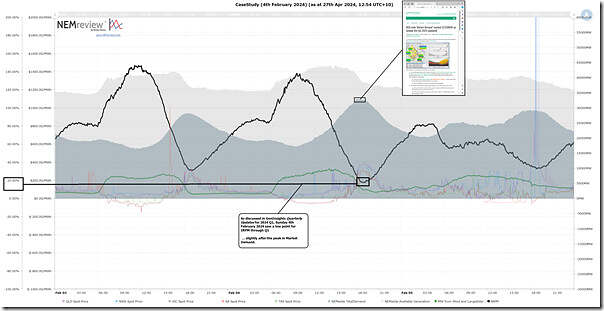

As it happened we had noted ‘NEM-wide ‘Market Demand’ reached 32,938MW on Sunday 4th Feb 2024 (updated)’.

Now that we’re reviewing 2024 Q1 more systematically, we’re starting to see other things as well – which are being explored and explained in the GenInsights Quarterly Updates for 2024 Q1 report. To assist in that process, we’ve posted here this 3-day trend covering Saturday 3rd February, Sunday 4th February and Monday 5th February 2024 (produced with NEMreview v7):

In the 18:40 and 18:45 dispatch intervals the Instantaneous Reserve Plant Margin (i.e. IRPM) dropped to a low point of 17.7%:

1) Note that this was 25-30 minutes after the daily peak in Market Demand, as noted in the earlier article

2) We can see in the chart above that supply from Large-Scale VRE continued to drop more quickly than the Market Demand.

Leave a comment