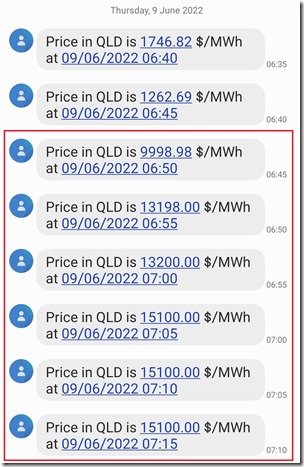

It’s a sad indication of the state of this ‘2022 Energy Crisis’ that we now expect prices above $1,000/MWh in the mornings in the QLD region. Today, however the prices have hit another level, as seen in this snapshot of the start of the fireworks in SMS alerts:

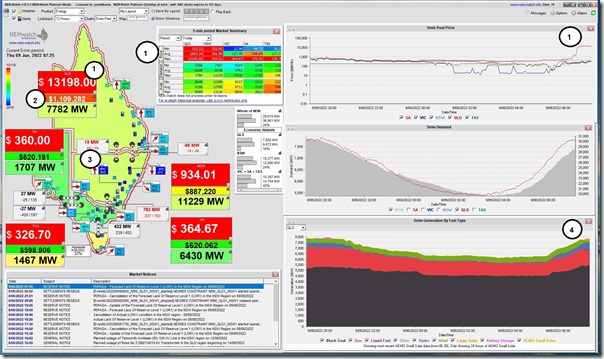

Here’s the 07:25 dispatch interval, captured in NEMwatch:

I’ve highlighted only a couple important things this morning:

1) The QLD dispatch price up at $13,198/MWh … after being as high as the $15,100/MWh Market Price Cap earlier, as noted in the SMS alerts above.

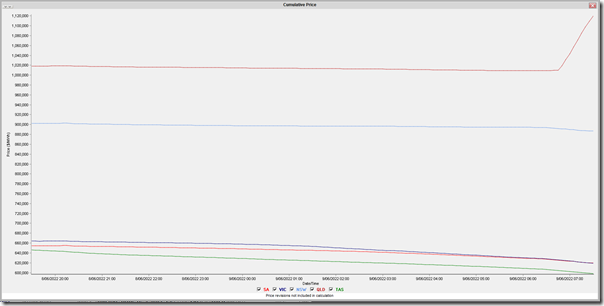

2) This run of pricing has driven the Cumulative Price up above $1,100,000 … so well on the way towards the Cumulative Price Threshold (CPT):

(a) The effect of this morning’s ramp in prices can be seen in this drill-in from NEMwatch:

(b) As noted on this explanation in the WattClarity® Glossary, the critical CPT number increased to $1,359,100 with the transition to Five Minute Settlement.

(c) I believe it’s still the case that the QLD region has never struck the CPT, so it would be a sad milestone if this were to happen.

(d) Based on prior questions (such as here on social media) I recently added a live updating trend of the Cumulative Price (for ENERGY) in all 5 regions in this Dashboards service… you should just need to register and log in to watch it trend through this day in particular.

3) Severely constrained imports from NSW are, once again, a significant factor

(a) As noted on Tuesday, the the ‘N-ARTW_85’ constraint set is invoked … by virtue of an outage on the Armidale to Tamworth (85) line;

(b) This outage is going to run today, tomorrow (Friday), Saturday and Sunday

(c) The constraint set has many constraint equations in it, with the ‘N^^Q_ARTW_B1’ constraint equation the one that’s bound at the 07:25 dispatch interval above.

(d) This is different to the (Raise FCAS related) constraint equations bound on Tuesday morning, but the net effect is similar … limiting flow north from NSW.

4) At some point later I’ll have a look at what plant are running, and which plants are, at this point.

Paul: I think the local contingency raise FCAS constraints, as well as the negative residue management constraint on Qld-NSW flows, were still fundamentally the drivers for these Qld events this morning – they were all binding in this DI, and as noted in Marcelle’s article (https://wattclarity.com.au/articles/2022/06/interconnector-constraints-and-limits-an-explainer-and-a-few-traps/) AEMO data only lists one constraint as setting an interconnector limit even when there are multiple constraints binding. The only reason N^^Q_ARTW_B1 bound was because NEMDE was trying to increase northward flows to satisfy the NRM constraint. That in turn was only binding (violating in fact) because the local FCAS constraints had previously been pushing counterprice flows southwards.

… so I was tripped up on those same tripwires Marcelle had written about coincidentally today!