In this article, I’ll unpack:

- What’s really driving the current low-price FCAS environment

- Why Demand Response (DR) has been squeezed, and what DR still brings to the table in terms of:

- Reliable sub-150 ms contingency event response

- Technology diversity in the bid-stack

- Essential two-sided market participation for the energy transition

To cover the first point, I’ll draw on two different (though related) developments as follows:

The rise of Battery Storage

Utility-scale BESS has grown rapidly to become the dominant provider of Contingency FCAS services and is well on its way to achieving a similar position in the energy market, alongside renewable energy sources.

- To date, existing energy traders have been the primary participants bidding in BESS capacity.

- However, as discussed by Matt Grover of Fluence in his article ‘The growing NEM BESS fleet: Who is controlling all this capacity, anyway?’, by the end of CY26, 40% of BESS traders will be new entrants.

In the modern NEM, responsibility for trading optimisation is becoming increasingly blurred. BESS operations now involve a mix of O&M contractors, investors, virtual tolling agreements, and off-takers, making it harder to identify who is accountable for ensuring that the asset is extracting optimal revenue from the market.

In February 2025 Declan Kelly (in his article ‘Hot chips, algorithms and electricity markets’) highlighted some considerations about the rise of auto-bidders operating in the market.

All of this means that the BESS bidding and optimisation world is still very much in a state of flux.

The decline of prices for Contingency FCAS

Furthermore, as noted in this recent ‘long-run trend of monthly average Contingency FCAS prices in NSW‘, recent times have seen the collapse of average prices for all 8 markets in the Contingency FCAS markets.

So why have Contingency FCAS prices been clearing so low recently?

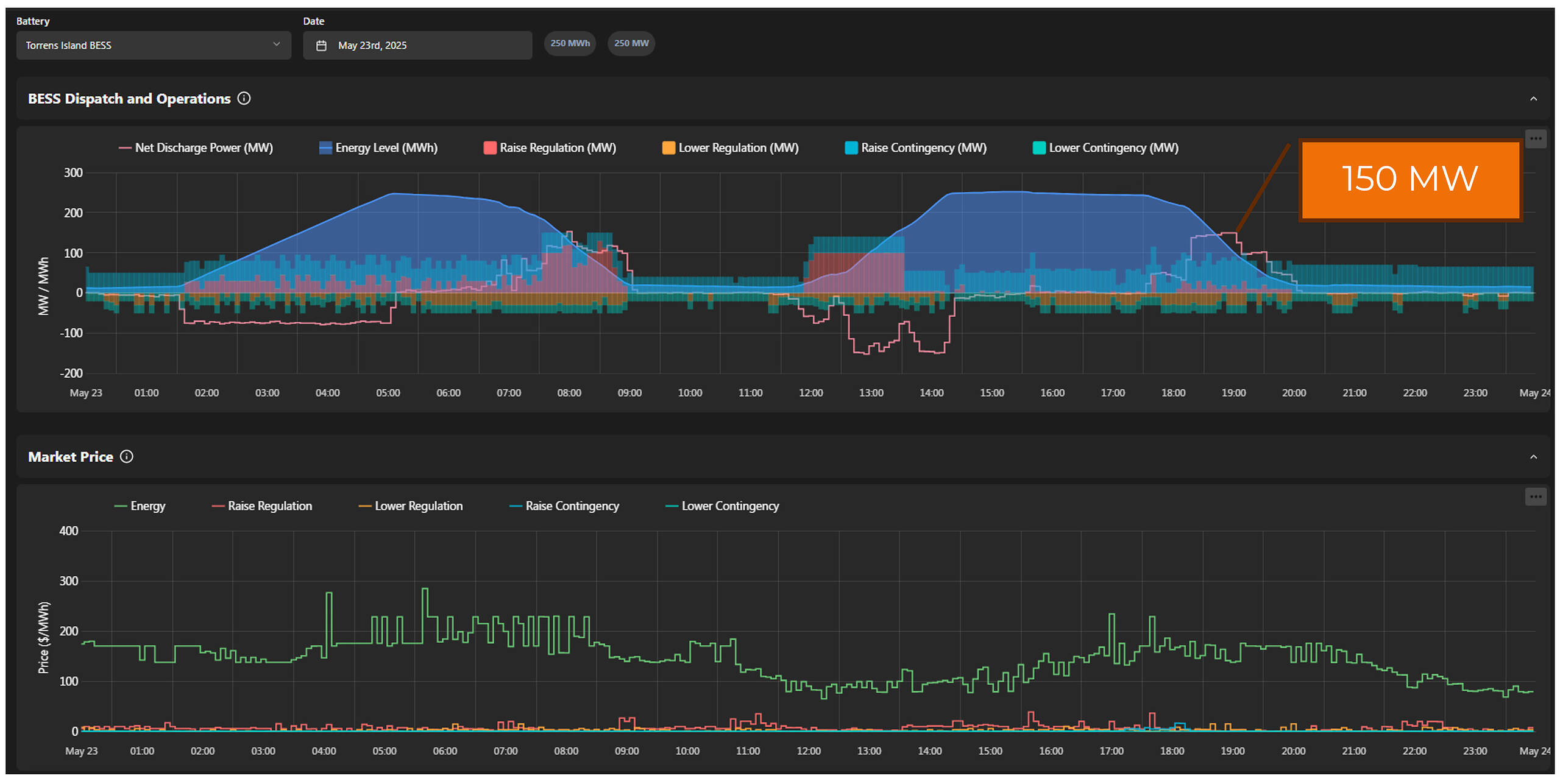

To help illustrate why, Figure 1, from OptiGrid’s OpenBESS platform, shows the operations of Torrens Island BESS on 23 May 2025. I’d highly recommend OptiGrid’s OpenBESS website for NEM and BESS nerds.

This date was chosen simply because I live in South Australia and drafted the article that day. Like many current utility BESS, Torrens Island has a one-hour energy storage capacity.

Figure 1 – Torrens Island operation example from 23rd May 2025, courtesy of OpenBESS.

For clarity, the contingency FCAS raise and lower prices shown on OpenBESS are the average of the regional price for each of the markets.

Torrens Island never discharges at a rate higher than 150 MW on 23 May 2025, despite having a 250 MW nameplate capacity and high energy prices.

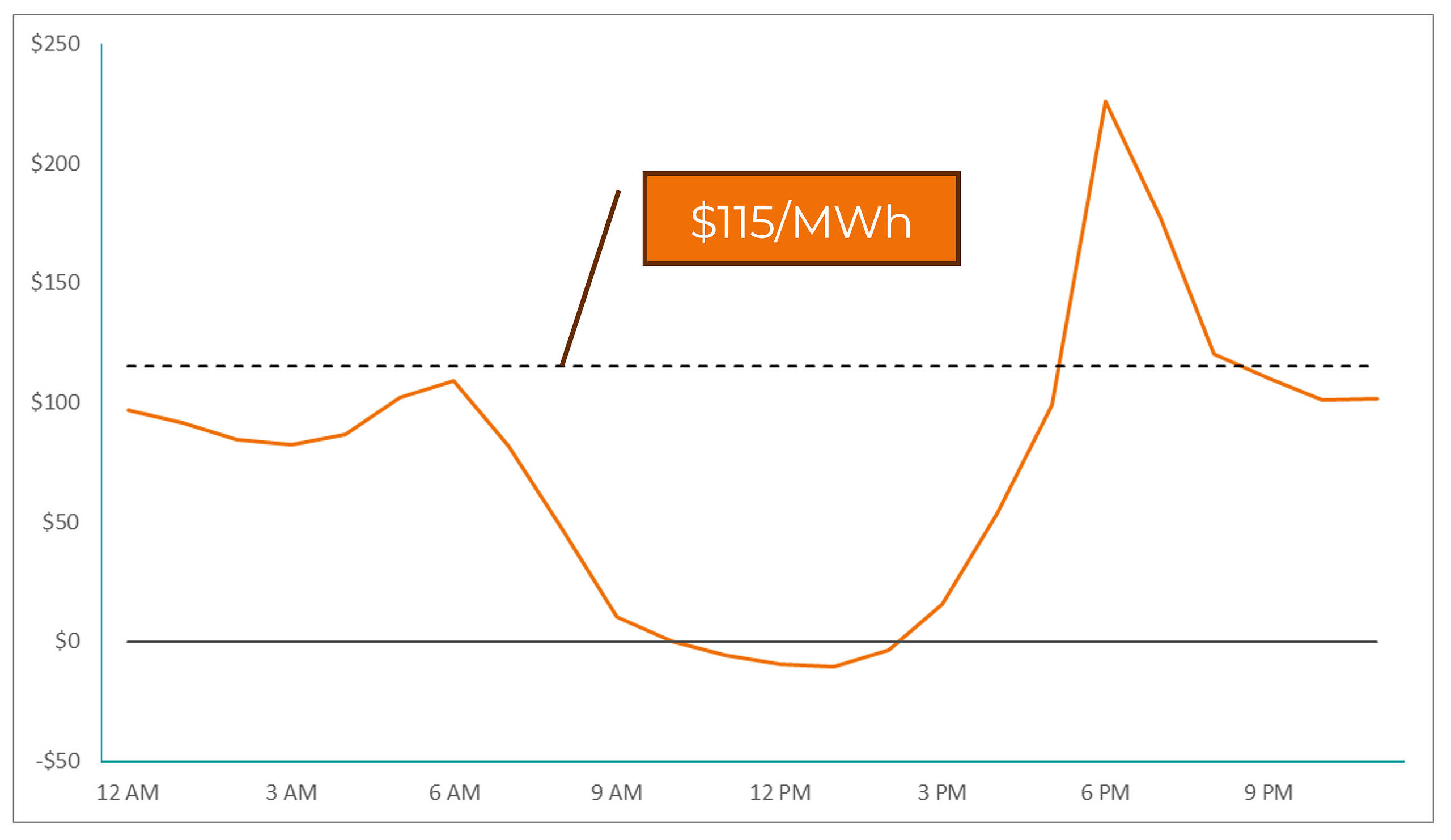

To understand why this is optimal, Figure 2 shows the average daily energy price profile for South Australia since January 2025. Prices remain above the dashed $115/MWh line between 16:45 and 20:45 NEM time. Incidents of extremely high energy prices (>$10,000/MWh) are all clustered within this window.

The optimal BESS strategy, therefore, is to discharge at a moderate rate, ensuring sufficient state of charge (SoC) to capture the very high prices as they arise in that window.

Figure 2 – Average daily wholesale prices in SA since January 2025.

As a result, the ‘spare MW capacity’ is put into the Contingency FCAS market, with significant amounts seen at exceptionally low prices.

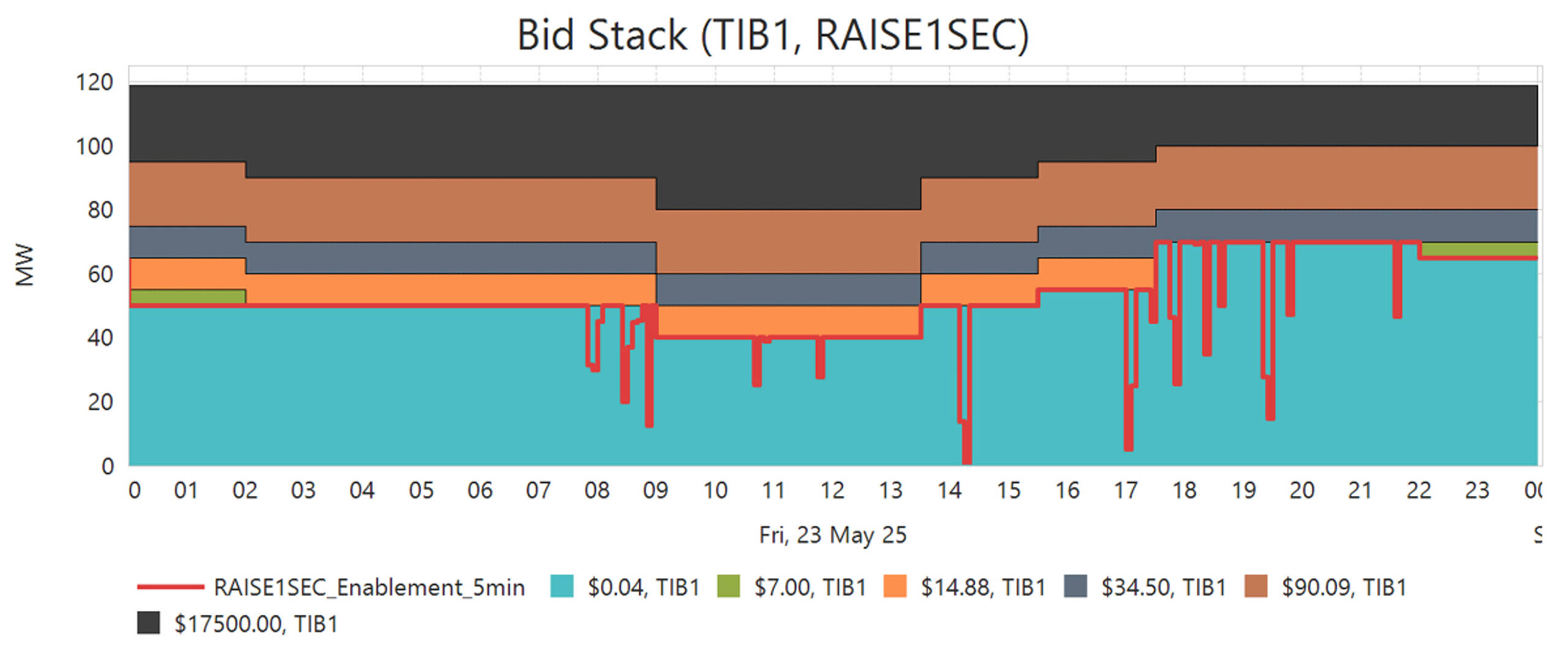

The Torrens Island BESS (which was re-registered as BDU following the IESS rule change) offers 70 MW of Very Fast FCAS raise service at $0.04/MWh throughout this evening peak energy window as seen in Figure 3a.

Figure 3a) Torrens Island Very Fast FCAS BESS Bid Bands and Volume for 23rd May 2025 (i.e. the day in focus)

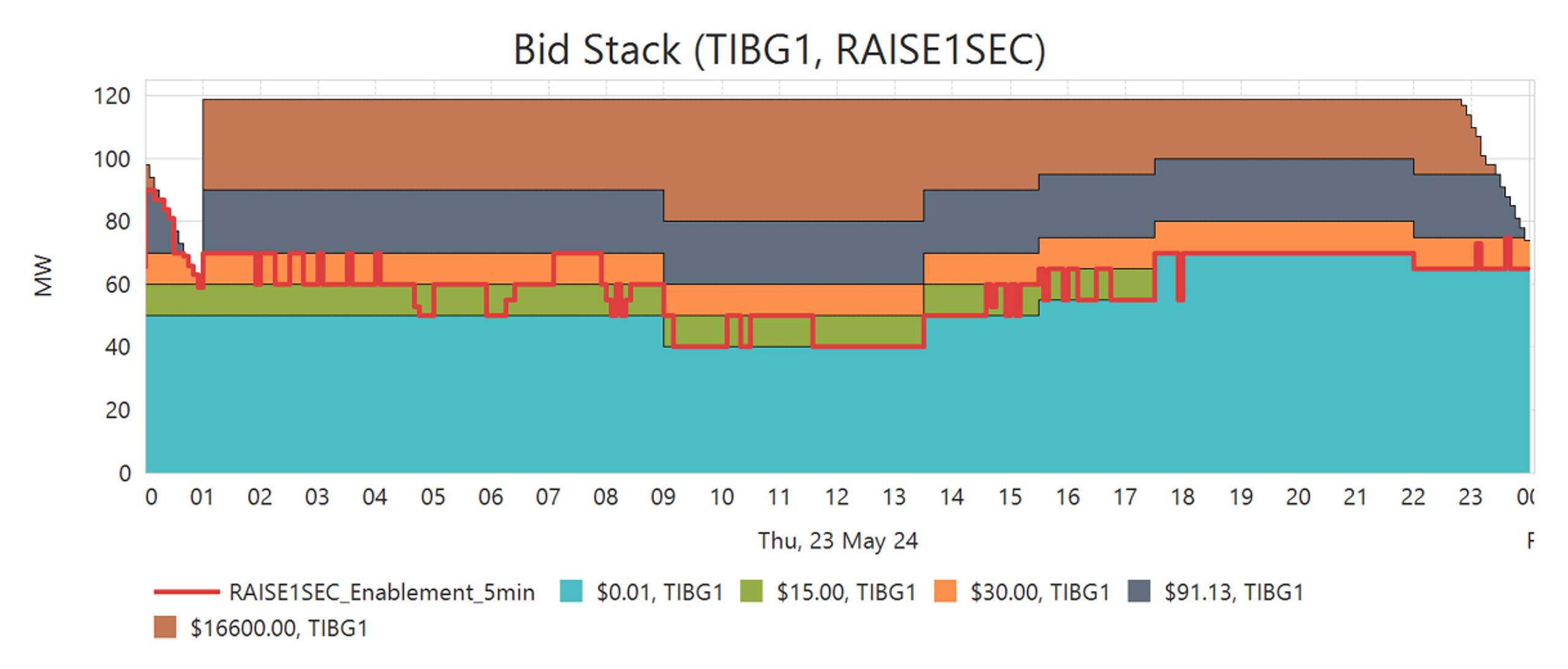

In Figure 3(b) below, we show the similar chart for Torrens BESS a year earlier (on 23rd May 2024), but note that this DUID is TIBG1 (i.e. pre-IESS transition).

Between the two figures, in my view the bidding has not changed significantly:

- I’m particularly focused on the lowest price band – which was $0.04/MWh on 23rd May 2025 for Very Fast FCAS, but down even lower (at $0.01/MWh) for the same service a year earlier.

- Five to six utility scale batteries offering this kind of volume in these extreme low-price bands is all it takes to clear typical Contingency FCAS demand at prices less than $1/MWh.

Figure 3b) Torrens Island Very Fast FCAS BESS Bid Bands and Volume for 23rd May 2024 (i.e. a year earlier)

That’s just market supply and demand though, right?

Yes, but the outcome is slightly more nuanced than simple supply and demand.

It’s a function of the same supply pool simultaneously servicing multiple demand markets. The kicker for the Contingency FCAS market is that its demand is significantly lower than that of the energy market, meaning it has reached saturation point orders of magnitude earlier. Using significant volumes of ‘price-taking’ bids is a strategy that traders will need to consider increasingly carefully as time goes on.

Recent Contingency FCAS prices are lower than what some have calculated the cost to be, to provide the service. Price-taking bids work if someone else in the bid stack is making the effort to set reasonable prices, which is no longer the case in the Contingency FCAS markets. This bidding approach is also used extensively in energy and could potentially erode energy arbitrage value sometime in the future if left unchecked.

Is there still value to be had in Contingency FCAS?

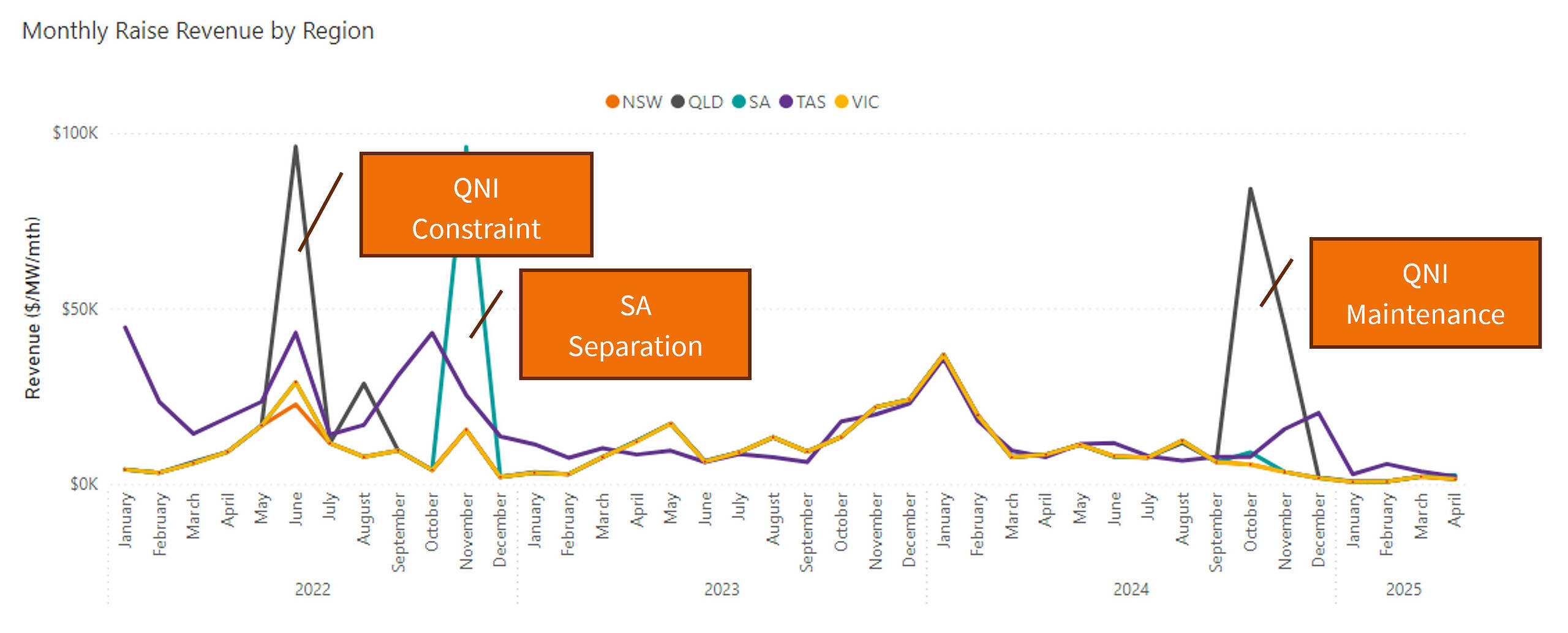

Historically, Contingency FCAS prices in Queensland, South Australia, and Tasmania have been primarily influenced by interconnector related constraints, due to each state being connected to the NEM by a single interconnection. Figure 4 shows historical price per state dating back to 2022. This type of constraint is not expected in NSW and VIC as multiple interconnections exist.

Figure 4 –Historical Contingency FCAS raise monthly revenue based on 1 MW accepted into all available markets 100% of the time.

QLD and TAS Contingency FCAS market participants will continue to see periods of elevated prices due to interconnector constraints. It will take more time for Contingency FCAS capacity in these individual states to reach saturation, given local demand in islanded scenarios. Our opinion is that there will still be good value for Contingency FCAS market participants in those states for the near future.

These low Contingency FCAS prices are a good outcome, right?

While this may reflect efficient market mechanisms, is it a desirable outcome free of unintended consequences?

A knock-on effect of the decline in Contingency FCAS prices is that critical smart grid technology like demand response (DR) is increasingly pushed out of the Contingency FCAS bid stack.

Demand Response in the FCAS Markets

Contingency FCAS has been a natural home for DR in the NEM since the 2017 go-live of the AEMC’s rule promoting Demand Response Mechanism and Ancillary Service Unbundling.

- Several large industrial facilities already deliver ~150 ms stepped response for the Very Fast FCAS raise market.

- As of May 2025, 27% (382 MW) of the registered capacity in VF FCAS raise is provided by DR. Of course, this capacity is only utilised if it clears in the bid stack.

- VIOTAS’s entire DR portfolio has been participating in VF FCAS since October 2023.

This may surprise readers who still picture DR as a ‘call-and-respond’ mechanism.

Demand Response as a valuable service

Those with a power systems background will recognise that a 150 ms response falls within the inertial response timeframe, making it an increasingly valuable capability as we transition to a grid dominated by grid-following inverters.

The recent grid event in the Iberian Peninsula underscores the importance of critical services like VF FCAS in the modern grid. There is a strong argument to be made for maintaining diversity in the supply of such services to ensure system security, something that cannot be achieved if one technology is allowed to dominate the bid stack.

DR assets have made significant upfront investments, passed the same technical assessments as other market participants, maintained continuous compliance, and have adapted their operations to provide critical grid stability services, while still meeting their own production schedules.

It’s widely acknowledged that the NEM must evolve towards a fully functioning two-sided market. And yet:

- The Wholesale Demand Response Mechanism (WDRM) in the ENERGY market has not met expectations, which is being considered in the AEMC’s current review.

- Additionally, as noted in this article DR is now increasingly pushed out of the Contingency FCAS bid stack.

Industrial DR sites have held firm and continue to participate in the Contingency FCAS markets, but how long can that be sustained with recent clearing prices, especially in the states of VIC and NSW where interconnector constraints are not expected to cause elevated prices?

My question is:

- Should the NEM consider an interim mechanism to ensure a healthy level of DR participation in Contingency FCAS until robust two-sided market structures are in place? There is a real danger of losing this valuable capability, the loss of VF FCAS capability from DR would be a particular shame.

- Is that something that will come from the AEMC’s current review, or is that something being considered in the Nelson Review?

About our Guest Author

|

Paul Moore is the Managing Director of VIOTAS Australia. Paul leads the Australian team with a strong emphasis on growth strategy. His career focus has been on driving technology innovation in renewable energy. With over 20 years of experience, he brings a wealth of knowledge and capability to VIOTAS in both technical and senior leadership functions. You can find Paul on LinkedIn here. |

Dear Paul,

Thank you for writing this thought-provoking article. However, I’m struggling to reconcile the idea that BESS traders and their auto-bidders are simply making poor decisions and consistently losing money. The paper you linked mentions that the provision of contingency FCAS costs $10/MW/hr, which raises a couple of questions for me regarding their methodology:

a) Could the BESS be holding other underlying financial contracts? For instance, is it possible they are strategically withholding capacity as part of a broader hedge against wholesale price movements? Do we have any visibility into the terms or pricing of such contracts?

b) How is BESS Capex impacted by charging and discharging patterns? Is this accounted for in their analysis?

It would be helpful to really understand the bidding behaviour of BESS so DR participants can identify and exploit rare opportunities when they arise.

I’d appreciate your thoughts on these points.

Hi T C,

Thanks for your comment. I agree, it’s unlikely to be a case of poor decision-making. My article was intended to draw attention to the consequences of whatever is driving this behaviour.

a) Protecting a 3–4-hour hedge seems like a plausible explanation. Unfortunately, the NEM is not ‘perfectly competitive’ in the economic sense, as details of such arrangement are not, to my knowledge, made available to all market participants. I’m also not clear on how modern tolling arrangements might result in this behaviour.

b) Battery replacement costs are certainly a likely factor. That said, with battery prices continuing to fall, most analysts would argue that it is best to maximise revenue in the short term rather than conserve capacity.

Greater transparency around out-of-market contracts would help all participants understand how these deals influence market outcomes.

Kind regards,

Paul M

I can see why there is an argument for geographic diversity of supply in provision of these services (assuming this better ensures power system security than geographic concentration).

But I struggle with the concept that ‘technology diversity’ is required. These contingency services, particularly very fast frequency response, are very inexpensively provided by BESS (in pretty much the same way that provision of inertia used to be effectively costless in a fully synchronous system) – I don’t see any good argument at all for forcing inclusion of higher cost FFR technologies into the supply stack.

The article seems to be arguing that we won’t have enough of these services at some future date if economic competition drives DR providers out of the FFR markets, but given the level of investment in BESS, that seems a very long bow to draw.

Hi Allan, thanks for the comment.

Just to clarify, the article isn’t arguing that we’re heading for a shortage of FFR supply. The current low prices reflect an abundance of BESS-based supply, and projections from Modo Energy suggest this supply will continue to grow rapidly in the NEM.

The case for technology diversity is more about risk management. Each technology brings its own physical response characteristics and commercial behaviours. With the rise of algorithmic bidding and increasingly strategic dispatch from BESS, those commercial behaviours may become a system risk in their own right.

My argument is simply that it would be prudent to maintain some technology diversity within the FFR, and broader FCAS, stack. That diversity could be at risk if prices continue to clear at very low levels, potentially leading to over-reliance on a single technology class with tightly correlated incentives and response profiles.