As noted earlier today, we’re a little behind schedule in completion of GenInsights Quarterly Updates for 2024 Q1 – for several reasons (including that this quarter experienced a significant number of interesting events that we are delving into.

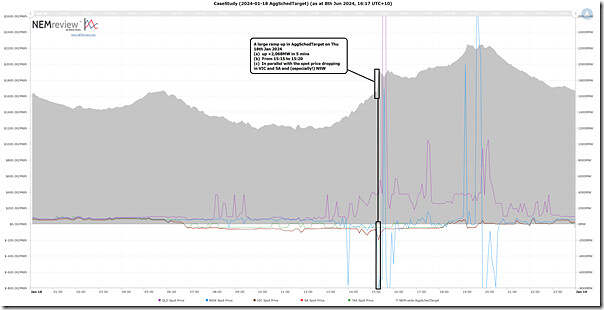

In this second article today about NEM-wide Aggregate Scheduled Target (i.e. which we review each quarter as a measure of the changing requirement for firming capacity) we utilise NEMreview v7 to post this quick summary of AggSchedTarget across all 288 dispatch intervals on Thursday 18th January 2024:

Those with a licence to the software can open their own copy of this query here.

Without delving more deeply…

1) We can see (from 15:15 to 15:20, NEM time) on the day, a significant ramp up on AggSchedTarget;

(a) This was 2,068MW in a five-minute period;

(b) We see that, coincident with this ramp up, the spot price drop in SA, VIC and NSW:

i. All to below ‘negative LGC’ levels

ii. But particularly in NSW … down to –$814.82/MWh.

(c) Without looking further, we hypothesise that:

i. this price drop led to significant Economic Curtailment of Semi-Scheduled VRE … leaving Scheduled Capacity to ramp quickly to fill the gap.

ii. we wonder what triggered that price drop, particularly in NSW:

… To what extent was rebidding involved?

… Or was it network congestion?

(d) We also wonder what (Semi-Scheduled) units ramped down, and what (Scheduled) units ramped up?

2) We also see other dispatch intervals in which AggSchedTarget bounced around in parallel with price variability.

… all things that might be explored later…

Leave a comment