I’m running out of time – prior to my talk at All Energy this Thursday.

In order to provide the basis for some objective commentary about how Demand Response, and storage, might play a role in a future world high on intermittent (wind and solar) supply, I have been crunching some numbers – as noted in this post (about the demand shape), and this follow-on (about spillage) last week.

The shape that “Scheduled Demand” would take in this future 10x world is certainly different to that which currently applies – representing a challenge for “keeping the lights on” through a combination of other technologies including:

1) Storage, reinjected into the grid at times that would help to moderate the peak demand that would otherwise be experienced;

2) Demand Response, to moderate times of “super peak” demand; and

3) Other forms of (more controllable) generation.

In a word, the challenge would be summed up as “Peakiness”.

I’ve been scratching my head, trying to work out the most effective way to deploy storage and Demand Response (from a system-wide perspective over the full year modelled) – playing Adam Smith.

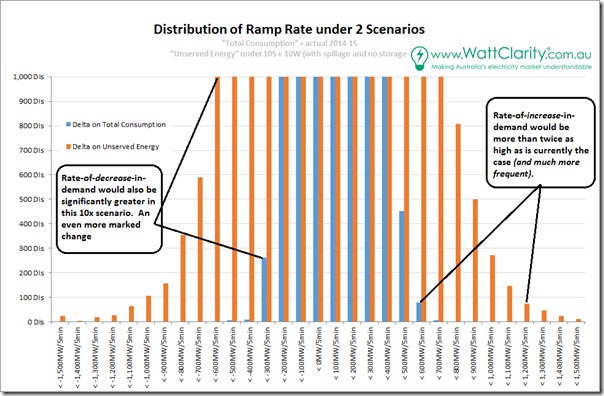

One chart that particularly jumped out at me was the following, highlighting how significantly the shape of demand curve will have changed in this future world, with ramp rates being considerably higher – both up, and down – than is currently experienced:

Returning to my “clapped out 2nd car” analogy to represent the fleet of dispatchable plant that will still be required (to the limits of what storage and demand response cannot otherwise provide for), my suspicion is that the current fleet of thermal assets would be hastened into retirement if they were collectively asked to be as dynamic as this chart would indicate in this 10X world.

Of course, by the time we have 10x the amount of solar and wind installed (if that were to happen) the existing fleet of thermal assets would have long since retired.

The engineers choosing the new fleet of plant to replace them will need to take the much higher, cycling-induced creep and fatigue loading the above would represent into account in providing for the new fleet that will replace them…

Back to the presentation…

Paul

How right you are about the need for better ramp rates in the “new electricity supply world”. In its response to the AEMC review of the AER ramp rate rule change, the Major Energy Users commented to the AEMC that the AEMC should be looking to the minimum ramp rates needed for the future market rather than setting ramp rates that could be provided by the existing fleet. By mandating a higher ramp rate requirement on generation plant, the AEMC would recognise the need for more agile plant in the future but could also provide a mechanism for allowing exemptions for existing low ramp rate plant.

But the AEMC persisted with a low ramp rate minimum in its preferred rule change

Some of our rapid-response fleet has come from hydro, and some from gas. An ideal gas plant would have its own storage facility nearby so it is not at the mercy of the spot gas market. The only one like this I am aware of like this is Mortlake, which has a nearby gasfield as its storage facility a start-up time of less than 5-minutes.

An interesting scenario is emerging for this coming season for drought-affected Tasmania. Their 2 main storages – Great Lake and Lake Gordon – have shown virtually no net replenishment since their power stations were run hard until the end of the carbon tax in July last year. Has the owner of Hydro Tasmania (the Tasmanian government) been asking too much in dividends, rather than sparing these dams by more imports from Victoria ? If water levels get close to the low supply levels on the intake structures, they may be in some trouble which they may blame on the drought, but is really because of their own management. Meanwhile Snowy Hydro has managed its resources much more conservatively.

Re: Malcolm. I think line-packing is pretty common for a lot of gas generators in Australia – which is really just storage by another name.