This week our electricity system re-configures itself to accept hybrids, the Power Stations of the Future, the Holy Grail of dispatchable renewable energy. Fantastic.

We just want to sound a warning and highlight some key new complexities so they can be avoided. Neither the power system nor the industry can afford too much trial and error.

—

This article is based on a presentation from Overwatch Energy’s Operations Manager, Ellise Janetzki, at the Australian Large Scale Solar and Storage Summit (ALSSSS) in Brisbane earlier this week – so this article focuses on solar, but the same generally applies to wind. References are kept to solar for simplicity and because of the status of self-forecasting in the solar sector. See here for more context on that issue.

What Do We Mean by a Power Station of the Future?

First some language. “Integrating energy storage systems into the NEM” or IESS is a complex reform with four major components. More details can be found here on the AEMO website, but we are going to concentrate on just one of those reforms, the introduction of a new type of participant to the NEM –the Integrated Resource Provider or IRP.

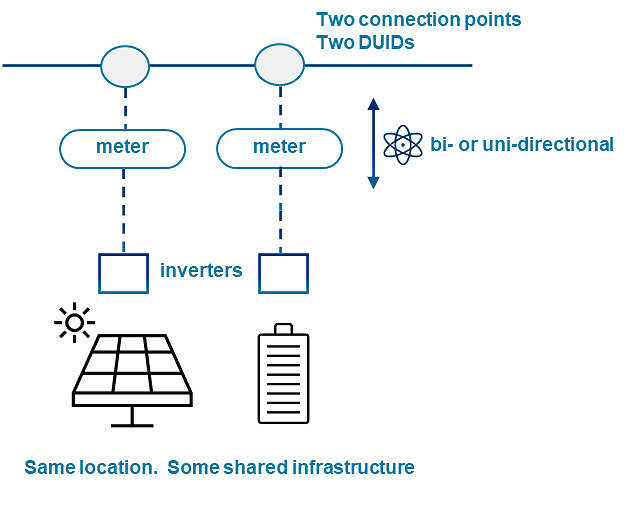

Despite what you might sometimes hear, there are currently no IRPs (also sometimes known as hybrids) operating in the NEM. There are some configurations like the one below, but from an energy market perspective, this co-location means little.

Figure 1. This is co-location. Two separate power stations

When the assets are not sharing the same connection point, when they are not the same Dispatchable Unit ID, 10 meters apart might as well be 10km.

And from an asset owner perspective, both assets are buying (charging) or selling (discharging or generating) at spot market prices. Short of throwing an extension cable over the fence, each asset is still dispatched separately into the market, with limited benefit gained from any surpluses or deficits from the other.

They might share some civil infrastructure and environmental approvals that reduces the cost per MWh a fraction, but that’s largely it. Nothing futuristic to see here.

The Future

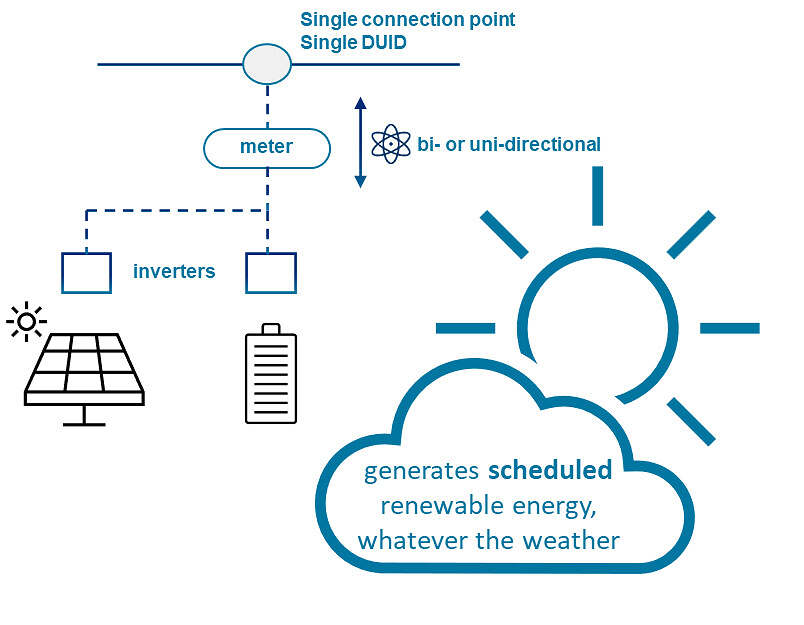

The future starts this week. For the first time we can now have genuinely dispatchable generation. Solar and wind can now supply into the grid with a degree of control they’ve never had before, and batteries can provide all the services they already do and discharge clean energy.

It’s worth remembering that standalone batteries – batteries with no associated generation, are loads on the network. Valuable as they are, they make no direct contribution to the gazillion GW of clean generation we need.

Figure 2. This is an IRP. A single power station.

Why are Hybrids More Challenging?

Let’ s start with what we know.

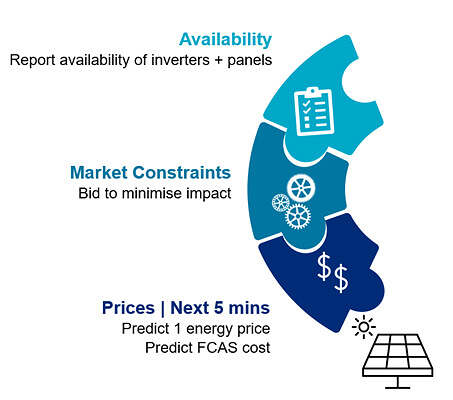

A Solar Farm

The market operations of a solar farm owner are relatively simple. Bidding strategies and outcomes are generally binary – on or off against a single energy price. You should check FCAS costs, market constraints and the availability of the site but it’s all very near-term, 5 minutes ahead at most.

You’re Semi-Scheduled too, so unless there is a cap on you – a Semi-scheduled Dispatch Cap or SDC, then your output can and will vary with wind or solar resource.

Figure 3. Solar Farm market operations – limited variables and time horizon; simples.

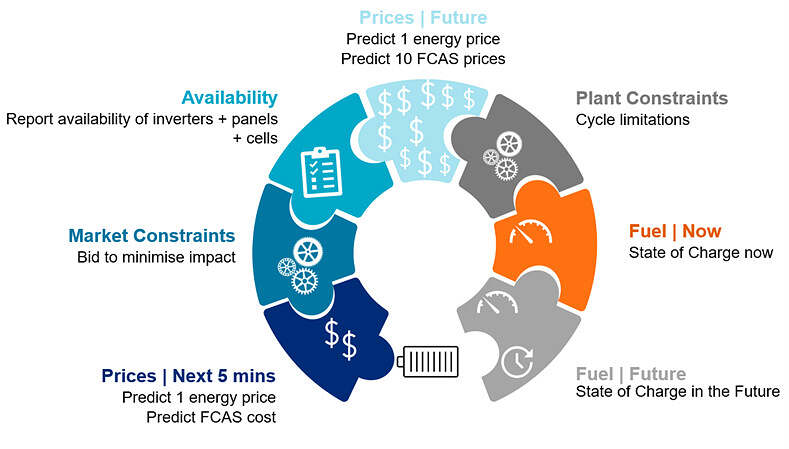

Standalone Battery

A standalone battery is a magnitude more complex than solar. The number of variables to account for and the times horizons are much more.

Starting with your solar farm, add all the future markets pricing for energy and all the FCAS markets, and start thinking 24hrs ahead, not just 5 minutes. Think plant limitations too – battery cycling, and battery state of charge – now and in the future.

Figure 4. Standalone BESS operations: think lots more variables, near and medium term.

IRPs

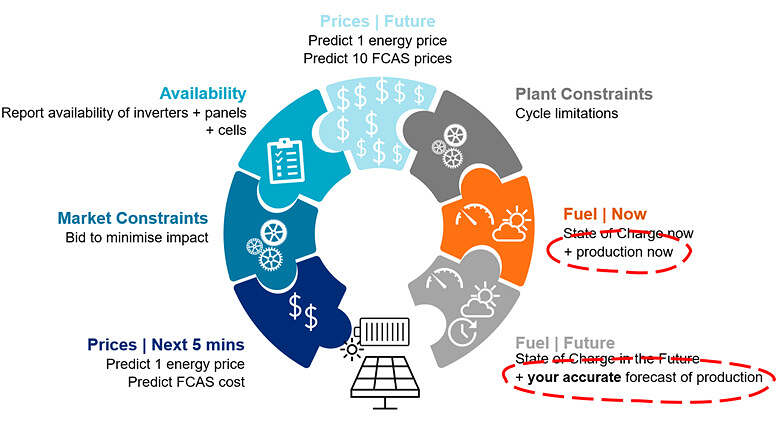

For Integrated Resource Providers, you need to take your BESS and your solar obligations and you need to integrate them. You need to think about everything a BESS needs and everything a solar farm needs and these two systems need to operate in an integrated manner. Each element needs to look accurately at the ‘right now’, but also forecast many hours ahead – for however far ahead you want to optimise your battery operations.

Figure 5. IRP Operations. Take BESS operations and add yet more variables and forecasting.

OK, so don’t I just plug my solar forecast into my battery?

Well, yes, but here the problems start.

A coal plant has more certainty of its fuel than you have of your solar resource; so does a gas or a hydro plant. The hardest resource to forecast is irradiance, it carries the highest uncertainty.

And if that were not problem enough, most self-forecasting is now not striving for accuracy but instead gaming the causer-pays algorithm.

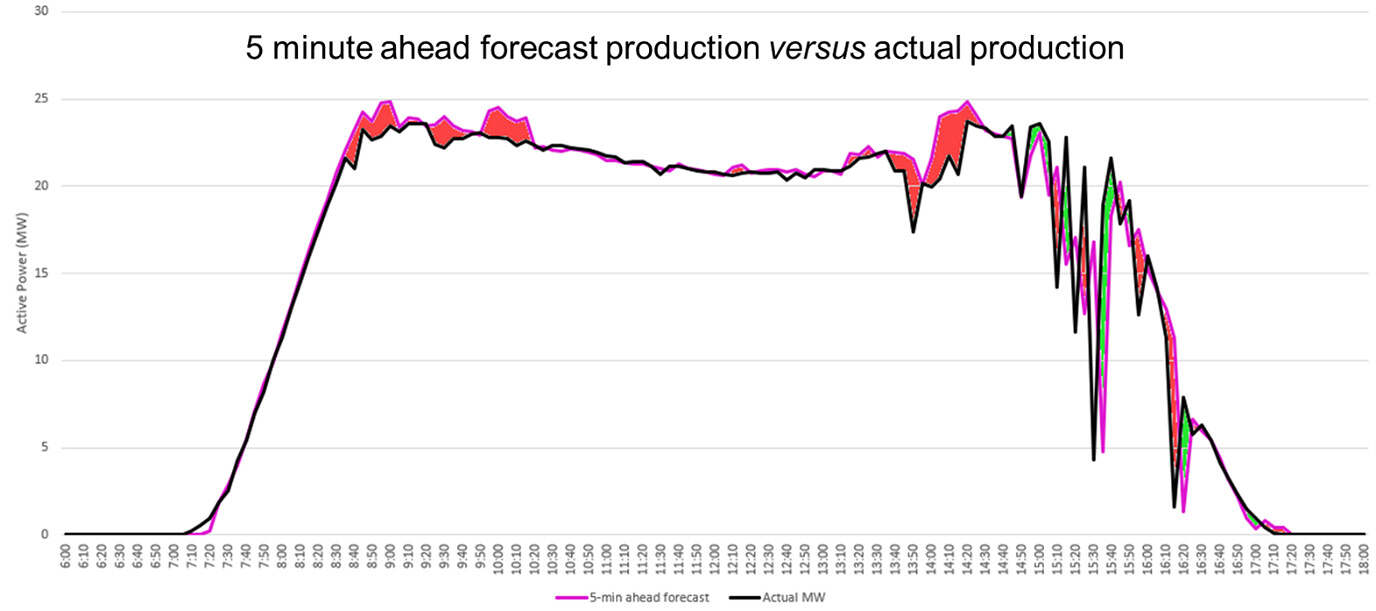

Below is a very typical example of the discrepancies between actual production and a forecast production made only 5 minutes prior. You can see several deviations of 10-30% – several MW difference in many, many 5 of the minute trading intervals.

Figure 6. Deviations in solar forecasting accuracy are currently frequent and significant

So What? Why Does the Solar Forecast Need to be Better?

The reason why the solar forecast needs to be a whole lot better than this is because the efficient operation – the financial returns of your whole asset and power system security, depend on good accuracy.

Every 5 minutes your BESS control and trading software will be relying on your solar forecast to decide what to do in the next 5 minutes. What will it do each time your forecast is wrong? How will it respond to deviations of +/- 10-30%?

We’re not entirely sure, but the implications could be multiple, and none of them are great.

Your unit could fall short of it’s dispatch target, or the battery will have to compensate with it’s own charge or, if actual is more than you forecast, you may overshoot your dispatch target. The knock-on effects could include:

- less actual FCAS available than bid, so compliance and financial problems,

- being short of or wasting energy for arbitrage, or

- more cycling than forecast.

It depends heavily on how you have configured the overall control strategy of the whole hybrid.

And this is our point. If the implications of these forecasting errors have not even been contemplated, then at who’s expense will the trial and error be?

And remember that this cycle is happening every 5 minutes, so 288 times every day.

Rising to the Challenge

We’ve little doubt that the technical risks described here are soluble, be that in better forecasting or developing BESS control and trading software that manages inaccuracy effectively.

The warning we sound right now, the week that IESS/IRP becomes a thing in the market is as follows:

- BESS control and trading software is a separate specialism to solar (and wind) forecasting,

- Anecdotally, we understand BESS control and trading specialists may simply take a feed from the forecaster; it’s unclear how they will respond to inaccuracy,

- Solar forecasting is not focused on improving accuracy,

- Developers and owners of IRPs risk being stuck in the middle, between the BESS and the solar-forecasting teams. Are they aware of this and responding appropriately before they buy the kit and install it?

If this article gives you cause to think and consider that you may need to act, then we leave you with the following suggested steps:

- Acknowledge that being Scheduled means greater compliance, that BESS dispatch and trading is likely to rely on your solar forecast and forecasting this accurately is key

- Understand that self-forecasting is not currently always focussed on accuracy, so figure out what that means for your hybrid

- Design, for BESS control systems that genuinely accommodate inaccuracy but strive to accurately forecast your solar resource

- Resource for more components, more interfaces, taking more responsibility, more testing and more time.

- Lead with human capital. Drive software development to support what you need. Don’t be led by software and don’t get left stuck in the middle of two software vendors with different agendas.

Figure 7. Humans who over-rely on software create problems that other humans have to fix

Overwatch Energy is a specialist Australian market operations services company, providing consulting and 24×7 services to NEM-connected assets to help owners and operators find success in the NEM. Yesterday was our birthday as we flipped into our 6th year.

See FULL DISCLOSURE 5 about how we at Global-Roam Pty Ltd (facilitators of this WattClarity® insights service) were one of the founding shareholders of Overwatch Energy Pty Ltd.

|

Ellise Janetzki is Operations Manager for the specialist NEM Operations firm Overwatch Energy. She leads a team of round-the-clock power sector operators working across more than 20 DUIDs and 2GW of solar, storage and wind in all regions of the NEM.

Ellise has more than 9 years’ experience in energy markets with Overwatch and AEMO, starting in retail and wholesale market then progressing to short-term NEM forecasting, including short-term demand, wind and solar forecasts. Her knowledge of NEM Operations across AEMO and more than a dozen owners offers a uniquely qualified perspective on what makes for successful power station operations. You can find Ellise on LinkedIn here. |

Leave a comment