LIL consumption and around 5% of total NEM operational consumption by 2033-34, staying at this proportion until 2053-54. Around two-thirds of the consumption from these more prospective projects is assumed to be located in New South Wales, particularly in the Western Sydney area, one-fifth in Victoria, and the remainder in Queensland and Tasmania (see Figure 12 below).’

‘Increased investment in data centres will increase annual electricity consumption, and impact forecast peak demands. Based on analysis of existing data centres, these facilities are estimated to have a relatively stable demand shape that is not materially temperature sensitive. Ambient temperatures marginally increase summer loads, with cooler ambient temperatures reducing cooling load in winter. Data centres may also have diesel generation backup to potentially reduce peak demand impacts.’

From Appendix A6 (Demand Side Participation Forecast)

As noted in ‘once through the ESOO’, because of the role we’ve played over ~20 years in facilitating a certain form of demand response in the NEM, we’ll be interested to refer back to Appendix A6 (p164/177) in more detail separately.

But in this article, the particular focus is what it says in terms of Data Centres. However in a quick scan it seems that’s limited to the comment:

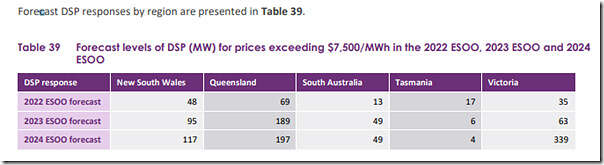

‘AEMO’s improved identification and classification of virtual power plants and data centres has helped to recognise this larger DSP participation in Victoria, and similarly, to a smaller extent in New South Wales.’

… which is with respect to Table 39, copied in here:

The ‘Accelerated Data Centre Growth’ sensitivity

Obviously this will be of further interest, as we delve further…

In the ‘Forecasting Assumptions Update’ report from 29th August 2024, it notes (p35/54):

‘AEMO’s 2024 LIL forecast is higher than in the 2023 IASR, due to the reallocation of about 60 sites from the Business Mass Market (BMM) sector to the LIL sector. The increased LIL consumption resulting from the reallocation is counterbalanced by a lower BMM forecast.

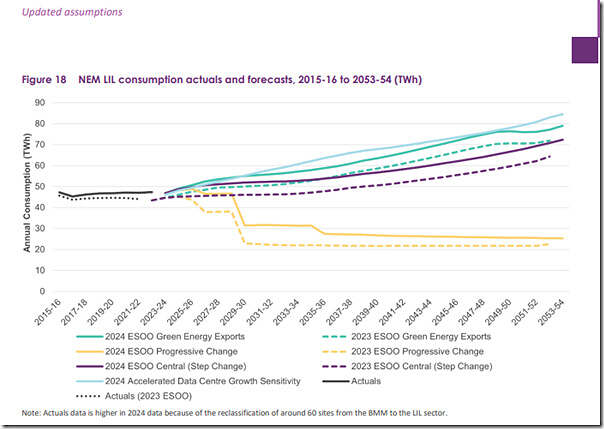

• About half of the newly reallocated LILs are data centres which have a large growth potential. In the 2024 Step Change scenario, data centres are the fastest growing segment within LILs. Committed and existing data centres are forecast to consume almost 5 TWh per year by the early 2040s.

• More prospective (footnote 38) data centres loads were included in the 2024 Accelerated Data Centre Growth sensitivity that showed an increase of more than 10 TWh of annual consumption in this market segment alone by the 2040s.

• The loads that were classified as LIL in the 2023 ESOO show a slight decrease in the forecast due to lower desalination water orders in the short term and production downgrades in mining and manufacturing in the longer term.

Similar to the 2024 Step Change scenario, the alternative scenarios are higher compared to the 2023 ESOO, due to the reallocation of sites from the BMM to the LIL sector, compensated by slight downgrades in mining and manufacturing. The 2024 Progressive Change scenario also forecasts a lower risk of closures for some LILs in the short term (2022-26). ‘

… with Footnote 38 reading:

‘The sensitivity was informed by the 2024 Standing Information Request responses received from NSPs and other industry engagement on data centre application enquiries and non-committed loads.’

This report continued:

‘The LIL consumption forecast for all scenarios is shown in Figure 18.’

That’s all for now…

Be the first to comment on "What’s the 2024 ESOO say about Data Centres?"