For those not already drowned in documentation relating to the escalating pace of reform in the NEM, the ESB has just added another 149 pages for you to consider in the release of this Directions Paper for Transmission Access Reform here:

A couple quick notes to follow:

(A) What’s this all about?

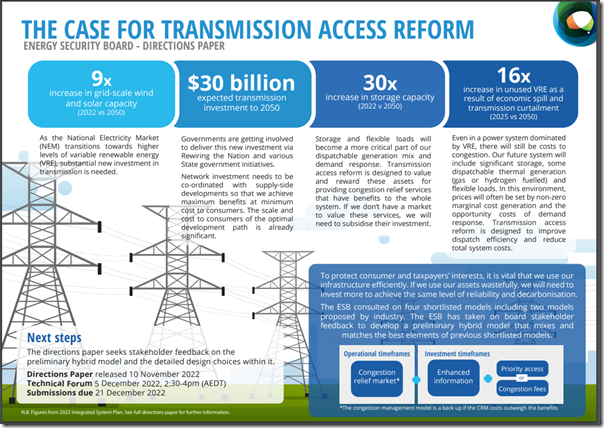

The ESB tries to explain in this infographic:

I’ve scratched my head, sitting on the outside looking in, trying to understand what all the commotion is about, so thought I would have a quick read of the Executive Summary of the report.

(A1) Is the Directions Paper saying ‘the ISP is right, the Market is Wrong’?

In scanning the Executive Summary, the following jumped out at me as what’s used to justify Transmission Access Reform:

‘In the absence of reform, actual levels of curtailment are likely to exceed the levels forecast in the ISP. The ISP models the suite of transmission and supply-side projects that together deliver the optimal development path, but there is no requirement for generators to locate in accordance with the ISP.

The current market design is misaligned with the ISP because market participants receive price signals that make it profitable for them to locate in places, and bid in ways, that do not align with the lowest overall cost to consumers. In some cases, generators are connecting in locations where, a lot of the time, they are not adding new renewable energy to the power system. Instead, they are displacing existing renewable generators. This adds pressure to customer prices because renewable investments are riskier than they need to be. At the same time, storage and hydrogen are not rewarded for locating in areas of the grid where they can soak up excess renewable generation.

Transmission access reform creates incentives for storage and flexible loads (such as hydrogen) to locate in REZs and operate in ways that alleviates congestion. At present, storage and flexible loads face the same price wherever they are in a State, which means they have no reason to locate in places where they could provide most value to the grid, nor to operate in ways that soak up surplus energy. Fewer subsidies would be required to underpin investments if we introduce reforms that reward storage and flexible loads for the valuable services that they provide.

If we don’t change the transmission access regime, we are likely to end up with a larger generation and storage fleet and transmission network than necessary to achieve the same decarbonisation and reliability outcomes (Figure 1). ’

… and …

‘A key goal of transmission reform is to reduce the risk of inefficient network build, and to allocate the risk of locational decisions to generators. This will mean that network capacity is only built where it is needed and that government programs including REZ initiatives and Rewiring the Nation are able to achieve more’

I’ve read this quickly just now but (at first glance) it reads to me like the ESB is treating the ISP as gospel and saying that if participants are locating other than as modelled in the ISP, then they must be wrong? I’m prompted to recall that old adage ‘a model’s just a model, it’s not reality’ … but wonder if we’re trying to bend the market to make the model a reality?

(A2) Is the ESB labelling some Wind and Solar operators ‘un-sophisticated’?

On p9/149 this also jumped out to me:

‘The current mechanism for deciding who gets dispatched in the presence of congestion is a function of complex interrelated technical factors, which means that outcomes are opaque, volatile and hard to predict for all but the most sophisticated industry participants.’

… but the market has already been responding to this?!

For instance:

1) we’ve recently further enhanced the capability in ez2view (for instance, through the new ‘Constraint Dashboard’ widget in ez2view v9.5) such that many industry participants (including those who the ESB seems to label as ‘un-sophisticated’) have the opportunity to understand the reasons why people are dispatched.

2) the number of Wind Farm and Solar Farm operators using ez2view continues to grow.

(A3) Hybrid Model envisaged?

On p10/149 the ESB says:

‘In May 2022, the ESB consulted on four shortlisted models to manage congestion in the NEM, including the two models put forward by industry.

…

The hybrid model is designed to incorporate stakeholders’ feedback and ideas in a way that best promotes the access reform objectives, in the overall interests of consumers. The hybrid model combines measures that apply in both operational and investment timeframes. To get the benefits of the reforms, it is necessary to do both. If the reforms only encompass investment signals, the signals could be undermined in real time. If the reforms only take effect in operational timeframes, then the market design would continue to send poorly targeted locational signals to investors. ’

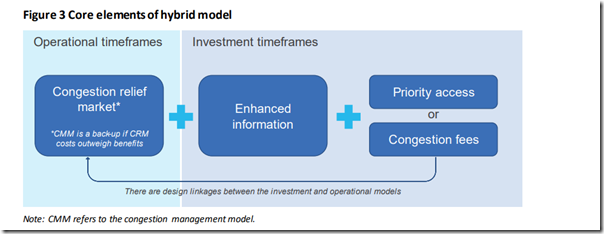

… and includes this image to explain:

The two options flagged above (in the Investment timeframe, but with links to the Operational timeframe) are described as follows:

‘There are two key variants within the hybrid model, which reflect two different ways of signalling efficient investment locations to prospective investors:

• Priority access – this option establishes a queue in the event of tied price bids to prioritise access to the RRP.

• Congestion fees – the option leverages the transmission planning process to administer fees that reflect the level of available hosting capacity for new generation’

From the quick skim of the first few pages there is clearly more in this that we’ll need to read through!

(B) Two key dates

In the paper (and the email subscribers were sent) there are notes that the next key dates are as follows:

| Key Date | What’s on |

|---|---|

|

Monday 5th December 14:30-16:00 AEDT

|

The ESB will hold a technical forum to discuss the paper on Monday 5 December 2022. You can register for it here. They say that: ‘There are two key variants, which reflect two different ways of signalling efficient investment locations to prospective investors: (a) Priority access – this option establishes a queue in the event of bids being tied at the market price floor to prioritise access to the regional reference price (RRP) (b) Congestion fees – the option leverages the transmission planning process to administer fees that reflect the level of available hosting capacity for new generation. Stakeholder feedback in response to the directions paper will inform the ESB as it develops a draft preferred model. The purpose of this technical forum is to give stakeholders the opportunity to ask clarifying questions and to discuss the design choices associated with the hybrid model.’ |

|

Wednesday 21st December

|

Submissions on the paper close 21 December 2022, and can be submitted via email to info@esb.org.au . |

|

first Energy Minister’s Meeting in 2023

|

At the end of the Executive Summary, it is noted: ‘At the recent Energy Minister Meeting, Ministers tasked Senior Officials to jointly undertake stakeholder consultations with the ESB on the full range of options for transmission access reform (including additional options that are not set out in this paper), with recommendations to be considered at the first Energy Ministers’ Meeting in 2023. The ESB is working with Senior Officials to determine the nature and scope of the additional consultation and will update stakeholders shortly’ There may be more in the main document about this? |

We’ll need to keep a closer eye on this process…

Be the first to comment on "ESB releases Directions Paper with respect to Transmission Access Reform"