Yesterday we posted ‘A first quick look at bids for NSW participants, including Wednesday 8th May 2024’ – including (amongst other things) an aggregate level view of coal generator bidding in NSW, looking back 30 days.

Today we have already delved further, with a series of articles:

#1 = ‘Delving deeper, into coal generator performance in NSW on Tue 7th May and Wed 8th May’

#2 = ‘Delving deeper, into Wind Farm performance in NSW on Tue 7th May and Wed 8th May’

#3 = ‘Delving deeper, into battery (discharge) performance in NSW on Tue 7th May and Wed 8th May’

#4 … so in this article we’re going to take a similar approach, but look at gas-fired peakers instead.

#5 … might get around to looking at hydro in more detail at some point (but not now)

We’re still using the ‘Bids & Offers’ widget in ez2view.

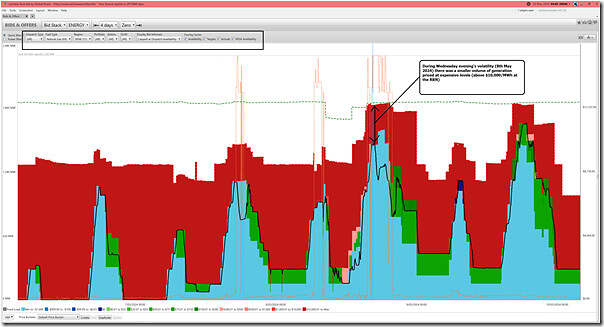

(A) All gas units across NSW (4 stations)

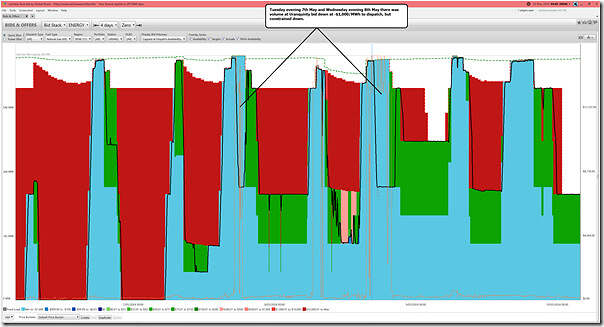

There are 4 gas-fired stations in NSW at this point – here’s the shorter time-range aggregate view:

It’s easy to see in this trend that:

1) As the ‘peaker’ name suggests, capacity is bid to run during peak times (but not at other times)

2) This was the case on Monday evening (even without extreme volatility), and then Tuesday evening, Wednesday morning and Wednesday evening … and then similar on Thursday as well (under Administered Pricing).

3) For Wednesday evening we see that three things occurred:

(a) More capacity was offered

(b) Much of it was offered down at -$1,000/MWh at the RRN (although some was still above $10,000/MWh)

(c) More of it was dispatched.

(B) Unbundling, for each of the 4 x NSW gas-fired stations

Let’s unbundle for each of the gas peakers, alphabetically…

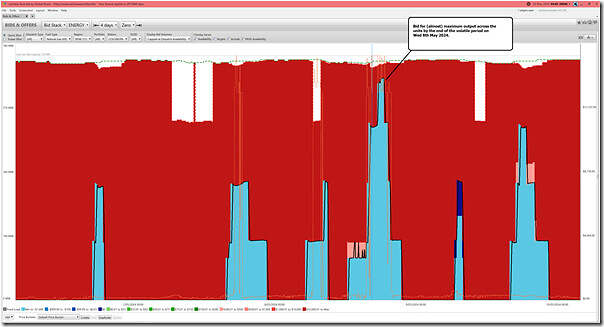

B1) Colongra Peaker

For Snowy Hydro’s Colongra Peaker, we see very distinct bidding patterns to reflect the output profile:

During the Wednesday evening volatility period, almost all of the capacity was dispatched for a period of time (and almost all of it was bid down at -$1,000/MWh).

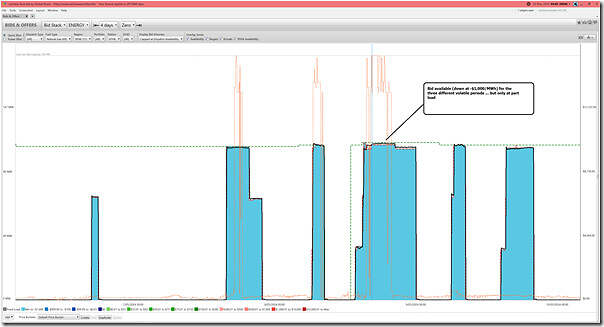

B2) Smithfield Peaker

For the Iberdrola owned Smithfield peaker, it was bid down at -$1,000/MWh at the RRN during the three periods of extreme volatility, and also at other times:

However this was only at partial capacity (when compared to the Maximum Capacity of the station).

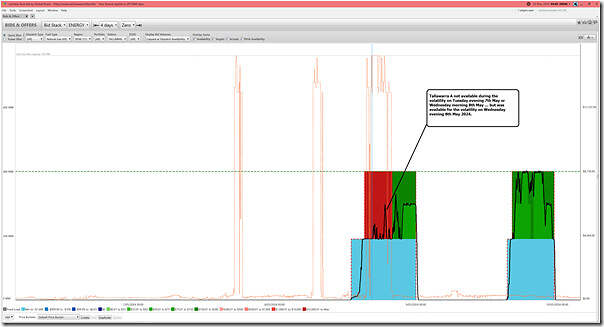

B3) Tallawarra Peaker

There’s two units in the Tallawarra station (the way they are registered at the AEMO). This chart shows that Tallawarra A was not bid to dispatch on Tuesday evening or Wednesday morning … but was on Wednesday evening and then also Thursday evening (despite the Administered Pricing):

Note that Tallawarra B did not run (was not bid available).

B4) Uranquinty Peaker

We earlier posted ‘A quick look at the ‘N::N_CTYS_2’ constraint equation, with respect to Wednesday 8th May 2024’, in which we noted that there were the 4 units at Uranquinty that were ‘constrained down’ by this constraint:

1) along with wind farms.

2) Keep in mind that there were other constraint equations that were also bound (so it’s not only this one that was a factor!)

We can see this during the volatility periods on Tuesday evening 7th May and Wednesday evening 8th May … though not so much on Wednesday morning:

From a bidding point of view, the profile distinctively shifted across the 4 day period … even outside of peak demand periods, with more volume bid to run.

Be the first to comment on "Delving deeper, into gas-fired peaker performance in NSW on Tue 7th May and Wed 8th May"