Today I had the pleasure of presenting at the Solar Asset Management conference in Sydney, concentrating on the key issues around storage and curtailment, a hot topic for all fuel types but especially utility scale solar. Given the recent findings from the Generator Report Card, I thought I would also share the presentation here given the cross-over in content and findings.

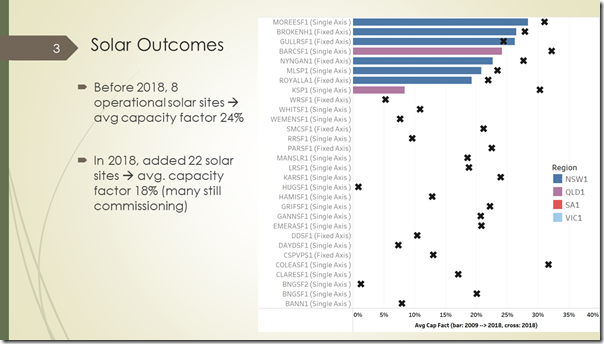

In taking a birds eye view on recent operations for solar, the findings of the Generator Report Card helped considerably, highlighting just how much constraints have already been occurring, not just what may happen in the some way-off future. Pages 3 and 4 of the slide deck (here) were straight out of the GRC.

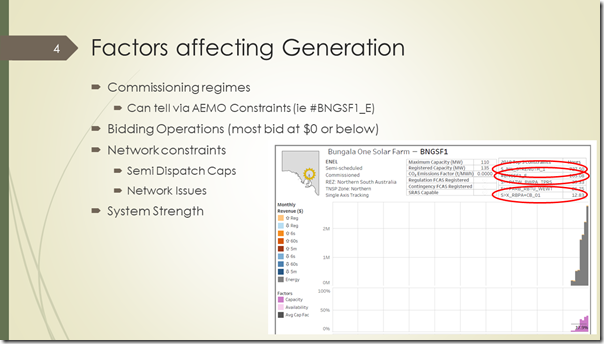

When I reflected on the capacity factors that we have been seeing in the past 12-18 months, it naturally focussed my attention on why the generation levels are the way they are.

And like all good energy traders, it led me to network constraints and pricing.

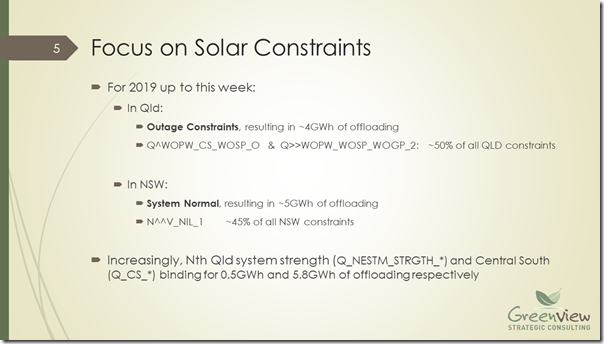

Slide 5 highlights that, once we remove many of the commissioning and hard/soft ramping constraints associated with typical operations, there are two main constraints affecting NSW and QLD solar assets over the months in 2019: system normal (voltage management) in NSW, and network outage constraints in QLD.

As I reflected on that further, while outage constraints would have been suspected to cause some issues (albeit rarely), I suspect many would not be suspecting constraints would curtail generation under system Normal constraints in the middle of the day, even without the impacts of duck curves or pricing (as is occurring in SA today!).

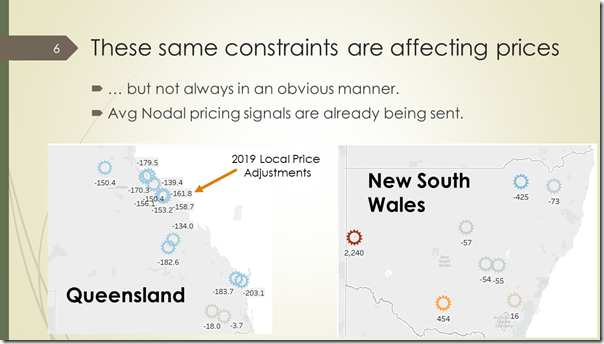

I then took this to the next level to understand these constraints impact on dispatch outcomes, and the effective nodal price or curtailed price jumped out as something requiring further investigation. Slide 6 highlights the effective average dispatch price at the node that the generators needed to be bid below the prevailing RRP in order to ensure their generation was dispatched, despite the QLD or NSW RRP potentially still being highly positive. When this type of assessment, just for 2019 was, done, it became easier to see that the constraining operations are well and truly underway.

I then drew the conclusion that with the ever changing energy landscape, the operations of the incumbents, new entrants and impending participants will all need to progressively adapt and adjust with close-in monitoring of dispatch outcomes, and that the resulting market outcomes will start to push and develop more sophisticated generator setups such as pure solar/battery and wind/battery hybrids.

With these increased levels of close-in monitoring, automated bidding and new types of generators that can start to move and optimise generation that would otherwise have been curtailed, not to mention changes to 5 minute settlement that is now just 2 years away, there is no doubt what has happened in the past will not be the future. The ‘set and forget’ generator will become a thing of the past.

————————————–

About our Guest Author

|

|

Jonathon has nearly 20 years practical experience in the Australian NEM, having held senior operational and trading roles in participant organisations and now as the Director of a specialist market consulting organisation, with a specific focus on renewable energy integration. Current clients include some of Australia’s largest integrated utilities, market regulatory organisations, transmission system operators and not-for-profit market observers. Jonathon has spent considerable time working with AEMO, Australia’s energy market operator.

As a former member of the NEM’s Dispatch and Pricing Reference group, Jonathon’s intricate knowledge of power system dispatch and security, coupled with practical, on-site experience with power system operations across all forms of electricity generation, allows him to bring operational and energy trading realities to strategically significant policy discussions. Jonathon has degrees in Engineering and Management, and is a member of the Australian Institute of Company Directors, CIGRE and IEEE You can find Jonathon on LinkedIn here. Jonathon, and his team at Greenview, are also co-authors of the Generator Report Card (released on 31st May 2019). |

Page 3 is interesting.

As all of the best sites are used for solar and wind, you will get diminishing rates of capacity factors for future installations being in lower quality areas.