On Tuesday 13th May 2025 evening, as it was happening, we quickly noted ‘Late afternoon volatility in NSW (and QLD!) on Tuesday 13th May 2025’ at the start of a period of volatility that was mainly focused on the NSW region.

We decided to piece together a Case Study in a few parts and, as such:

- On Wednesday 14th May 2025 we included a single snapshot of a single rebid for TUMUT 3 in ‘Part 2 of a Case Study – looking into evening volatility in NSW on Tuesday 13th May 2025’

- This is Part 3,

- with more to come…

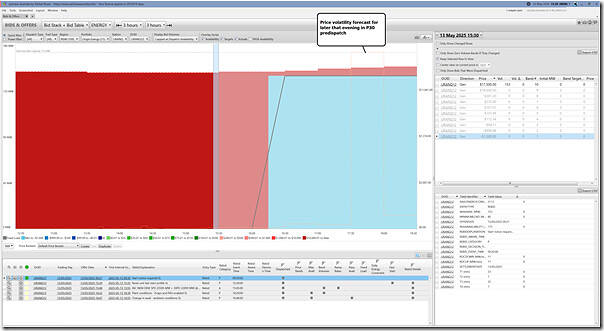

In this article we’re going to use a Time-Travelled ‘Bids & Offers’ widget in ez2view to highlight 5 different rebids at the following dispatch intervals (all in NEM time) on Tuesday 13th May 2025:

The 15:30 dispatch interval

For the 15:30 dispatch interval, a rebid received by the AEMO at 09:21 that morning was still in use:

This shows both:

1) An expectation that, by 16:20, volume would be shifted down to –$1,000/NWh

2) Which we see is about an hour before the expected price spike (to >$14,000 at 17:35).

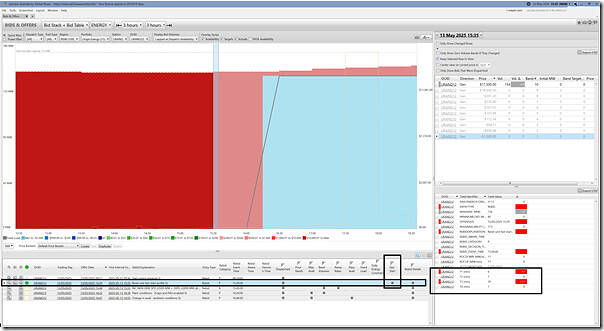

The 15:35 dispatch interval

At 15:29 (just prior to Gate Closure #2!) the AEMO received a rebid that ‘reset unit fast start profile SL’ and specifically:

1) Reduced T1 (i.e. ‘time to synchronise’) by 17 minutes to only 6 minutes

2) Increased T3 (i.e. ‘time at minimum load’) by 17 minutes to 39 minutes.

One might infer, from this, that (remembering that the unit already had bids down at -$1,000/MWh later in the day):

1) There was already an expectation of some action a little later on…

2) This rebid (and others that followed) was about fine-tuning the approach

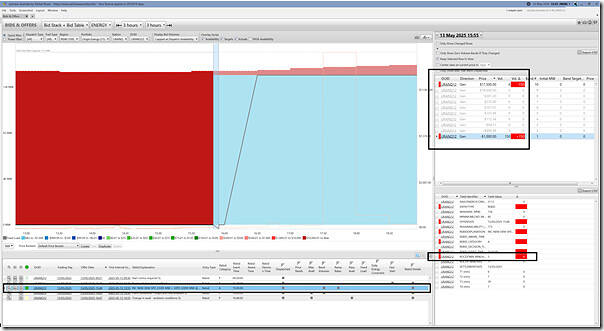

The 15:55 dispatch interval

At 15:48 the AEMO received a rebid (referencing AEMO’s P5 predispatch demand forecast as the reason) and which

1) Shifted 150MW from the ~MPC bid band to down at the Market Price Floor bid band at the RRN;

2) and reduced the ROCDOWN rate (by 8 MW/min) to 3MW/min (similar in style to TUMUT3 in Part 2).

Here’s the view

The 16:30 dispatch interval

At 16:22 the AEMO received a rebid that spoke of plant conditions that allowed for an increase in MaxAvail by 19MW … which contributed to a 23MW increase in volume down at –$1,000/MWh:

The 16:55 dispatch interval

At 16:47 the AEMO received a rebid that spoke to ambient conditions, requiring a small (3MW) drop in MaxAvail:

Remember that there are 4 units at Uranquinty … the approach was slightly different at each unit, but had some similarities.

Be the first to comment on "Five (re)bids for URANQ12 on on Tuesday 13th May 2025 – Part 3 of a Case Study"