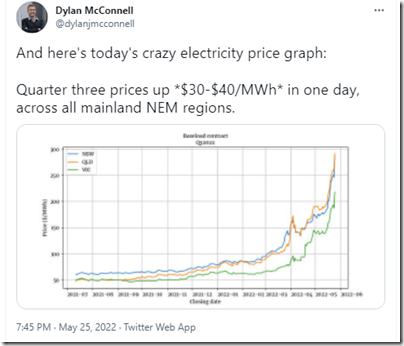

This morning I noted this staggering tweet yesterday evening (Wed 25th May) from Dylan McConnell about futures pricing jumping $30 to $40/MWh in one day:

Ouch, and double ouch!

(A) A closer look at Q3 futures

The amazing rise quoted for baseload futures in QLD, NSW and VIC was such that I thought I would rearrange my calendar today to have a closer look …

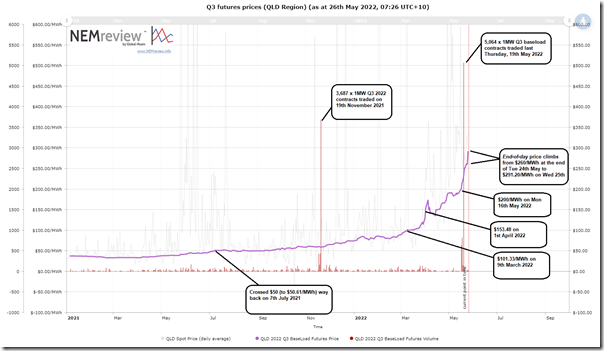

(A1) QLD Region

Let’s start with the QLD region, which has become the epicentre of price pain in recent times.

Using our NEMreview v7 application, I quickly created this trend to isolate out prices in QLD … both time-weighted average spot for each day and the end-of-day clearing futures:

(for those with a licence to the software, they can access their own copy of this trend query here)

Out of curiosity, I have added a few milestones in terms of price growth – particularly the $31.20/MWh jump over 24 hours (from $260/MWh at the end of Tuesday 24th May to $291.20/MWh at the end of Wednesday 25th May 2022).

I’ve also added in the ASX Energy reported volumes traded for this contract with both:

(a) A cluster in November 2021 (highest on 19th Nov 2021 with 3,687 x 1MWh contracts traded); and

(b) A cluster in May 2022 (highest last week, on Thursday 19th May with 5,064 x 1MWh contracts traded).

Perhaps a more futures-focused reader can explain to me if there is any significance of the 19th of the month – or if it’s entirely coincidence?

—————-

PS1 – multiple readers provide an answer!

Over on LinkedIn here, Glen Watkins noted:

‘Paul McArdle I think you’ll find the answer to your question regarding volumes on the 19th is related to option expiry

https://www.asxenergy.com.au/newsroom/industry_news/fy2223-options-expiry-19-may-

It’s not always the 19th, but it’s 6 weeks prior to the start of the contract’

Others also chipped in via email with more details – for instance:

‘Contract Expiry Options will cease trading at 12:00pm on the Last Trading Day.

The Last Trading Day shall be the day 6 weeks prior to the day immediately preceding the commencement of the first Contract quarter for the underlying strip. If this day is not a business day or is recognised in the underlying regions as a Public Holiday then the following business day will be the expiry day.

In-the-money options get exercised (converted into the relevant Futures contracts) automatically on the Last Trading Day – so those would be the volume spikes.’

And also, to explain the spike at 19th November 2021:

‘Options typically expire 6 weeks prior to the start date of the underlying contract. So for a Cal year strip, e.g. a Cal 22 flat swap, the underlying contract starts on 1 Jan 2022, so the option to purchase that swap would have expired on 19th November 2021. Likewise, for a Q2 22 flat swap starting on 1 July 2022, the option will have expired on 19th May 2022. The options exercise automatically, so assuming they are in the money (which most probably have been given recent price runs), there will have been large automatic trades in the underlying flat swaps on those days.’

Thanks for that!

—————-

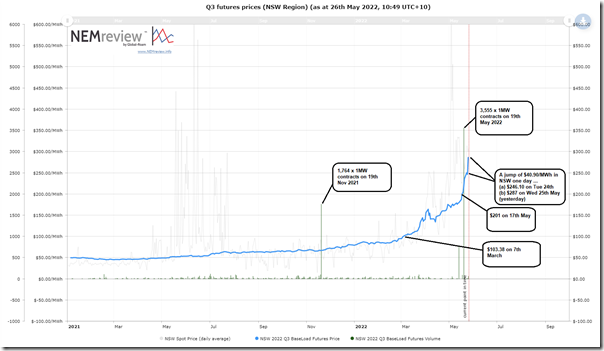

(A2) NSW Region

Moving south into NSW, we see a similar trend:

(for those with a licence to the software, they can access their own copy of this trend query here)

The NSW region saw an astronomical jump of $40.90/MWh in one day … from $246.10/MWh on Tuesday 24th May to $287/MWh yesterday (Wednesday 25th May).

Volumes traded also spiked sharply on the same two dates as above for QLD (though slightly lower volumes).

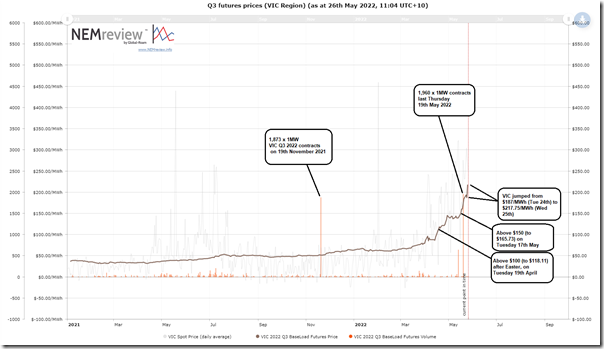

(A3) VIC Region

Further south into VIC we see the recent escalation is still quite pronounced, but not quite as remarkable:

(for those with a licence to the software, they can access their own copy of this trend query here)

As noted in the chart, the VIC futures price jumped $30.75/MWh in one day … from $187/MWh on Tuesday 24th May to $217.75/MWh yesterday (Wed 25th May). The price has almost doubled since Easter … just over 4 weeks ago.

Volumes traded also spiked sharply on the same two dates as above for QLD and NSW (though slightly lower volumes than both those regions).

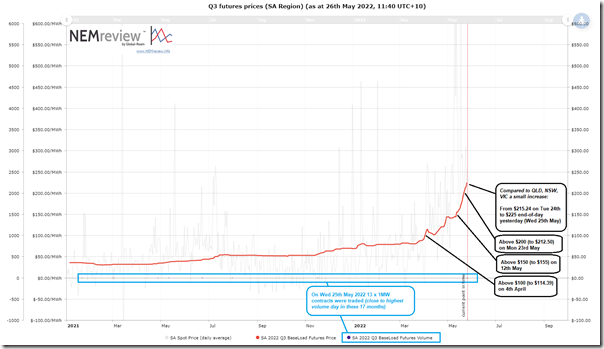

(A4) SA Region

In Dylan’s chart yesterday evening, the equivalent South Australian contract was not shown.

Whilst acknowledging the small size of the underlying region, and thin trading of any hedging in South Australia, for what it’s worth I have included the equivalent trend here:

(for those with a licence to the software, they can access their own copy of this trend query here)

As noted on the chart, South Australia (to the extent that futures prices are useful) showed the smallest one-day rise in prices for Q3 baseload from Tuesday 24th May to yesterday, Wednesday 25th May (i.e. only $9.76 .. from $215.24/MWh to $225/MWh for a 1MW contract).

However the thin volume of trading is very apparent at the bottom of the chart … coincidentally yesterday saw close to the largest volume (i.e. 13 x 1MW contracts) traded for this contract over the 17 month period selected (just behind an instance of 15 x 1MW lots).

(B) Implications

I started writing this here, but will shift to a separate article as it will take more time to complete and is much broader than just the escalation in price escalation for Q3 2022!

Leave a comment