Project Energy Connect, Snowy 2.0, Borumba, Basslink, Central Queensland Hydrogen Hub, Marinus Link, Pioneer-Burdekin, Copperstring – the NEM has its share of past, present, and proposed mega-projects, showcasing both promise and peril.

In the past week, several news articles have highlighted ongoing issues surrounding the construction of Project Energy Connect (PEC), drawing parallels to the challenges faced by Snowy 2.0 in recent years.

Given these similarities, I thought it would be useful to collate a timeline of both projects to understand how three key aspects of each of these projects have evolved over time: 1) expected cost, 2) expected benefits, and 3) expected delivery date.

Project Energy Connect

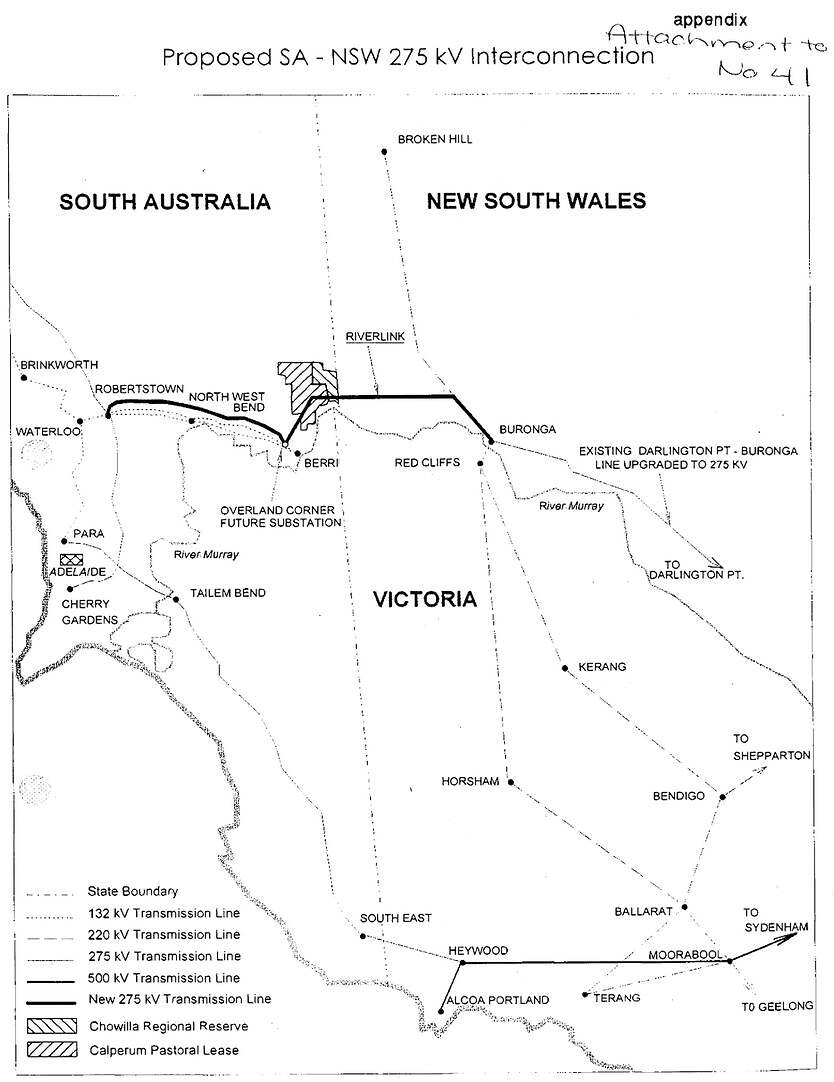

An interconnector between SA and NSW (then-named Riverlink) was originally approved in principle by the SA Government in December 1997 at a projected all-in cost of $95m. The original proposal included a new 275kV line between Robertstown (SA) and Buronga (NSW). However, with the privatisation of the Electricity Trust of South Australia in 1999, the Riverlink project was effectively scrapped.

Riverlink Original Proposal, December 1997

Source: SA Department of Premier and Cabinet

In June 2016, then-Premier of South Australia, Jay Weatherill, announced a partially state government-funded feasibility study to revive the Riverlink interconnector proposal, amidst a trend of increasing wholesale prices. In September of that year, SA experienced its now-infamous state-wide blackout, which fuelled concerns over the state’s energy security, and specifically, about the region’s ability to navigate interconnector separation events from VIC.

An initial cost-benefit assessment as part of the RIT-T process was eventually published by ElectraNet in June 2018, and ultimately detailed four options for consideration:

- no new interconnector. Instead this option included several new support agreements, two new batteries, and FCAS enablement on Murraylink.

- HVDC interconnection to QLD connecting Port Augusta (SA) to Western Downs (QLD).

- Several variations of HV AC and DC interconnection to NSW in several different configurations and capacities.

- A new HVAC interconnection path to VIC connecting Tungkillo (SA) to Ballarat (VIC).

A variation of the SA-NSW interconnector was identified by the report as the preferred choice – this specific option consisted of a new 900km HVAC line between Robertstown (SA) and Wagga Wagga (NSW). The project was eventually given the new name ‘Project Energy Connect’.

Below is a tabulated timeline of milestones and events concerning PEC.

|

Date |

Event |

| 2016-06-14 | The SA Government announced a new feasibility study for an SA-NSW interconnector, citing increasing wholesale electricity prices.

In the announcement, then-treasurer Tom Koutsantonis stated that an initial cost estimates for a proposed interconnector were in early stages, but ranged “between $300m to $700m”. |

| 2016-09-28 | South Australia experienced the now infamous state-wide system black event. |

| 2016-11-01 | A RIT-T Project Consultation Report was published by ElectraNet outlining that four credible interconnector options would be assessed. |

| 2018-06-29 | ElectraNet published their RIT-T Draft Assessment Report, with the finding that a 330kV line connecting Robertstown and Wagga Wagga was the preferred option at an estimated cost of $1.52b. |

| 2019-02-13 | The RIT-T Final Assessment Report was released, confirming the Robertstown-Wagga Wagga line as the preferred option. ElectraNet concludes that net market benefits are expected to be $900m over 21 years (in present value terms). |

| 2020-12-18 | The AER published its preliminary position on PEC, but was unable to make a final determination as neither Transgrid nor ElectraNet had committed to the project. In their preliminary assessment, the AER reduced the projected cost of the project by 9%, to $2.15b. |

| 2021-02-04 | The AEMC rejected an urgent rule change request from ElectraNet and Transgrid, that would have assisted PEC to secure necessary debt financing. |

| 2021-05-31 | The AER published their final determination, giving the project a green light at a proposed cost of $2.28b.

The CEFC announced that they had facilitated the project with a $295m ‘subordinated note instrument’. Several media outlets reported that the project was unlikely to proceed without the CEFC’s intervention. |

| 2021-06-02 | Clough Engineering and Elecnor were awarded the EPC (Engineering, Procurement and Construction) contract for the New South Wales (Transgrid) portion of PEC, through a new joint-venture enterprise, SecureEnergy. SecureEnergy was later renamed Elecnor Australia. |

| 2021-10-08 | Downer were awarded the EPC contract for the South Australian (ElectraNet) portion of PEC. |

| 2022-12-06 | Clough Engineering was placed in voluntary administration. The company was eventually acquired by Webuild in February 2023. |

| 2023-12-21 | ElectraNet announced that the South Australian side of the transmission line had been completed. The SA portion makes up 206 km of the near-900 km line. |

| 2024-01-24 | In their annual report released in January 2024, Elecnor, cited COVID-related execution delays, rises in prices for raw materials, labour, and logistics as factors behind negative margins on their Australian projects. |

| 2024-05-21 | In the May 2024 update of the 2023 ESOO, the AEMO highlighted an official one-year delay to the final completion of the project. Stage 1 (a 150MW transfer capacity) is expected for November 2024. |

| 2024-07-10 | A second engineering contractor, Downer, is added to the Transgrid portion of the project after original engineering contractor, Elecnor, defaulted on parts of its contractual obligations. |

Table 1: Timeline of major events and disruptions to PEC

The next table lists the estimated cost and completion date for the project from official sources, as they have evolved throughout the life of the project.

| Date | Expected Capital Cost | Expected Completion | Note, Source(s) |

| 2016-06-14 | $700m | – | SA Premier’s Announcement (Pre-Feasibility) , SBS Financial Review |

| 2018-06-29 | $1.48b | July 2023 | Assessment Draft Report, ElectraNet |

| 2019-02-13 | $1.52b | July 2023 | Assessment Final Report, ElectraNet ABC |

| 2020-09-30 | $2.36b | June 2023 | Initial Project Application, AER |

| 2020-12-18 | $2.15b | – | AER Preliminary Position Report, AER |

| 2021-04-30 | $2.33b | – | Revised Project Applications, AER |

| 2021-05-31 | $2.28b | June 2023 | AER Final Determination, AER |

| 2022-11-29 | – | December 2024 | Construction Update, Transgrid |

| 2023-08-05 | – | July 2026 | ElectraNet COO Statement, PV Magazine |

| 2024-05-21 | – | July 2027 | ESOO May 2024 Update, AEMO RenewEconomy |

Notes: Technical design specifications have changed upon project progress. Where an estimated cost was given as a range, the upper estimate is shown in the table.

Table 2: Changes to official estimates of cost and completion.

No official update to the project’s total cost appears to have been made public since the final determination in May 2021.

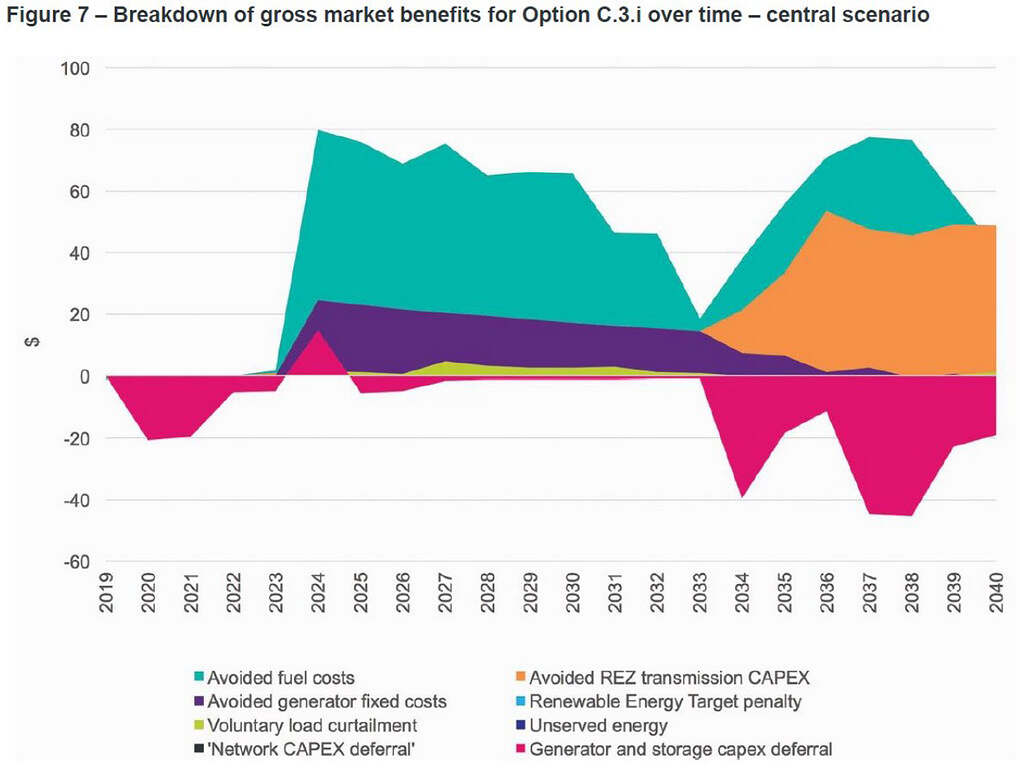

In the initial assessment published in June 2018, ‘avoided fuel costs’ made up the largest share of projected market benefits from PEC (in the central scenario), and were predicted to begin from mid-2023.

The modelled market benefits (central scenario) of the original iteration of PEC from June 2018, which assumed completion by July 2023.

Source: ElectraNet Project Assessment Report Draft June 2018

Other market benefits such as reduction in generator capital and fixed costs, avoided REZ transmission capital expenditure, etc. were also projected.

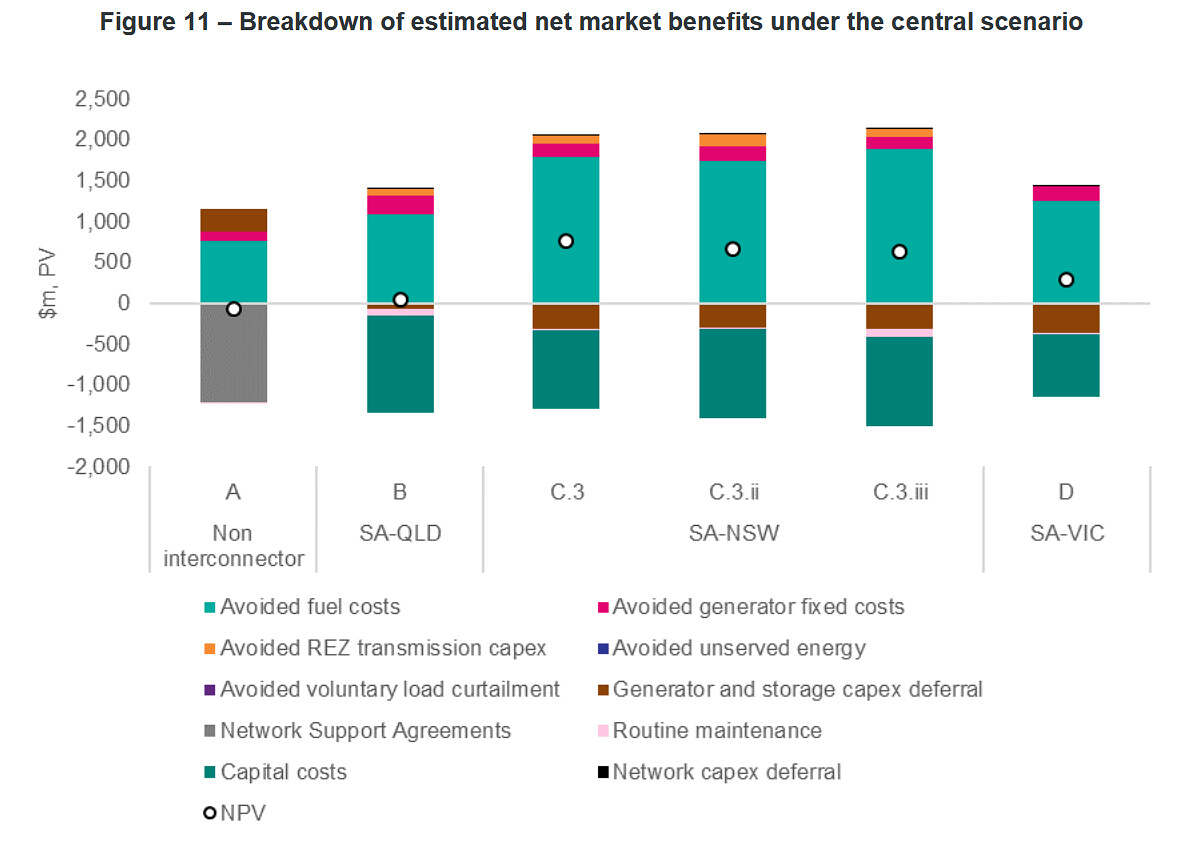

Estimated market benefits from each of the assessed interconnector options, from February 2019.

Source: ElectraNet Project Assessment Final Report February 2019

Key Takeaway

Industry veterans appear trained to be skeptical of any estimate of cost or delivery time of these mega-projects. Upon the AER’s approval of PEC in 2021 for $2.28b, Grattan Institute’s Tony Wood colourfully put it “Anyone who thinks it’s going to get built for what they are saying it will be, has rocks in their heads.”

Of course, it’s an inherently impossible task to accurately model and predict the total cost and delivery time for any long-dated large complex engineering project. But erring on the side of optimism can risk harm to investor appetite. And in particular, a greater concern is that delays to critical infrastructure could create potential domino effects for parts of the development industry.

In Part 2 I will publish a similar timeline for the Snowy 2.0 project, and provide further takeaways from examining the evolving expectations surrounding both projects.

Really sterling article Dan.

Do you have any view on how the marginal benefits of energy connect compare with where we would be had the original $95M been spent on Riverlink in 1997?

Thanks Mark. Many would argue that the situation would have been easier, cheaper, quicker, etc. if things were started two decades earlier.. I don’t disagree, but hindsight is 20/20.

A few what-ifs and other questions worth thinking about:

– How things would have panned out had Riverlink been in place before the renewable development supercycle (and the system black event)?

– Would it have actually cost $95m?

– Were the expected benefits the same back then, as they are now? (and how easy was it to predict these when the original Riverlink didn’t go ahead)

– Are all the benefits measurable/model-able?

Sorry that should be “Project Energy Connect” in my comment!