Much recent discussion about negative spot prices in Queensland, including some prompted by my own article, has questioned how any generator could benefit from having to pay money to AEMO to generate – since this is what a negative spot price means.

Lacking a well-understood motivation for bidding behaviour which results in low and negative spot prices, conspiracy-style theories tend to take root, such as certain generators deliberately trying to drive certain others broke (see for example some of the comments on this otherwise very informative article on RenewEconomy).

This has made us at WattClarity realise that it would be helpful to outline how common electricity derivative contracts operate, and the significant impacts they can have on generators’ financial incentives. This is stuff that is reasonably well known to active wholesale market participants, but can still seem quite mysterious to those looking in. In keeping with this site’s focus on raising general awareness and better understanding of factors arising during the energy transition, we’ve put together this explainer.

Swap Basics

This is not going to be a deep dive into all types and aspects of electricity derivatives. My aim is to go into just enough detail on one common form of contract – electricity swaps – to make clear how they can give a generator – under certain, limited circumstances – a financial incentive to seek lower spot prices, despite the natural incentive for generators being the opposite.

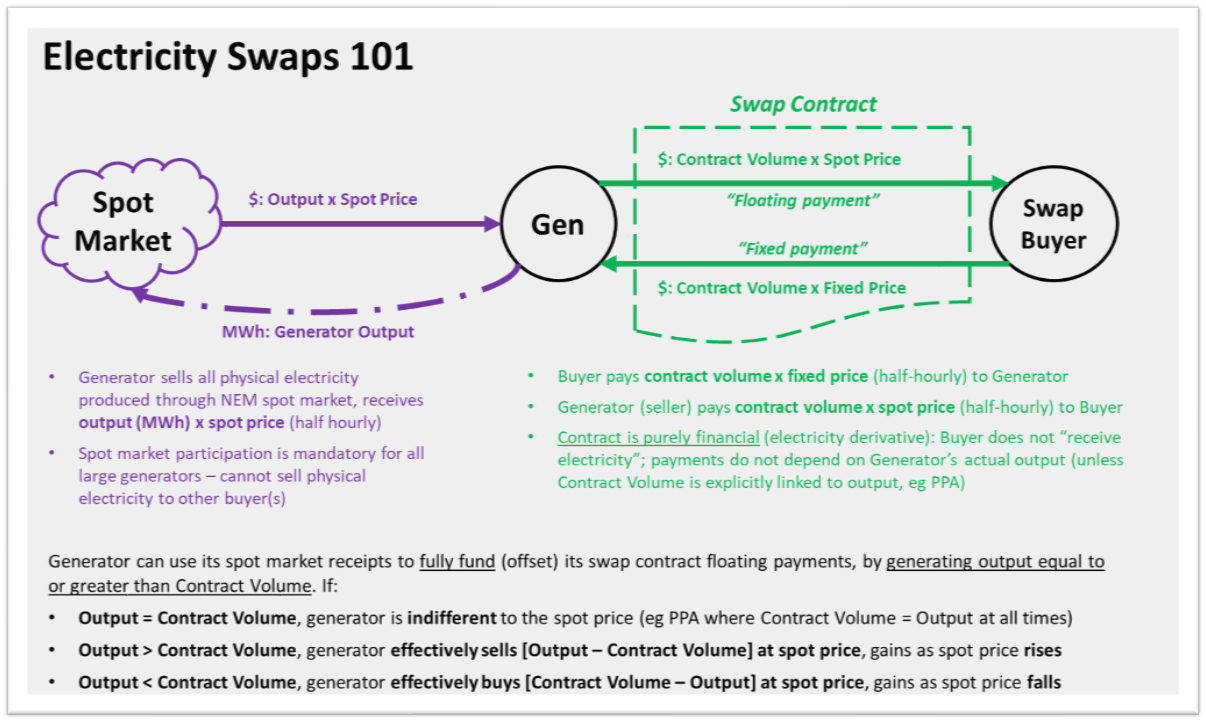

Study the following diagram carefully – it’s the key to understanding this issue and I’ll be referring to it a lot:

At the top left in purple are the physical electricity flows and payments between NEM market generators and the spot market operated by AEMO. Generators are paid at the half-hourly spot price for all electricity they produce.

At the top right in green are the payment streams under an electricity swap contract. It is crucial to understand that this contract is a purely financial agreement between two parties, neither of whom need be a generator. Such a contract is merely a legal agreement to exchange (“swap”) payment streams which depend in some way on the spot price of electricity.

In a swap contract, the Buyer pays a fixed payment stream to the Seller (the generator in the above diagram – but it could be anyone). In return the Seller pays a floating payment stream linked to the half hourly spot price.

In practice these payment streams are accumulated over a week or longer, and a single net settlement payment is made one way or the other depending on which is larger, but this is just accounting detail.

The Contract Volume is a “notional volume” of electricity, specified at half hourly level, on which both payment streams are based. For the floating stream, payments are the Contract Volume (MWh) multiplied by the spot price. For the fixed stream, payments are the same half hourly Contract Volume multiplied by an agreed Fixed Price (or Contract Price).

In many cases the Contract Volume will be a single fixed half hourly volume across the whole contract period – this is a “flat” or “base” contract. Other contracts may have volumes varying by time of day and day type. These details don’t matter to the bidding incentives I’m discussing in this article, which will deal with those incentives in any particular half hour.

What’s critical to understand here is that even if the contract seller is a generator, under a standard fixed volume swap there is no relationship between how much electricity that generator physically produces in the spot market, and the Contract Volume.

A Power Purchase Agreement (PPA) in the NEM is, in most cases, a special type of swap where the seller is a NEM generator, and the Contract Volume is defined to be the generator’s half hourly production. But even under a PPA, the generator is not selling physical electricity to the buyer – just a stream of payments that mimic the spot market value of that electricity.

The Long and Short of It

The reasons why a generator might enter into a swap contract as seller should become clearer on looking at all the cashflows in the diagram and realising that a generator can naturally fund its obligation to make swap floating payments in any half hour by generating output equal to or above the swap Contract Volume, earning spot market receipts from AEMO.

Let’s assume it generates output exactly equal to the Contract Volume. It can notionally take the entire payment it receives from AEMO and pay this on to the swap Buyer. In return the generator receives payment from the Buyer at the Fixed Price for the same Contract Volume. In this situation (which always applies under a PPA where Contract Volume is defined as generator output), the generator is financially indifferent to the spot price – “fully hedged”.

If the generator’s output exceeds Contract Volume, the net effect is that it receives the Fixed Price for that part of its output equal to Contract Volume, and spot price for the excess. We say that the generator is “net long to the spot price” or “long to its swap position”.

But if the generator produces output less than the Contract Volume, its spot market receipts will not fully cover its swap floating payment, and the generator’s financial position on the difference (Contract Volume minus output) is the same as that of a buyer of physical electricity from the spot market. We say that the buyer is “net short to the spot price”, or “short to its swap position”.

Often, being short like this is not a comfortable position for a generator – its generating plant might have broken down completely, but it is still required to make floating payments to its contract counterparty, whatever the spot price, right up to $14,700/MWh.

But if a generator is short and the spot price is negative, the generator wins on both legs! Its floating price “payment” becomes a receipt greater than the amount it has to pay AEMO to take its output, and it also receives the Fixed Price payment from the (now unhappy) swap Buyer.

So what determines whether a generator is long or short to its swap position in any half hour? Simply its volume of output, versus its volume of sold swaps. The latter is determined well in advance by the set of swap agreements the generator has transacted with counterparties. Its output depends on the availability of its generation capacity, and how it chooses to bid that available capacity in the spot market.

Price Takers vs Price Makers

If the generator’s bidding has little or no influence on the spot price – say it’s a very small generator – then it has a fairly simple decision about whether to run long or short, regardless of swap contract volume sold. If spot price exceeds its short run production cost, its best financial position is to maximise output and run long if it can, while if spot price is below its short run production cost, it’s best not to generate anything at all, and run completely short to its swaps – because it’s cheaper to cover its floating swap payments by (in effect) “buying” at the spot price than by generating.

A generator covered by a PPA-style swap has an even simpler calculus – run regardless of spot price, because its net position is receipt of the Fixed Price payment for all output and it is therefore indifferent to the spot price. Of course the PPA buyer may not be happy about this when spot prices are very low or negative.

For a large portfolio generator whose bidding will inevitably influence the spot price, the decision is more complex. The more output it seeks to dispatch in the spot market (by bidding more capacity at lower offer prices) the lower the spot price will be. Such a generator with a significant volume of sold swaps typically faces a choice between producing more output and running long at lower spot prices, or producing less output and running short at higher spot prices, In many cases the optimum decision is to run somewhat long to its swap position.

Crashing the Spot Price

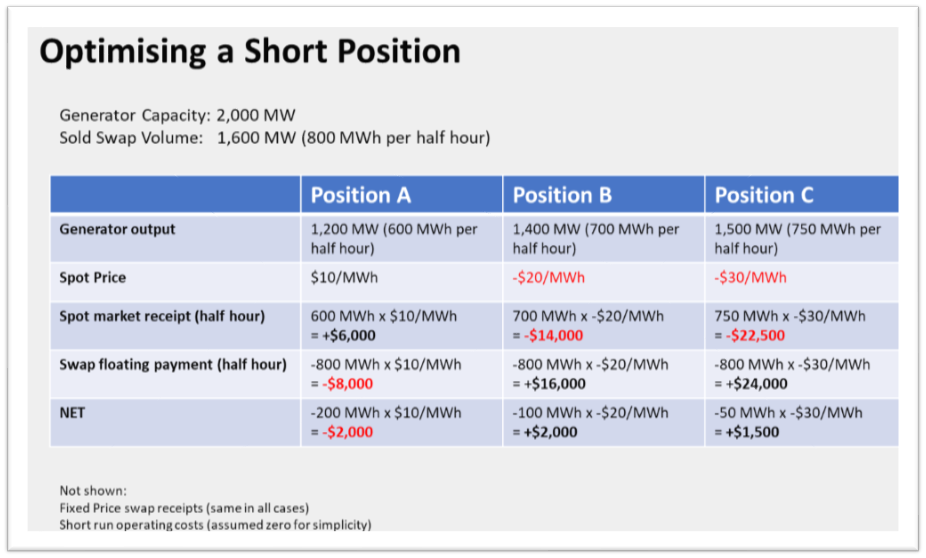

However if circumstances arise in which spot prices are low even with that large generator running significantly short to its sold swaps, then the generator may have a direct incentive to increase its output and reduce the spot price further, if it can still remain short enough to benefit from that drop in price. A worked example might help here. I’m only going to show the generator’s spot-price linked payments, namely its spot market receipts and swap floating payments, since these are the critical cashflows:

In this example, spot price is low even with the generator running 400 MW short to its sold contract volume (Position A). In Position B, bidding 200 MW more generation at a low offer price to increase output to 1,400 MW reduces the spot price to minus $20/MWh. This increases the generator’s loss in the spot market by $20,000 but its swap floating payments improve by $24,000 (instead of paying $8,000 in Position A it receives $16,000 in Position B because of the negative spot price). In Position C a further increase in output to 1,500 MW drops spot price further, but not by enough to compensate for the fact that the generator is less short (only 100 MW not 200 MW) and its net financial position is worse than in Position B.

In practice a generator will never know in advance exactly what relationship may exist between changes in its own dispatch level and changes in the spot price, because this depends on the bids of all other generators. But the general point stands that a generator materially short to its swap volume at low prices has clear incentives to keep prices low and perhaps reduce them even further through its bidding strategy.

This is already a long article to cover a fairly simple but very important concept. While it would be good to have time and space to discuss how swaps are traded, why buyers buy them, and how in practice a market might end up with some of its larger generators “overcontracted” (ie with more sold swaps than their “natural” level of output), that would require a whole other article, or series of articles. Suffice to say that recent outcomes in Queensland suggest that overcontracting may just be the case, at least during certain times of day.

——————————————-

About our Guest Author

|

Allan O’Neil has worked in Australia’s wholesale energy markets since their creation in the mid-1990’s, in trading, risk management, forecasting and analytical roles with major NEM electricity and gas retail and generation companies.

He is now an independent energy markets consultant, working with clients on projects across a spectrum of wholesale, retail, electricity and gas issues. You can view Allan’s LinkedIn profile here. Allan will be sporadically reviewing market events here on WattClarity Allan has also begun providing an on-site educational service covering how spot prices are set in the NEM, and other important aspects of the physical electricity market – further details here. |

Murphy’s Law can pop up too – say the spot market is low and a generator has planned testing that requires it to generate through periods like this.

Braemar 2 was pigging its gas inlet last week, meaning it had to guarantee a constant gas flow for a time period – some of that was through negative prices when they wanted to be offline.

There is a problem when the WeekEnd Australian which is known as the weak lend of you Australia publishes the opposite type of article.

Perhaps with edited quotes to support the view point.

The None Australia paper says the reason for -$1000 price is because of Solar.

Paul has pointed out Solar turned off.

I think it is time for truth in articles frankly.

Missing from the worked example is the cost of fuel. A generator that increases output to crush the spot price will incur higher fuel costs. The rising cost of fuel will offset any gains from the swaps. So the question is the degree of offset.

This is very useful, just picked up on it. Could we perhaps have a think piece on renewable PPA’s from the point of view of the buyer, particularly a gentailer buyer? Renewables are increasingly achieving low NEM prices as their weight in the bid stack increases. To make this worse, I suspect that correlation is rising as geographical dispersion of assets falls. The PPA buyer is paying a fixed price for variable volume, and will frequently have been better off just taking spot – perhaps one reason for large hedge expenses booked by AGL and Origin. So what exactly is the point of a PPA for the buyer? If PPA buyers start to get cold feet, could it make it harder for new projects to get financing?