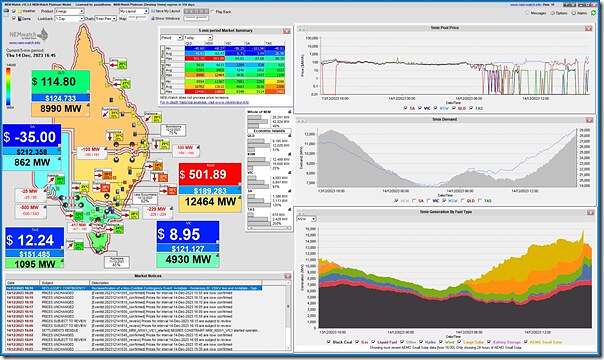

A short article with a snapshot from NEMwatch for 14:45 NEM time:

We see that:

1) The NSW ‘Market Demand’ is at 12,464MW; and

2) The spot price (at $501.89/MWh) is past $300/MWh for the first time today.

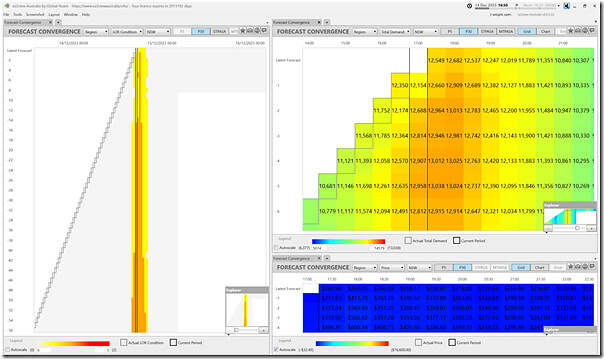

Flipping back to the 3-window ‘Forecast Convergence’ view in ez2view at 16:50 and we see that:

1) Forecast for the same ‘Market Demand’ has fallen away from the earlier 13,000MW expectations

2) Prices are still forecast to be modest; and

3) The forecast LOR2 Low Reserve Condition warning has been downgraded to be LOR1:

So it looks like hot and sweaty … but not quite as stressful as earlier thought.

You can also see in this screenshot the VIC-NSW interconnector running counter-price. It’s been doing that all day – I saw over 1GW of counter-price flow earlier – with intervening periods of constraint when the NRM_NSW1_VIC1 constraint set has been invoked due to the accumulation of negative settlement residues.

I am not sure the costs of inadequate transmission from Wagga north-eastward are being accurately captured. Possibly (probably?) the need to activate RERT today would have been avoided if that south-westerly generation was available to the Sydney load centre.

Yep, noted in this subsequent article:

https://wattclarity.com.au/articles/2023/12/14dec-nsw-demand-13031mw/

————-

PS have added more detail in the subsequent article ‘Disallowed flow north on VIC1-NSW1 another significant factor in tight supply-demand in NSW + QLD’