This evening I’m keeping one eye on the Olympic coverage and one eye on the electricity market – given earlier warnings of a possible demand record in TAS, and the prolonged run of high prices seen in SA last night.

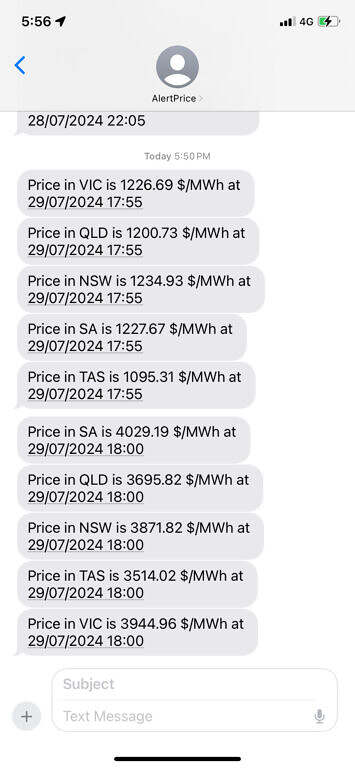

Starting from the 17:55 dispatch interval this evening, we have seen a rare occurrence of prices spiking >$1,000/MWh in all five NEM regions simultaneously. Outside of the 2022 energy crisis, this has seldom occured in (at least) the recent history of the NEM.

As time permits, we will endeavour to take a closer look into the market conditions that led to these price outcomes.

Blocking high causing a significant downturn in wind production.

Callide C3 is apparently offline as well for another month.

Businesses in general are at a 25yr high for bankruptcy/insolvency. Nothing to see here folks.