Editor’s Note – This article is based on a presentation by James Tetlow at All-Energy Australia 2024 in Melbourne on October 24, 2024. The presentation explored the challenges, risks, and opportunities for Battery Energy Storage Systems (BESS) operating as Scheduled assets in the National Electricity Market (NEM). James’ talk was the one of 4 presentations that Paul noted in his article ‘‘Operating in the NEM’ … from All Energy 2024’.

Why is this important?

The operating experience of most people working in the energy transition has been gained from Semi-scheduled wind and solar farms, but many of those people are now developing and planning to operate Scheduled storage assets. For the transition to succeed, it’s vital to understand the important differences between operating Scheduled compared to Semi-scheduled assets.

Scheduled vs. Semi-scheduled

Operating in the NEM as a Scheduled asset is a significant step-up in commercial opportunity but also in risk and obligation. The need to plan and execute to your plan is greater, and whilst the commercial opportunities are greater so are the commercial risks. There is also a greater role for automation, but in turn that needs more human skills and experience to oversee. There is no “semi” in Scheduled; it’s a serious operational commitment.

Semi scheduled. There is no semi in Scheduled

A flying analogy

The differences between operating Semi-scheduled and Scheduled assets can be illustrated with the analogy of a glider and a commercial jet plane. Like soaring in a glider, Semi-scheduled units have some freedom to follow the natural flow of weather patterns, they may be bound by certain restrictions or caps but within those boundaries they generally follow the natural resources.

In the NEM, Semi-scheduled assets glide with natural conditions like a glider, while Scheduled assets require the precision, planning and control of a jet.

Images courtesy of Wikipedia.

Operating as a Scheduled asset can be compared to flying a jet plane—where precision matters, and every deviation has consequences. Scheduled operations are higher risk and need tighter planning and control. Success demands mastery over dispatch, careful market timing, and the ability to quickly respond to changing conditions. There’s no gliding through Scheduled operations.

Three Pillars of Scheduled Operations

Let’s focus on three particularly important differences between the two types of operation.

#1 Planning and Control: Every Action Matters

Semi-scheduled wind and solar must follow rules. They must meet PASA obligations, forecast conditions accurately, and adhere to dispatch caps. Much like a glider navigating designated airspace and adjusting to shifting winds, Semi-scheduled generators respond to environmental conditions and mistakes do still carry consequences, but these assets have some flexibility.

With a passenger jet, every start and every turn, every take-off and landing is planned, agreed with the air traffic control tower and must be executed as per the plan. Scheduled operations also require planning and precise control. Every dispatch interval is deliberate, with strategies in place to handle market fluctuations and unforeseen events.

In scheduled operations, every step must align with the plan—like a flight path gone wrong, small deviations can lead to costly consequences.

Image courtesy of The Canberra Times.

Just as a pilot makes a plan, shares the plan with air traffic control and sticks to the plan, operators of Scheduled assets must also accurately forecast their output now and in the future and ensure their output follows their plan, with deviations of less than 6MW.

When Things Go Wrong

If you are a Semi-scheduled wind or solar farm, there are consequences to getting things wrong. There are clear PASA obligations, real-time forecasting is crucial, and you must respect a Semi-Dispatch Cap, but there is certainly more latitude. You are, after all, only half, or Semi-scheduled.

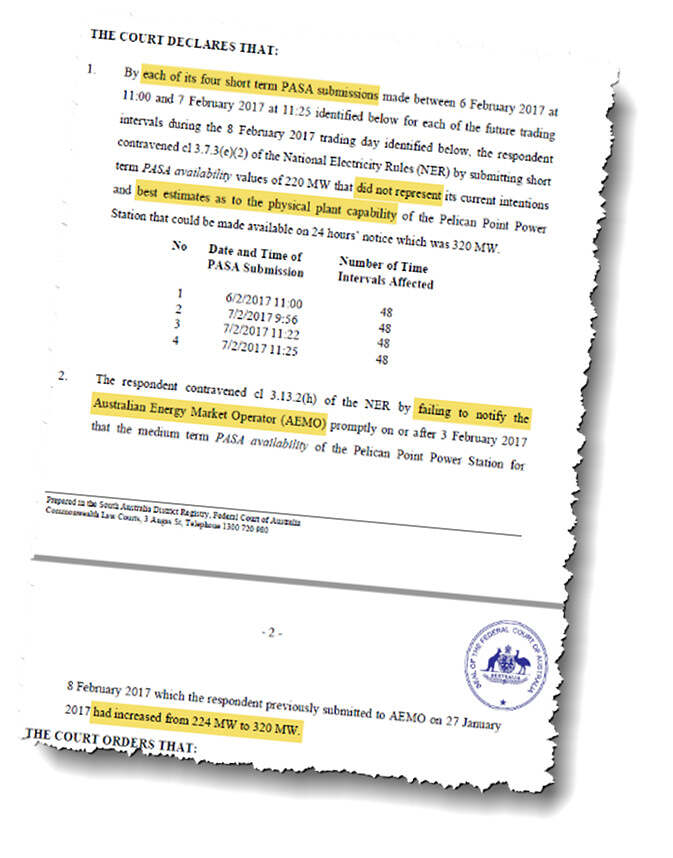

But there is no half or semi- in Scheduled operations. Get your PASA forecasts wrong, and you can expect trouble. Like Pelican Point’s inaccurate STPASA submissions in 2017, which were off by just 96 MW—and cost the owners $900,000.

Pelican Point was fined $900,000 for four incorrect ST PASA submisisons

And you must follow your target all the time, not just during a Semi-Dispatch Cap.

So, there are significant differences and failure to understand and respect these has significant financial consequences.

But planning and precision are only part of the equation – navigating the financial landscape of Scheduled operations brings its own set of challenges.

#2 Commercial Complexity: Juggling Markets and Managing Risks

Complexity

A Scheduled storage asset typically needs multiple revenue streams across energy and Frequency Control Ancillary Services (FCAS) markets. A bit like the complexity of a full-service airline selling multiple classes of comfort with dynamic pricing whilst also managing highly variable operating costs.

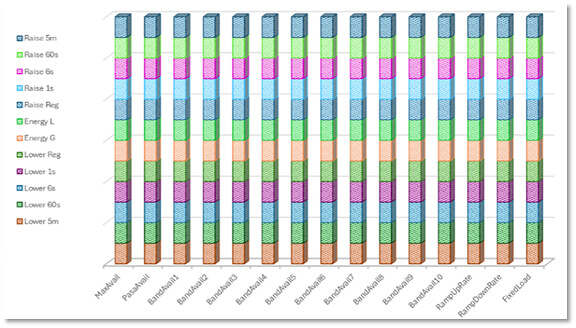

Conversely, a Semi-scheduled generator needs to think only of energy – 1 bid with 10 price bands.

Semi-scheduled assets (Top) operate with 10 simple price bands, while Scheduled assets (Bottom) must navigate the complexity of multiple markets and bid bands—balancing FCAS, energy markets, and state-of-charge strategies in real time.

Images courtesy of Overwatch Energy.

A Fine-Tuned Balancing Act

Scheduled operations demand constant vigilance. Operators must track multiple services—eight contingency markets, two regulation markets, and the energy markets, and not just right now.

To be any good at this, you need to also forecast prices and be aware of your State of Charge and any warranty limitations. And, just like an airline that balances passenger classes to optimize profit, BESS operators need to determine every 5 minutes where the best value is – how to co-optimize across energy and FCAS markets.

So, great opportunity for value, but far more complex, and far riskier. But why more risky?

With extra reward comes extra risk

These extra markets offer more financial reward, but they also bring extra financial risk that requires constant management. Let’s look at two in particular.

You could buy energy at $17,500/MWh

While Semi-scheduled assets worry about prices dropping to – $1,000/MWh, Scheduled BESS must prepare for the possibility of buying energy at $17,500/MWh. Nobody should be buying energy at $17,500/MWh, but you now have that opportunity.

Failure to Deliver the Services

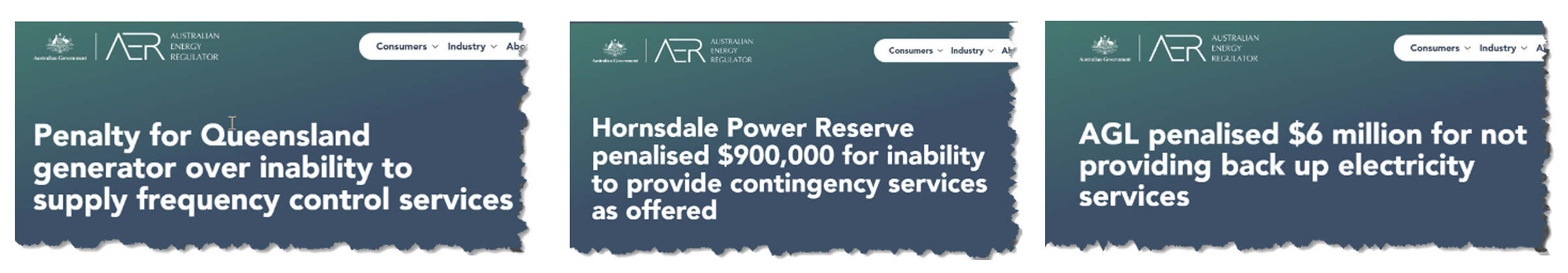

You are now earning money selling ancillary services, but the services are technically complex. What if you don’t deliver them? Here are some examples of what happens:

- 2021: CS Energy for failures in 2019 and 2020 at Callide B and Gladstone re FCAS Contingency: $200k and repaid $1.3m.

- 2022: Hornsdale for failures in 2019 re FCAS Contingency Services: $900k.

- 2023: AGL, various units for failures between 2018 – 2020 re Contingency FCAS. $6million.

The risks of non-compliance are real—penalties like the $1.3 million repayment from CS Energy and the $900,000 fine for Hornsdale Power Reserve highlight the high stakes of failing to meet operational obligations.

Images courtesy of the AER website.

So you may be taking the money, but if you are not actively checking your technical outputs, then one or two years later you might having a difficult conversation with your investors. Can you please return your dividend because some while ago someone did a software upgrade on site that we didn’t control.

When you register and commit to providing these services then, you must ensure those services are available.

#3 Automation and Human Expertise: The Perfect Balance

A passenger jet uses sophisticated hardware, software, and autopilot systems to manage routine operations. But no one suggests you don’t also need a skilled and experienced pilot for a passenger jet.

Similarly automation for Scheduled operations is essential. But it can’t solve everything. Automated systems handle routine dispatch, co-optimize energy and FCAS participation, and should support compliance with the NEM’s rules. Automation helps operators manage the rapid pace of the NEM’s five-minute settlement cycles, but it’s not enough on its own.

Just as a pilot is essential to talk to air traffic control and take over when automation fails, skilled operators are essential to talk to AEMO and network Service Providers and manage outages and problems.

Success in the NEM requires more than just smart algorithms—it depends on humans for routine operations and when things don’t go according to plan.

In Scheduled operations, just like in a cockpit, success depends on having the right people in control—those you can trust to make quick, informed decisions when it matters most.

Image courtesy of Smithsonian Magazine.

Perhaps counter-intuitively, the more complex the system and the greater the reliance on automation, the more critical it becomes to have experienced operators who can act swiftly and decisively when needed.

Key Takeaways: Your Flight Plan for Success in the NEM

Expect to see lots more Scheduled units in the NEM. That could be great news for the energy transition, but only if the differences with Semi-scheduled are understood and managed. So:

- Don’t try and fly a passenger jet with a gliders licence: If you are new to Scheduled assets then upskill your staff.

- Airline revenue is more complex and riskier than gliding revenue: Understand the services you are selling and constantly check you are delivering them.

- Think carefully about who you put in the cockpit: More complex Scheduled operations require more, not less, human experience.

|

James Tetlow is an Executive Director at Overwatch Energy.

James has more than 20 years’ experience working on behalf of owners to deliver large and complex project financed assets. His range of expertise spans pre-close, design and construction, commissioning and steady-state operations including many ‘behind the meter’ energy and controls system projects and forays into waste to energy. In 2019 he co-founded Overwatch Energy. You can find James on LinkedIn here. |

Leave a comment