As noted before, I’ve been away for a couple of weeks – so am trying to get back up to speed with a review of the key developments that have happened in the NEM whilst I’ve been switched off.

Another thing I could not help noting was the significant volume of discussion about price caps potentially being applied to domestic thermal coal and gas, with talk of Federal Legislation passing as early as this Thursday 15th December in Canberra.

I can’t be the only one who’s struggling to get my head around this – given the size of the mooted change I’m concerned that I’m even finding it difficult to understand the specifics of what’s being considered. At a high level there seems to be talk of government intervention (both state and Federal) over two timeframes:

1) There’s talk about a one-year ‘temporary’ cap relating to both:

(a) A gas price cap of $12/GJ fixed for a year

… but I’ve not yet exactly worked out what gas would be covered by such a cap, the specific dates and so on.

(b) A coal price cap of $125/tonne fixed for a year.

… but similarly I’ve not yet exactly worked out what coal would be covered by such a cap, the specific dates and so on.

2) There’s also talk about a mandatory Code of Conduct being applied in the gas market that (it seems) would seek to apply some ‘reasonable price’ test (judged by who?) interceding between potential buyer and seller.

… there’s lots I still have not worked out, but it’s this bit that seems to have really set the cat amongst the pigeons.

Thanks to Peter Hannam for pointing me at this page on the Treasury website titled ‘Options to ensure the domestic wholesale gas market delivers for Australians’, which at least provides some background to what all the discussion is about … though obviously there’ll be other documentation somewhere on the QLD and NSW Government websites as well, and potentially elsewhere?

There’s a lot linked from that page (4 documents – totalling ~130 pages) which would take some time to review.

Despite the headline of this page suggesting an interested stakeholder would have until 7th February 2023 to ‘have their say’ we need to read further down the page to see that there are actually three different deadlines as follows:

1) Consultation on the draft Bill closes on 13 December 2022 (i.e. today, or only 4 days since it opened on 9th December).

2) Consultation on the price cap section of the consultation paper and the draft price order instrument closes on 15 December 2022 (i.e. this Thursday – the mooted day talked about in the media about the legislation).

3) Consultation on the remainder of the consultation paper closes on 7 February 2023.

This seems to be pretty poor page design (in that readers need to scroll down to see the short deadlines)!

Our article here today is primarily something we can reference back to later – but you might find the following brief notes useful:

(A) Prior coverage on WattClarity

This energy crisis has been a long time coming – with Australia’s ham-fisted approach to navigating the energy transition, at least in part due to a motley collection of ‘Villains’.

However concerns have really come to a head with the 2022 Energy Crisis (of which we’ve written at least 50 articles through this calendar year to date). What’s unfolding in terms of price caps has been mooted for some time – and clearly, with commercial and residential energy users suffering from significant cost rises, something was bound to give.

(B) Coverage elsewhere

Time permitting we might come back later and add in other links (i.e. collating them together so we have one reference point) but for a start I’ll note that we have seen the following coverage elsewhere:

(B1) Media Coverage

In the ‘mainstream’ media labels, I found this extract quote particularly useful as a starting point:

‘The starting point for the debate should be whether Australian businesses and consumers deserve to be the beneficiaries of the country’s vast reserves of coal and natural gas, or whether it’s best to allow these to be sold to the highest bidder on global markets.

If the answer is that Australians are entitled to cheaper energy prices than what global buyers are prepared to pay, the question is then how best to achieve this outcome, while still allowing coal miners and gas producers the ability to run profitable companies that can invest for the long term.’

… which came from the Reuters article by Clyde Russell ‘Column: Australia’s gas and coal price cap needs sober debate, not emotion’ published 12th December.

In terms of other articles, here are some I can currently see.

1) via the ABC:

(a) On 7th December, Someone wrote ‘Energy ministers to tackle skyrocketing power prices ahead of national cabinet meeting’.

(b) On 8th December, Henry Belot wrote ‘Federal Treasury secretary Stephen Kennedy recommends government intervene in energy market to drop power prices’.

(c) On 9th December, Stephanie Dalzell wrote ‘Anthony Albanese urges national cabinet to endorse unprecedented intervention to cap coal and gas prices’.

(d) On 9th December, Jake Evans wrote ‘Coal and gas prices to be capped as national cabinet strikes deal’.

(e) On 10th December, Elizabeth Byrne wrote ‘Energy minister defends federal government’s plan to relieve impact of rising power prices’‘.

(f) On 11th December, Nour Haydar wrote ‘Greens leader Adam Bandt says his party will oppose any plan to compensate coal companies under plan to cap prices’‘.

… plus no doubt more to come…

2) via the AFR, which seems to have the most extensive coverage (though perhaps gas price caps more than coal price caps) that I have seen, there have been articles such as:

(a) On 8th December, the AFR View was that ‘Perils of messing with energy market‘.

(b) On 9th December, Samantha Hutchinson wrote ‘It was $15k a month, now it’s $50k’: gas users despair at high prices‘.

(c) On 9th December, Phillip Coorey wrote ‘States and Commonwealth to co-fund power bill assistance‘.

(d) On 9th December, Jacob Greber wrote ‘Albanese’s double energy shock‘.

(e) On 9th December, Tony Boyd (writing as Chanticleer) wrote ‘Price caps essential for energy transition‘.

(f) On 11th December, Tony Wood (from Grattan Institute) shared his Opinion about a possible … ‘Messy end to gas market intervention?‘ in which he ponders…

‘Before Friday’s National Cabinet meeting, there was an expectation that the gas price cap would be based on the price that would apply outside a war premium. This could have been determined and reviewed transparently by the ACCC, which has been tracking LNG netback parity pricing since 2017. The initially announced $12 cap seemed consistent with that approach.

However, late on Friday, the government announced that a longer-term reasonable price would “reflect the cost of domestic gas production, allowing for a reasonable return on capital”.

Presumably, this definition of reasonable price will not change the announced $12 figure. Yet, even if used for ongoing price caps or for new sources of gas, such a level of cost-based price control seems unnecessary and has raised alarm from industry analysts and the gas industry.

The alarmists may be overreacting, and some clarification may provide a sensible resolution. Let’s hope the government hasn’t snatched a messy defeat from the jaws of a major victory.’

(g) On 11th December, The AFR View was that ‘Labor’s plan to make energy crisis worse‘.

(h) On 11th December, Mark Ludlow wrote ‘State energy compensation a ‘dog’s breakfast’‘.

(i) On 11th December, Jennifer Hewett wrote ‘The risks in Albanese’s energy deal‘.

(j) On 12th December, Mark Samter (partner and senior research analyst at MST Marquee) shared his thoughts in the Opinion piece ‘Reasonable’ gas price a disaster for the energy grid‘, including these thoughts:

‘However, the real policy disaster is what the legislation creates for future years, with the mandatory code of conduct that will enshrine a “reasonable price provision”.

In effect, this reasonable price provision is nationalising the gas industry, but still expecting private capital to fund it.

It will allow a “reasonable” return on capital, based on a cost assessment by that bastion of accurate predictions, the Australian Competition and Consumer Commission.’

(k) On 12th December, Angela Macdonald-Smith wrote ‘Origin shares slammed amid takeover bid doubts‘, containing this dramatic picture:

(l) On 12th December, Angela Macdonald-Smith wrote ‘‘Near nationalisation’: Global gas sector damns Labor‘.

(m) On 12th December, Michael Roddan wrote ‘Ghost of Whitlam haunts Albo’s energy policy‘.

(n) On 12th December, Elouise Fowler wrote ‘Gas producers face $50m penalty for breaching price cap‘.

(o) On 12th December, Phillip Coorey wrote ‘Gas giants knew mandatory code was coming: PM, Treasurer‘.

(p) On 12th December, Jennifer Hewett wrote ‘Why Labor is dismissing the gas industry’s anger‘.

(q) On 12th December, Tony Boyd (as Chanticleer) shared thoughts in ‘Gas intervention accelerates transition‘.

(r) On 13th December, former Energy Minister Angus Taylor contributed his thoughts in ‘Even tin-pot autocrats wouldn’t cap gas profits‘ .

(s) On 13th December, Angela Macdonald-Smith wrote ‘Gas market grinds to halt as Woodside, Shell suspend sales talks‘.

(t) On 13th December, Phillip Coorey wrote ‘PM to meet gas industry but holding firm against threats‘.

… and I have probably missed some as well.

3) via the Australian

(a) On 9 December, Geoff Chambers and Patrick Commins wrote ‘Bill relief: Anthony Albanese seals energy deal with premiers‘.

(b) On 11th December, Patrick Commins, Jess Malcolm and Perry Williams wrote ‘Anthony Albanese facing Senate roadblock from Greens and David Pocock on energy bills‘.

(c) On 12th December, Eric Johnston wrote ‘Labor’s coal and gas price caps could do long-term damage to broken energy market‘.

(d) On 12th December, Eric Johnston wrote ‘Few winners as Labor’s ‘war’ on gas prices to extend beyond a year‘.

(e) On 13th December, Guiseppe Tauriello wrote ‘Energy shares slump amid fears gas and coal price caps could be extended‘.

(f) On 13th December, Geoff Chambers and Sarah Ison wrote ‘Generators blamed for power crisis‘.

(g) On 13th December, Perry Williams wrote ‘Woodside, Shell raise alarm on Albanese government’s gas intervention‘.

(h) On 13th December, Rosie Lewis, Perry Williams and Sarah Ison wrote ‘Gas reservation mooted as energy row heats up‘.

(i) On 14th December, Paul Kelly wrote ‘PM’s energy policy wins the politics but there are lots of risks‘.

4) via the Guardian:

(a) Early on 8th December, Peter Hannam and Ben Smee wrote ‘Australian energy ministers to agree on promoting battery uptake but views on price caps differ‘.

(b) On Friday 9th December, Peter Hannam wrote ‘What is the energy price relief plan and will it actually reduce power bills?‘.

(c) On Monday 12th December, Peter Hannam and Josh Butler wrote ‘Energy users and ex-ACCC boss praise government for staring down ‘bullies of the gas industry’.

(d) On Wednesday 14th December, Peter Hannam and Josh Butler wrote ‘Coal-fired power plants could receive bulk of price cap compensation, Treasury briefings suggest’.

5) via the SMH/Age:

(a) On 12th December, Nick Toscano wrote ‘East coast gas supply pact at risk as price controls loom‘.

(b) On 13th December, Jessica Irvine wrote ‘Desperate times justify unusual economic measures to curb power bills‘, and references thoughts from Rod Sims and Ken Henry.

… and there are no doubt other articles as well.

6) via RenewEconomy:

(a) On 12th December Giles Parkinson wrote ‘Dirty, unreliable and yet more blackout threats: Australia’s charming fossil fuel industry‘.

(b) On 13th December Giles Parkinson wrote ‘Fossil fuel hysterics make coal and gas price caps look like a really good idea‘.

(c) On 14th December Sophie Vorrath wrote ‘Greens support gas price cap with deal to help people get off gas‘.

7) via PV Magazine:

I’ve not seen anything yet.

If you have seen other coverage, feel free to link to it below in a comment.

(B2) Industry Organisation comment

In addition to the media articles above, I’ve also seen the following from various industry organisations:

1) The Australian Energy Council (AEC):

(a) On 9th December, the AEC noted ’Statement on Energy Price Relief Plan: Good news for customers in the short term but price cap impact uncertain’.

i. This release linked to this ’Background briefing: How coal and gas prices impact retail electricity bills’ from 9th December.

ii. This was also shared on LinkedIn here.

(b) On 13th December, the AEC said ’Blame-shifting to Generators doesn’t stack up: AEC’, which seems to have been in reaction to some (mis?)interpretations of the Oakley Greenwood paper for MCA below.

2) The Energy Networks Australia (ENA):

(a) I could not find anything from them.

3) The Clean Energy Council:

(a) I could not find anything from them

4) The Smart Energy Council:

(a) I could not find anything from them.

5) The Energy Users Association of Australia:

(a) On 4th November, Emily Wood had written ’Gas Industry Misdirection Can’t Hide The Truth’.

(b) On 10th December, Emily Wood wrote ’Energy Package Shows Governments Willing To Stand Up For Energy Users’.

6) I don’t normally watch what’s said by the Australian Petroleum Production & Exploration Association (APPEA), which describes itself as ‘the effective voice of Australia’s upstream oil and gas industry’, but given these caps to gas prices fall in their court, it seemed useful to have a look at what’s been said:

(a) On 9th December they wrote ’Media Release: Risk to future energy supply as intervention dismantles Australia’s gas market’…. which referenced this Energy Quest 26-page report ‘A review of gas cap pricing’ (not sure when that was published).

(b) On 9th December they wrote ’Media Release: New supply measures needed from National Cabinet, not damaging intervention’.

(c) On 12th December they wrote ’Media Release: APPEA requests urgent meeting with PM as more damaging intervention emerges’.

7) I also had a quick look at the Australian Pipelines and Gas Association (APGA):

(a) But could not find anything from them.

8) With respect to the Minerals Council of Australia (MGA):

(a) On 13th December, Oakley Greenwood noted here on LinkedIn that they were ‘commissioned by the Minerals Council of Australia to analyse NEM price outcomes and ‘price setter’ generators for calendar 2022’, and included some clarifications:

i. The Oakley Greenwood report for the MCA is shared here on their website.

ii. On the MCA website, on 13th December they published ‘NEM Pricing issues: Fuel costs and NEM prices’.

(b) I have not seen any other specific comment from the MCA to link in here.

9) I also note that the Energy Consumers Australia:

(a) On 13th December, noted on LinkedIn that …

‘Their position is untenable. They are making profits, they will still make profits at these kind of cap levels that have been proposed. This kind of grandstanding or fearmongering that somehow gas supply will be withdrawn just can’t be supported’.

(b) That quote referenced this Ratio National interview ‘Gas companies question caps, consumers brace for continued price rises’.

(B3) Other comment (e.g. on Social Media)

If we notice other comment, will add them in here…

1) Via the Conversation:

(a) On 9th December Bruce Mountain wrote ’Will price caps on coal and gas bring power prices down? An expert isn’t so sure’.

2) On Linkedin:

(a) On 12th December Paul Hyslop (of ACIL Allen) shared these thoughts, in particular noting that:

‘Unfortunately, in our view, price caps on coal and gas are the least preferred option. And while coordinating coal and gas price caps is better than not, price caps will reduce incentives to supply and increase incentives to consume.’

3) On Twitter:

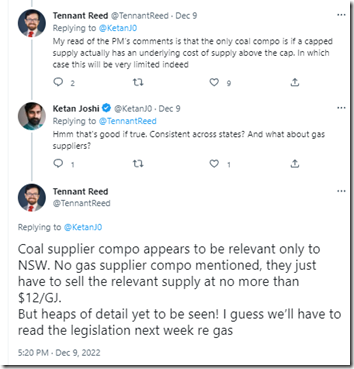

(a) On 9th December Tennant Reed shared these thoughts:

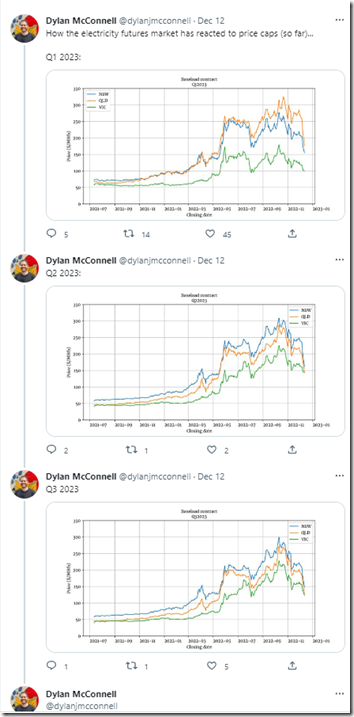

(b) On 12th December, Dylan McConnell shared how the price cap announcement (on Friday the prior week), and growing anticipation of it perhaps, had impacted on electricity futures pricing:

Paul Hyslop’s article like many others, including unfortunately some of my own, focusses on the 6300 kcal/kg coal price which is (i) extremely high relative to history and (ii) very visible because there is a futures market. However it is not I have read a highly traded contract and possibly not a good reflection of the lower spec 5500 kcal coal that forms the bulk of sales to Asia and which is, in an even less washed form, what is mostly used in the domestic market at least in NSW. The lower spec coal was recently “only” US$136/ or say A$200 and at 23 gj/t is $8.7/gj and at a heat rate of 9.5 gets you to a fuel SRMC of “just” A$82.6 although that is pre transport. Using the “proposed” and no doubt soon to be legislated cap A$125/t and assuming probably incorrectly the same number of GJ/t gets you to say about A$55/MWh + transport and other costs. Not sure what freight rates are at the moment

High prices have been a function of several things, mostly fuel and generation scarcity. The AER’s price-setter data shows hydro is increasing wholesale prices far more than coal and even gas. Hydro is not affected by Putin as far as I can tell.

Why the focus on coal, apart from ideology and the narrative?