As many WattClarity readers will be aware, the National Electricity Market (NEM) was to change from half-hourly settlement to 5-minute settlement, from July 1, 2021 but this change is now delayed until 1st October 2021. The Australian Energy Markets Commission put forward a proposed delay and sought stakeholder input which is visible on their website.

For those readers less familiar with the difference between the current 30-minute settlement and the proposed 5-minute settlement methodology, it worth revisiting this concept. At present, all scheduled generators (those registered to bid into the National Electricity Market and normally >=30MW) are dispatched every 5-minutes, which means that after having submitted their bids to AEMO, they are given targets to which their generation should produce. This has been in place since the 13th of December 1998, when the National Electricity Market (NEM) started. Notably, the financial settlement was based upon the arithmetic average of the 6 dispatch prices as shown below:

The motivation at that time, more than 20 years ago, (when the Nokia 5110 was the most popular mobile phone!) was to likely minimise the complexity and cost in information technology and metering. As the cost of technology has fallen, it would have been expected that if the market were established at a later date that there would not be this disconnect between dispatch and settlement timing.

Historically, most of the time there was little material difference as usually generators are running stably and consumers have been metered half-hourly, so there were only minor differences in the financial outcome for most participants. One exception to this was that peaking generators such as gas fired power stations or hydro power plants that may have been off-line, waiting for a spike in the market price, before firing up. Almost all of these power stations would take more than 5 minutes from a cold start to reach full load. Half-hour settlement would mean that these fast start generators would likely deliver some energy at an elevated price so long as they delivered this energy within the half hour, with a better likelihood of improved financial performance if the price spike occurred earlier in the half hour. This also has the adverse impact that sometimes the following half-hourly price would turn out negative as many generators would rebid their capacity negatively to maximise their energy dispatched when prices are likely to be at their highest, a situation referred to as “piling in”. It is also important to recognise that the market price cap (maximum price) is $14,700/MWh, whilst the market floor is -$1,000/MWh, so if the price spikes to $14,700/MWh in one 5-minute period, and the rest of the half-hour is at the market floor, the half hour price will be $1,617/MWh, a price likely to be well above the cost of generation. So, under the current rules, and notwithstanding start costs for generators (i.e. fuel burned before connecting to the grid and additional maintenance costs), it would usually be financially advantageous to dispatch a generator in response to a single price spike even if no generation is provided at the precise time of the price spike.

The existing arrangement has suited peaking generators as it has meant that it has given them additional comfort to sell financial contracts to minimise their earnings volatility. This is usually a cap contract, set at $300/MWh, where the seller pays the buyer the difference between the spot price and $300/MWh only when the price is above $300/MWh. In turn, the buyer pays the seller a premium for every single period, regardless of the spot price, which is effectively a form of insurance. These contracts are not based upon “physical delivery” and are purely financial which means that the seller pays out based only upon the spot price outcomes and volume sold, not upon the level of generation. In practice, half hour settlement reduces both the financial impact of price spikes as you are likely to be able to generate some energy in a half-hour rather than none at all (if you cannot start within 5-minutes) and usually ensures that the generator should be able to cover its costs for the half-hour.

Some generators that can exercise market power may also benefit from 30-minute settlement by reducing their capacity offered to the market late in the half hour, causing a late half-hour price spike, meaning they can be financially advantaged as they have dispatched significant energy in the half-hour even if only a minimal amount at the time of the price spike.

The observed mismatch between 5-minute dispatch and 30-minute settlement reached its peak when Sun Metals, a large smelter in Queensland that had been actively managing its consumption found that it had been adversely affected. It had been reducing its smelter load in real time in response to high dispatch prices to minimise the cost of its electricity consumption but had found that many of these price spikes occurred late in the half-hour so the impact of reducing demand to match the underlying 5-minute dispatch price was significantly reduced. As a result, in 2016, Sun metals referred to the Australian Energy Markets Commission (AEMC) to consider a rule change for the National Electricity Market so that both dispatch and settlement were aligned at the 5-minute level.

I did some work for the AEMC in 2017 on the 5-minute settlement rule change primarily on the impact on retail portfolios and for how the economics of energy storage changes under 5-minute settlement. Whilst, since then there has been much commentary and many submissions on the proposed rule-change, especially from those that may be worse off under 5-minute settlement there has been scant input from those that will be advantaged by the rule change and this is especially true for the recent stakeholder input for the proposed delay where only a few, such as the ACT and South Australian governments were expressing concern at the proposed 12 month delay.

The key stakeholders that will benefit from the five-minute rule change will be large flexible loads that are metered at the 5-minute level and high-power utility scale batteries. We would also anticipate that consumers may benefit through the potential for more cost reflective pricing. Some of the market participants will genuinely have significant costs in terms of metering and information technology, whilst fast start conventional generators such as gas peakers and hydro generators will face greater uncertainty when starting these generators if they are off-line.

One of the key beneficiaries of 5-minute settlement will be high power, short duration batteries which are those that store a minimal amount of energy but can charge and discharge quickly. These batteries benefit the most because price spikes under 5-minute will endure for an even shorter period of time.

Battery Economics

There is a limited amount of material that actually discusses the economics of utility scale batteries in the Australian context, but one of the fundamental revenues is energy arbitrage, which is charging the battery at low priced times and discharging it at high priced times. A good starting point I believe, is a previous article I wrote some time ago for Reneweconomy that discussed how the correct sizing of the battery needed to be considered before South Australia’s big battery was to be built. Subsequently, a number of utility batteries including the Hornsdale Power Reserve have been built but almost all, with the exception of some such as Nexif’s 10MW/10MWh ESS, co-located with the Lincoln Gap Wind Farm have been significantly subsidised.

To examine the potential benefits of 5-minute settlement to a battery, it is worth examining the difference that 5-minute settlement makes against 30-minute settlement in the following two scenarios where I have ignored losses for simplicity:

Case 1

| Period | Spot Price |

| 0:05 | $50 |

| 0:10 | $40 |

| 0:15 | $60 |

| 0:20 | $55 |

| 0:25 | $60 |

| 0:30 | $14,700 |

In this case, where we assume that the price spike was not expected, a battery would be dispatched only in the 6th period in this scenario (reasonably assuming it had been charged earlier), so the payments would be as follows:

30-minute:

($50 x 0 + $40 x 0 + $60 x 0 + $55 x 0 + $60 x 0 + $14,700 x 1)/6 = $2,494.17/MWh for energy dispatched (or $415.69/MW of installed capacity)

5-minute:

($14,700 x 1)/ = $14,700/MWh for energy dispatched (or $2,450/MW for installed capacity)

Case 2

Alternatively, we can consider the possibility where spot prices are negative earlier in the period (-$1,000 for the first two periods), spiking unexpectedly at the last interval in the half-hour.

| Period | Spot Price |

| 0:05 | -$1,000 |

| 0:10 | -$1,000 |

| 0:15 | $60 |

| 0:20 | $55 |

| 0:25 | $60 |

| 0:30 | $14,700 |

It’s important to note that the dispatch behaviour will be identical for each scenario, such that a battery will charge in the first two periods and discharge in the 6th period such that we have:

30-minute:

- Purchases = -2 x ((-$1,000 -$1,000+$60+$55+$60+$14,700)/6) = -2 x ($2145.83) = -$4,291.67

- Sales = 1 x ((-$1,000 -$1,000+$60+$55+$60+$14,700)/6) = 1 x($2145.83) = $2145.83

Total = -$4291.67+$2145.83 = -$2145.83/MWh for energy dispatched (loss) (or -$357.64/MW of installed capacity)

5-minute:

- Purchases = -1x-$1,000 -1x-$1,000 = $2000

- Sales = 1 x $14,700

Total = $2000 + $14,700 = $16,700/MWh (or $2,783.33/MW of installed capacity)

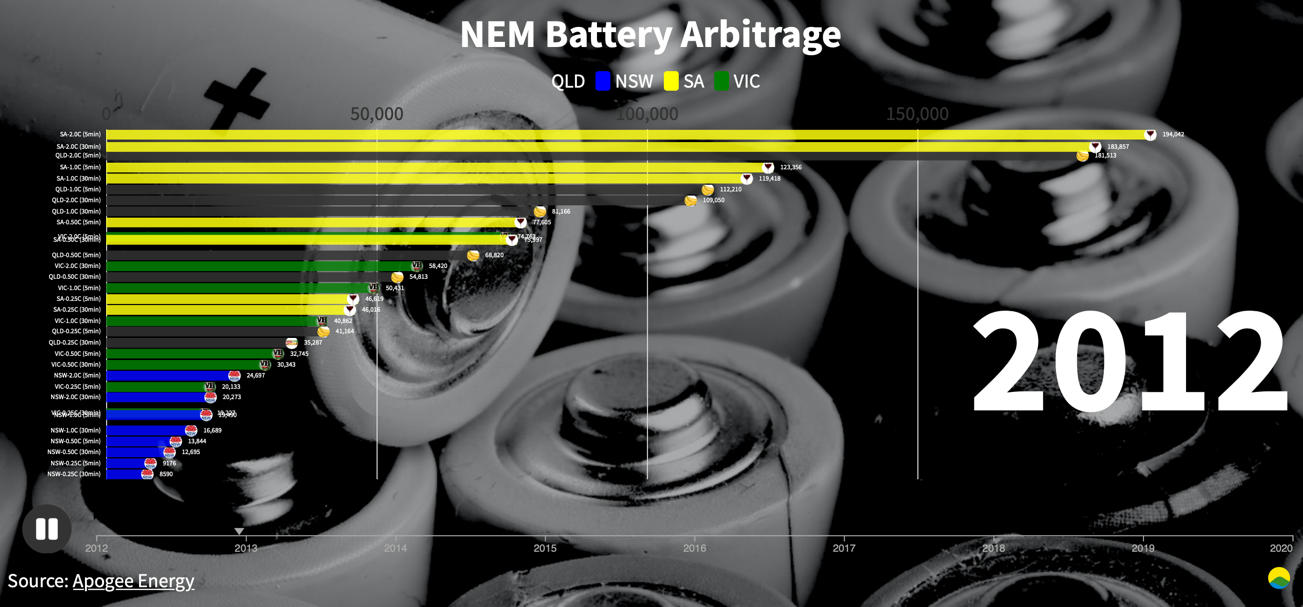

What is noticeable is that in both cases, whilst the dispatch of the battery is identical, the financial results are much higher under 5-minute settlement. These cases here were hypothetical, so it’s worth examining some real data to examine the potential impact of the change to 5-minute settlement. So, to illustrate the difference that occurs between differing utility battery installations in the NEM, I have retrieved both 5-minute and 30-minute settlement data from NEM-review (www.nem-review.info) and then employed a basic dispatch algorithm that charges at the lowest prices and subsequently discharges the battery at the highest prices until it runs out of energy. We also account for 10% roundtrip losses as indicative of electrical and other losses that would be expected in the operation of a utility scale battery.

These results are impacted by the assumption of perfect foresight when in reality any NEM battery will be impacted by the errors in AEMO’s price forecasts. When AEMO runs its dispatch engine every 5 minutes, updating the dispatch price and giving each generator dispatch targets, it also solves the rest of the trading day with forecasts known as “predispatch”. AEMO’s forecasts have inaccuracies due to errors such as forecasting demand, the tripping of generators or loads, and changes by market participants in the rebidding of capacity between the 10 fixed price bands for each unit for the day. This error in predispatch currently affects batteries significantly as if a price spike (or dip) is unexpected and unless if it occurs in the first 5-minute dispatch interval, then a battery will be unable to deliver (or withdraw) the maximum power for the full half-hour as shown in Case 1. Essentially, under 30-minute settlement, in the light of unexpected price spikes (and dips) that occur in anything other than the first dispatch interval, with hindsight you’d likely change your activity to maximise your discharge or charge for the whole period, or even potentially not run at all. Under 5-minute settlement, you get exactly what you deliver, so the uncertainty in settlement pricing disappears but you still face the risk of being fully discharged at times of price spikes or being fully charged at times of price dips. What this means for analysing the potential arbitrage is that the 30-minute settlement results are overstated, whilst the 5-minute results are closer to actuality. Both situations could be improved by additional charge cycles on some days. The following animated charts illustrate the difference in cumulative earnings for a 1.0 MWh battery since 2012 across each of the mainland NEM states (Queensland, NSW, Victoria and South Australia), for 30 minute (2.0C), 1 hour (1.0C), 2 hour (0.5C) and 4 hour (0.25C) charge times, for each of 5-minute and 30-minute settlement.

https://www.apogeeenergy.com.au/arbitrage/

Investing in a battery

Conceptually, a utility scale battery is very similar to a peaking generator in that its fuel price varies, it usually only runs for a short period, it earns high revenues a few times each year and it bids energy into the market identically to a generator. However, it is rare for an investor to build a peaking generator in the NEM as a pure merchant play without an underlying contract such as a power purchase agreement, network support agreement or through the sale of caps.

Whilst it is possible that a utility scale battery could sell caps, there is little evidence to date that such a structure has been employed at scale. Batteries may also earn revenues from ancillary services, particularly frequency control but these are particularly volatile and hard to predict. Therefore, in the absence of underlying contracts to provide revenue certainty, a potential criterion for an unsubsidised battery is whether it is plausible that the energy arbitrage revenues are sufficient to at least cover the initial investment over the life of the battery. Whilst we do not know future energy market prices, an observation of historic spot prices provides a potential guide to these values and we can observe that as well as offering improved certainty, 5-minute settlement improves the financial performance of a battery. These improvements over the eight and a half years analysed can be as much $380,000 per MWh in Queensland or $421,000/MWh in South Australia for high power 30-minute batteries as compared to 30-minute settlement, with less significant improvements in Victoria and NSW, and for slower charge batteries. This material difference due to 5-minute settlement may improve the business case sufficiently, such that battery investments occur that would not have under the existing 30-minute regime.

——————————————-

About our Guest Author

|

Warwick Forster is an experienced energy professional with 20 years of experience covering energy trading, risk management, market operations, retailing, pricing, renewable project development and energy storage.

He is now an independent energy markets consultant operating through the business, Apogee Energy. You find Warwick on on LinkedIn, and Twitter.

|

Very interesting article Warwick. However, I have to take your “backcasting” of battery revenues with a pinch of salt. Firstly, on a global level the AEMC’s analysis showed that the difference in historical market revenues/costs under 5 or 30 minute settlement was negligible. in other words, 5 minute settlement is only worthwhile if it changes bidding behaviour as compared to 30 minute settlement. in which case you can’t predict future outcomes from historical bidding patterns.

Setting aside the question of the extent to which bidding dynamics change as a direct consequence of 5MS, numerous other factors have changed over the last 8 years such that the past may not be a good guide to the future. Legislation and rule changes have strengthened the regulator’s hand against bidding that is not in “good faith”, which in itself should reduce any gaming. market conditions are also eroding the market power that has been imputed to certain generator portfolios. It’s no surprise that the biggest gains in your analysis are in SA and QLD, given the main allegations of market power abuse have been against AGL in SA, where its TIPS A and B are a significant share of the total capacity and against government owned generators in QLD. In the former case, TIPS A is on its way out (although AGL has a smaller faster plant Barker Inlet that has recently fired up) but more importantly, there are already 3 large batteries with more coming and soon a new interconnector with NSW. In QLD the main change is that the government has instructed its generators to bid differently, which admittedly could easily unwind. For a range of reasons and because 5 minute settlement will remove the incentives for late rebidding in any case, the p1 or p6 spikes you refer to seem less likely to occur.

Even when they do, the arbitrage opportunity will be eroded by new entrants. I don’t know what the equilibrium is, or how fast it will change as the generation mix changes, but there may not be that much new battery capacity needed to make the next battery uneconomic. It didn’t take much new capacity overall to make SA’s FCAS markets competitive again (at least when the state’s not islanded…) after Northern’s exit.

We can also logically expect an increase in DR. how much of that will be due to 5 minute settlement and how much to the new wholesale DR mechanism may never be clear.

Finally, the wholesale market works well when both buyers and sellers have an incentive to hedge out volatility. it may not be a great outcome for the market to have lots of batteries happy to play spot price arbitrage rather than lock in a revenue stream by selling caps. logically this leaves some load on the buy side exposed to those price spikes…

Hi Kieran,

Two of the best traders in the NEM are Harry Hindsight and Felicity Foresight, who can always see the future. So, yes, the backcasting is not a reflection of reality. I don’t believe this is too much of problem in NSW, VIC and QLD where the price spikes likely occurred much of the time at times of peak demand, so whilst you’re uncertain of the pricing in predispatch forecasts, you still likely know when the maximal prices occur. SA is different as price spikes and dips are less predictable, so you are less likely to take full advantage of these. These figures are imperfect but present a rough guide to potential values. You will probably underperform against these, but it’s plausible that you could outperform if you judiciously did some extra charge/discharge cycles.

It’s not surprising that adding the revenues/costs under both 5 and 30-minute settlement makes little difference to the whole market value as the usual change from one dispatch interval to the next is rarely more than 10’s of MW’s. This makes little difference to stable loads or generators where time weighted and volume weighted prices are almost the same. Those however at the margin, who operate for just a short while will be impacted the most such as high power batteries.

I would also agree that much has changed over the last 8 years, including the fact that all the history represents bidding under half hour settlement and for much of that time, no batteries participated in the market. Other factors such as “good faith bidding” seem to have crunched QLD arbitrage values in recent years. Changes in the market cap, value in FCAS and other issues also have an impact.

Predicting the future arbitrage is challenging. It’s difficult enough to forecast future electricity prices. I agree with your suggestion that P1 and P6 spikes will not be as prevalent as we should expect price spikes to be evenly distributed. Arbitrage is not unlike FCAS markets in that in probably does not need more than a few 100MW to begin to erode the market value.

What I’m trying to achieve is to highlight the difference than 5MS can make to batteries and some insight into how different regions and configurations impact the potential return.

regards

Warwick

Thanks for your reply Warwick. I agree the debate about the scale of the arbitrage opportunity doesn’t undermine your basic premise which I think is largely correct. It will be interesting to see the rate of battery deployment over the next few years.

In the meantime I hope your friends Harry and felicity are working in AEMO’s ISP team now…

Thanks Warwick for the interesting perspective and backcasting calculation.

First I have to say that I am not very neutral in the discussion since I work in Business Development for BESS at Wartsila 🙂

We did as well some backcasting simulations over the year 2019 for a larger BESS (based in NSW) and considering the current 30min settlement, and landed on an optimal battery duration between 2C and 1C. Our simulation was considering a merchant application FCAS+Arbitrage, and the purpose was to check what BESS size would have the highest NPV.

I do agree with you below conclusion that the 5MS will further enhance the value of power vs energy.

“One of the key beneficiaries of 5-minute settlement will be high power, short duration batteries”

One question, not related to BESS ; The market price cap (maximum) has been recently updated to $15,000/MWh. Why has the minimum price cap not been updated ?

Cheers,

Loic

Thanks Loic,

I think it is challenging to make the business case for batteries in excess of 2 hours given the pricing I’ve seen unless there are other value streams outside of FCAS and arbitrage requiring a longer duration. On the other hand, whilst your return per MWh is highest for high C-rating batteries, the installed cost per MWh is also higher, so the best NPV is getting the balance right in terms of installed cost and expected return.

I’m not sure why the market floor is still only -$1,000/MWh. I believe a lower price has merit. It’s also interesting to note that whilst some might observe that negative prices help batteries, which is true, the value is still in discharging for a short time for high prices i.e. you’d need 7.5 hours at -$1000/MWh to equal the value of a single half-hour discharging at $15,000 and having a 7 hour battery would have a woeful return compared against a high C-battery.

regards

Warwick

Hi Warwick,

Very interesting article. I would just have one question regarding how prices are being calculated in both Case 1 and 2 for 30-min settlement:

In Case 1, payment is calculated as follow ($50 x 0 + $40 x 0 + $60 x 0 + $55 x 0 + $60 x 0 + $14,700 x 1)/6 which is different to Case 2 (-$1,000 x 1 + -$1,000 x 1 + $60 x 1 + $55 x 1 + $60 x 1 + $14,700 x 1)/6). As I understand, regardless of when the battery dispatches, settlement price is calculated as the arithmetic average of the 6 dispatch prices. Would you mind clarifying why 2 different calculation methodologies are used here?

Regards,

Antoine

Antoine,

The two calculation methodologies are 5-minute and 30-minute settlement. The key point is that the battery would rationally be dispatched the same for each case (i.e. 1 single high price or both high and low prices in a half hour) yet it results in adverse outcomes especially in case 2. Therefore 5-minute settlement does not penalise a battery, the way half-hour settlement can.