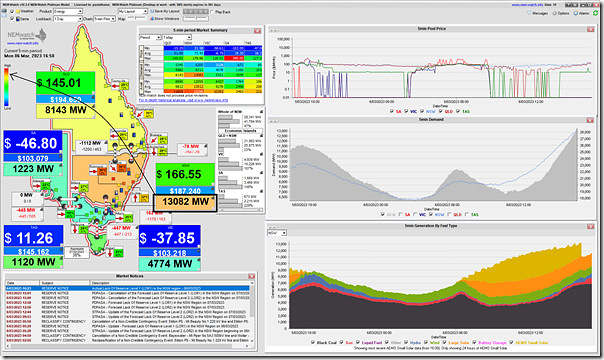

Worth a short note (to follow yesterday evening’s warning) with this snapshot from NEMwatch in the 16:50 dispatch interval with NSW ‘Market Demand’ up above 13,000MW:

At this dispatch interval, the ‘Market Demand’ up above 13,082MW and looking set to climb higher.

… at some point later I might check, but this will be the highest level of ‘Market Demand’ seen in NSW for a number of years.

Prices are elevated, but still contained – though the AEMO has also just published MN106308 at 16:23 about an Actual LOR1 tight supply-demand balance forecast to persist until 19:00 (NEM time) this evening:

——————————————————————-

MARKET NOTICE

——————————————————————-

From : AEMO

To : NEMITWEB1

Creation Date : 06/03/2023 16:23:20

——————————————————————-

Notice ID : 106308

Notice Type ID : RESERVE NOTICE

Notice Type Description : LRC/LOR1/LOR2/LOR3

Issue Date : 06/03/2023

External Reference : Actual Lack Of Reserve Level 1 (LOR1) in the NSW region – 06/03/2023

——————————————————————-

Reason :

AEMO ELECTRICITY MARKET NOTICE

Actual Lack Of Reserve Level 1 (LOR1) in the NSW region – 06/03/2023

An Actual LOR1 condition has been declared under clause 4.8.4(b) of the National Electricity Rules for the NSW region from 1600 hrs.

The Actual LOR1 condition [is forecast to exist until 1900 hrs.

The forecast capacity reserve requirement is 1365 MW.

The minimum capacity reserve available is 794 MW.

Manager NEM Real Time Operations

——————————————————————-

END OF REPORT

——————————————————————-

That’s all for now.

So now let’s take out the 650MW being contributed by the two running Liddell units for next summer and you are in LOR2 territory……and if the contingency then is loss of the interconnector to Qld and things start to get a bit dark. How come there are other, more modern and efficient plants (BW & MP) off in the first week of March? This is starting to look third world stuff. This slow-moving train wreck will not be arrested quickly either. Ironically, the last time NSW was on the cusp (and actually in) this sort of disaster over summer was in the 1970’s when the (then) near new units at Liddell started having generator failures. Market price signals only work when there are some generators left to respond to them!

Further to Andy’s comment NSW has nominally 9,500 MW of coal after accounting for the derating of the remaining three Liddell units and yet peak coal output was 7,017 MW. It also has 2 GW of gas which only managed 1.2 GW, not to mention 4.1 GW of hydro which maxed out at 2.1 GW. Combined output from 15.6 GW of dispatchable capacity did not exceed 12.1 GW, and 11.5GW of coal and gas maxed out at 8.3GW so much for the “reliable coal and gas”