In the first article of the four-part series we looked at how the cheapest electricity is the electricity that you do not use and the many opportunities to capture the low hanging fruit of energy efficiencies.

In the second article we looked at how savings can be achieved through purchasing electricity at wholesale market pool prices and then achieving even further savings by employing Demand Side Management or Demand Response strategies.

In this article we will look another supply arrangement that is increasingly being used by large businesses to reduce the cost of purchased electricity at well below the standard retail fixed prices. This supply arrangement is called the Corporate Power Purchase Agreement or Corporate PPA and it offers businesses the opportunity to lock in prices at or below the current market price for a long-term period.

The article is an expansion on Chapter 13 (Step 6) and Chapter 15 (Step 8) of my book “Power Profits – A Comprehensive 9-Step Framework for Reducing Electricity Costs and Boosting Profits”.

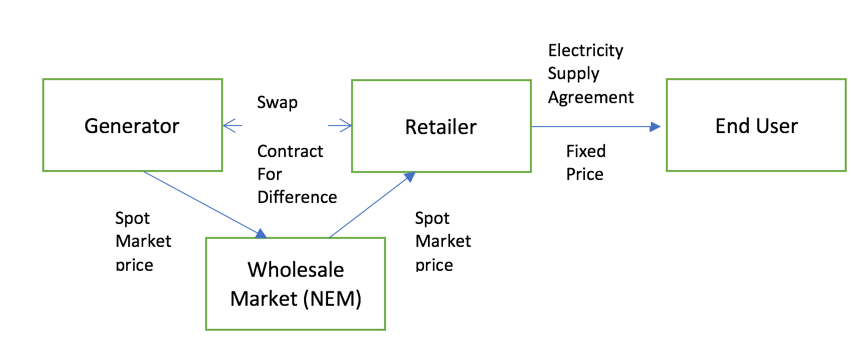

Traditionally, retailers contract with generators, who may be the same company, for the supply of blocks of electricity in the future which they then sell to end user customers through standard retail contracts. These blocks of electricity are often in the form of a strip of Over-The-Counter Swaps which are contracts for the purchase of a fixed volume of electricity for a specific period at a fixed price in the future. For example, a Swap for a block of electricity could be 1 MW for Quarter 1 in 2019. This means the contract is for the purchase and sale of 1MW per hour for 90-days or 2,160 MWhs.

In simple terms, the retailer would contract for a strip, or series, of Swaps to cover their requirements for the supply to a portfolio of end users. In reality it gets more sophisticated than this with peak and off-peak contracts, price cap contracts, options and other derivatives. For the purpose of this article we will assume the simplest case.

The Swap is a financial derivative and not a contract for the actual supply of electricity. There is a cash flow between the generator and the retailer based on the face value of the Swap and the underlying wholesale market price. If the wholesale market price is higher than the Swap price, then the generator pays the difference to the retailer. If the wholesale price is lower than the Swap price, then the retailer pays the difference to the generator. If the prices are the same, then there is no net cash flow. There is usually a daily settlement throughout the term of the Swap based on daily movements in the wholesale market price.

This form of contract is known as a Contract-For-Difference or CFD. It allows the generator to receive a known fixed price in the future for a volume of generation irrespective of the underlying wholesale market price. Similarly, it allows the retailer to purchase a fixed volume for a known price in the future which is then passed on to end users along with a set of risk premiums, other costs and its own profit margin.

In summary:

Swap – contract between retailer and generator for fixed volume and fixed price

Contract-For-Difference CFD – the structure of a Swap – there is a cash flow between the two parties reflecting the difference between the face value of the contract and the wholesale market price

Retail contract – contract between customer and retailer for variable volume (within limits) and fixed price

Wholesale market – the electricity market where a variable price is determined for each half-hour based on end user demand and the electricity generation bid stack to meet that demand

The simplified relationships between the end user, retailer, generator and the market are shown in Figure 1. It is much more complex than this with market intermediaries and a financial settlement clearing house also involved.

Figure 1 – Simple market structure between end user, retailer, generator and the market

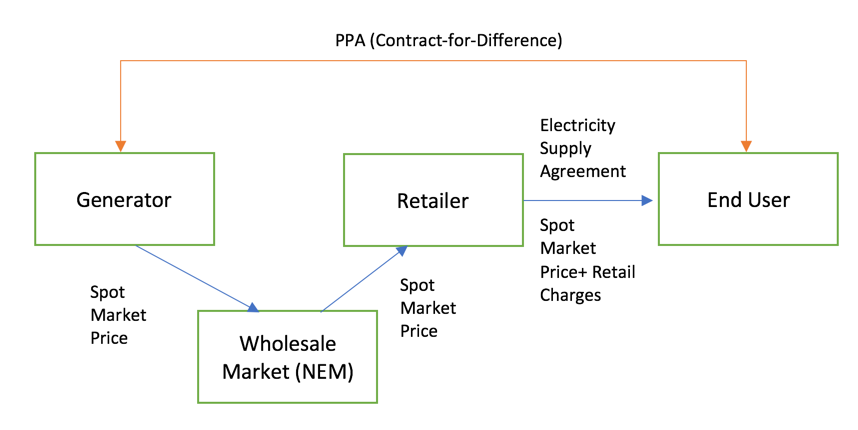

In this case, there is a Power Purchasing Agreement (PPA) between the retailer and the generator based on a Contract-For-Difference (CFD) with the wholesale market price.

A Corporate PPA is a similar arrangement directly between the end user and a generator but is typically a long-term Power Purchasing Agreement with a renewable electricity generator, although it doesn’t necessarily have to be renewable. These PPAs are often negotiated prior to the development of the renewable generation assets being built as they are very important prerequisites for the project financing by the banks. It is for this reason that end users are able to enter into a PPA for long-term electricity supply at a price well below the current wholesale market price.

There are generally two types of Corporate PPAs. One is a physical PPA that is a “behind-the-meter” supply of physical electricity to the end user that is co-located on the same site. In this case, the renewable electricity proponent enters into a contract to supply some or all of its output to the end user at a pre-determined price. The electricity is not supplied via the market, or a retailer however, there may be an agreement with the retailer to export surplus electricity to the grid at a pre-determined or floating price.

The second type of Corporate PPA and the one that we will focus on, is called a “Synthetic PPA”. This is where the end user enters into a long-term off-take agreement with a proposed, or sometimes existing, renewable generator for the supply of electricity at a negotiated price. It is essentially a long-term CFD as the physical electricity supply is supplied via the retailer who may, or may not be, the project proponent. The retailer typically supplies the electricity at the variable wholesale market price and there is a separate cash settlement between the end-user and the renewable energy generator based on the difference in the PPA price and the underlying wholesale market price.

The advantage of a Corporate PPA to an end-user is that it can secure a long-term electricity supply for a known certain price for some or all of its requirements. The advantage to a proposed renewable electricity generator is it can secure a financing for the project and a certain long-term price for its output.

The simplified relationship between the end-user, retailer, generator and the market differs from the traditional approach in that now the end-user has a direct relationship with the generator and the generator does not necessarily have a direct relationship with the retailer, although it can have a relationship or it can even be the same entity.

Figure 2 – Simple PPA market structure between end user, retailer, generator and the market

Avid readers of this four-part series would have noticed that, with the exception of the PPA, the structure is the same as an end-user with a pool price pass-through supply agreement with a retailer as discussed in Part 2 of this series.

So a Corporate PPA is, in effect, a long term hedge against wholesale market pool price exposure. However, that hedge price has more recently been observed to be well below the current market prices.

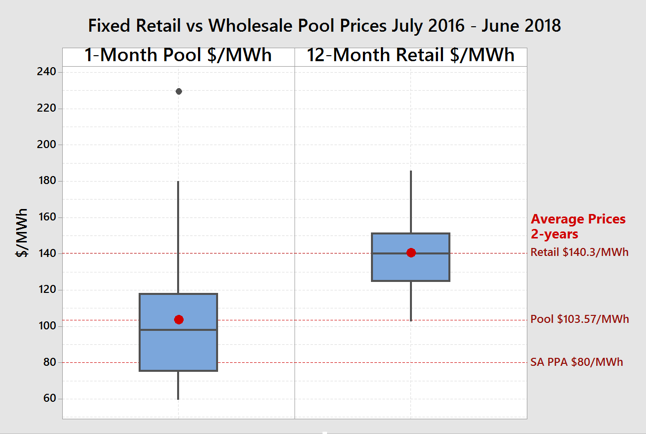

Figure 3 shows a chart that was introduced in in Part 2 of this series. The box plots compare actual average monthly wholesale market spot prices from July 2016 to June 2018 and observed retail price offers made throughout that same two-year period. Whilst not comparing “apples with apples” it does give an indication of the differences in wholesale prices and fixed price retail offers. On average, wholesale market prices were 26% below typical fixed price retail offers. Even lower prices could have been achieved with the market exposure approach through effective demand side management.

Figure 3 – Box Plots of Average Monthly Pool Prices and Observed Typical Monthly Retail Offers Over 2-Year Period July 2016 – June 2018

Enter the Corporate PPA. There has been commentary that PPAs have been struck in South Australia at or below $80/MWh for a “firmed” product (we will come back to “firmed” products). In the Eastern States, PPAs have been reported to have been struck at even much lower prices closer to $50/MWh. Figure 3 shows where this firm PPA price level sits with respect to both the wholesale prices and the fixed retail prices over the last two-years.

If you were an end-user who has been taking pool exposure in South Australia then a PPA offer of $80/MWh would look very attractive as a hedge, at current market prices. If you were an end-user who used a more traditional fixed price retail contract then a PPA offers the opportunity to reduce the energy component of electricity bills by more than 40%.

Of course, the above scenario is highly simplified and negotiating a PPA is much more complex. The most obvious issue is that a renewable electricity generator such as wind or solar does not have a continuous flat output. Wind generation depends on the wind blowing and wind strength. Solar generation depends on the time of year and the extent of cloud cover. Both depend on design issues, quality of components and ongoing maintenance.

The box plots cover two-years of price data but a PPA is most often for a period of more than seven-years. So it is important to have a good understanding of the market and market trends and form a view of likely future prices when negotiating a PPA.

PPAs have a wide range of permutations of contract parameters that the end-user needs to be very wary of when negotiating an agreement. Some of the most obvious ones are:

- Does the agreement contract for a certain percentage or all of the actual sent-out generation? i.e. does the end-user takes the generation volume risk?

- Does the agreement contact for a fixed volume based on a modelled output from the generator? i.e. the generator takes on the generation volume risk and supplies a fixed volume.

- Does the agreement contract for a fixed flat volume and fixed price with the renewable generator providing a “firmed” product? i.e. the generator takes on the generation volume risk and hedges with other parties to provide it with fixed prices on additional volume required when the renewable generation isn’t occurring, known as “firming”.

- Does the end-user receive Large Scale Renewable Generation Certificates LGCs as part of the agreement? Does the end-user receive certificates on a 1:1 basis of volume contracted or based on the mandatory surrender rate for each year?

- Is the entire output from the renewable generation project dedicated to the one end-user or does it supply a portfolio of end users? How is actual generation allocated? Does the end-user have any control over the generation operation?

- What is the term of the agreement? Is there a buyer option to extend at the end of the term? Most PPAs are at least seven years in order to achieve financing from the banks.

- Is there an annual price escalation clause? What is the formula?

- If there is a change in law in regard to LGCs or a carbon trading scheme introduced which party bears the risk or receives the benefit. E.g. if a carbon trading scheme is introduced and the wholesale market price increases as a result, how is this taken into account in the CFD?

- Will the renewable generator also provide the retail service? If so, what are the retail service charges?

In addition to the different contractual forms that a PPA can take, there are also several risks that the end-user needs to be aware of and manage. The most important are:

- Counterparty risks – the risk of the renewable electricity project not going ahead and conditions precedent not met or the risk of the project proponent financially failing and going into liquidation

- Volume risks – the risk that the project will not generate the expected volumes (depending on which party is wearing that risk) or the end-user having much higher or much lower consumption volume than planned. For example, an effective energy efficiency program could drive consumption below the contracted volume.

- Profile risk – the risk that the generation volume is different than modelled. For example, if there was a change in long-term wind patterns that was far different to the initial modelling. The end-user usage profile could be different than planned resulting in a mismatch between the planned generation and usage profiles.

- Price risk – although current PPAs are being priced well below current wholesale market prices, an increase in renewable generation penetration could drive long-term prices down below the PPA prices over the term of the agreement. This would mean that the end-users with PPAs struck, say in 2018, could be paying higher prices than the fixed retail contracts and wholesale market prices in 2022 and beyond.

- Legislative risks – change in law. This is particularly relevant in energy legislation in Australia. Changes in government can result in significant legislation changes that can impact the value of LGCs or the costs of renewable generation.

- Accounting risks – a CFD is a derivative and so the end user will need to apply more complex hedge accounting treatment. If the whole offtake from a project is contracted to one end-user, then it may be considered as a lease rather than a hedge and completely different accounting treatment applies.

- Long-term business strategy – the PPA term will most likely be more than seven years. The business needs to consider its potential operational profile in the context of its long-term strategy. For example, is the business considering rationalising operations, moving offshore, investing in expansion opportunities or embarking on an aggressive energy efficiency program.

End-users need to determine whether they want all of their electricity supply to be firm and at a fixed price or whether they want to contract a proportion of their usage via a PPA and then the balance from the wholesale market. For example, a manufacturing facility with a 30 MW load may be able to curtail half of its load for large periods. They may contract for 15 MW with a PPA and leave the balance of their requirements exposed to the wholesale market price and then use a demand response strategy to reduce the cost of the uncontracted volume.

Corporate PPAs are gaining momentum as a method for end-users to reduce their electricity costs compared with the more traditional fixed price retail supply agreements. At the moment, Corporate PPAs are being executed with very large electricity users, however it will become increasingly popular for smaller users to combine into energy buying groups to take advantage of the same significant costs savings.

Corporate PPAs are quite complex and require a thorough understanding of the electricity market, the structure of the agreements and the significant risks. However, with risk comes significant reward.

|

|

Michael Williams has 35-years’ experience working in resource based, energy and capital-intensive industries such as iron, steel, ferroalloys, cement, quicklime, mining and waste derived biofuels. His experience in operations general management and knowledge of energy markets has led him to become one of one of Australia’s foremost practitioners in energy strategy and energy cost reduction. In 2018 his book “Power Profits – A Comprehensive 9-Step Framework for Reducing Electricity costs and Boosting Profits” was published and was widely recognised as essential reading for those interested in how the Australian electricity market works and how to reduce electricity costs.

Michael has a Masters Degree in Applied Finance and Investment, a Bachelor of Engineering in Metallurgical Engineering, a Bachelor of Applied Economics and is a Graduate of the Australian Institute of Company Directors Course. He is a Fellow of the Institute of Quarrying Australia, a Graduate member of the Australian Institute of Company Directors and has memberships of the Australian Institute of Mining & Metallurgy, FINSIA, and the Australian Institute of Energy. |

Hi Michael, I just came across this article (April 2019…!), thanks for sharing it. The benefits to the end user and the generator from contracting power seem obvious, I guess also the retailer when the difference between spot and contract works in their favour.

Do you have any insights into what effect the contract market has (if any) on the spot market? Does contracting power tend to reduce spot prices or increase them? How much of the market is contracted at any time?

Also I am trying to understand how the gentailer arrangement with contracting power is affected by / affects the sport market.

Any insights appreciated.

Hi Ben,

Thank you for your feedback on the article.

The contract market would have an impact on individual generator bidding strategies. Generators would typically bid more competitively up to their contracted volume and then more aggressively (higher prices) for the uncontracted proportion of their generation capacity.

I cover this in more detail in my book Power Profits that you can find here https://www.amazon.com.au/Power-Profits-Comprehensive-Framework-Electricity-ebook/dp/B07C4HB5XL

I’m not sure how much of the market is contracted at any one time but I would expect that it would be a very high percentage. The number of users fully exposed to spot prices is quite small but has been growing over the last few years. Some end users have spot exposure plus some contracted positions (hedges).

In regards to gentailers, my observation has been that the retail arm of a business is not necessarily given more favourable contract prices to any other party that wishes to bilaterally contract. “The price is the price”. That is why retail prices offered by competing retailers are often very close.

Michael Williams

Altus Energy

Thanks Michael, I have your book on my list now 🙂 I read your bio and it’s safe to assume you are aware of the ongoing debate about renewables, cost and reliability.

In terms of the spot market and the bid stack, I can see that more low cost generation at the bottom of the stack should push some higher cost generation off the top of the stack, so the spot price is set by a lower cost generator. This will result in a higher margin for the retailer in the periods when SRMC is low, so retailers like this to happen. On the flipside, when intermittent VRE is not available, the SRMC is expected to be higher.

Since there are market caps for high and low prices, but the high cap is far higher than the low cap, it seems logical to me that retailers would hedge more against the periods of high wholesale prices than against low prices i.e. there is risk to retailers on the high wholesale price side, but rewards on the low side.

If this logic holds true, then intermittent sources result in higher retail prices, and the market cap on the high side can act like a target (not a cap) for SRMC generators.

So two questions (finally):

1. is it appropriate for intermittent sources to bid apples-for-apples against dispatchable sources in the same market?

2. if the market high cap (target) was removed, would extreme pricing be prone to self limiting?

Cheers

Ben