On Friday we received a couple different notices about forecasts for Monday (i.e. now tomorrow) in Sydney and NSW.

Weatherzone published this tweet (linked to the article ‘Sydney heading for hottest day in over two years’):

As I replied at the time, also on Friday there were a series of Market Notices from AEMO speaking about forecasts for LOR2 low reserve conditions for the NSW region on Friday evening (not really a surprise, given the late hot weather forecast). These AEMO notices have continued since that time, with the latest (at the point of publication) being MN106279 published at 08:52 this morning:

——————————————————————-

MARKET NOTICE

——————————————————————-

From : AEMO

To : NEMITWEB1

Creation Date : 05/03/2023 08:52:58

——————————————————————-

Notice ID : 106279

Notice Type ID : RESERVE NOTICE

Notice Type Description : LRC/LOR1/LOR2/LOR3

Issue Date : 05/03/2023

External Reference : STPASA – Forecast Lack Of Reserve Level 2 (LOR2) in the NSW Region beginning on 06/03/2023

——————————————————————-

Reason :

AEMO ELECTRICITY MARKET NOTICE

AEMO declares a Forecast LOR2 condition under clause 4.8.4(b) of the National Electricity Rules for the NSW region for the following periods:

[1.] From 1700 hrs 06/03/2023 to 1830 hrs 06/03/2023.

The forecast capacity reserve requirement is 1266 MW.

The minimum capacity reserve available is 1033 MW.

[2.] From 1700 hrs 07/03/2023 to 1830 hrs 07/03/2023.

The forecast capacity reserve requirement is 1372 MW.

The minimum capacity reserve available is 1240 MW.

AEMO is seeking a market response.

AEMO has not yet estimated the latest time it would need to intervene through an AEMO intervention event.

Manager NEM Real Time Operations

——————————————————————-

END OF REPORT

——————————————————————-

Note that this forecast is now also pertaining to Tuesday 7th March.

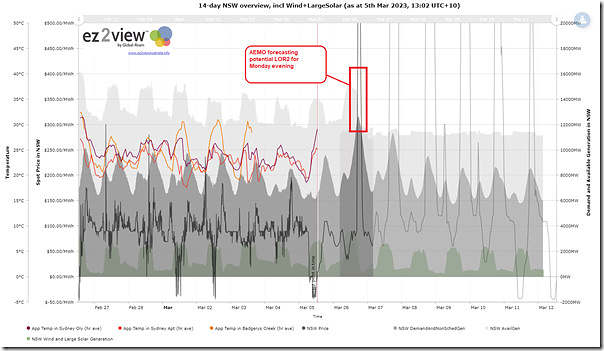

I thought I would quickly open this 14-day overview trend for the NSW region in ez2view online and see a bit more:

In the highlighted area of the chart for tomorrow evening we see forecast Demand-and-NonScheduledGeneration (similar to, but not the same as, Operational Demand) forecast to be above 12,600MW … which, I think:

1) Would I think be the highest we’ve seen since June 2021;

2) If the forecast hold, it would be marginally above the levels of February 2022.

Could be some volatility…

Leave a comment