Worth a short note today to copy in AEMO’s Market Notice 116052 as follows:

——————————————————————-

MARKET NOTICE

——————————————————————-

From : AEMO

To : NEMITWEB1

Creation Date : 09/04/2024 11:26:28

——————————————————————-

Notice ID : 116052

Notice Type ID : GENERAL NOTICE

Notice Type Description : Subjects not covered in specific notices

Issue Date : 09/04/2024

External Reference : Increase to QNI limit to next hold point of 850 MW NSW to Qld

——————————————————————-

Reason :

AEMO ELECTRICITY MARKET NOTICE

Refer to market notices 114742.

AEMO, TransGrid, Powerlink have reviewed the test results following the QNI minor testing on 15th February 2024. The next hold point can now be released.

The hold point of 850 MW from NSW to Qld will be implemented as of 1000 hrs 10th April 2024.

Please also refer to the published formal QNI minor testing information at the following link:

https://www.aemo.com.au/consultations/current-and-closed-consultations/qld-to-nsw-interconnector-qni-upgrade

Ben Blake

AEMO Operations

——————————————————————-

END OF REPORT

——————————————————————-

Back on 3rd February, Dan had noted a +50MW increase in export limit added for the purpose of testing QNI minor. That was one step in the testing process.

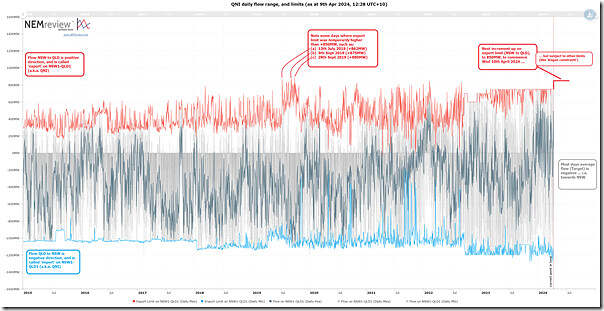

I thought it would be of interest to some to use NEMreview v7 to produce this trend of daily flow data for the NSW1-QLD1 interconnector (a.k.a. QNI):

From this we can see a number of things across the past ~10 years:

1) With positive flow being ‘export’ from NSW to QLD we can see that:

(a) Daily average flows through the 10 year period were on most days negative (i.e. from QLD into NSW).

(b) A notable exception was the summer 2023-24 period, where average flows were northwards for many days … understandable in part because of:

i. the higher level of demand in QLD (not just the extremes of 22nd Jan 2024); and

ii. and also the absence of Callide C3 (recently returned) and Callide C4 (still offline).

2) There’s larger capability to export QLD to NSW (i.e. the import limit on QNI) than there is to export NSW to QLD (i.e. the export limit on QNI).

3) With respect to the export limit, there are three days flagged in 2019 where the export limit on QNI was (at least for one dispatch interval) higher than the new 850MW limit that we’ll be progressing to above.

(a) These days were as follows:

i. 13th July 2019

ii. 9th Sept 2019

iii. 29th Sept 2019

(b) but they have not been further investigated at this point

Nothing more, at this point.

Leave a comment