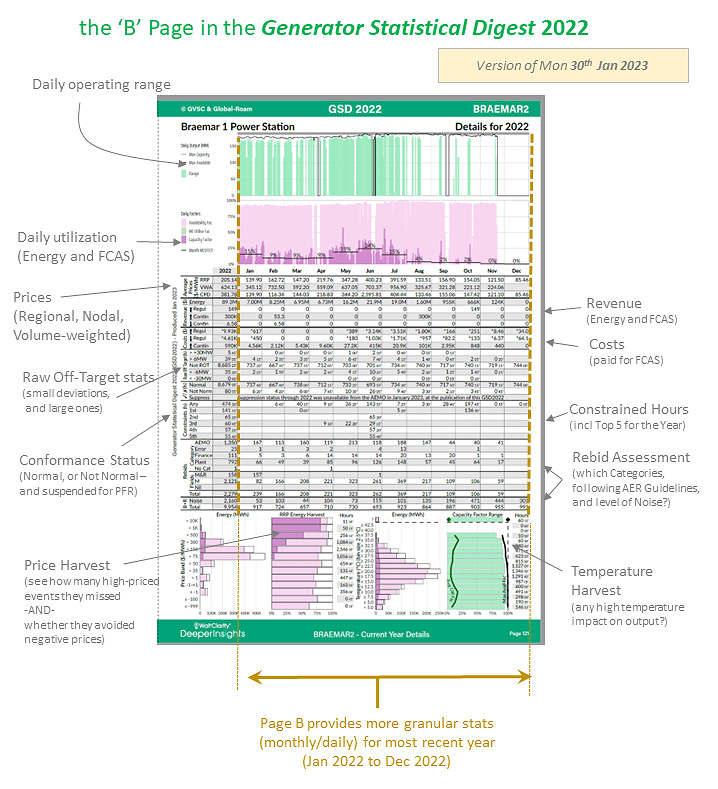

As noted here, for every DUID that operated at some point through CAL2022, we include two pages of statistical data on the technical and commercial operations of the plant.

We’re referring to the page on the left as the ‘A’ Page (described here), and the page on the right as the ‘B’ Page (which is described below):

In the table below, we provide more context to the data represented on each ‘B’ Page in the GSD2022:

| Data Sets Included | Brief Description |

| Daily Operating Range | Through 2019 we witnessed (and were involved in) some discussions with a broader group of energy sector stakeholders about the ‘typical’ operational patterns of different types of power generation assets – particularly as the market is likely to be requiring more flexibility in future years.

The addition of the ‘B’ Page into the GSD2019 provided the ideal opportunity to start the page with this simple trend that will help readers to quickly understand the operational profile of the unit in question – and, by comparing page-to-page, contrasting these operational profiles. This chart proved of great value to us (and our clients) through 2020, so we continued thru the GSD2020, the GSD2021 and this GSD2022. —————- In his article ‘Farewell Liddell’ on 31st January 2023, Allan O’Neil referenced this data for Liddell, Stanwell and Tarong power stations to highlight the significant difference in their operations over 10 years (2013 to 2022). |

| Daily Utilisation (for Energy and FCAS) |

As a ready-reference guide to assist in understanding, and communication, of operational patterns of the DUIDs operational across the NEM through 2022 we include the Daily Utilisation chart.

An increasing number of assets (particularly batteries) will be added to the grid in the coming years with a focus not just on Energy but also on the provision of FCAS services. With these assets, it’s important to recognise that “utilisation” – hence the adoption of metrics that span commodities: —————- In his article ‘Farewell Liddell’ on 31st January 2023, Allan O’Neil referenced this data for Liddell, Stanwell and Tarong power stations to highlight the significant difference in their operations over 10 years (2013 to 2022). |

| Prices (Regional, Nodal and Volume-Weighted) |

Three different monthly prices are provided for the unit in question:

Data Point #1 = Monthly Time-Weighted Average (TWA) spot price for the region containing that DUID are included in the table as a point of comparison. Data Point #2 = Volume-Weighted Average (VWA) price ($/MWh) for the month for that DUID. The VWA Revenue is a more commonly used metric, which incorporates the effect of the MLF on a generator’s revenue – but readers need to be clear that it’s not the same as VWA Price, which has its own applications (e.g. it has value in comparability between units that does not include the complicating impact of MLF). Data Point #3 = Connection Point Dispatch Price ($/MWh) – which is calculated by AEMO for every dispatch interval and for which we aggregate on a time-weighted basis for each month in the GSD2022 to help the reader understand the impact of transmission congestion on that asset. —————- In particular, Allan’s article ‘How good is Solar Farming?’ on 28th January 2020 highlights how this table in the (prior) GSD2019 makes it easy to quickly compare across a broad number of units to understand both: The way in which the (prior) GSD2019 makes it easier to understand congestion risk (and impact) was also picked up by Ben Willacy in ‘What lies ahead for the NEM in 2020? Some lessons from 2019’ on 28th January 2020. |

| Revenue (Energy and FCAS) |

Revenue is calculated on a monthly basis through 2020 for each of 4 categories as applicable:

1) Energy for production sent out (i.e. net of approximated auxiliary energy consumption); and also 2) FCAS Regulation (Raise and Lower) 3) FCAS Contingency Raise 4) FCAS Contingency Lower. Because we calculate costs for each just below this, it’s very easy to compare! |

| Costs (for FCAS) |

Utilising a methodology that has been developed by Greenview Strategic Consulting (based on understanding of AEMO’s processes) it has been possible to derive the apportionment of FCAS costs (global, and regional) across all Participants (and hence DUIDs), under these three categories:

1) FCAS Regulation (Raise and Lower) apportioned using the ‘Causer Pays’ method 2) FCAS Contingency Raise, apportioned to Generators; and 3) FCAS Contingency Lower, apportioned to Loads. —————- Allan’s article with respect to the (prior) GSD2019 highlighted the large FCAS costs incurred by some solar farms (and they were not the only ones!) due in part to poor Raw Off-Target performance. |

| Raw Off-Target stats | In the GSD2019 we built on what we had done from the GRC2018 (and also incorporated into our ez2view software through 2019) to incorporate a tabular summary of ‘Raw Off-Target‘ performance for each unit.

——————- On January 28th 2019 Paul McArdle posted the article ‘Review of extremes in ‘Raw Off Target’ performance through 2019, with the Generator Statistical Digest 2019’ that explored what was evident in the data for Calendar 2019 with respect to the metric we called ‘Raw Off-Target’ – which both: Following from that article, an ongoing amount of feedback received from a range of different parties (plus our own incessant curiosity) drove us to continue exploring how performance in the NEM has been changing specifically with respect to Aggregate Raw Off-Target for Semi-Scheduled plant, in an expanding series of Case Studies linked here. This proved of interest to a variety of different people and organisations – including the AEMO (in this ‘highlights of our 2020 year’ note, I included the comment that the Case Studies were referenced in AEMO’s presentation (p8-9) on 7th December 2020 to its Intermittent Generator Forum). The insights generated also fed into the ongoing development of ez2view, for the benefit of those clients. This analysis was continued and extended in Appendix 17 of GenInsights21. ——————- This data was updated for calendar 2022 in the GSD2022. |

| Calculated Conformance Status | This ‘Raw Off-Target’ metric is then developed further to derive a ‘Conformance Status’ for each DUID across all Dispatch Intervals in 2022:

1st Category = ‘Normal’, which is where all DUIDs are expected to operate, as part of their registration process. 2nd Category = ‘Not Normal’, which is an aggregation of all dispatch intervals for that unit where a unit was deduced as operating ‘Off-Target’ (according to AEMO’s Compliance logic) and ‘Non-Conforming’ 3rd Category = Added from the GSD2020 forwards (i.e. not in the GSD2019) we introduced a category of ‘Suspended’ to cover the dispatch intervals in which, for a given unit, the AEMO had switched off its Conformance Status logic…. (a) For GSD2020 and GSD2021 this primarily represented the unit implementing Primary Frequency Response (PFR). (b) For the GSD2022 the AEMO notes that this ‘suspension’ of Conformance Status monitoring might also be for a range of other reasons. ———- Articles tagged with ‘Conformance Status’ are here, whilst articles specifically tagged with ‘Non-Conformance’ are here. |

| Constrained Hours | In the longer 10-year trend of annual summary of constrained hours on the ‘A’ Page we list a ‘top 5’ constraints for a DUID through 2022.

On the ‘B’ Page here we expand on those top 5 constraints to record how many hours in each month the constraint was bound affecting that unit. ———- On 1st February 2021, Paul McArdle published the article ‘Which units were most impacted by constraints in 2020?’ exploring some of the insights accessible from the GSD2020 with respect to constraints. |

| Rebids and AER Guidelines | The AER is responsible for issuing Bidding Guidelines, which they expect to be adhered to (as they play an important role in ensuring that participants follow the NEM Rules when operating in the market).

———- In the GRC2018 we included several pages of analysis of bidding (discussed here), drawing on the guidelines to firstly automatically tag each bid as either: This analysis was extended (and included for every single unit) in the GSD2019, the GSD2020 and the GSD2021 . Because of a change in AER guidelines (and bid structure at AEMO) in conjunction with Five Minute Settlement, we refined the approach used to categorise rebids to highlight those that: * note that this uses automated logic. |

| Rebid Noise | Added into the GSD2022, this provides a monthly count of the # Bids and Rebids that have been classified as ‘Noise’ according to our automated logic.

———- When we publish articles using these statistics (and we remember) we will link them in here. |

| Rebid Categories | Following on from the initial categorisation, all rebids that could be determined as ‘Well Formed’ were then unbundled into one of the 4 categories prescribed by the AER in its Guidelines:

Category “P” for Plant Reasons ———- When we publish articles using these statistics (and we remember) we will link them in here. |

| Price Harvest | In this figure, we match the output in a dispatch interval with what the dispatch price was for that region at the same time. This presents a great way of helping the reader to understand how well the DUID is maximising revenue opportunities – particularly: (a) Securing the high-priced events; and (b) Avoiding the negatively priced events.———-In Allan’s article ‘How good is Solar Farming?’ on 28th January 2020 with respect to the GSD2019, he was able to utilise the respective Price Harvest charts to highlight a key difference (in revenue performance) between Solar Farms and Peaking generators.In the article ‘Using the GSD2020 to explore different operating patterns across generation types’ of 1st February 2021, Marcelle was able to use this chart to illustrate the different types of operating modes of different units. |

| Temperature Harvest | In this figure, we match the range of output at the particular DUID at the ambient temperature recorded at the nearest BOM measurement station (identified at the top of the ‘A’ Page).

———- In ‘Extreme temperature effects on generation supply technology’ on 11th February 2020 we were able to utilise the detailed per-unit analysis published in the GSD2019 to help explore limitations at high temperatures. The article ‘Temperature Alert!’ of 24th December 2020 also illustrated why this data is very necessary. |

The advantage of this format is that it enables data to be reported, on the same basis, for all ENERGY-market operational DUIDs!