This is a belated and back-dated article:

- set for 31st May 2019, which was the day we released the GRC2018

- from which we’ve extracted the full text of Theme 5 (minus footnotes), as follows:

It used to be the case that there was significant state-centric parochialism with respect to electricity supplies. The introduction of the NEM has largely eliminated many of the inefficiencies inherent in that mindset, though inter-regional transmission developments are still slowly catching up.

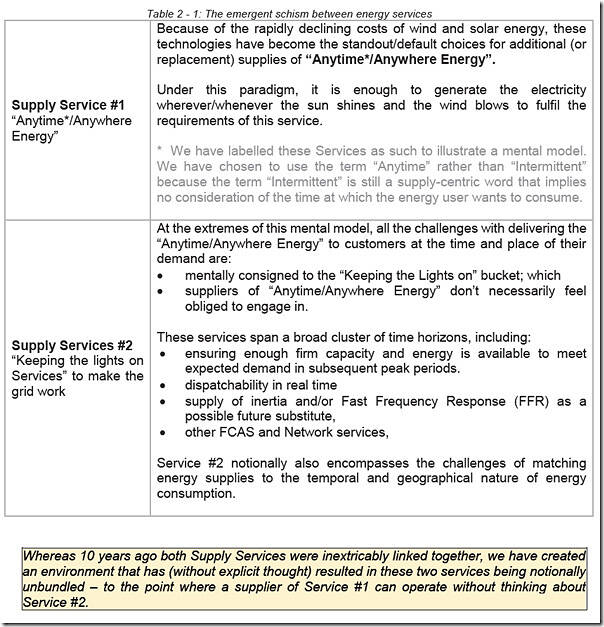

Largely because of the type of local, state and federal policies that governments have put in place, we have created an environment where a new battleground has emerged between suppliers of two different types of services, both of which will be integral to the energy transition.

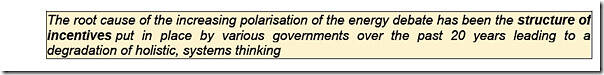

It is the author’s view that this schism has emerged not because a subset of people have deeplyheld ideological views that are either “pro-Coal” or “pro-Renewables”.

Rather, it has fundamentally arisen because we have structured market incentives in such a way that it promotes this increasing divergence (or dissonance). A rapidly increasing number of commercial businesses have “followed the money” to deliver what was disproportionately valued, due to scheme design. This is discussed further in Theme 12.

In turn, this has led to an increasingly polarised political debate, where all major politicians are increasingly straying further from objective reality that comes from considering both services as part of an integrated whole.

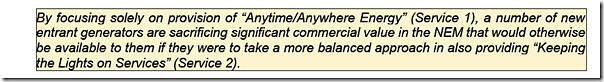

Responding to market signals that result from these incentives, new entrants have increasingly entered the race to deliver “Anytime/Anywhere Energy” – and hence:

- Only a small number of these parties are also choosing to be involved in supply of “Keeping the Lights on Supply Services ” as part of a more balanced portfolio approach to the business;

and - Indeed, a surprising number (in the experience of the authors) lack awareness of, let alone consideration of, the elements of “Keeping the Lights on Supply Services”.

This specialisation is hurting the long-term commercial prospects for these new entrants, because of the widening premium available for Service 2 over Service 1. Encouragingly, more recently

some new entrants (who have focused exclusively on Service 1 for several years) have taken early steps towards considering Service 2.

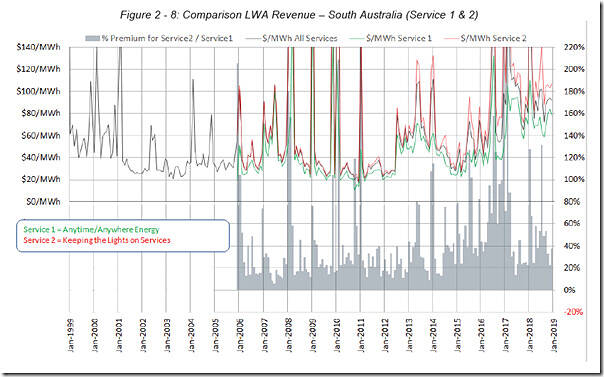

In Figure 2 – 8, we trend the Load-Weighted Average (LWA) Revenue across the history for the SA region (given that it is the region that has progressed furthest, in relative terms, in an energy

transition path encompassing implicit separation between these two types of Services).

In South Australia, the premium for Service 2 had been around 20% or higher for many years, butsince late in 2014 has generally been significantly more than that (amounting to a difference in average revenue of as much as $30/MWh. Readers should note that revenues earned from supply of FCAS services have not been included in the tally for LWA Revenue for Service 2 above, hence the real differential/premium would be higher than shown above.

With LGC prices of the order of $65/LGC historically, we can see why a commercially rational outcome for many new entrants to focus exclusively on Service 1 and ignore Service 2 entirely. The expected drop of LGC prices to a level close to zero should encourage these participants to consider Service 2 – however there is a learning curve to climb.

In the author’s experience, one of the practices that is working to mask the dichotomy between Service #1 and Service #2 has been an increasing tendency to reference and quote figures like Levelised Cost of Energy (LCOE) and specific PPA prices for wind and solar in comparison to average pot prices, or estimated cost for supply of other types of technology.

A lack of awareness and consideration of the integration of “Anytime/Anywhere Energy” with “Keeping the Lights on Services” is already having impacts on this energy transition – with respect

to two different types of stakeholders below.

Stakeholder #1) For the new entrant generator

As noted above, the new entrant generator is potentially missing opportunity by not providing a more integrated service to the market.

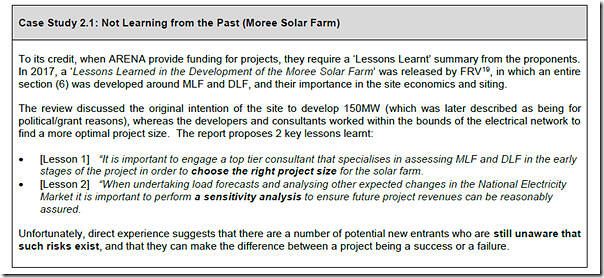

However, the mindset that has developed has led to a growing number of unpleasant surprises for these proponents when faced with “real world” considerations. Sometimes the initial project developers have sold the projects before these considerations take effect.

This list of surprises includes, but is not limited to:

- Rapidly declining (and volatile) Marginal Loss Factors which significantly impact revenue;

- Escalating incidence of transmission congestion (for System Strength, network development, and other reasons);

- Uncontrollable or ‘Out of the blue’ FCAS charges; and

- Increasing differential between LWA Revenues for plant providing the different services.

Arguably, these new entrants have not been well served by advisers who have failed to help them understand the risks involved and more broadly by the group of active energy sector stakeholders encouraging the mistaken belief that this massive transition can be accomplished easily, and by focusing only on LCOE, PPA Price, and Service 1.

Stakeholder #2) The broader energy sector

For the broader energy sector, this schism is potentially also delivering suboptimal outcomes in terms of cost and risk, hence adding to the overall economic cost.

The authors also share a concern about whether the energy sector is as effective as it could/should be in learning from experience.

Because of the intense competition that’s been delivered in ‘Supply Service 1’ (in part because of global trends in declining costs, reverse auctions and increasing learning curves) those with a mindset to provide ‘Supply Service 1’ are only just now having to think about providing ‘Supply Service 2’. The current discussions on installations in north west Victoria and the requirement for synchronous condensers is testament to this confusion.

The broader group of energy sector stakeholders (including the government and market bodies) could have made it easier for new entrants to understand and contemplate provision of Service 2, first and foremost by ensuring incentives were more holistically aligned with Capability development, as well as Capacity development, but also by being more proactive in providing clarity in the roadmap of challenges ahead.

Yet again, if we look to the past and look around, ‘Supply Service 2’ has been heavily talked about in the past within the wider industry. The Musselroe Wind Farm in Tasmania, a 168MW wind farm in the remote north east of Tasmania, was commissioned in 2013 with significant network support equipment because of its weak connection conditions, many years before system strength became recognised as an issue in South Australia, yet very few wind farms since 2013 have been installed with similar equipment (or were even aware of the possibility).

The power system of the future requires all Portfolios to have a much more holistic mindset towards the integration of (the more complex) “Service #2”. With this mindset in place, new entrant Portfolios will be able to play an active role in meeting the grid’s needs for Service #2 in some form.

Until such a time as this is commonplace maximum penetration levels will be artificially held back. Any discussion around ‘100% Renewable Grids’ without addressing the more comprehensive service offering around keeping the lights on, is bound to be short. The entire industry must mature!

Be the first to comment on "The NEM has developed a ‘them and us’ schism (GRC2018 Theme 5)"