Well, curiosity got the better of me* – both in relation to internally-generated questions and the ones we’re receiving from various external sources, so I’ve referred back to my copy of ez2view v9.9.1.98 (which is soon to be superseded) and filtered down to offers from all NSW-based units as follows.

* and we had other reasons to take a look at ‘Bids & Offers’ given what we’ve been doing at the back-end for the changed bid structures related to IESS

Note that this is intended to be a quick helicopter-level view that starts the process to explore answers to some of the questions I asked at the end of the day yesterday.

I’m expecting this to only partially answer questions … and indeed to open up for more questions we might explore further in the coming days…

(A) All suppliers, looking back 30 days

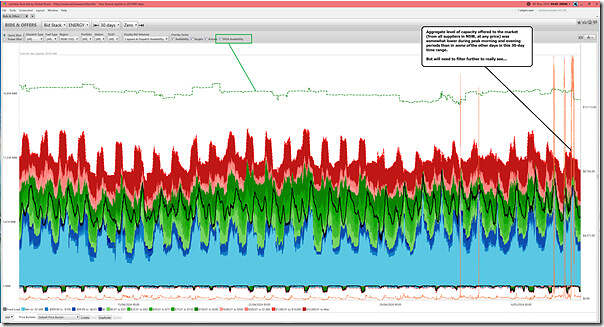

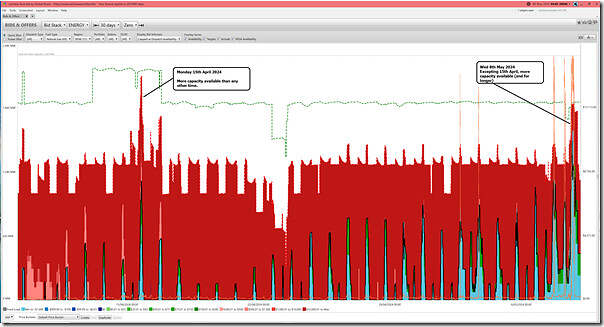

With this helicopter-level view, a key intent is to provide some perspective on Tuesday 7th and Wednesday 8th May in the context of other recent days, so readers might be able to quickly zero in on ‘what’s different?’. For that reason we’ve taken the option of showing the most recent 30 days of bids for all units in NSW, with NSW spot price for ENERGY overlaid for context in terms of when the various periods of volatility occurred:

1) Briefly on Thursday 2nd May;

2) Briefly on Friday 3rd May;

3) On Tuesday evening 7th May; and then

4) Both morning and evening Wednesday 8th May, and with prices elevated as well in middle-of-the-day.

So let’s start by looking at all units:

Remember that (for the IESS upgrade) we’ve already changed the representation of bids so that bids above the line are for injections, and bids below the axis are for withdrawals from the grid (i.e. charging, pumping, or just general consumption for any Scheduled Loads).

Also remember to click on an image to open in a larger size in another tab.

This chart is understandably busy … but, if you squint, you’ll be able to see that Wednesday 8th May saw lower aggregate supply in NSW from all sources, at any price, than on some of the other days in the 30-day historical range.

Meaning that (assuming import capability from QLD and VIC were the same, and demand was similar) the supply-demand balance would be tighter.

(B) Filtering down to different types … looking back 30 days

But we need to filter down further to see things in more detail – in this article we’re only going so far as Fuel Type aggregates – meaning that in some subsequent article we might drill into particular units. Given that the emerging operating philosophy is VRE + Firming, we’ll classify on that basis:

B1) VRE … Variable Renewable Energy

Leaving aside the invisible rooftop PV, let’s focus on what’s visible in terms of Semi-Scheduled capacity:

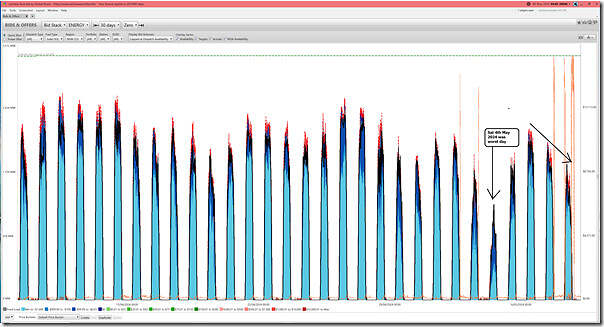

B1a) Large Solar

Here’s the last 30 days of offers from all Large Solar generators in NSW:

Briefly about this chart:

1) There’s the gradual seasonal decay of capability as we head towards winter;

2) Clearly Saturday 4th May was the worst day for capability in this date range;

3) Wednesday 8th May was worse than Tuesday 7th May … which in turn was worse than Monday 6th May.

4) With volatility clearly occurring at sunrise and sunset periods.

B1b) Wind

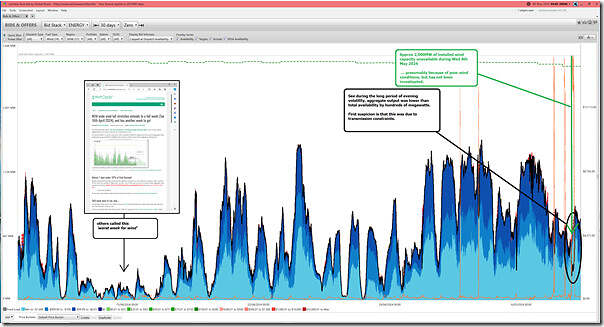

Here’s the last 30 days of offers from all Wind generators in NSW:

With respect to this 30-day span:

1) What others termed the ‘worst week for wind’ (earlier in April 2024) is clearly visible.

2) Prior to the morning of Tuesday 7th May, wind availability had been fairly strong (over 50% of installed capacity).

3) But this dropped lower through the latter half of Tuesday 7th and through Wednesday 8th May such that ~2,000MW of installed capacity was unavailable.

4) Curiously, it looks like ~300MW of available wind could not be dispatched during the time of peak volatility on Wednesday 8th May for reasons not confirmed at this point (but suspected to be transmission constraints)

B2) Firming … of various types

Let’s start with the old and finish with the new…

B2a) Coal

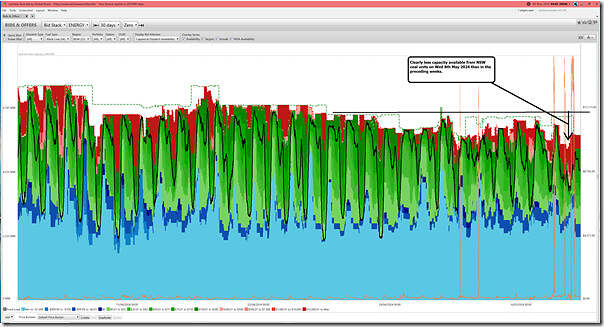

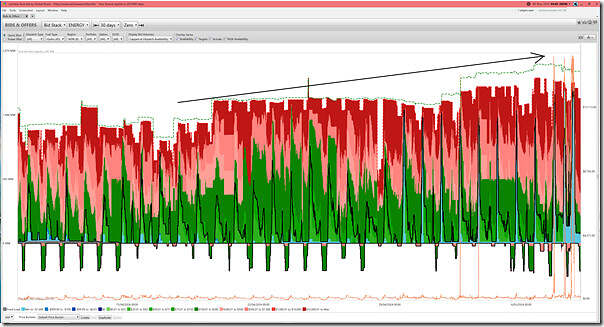

Here’s the last 30 days of offers from all Coal generators in NSW:

With respect to this trend:

1) There’s clearly less capacity available from coal on Wednesday 8th May 2024 than in the preceding couple of weeks

(a) We have already written that Vales Point 5 had come offline Wednesday morning, and also that there were two Eraring units off on unplanned outages.

(b) but is there more to this picture

2) Through the 30-day period there’s also a general decline:

(a) perhaps in part because of planned outages

(b) but clearly more to explore?!

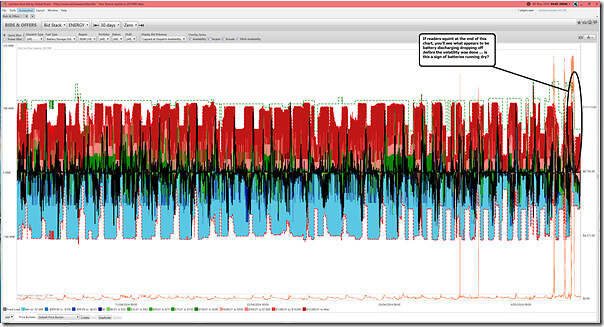

B2b) Gas

Here’s the last 30 days of offers from all Gas generators in NSW:

On this image note:

1) A period in the evening of Monday 15th April that saw more gas capacity available in NSW than any other period (this was during the wind lull).

2) Apart from that, Wednesday 8th May stands out as the most volume from gas-fired generators offered – and in this case over more hours, as well.

B2c) Hydro

Here’s the last 30 days of offers from all Hydro generators in NSW (noting bids under the axis are bids to charge):

With these hydro units, we see more volume offered progressively through the 30 day period, with Wednesday 8th May being a large day for discharge. There’s more to be explored here, though …

B2d) Batteries

Here’s the last 30 days of offers from all Battery units in NSW (noting bids under the axis are bids to charge):

There’s obviously more to be explored with the way the batteries ran … there’s some indication that they might have run dry before the end of the volatility period on Wednesday evening 8th May 2024.

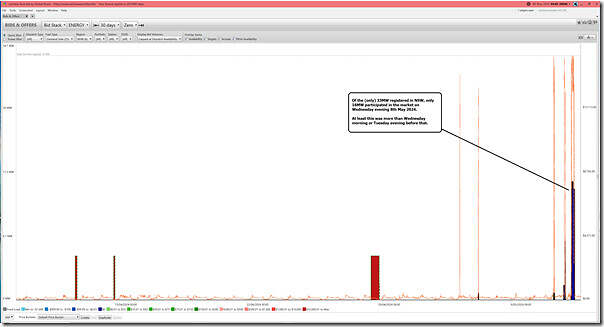

B2e) Negawatts

Here’s the last 30 days of offers from all Negawatt units in NSW:

Not sure I need to say more about the lacklustre contribution?

That’s all for now…

Leave a comment