Yesterday we posted about the ‘90-minute run of IRPM < 15% on Monday evening 17th June 2024’ – following on from an article about the lowest point for IRPM reached (11.76%) at 17:55. At that dispatch interval, we also saw the ‘Market Demand’ climb well past the 30,000MW mark and almost reach 32,000MW.

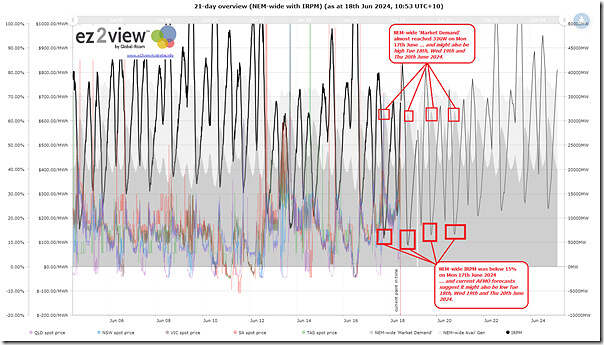

Curiosity got the better of me, so I opened up the ‘Trends Engine’ within my copy of ez2view and produced this 21-day trend of IRPM, looking back 14 days and forward 7 days into P30 predispatch and ST PASA:

Those with a licence to the software can open their own copy of this trend here.

I’ve highlighted two things on the chart:

1) At the bottom we see that the forecast levels of Instantaneous Reserve Plant Margin are such that the levels look set* to drop below 15% for each of the next three days:

* i.e. based on current forecasts, but remember that AEMO’s forecasts are intended to encourage a market response, if possible.

(a) Tuesday 18th June with forecast levels currently lower than yesterday:

i. down as low as 8.86% for the 5-minute period ending 18:30 … remembering Tripwire #1 and Tripwire #2 as legacies of 5MS;

ii. if this eventuated, it would be truly remarkable.

(b) Wednesday 19th June, with forecasts levels higher, but still below 15%;

(c) Thursday 20th June, with forecasts levels higher, but still below 15%.

2) At the top of the chart we see that the forecast level of ‘Market Demand’ is such that the levels look set to rise beyond 30,000MW for each of the next three days:

(a) Tuesday 18th June with forecast levels currently lower than yesterday:

(b) Wednesday 19th June, with forecasts levels higher than yesterday (up above 32,000MW);

(c) Thursday 20th June, with forecasts levels about the same as yesterday.

Might be an ‘interesting’ couple of evenings…

Leave a comment