* with apologies to Prince

A couple of our avid readers have emailed in about the (still slightly) unusual price outcomes seen across the NEM at 13:05 on Sunday 21st July 2019, with dispatch prices down at $0/MWh across the mainland regions – with Tassie going 1 cent better and being –$0.01/MWh.

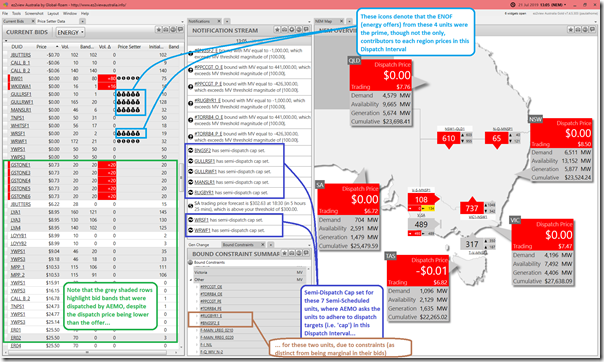

Here’s a view of that dispatch interval shown in ez2view wound back to yesterday using Time Travel:

I’ve annotated with a few of the more complex bits of the way in which that particular dispatch interval unfolded – some of which is only** visible on a “Next Day Public” basis.

* * though note that a participant using ez2view on their own MMS will receive the Semi-Dispatch Cap and (private) constraint notices in real time

As noted elsewhere over the weekend:

#1 we’ve been thinking through specific cases like this, and more generally “what happens when energy is free” for some years.

#2 in our Generator Report Card, we invested significant time and energy in investigating the widening gap between Service 1 and Service 2 in the NEM – and the implications for what this means for the success (or otherwise) of the energy transition. Dispatch Intervals like this are part and parcel of that difference.

#3 many will point at instances like this as demonstration of the need for storage – and, whilst that is true to a certain extend, we’re wary of any particular ‘solution’ being held up as a magic wand. In the Generator Report Card we also invested considerable time and energy exploring how storage has performed in the first 20 years of the NEM – with implications for how it might contribute into the future.

Those who already have access to the Generator Report Card can download it here, whilst those who do not can order it here.

That’s all I have time for today…

Re those bids dispatched where offer price is higher than spot – it looks like they’re mostly coal units limited by their offered ramp-down rates (typically ~3 MW per minute; note that this is a bid parameter not a fixed technical limit). The dispatch engine would prefer not to dispatch them but can’t move their targets by more than 5 * ramp rate in a 5 minute interval.

And for anyone wondering why those bids don’t set the spot price at their higher offer prices – it’s because those bids aren’t marginal – change demands by 1 MW and their dispatch levels wouldn’t change, constrained as they are by ramp rates.

In QLD there is still over 4GW of coal online during minimum demand and very low spot prices. For the coal generators to bid their capacity so low, is it fair to assume this capacity is already sold as PPA, so they don’t care what the spot market is?

And if that’s correct, or close to correct, then is there a ‘shelf capacity’ of PPA where the spot price changes from ‘care’ to ‘don’t care’?

And what happens when the unscheduled rooftop PV generation eats into the PPA capacity and the coal plants start to get dispatched out of delivering even their PPA volumes?

The same will eventually happen to utility solar and wind – they will be constrained like any other generator – when the rooftop PV eats into their market share. At least a coal plant can make money overnight and on cloudy days and can be held online for FCAS.

None of this gives me any confidence the market is working to price generation correctly.

Whenever generation is running at spot prices below its marginal cost/value, someone is losing money ie someone cares. In a true PPA situation where the generator is paid a fixed price per unit of production, the offtaker is receiving spot price (+ possibly LGCs if it’s renewable generation) for sale of that electricity into the pool, and that offtaker would prefer the generator not to produce once spot price (+ LGC value) is less than the PPA price. The generator is earning PPA price less its marginal cost, so in principle doesn’t care about the spot price. But work through the cashflows and everyone can be better off with no generation once spot price + LGC value is less than marginal cost (the offtaker could compensate the generator for its value of lost output, [PPA price – marginal cost], and still be better off than wearing a loss of [spot price + LGC value – PPA price]).

More typically, traditional coal fired generation is not contracted through PPAs but via swap contracts where they receive fixed price and pay spot price to a swap buyer. Again the incentive for these generators is to not generate once spot price < marginal cost. (In effect they can "buy" electricity from the pool, for financial delivery to the swap buyer, more cheaply than by generating themselves. These contracts are not for physical delivery and carry no obligation to actually generate – it's a financial decision).

So why do these generators bid $0 or -$1,000/MWh and keep running through zero or negative price periods? Typically if their costs of shutting down then restarting units once prices recover are likely to exceed the losses incurred while remaining online. For coal fired units these startup/shutdown costs can be quite significant and their marginal costs are relatively low so they choose to keep running through short periods of low price. But if you look at gas-fired generators with higher marginal running costs and lower startup costs they regularly decommit units rather than stay online at a loss.

In your great piece on price setting, you explain how MLF doesn’t affect the actual output but the price paid to the generator.

My question is: what is the output measure used in a PPA? Do you know if most PPAs take into account the output at the RRN (if so double counting the MLF on both the output and the spot price) or do they use the generator connection point?

You’ve also asked this here:

https://wattclarity.com.au/articles/2018/07/helping-to-tame-villain-4-by-understanding-more-about-mlfs/#comment-733520