Last week the AEMO released a draft of the Marginal Loss Factors (MLFs) that would apply to both generation and loads connected to the NEM. This page on the AEMO site links to more details.

On that page, the AEMO notes:

“The NEM is transforming, driven by new technology and a changing generation mix, newly formed supply hubs, leading to large year-on-year changes in MLFs. In many locations, MLFs have fallen by large margins, which in turn have material financial implications for existing and intending market participants.”

Well, the “fallen by large margins” comment has been echoed loud and clear in various pockets of social media.

Concurrently with this latest furore, we’ve been focusing our efforts to incorporate a 20-year review of Marginal Loss Factors as part of the compilation of our extensive Generator Report Card (MLFs are just one of dozens of other metric we’re assembling, some of which are described here) .

(A) MLF coverage in the Generator Report Card

Over the past couple days we (i.e. the authors) have tried to avoid getting sucked into the rabbit hole of endless social media, and rather invest time to deliver insights more efficiently and effectively through our 20-year review in the Generator Report Card.

We weren’t wholly successful in avoiding the distractions, but are pleased to note that our analysis has been extended with more insights to share with readers of the Report Card – over time, and down to individual details of discrete DUIDs (units within power stations). We’re looking forward to delivering these insights to the growing number of people who have pre-ordered the Report Card at “early-bird” pricing and are waiting patiently (thanks!) for their electronic access to be made available.

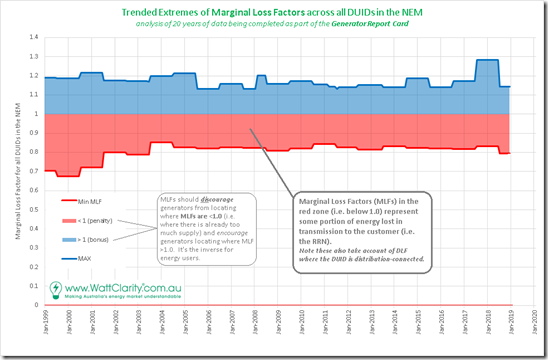

However for WattClarity readers at the start of the week, I thought it might be useful to share this 20-year trend of the extremes in MLFs in order to provide some context:

As can be seen, across all DUIDs in the NEM as they have existed at the end of every month over the past 20 years, there has been a fair range of MLFs across all time. It’s not just a recent development that loss factors have varied significantly – depending on a generator’s choice of location, and their choice of a particular connection to the grid (e.g. connection voltage).

1) Every year over the past 20 years, some generators have been rewarded for locating where there has been a relative scarcity of generation options, hence earning an MLF above 1.0 and hence receiving what’s essentially a bonus on the MWh production sent-out from the station gate.

2) Also every year over the past 20 years, other generators have essentially been penalized for locating where there is (especially after their entry) an over-abundance of generation compared to the local size of consumption, hence earning an MLF below 1.0 and essentially having their production discounted due to losses on transmission (and in some cases distribution) lines back to where the load is.

Whilst the specifics of the exact numbers are complex and require sophisticated modelling to determine, the directionality of the numbers should be fairly common sense and is along the lines of Business 101:

Rule #1) Locate close to where the customer is, or pay the transport cost (which, in this case, includes losses).

Rule #2) If you choose to build remote from your customer, and other competitors also come in afterwards to also build in the same place, then you are all going to suffer more.

Yet there was a surprise and outcry back in mid-2018 when loss factors changed – as a result of which I posted this attempt to help address Villain no 4 at the time.

In his “Lessons from the trenches” article from September 2018, Jonathon Dyson notes (about MLFs) that:

“physics of the power system beats financial models every day of the week”

(B) The current buzz on social media

We have noted the furore about the nature of the changes that have been heralded in last week’s AEMO announcements – and especially the claims that these were unexpected and appear unfair.

For our future reference, I have linked in the following particular discussions, which we might come back to in another few weeks to review commentary then in the light of the content we have included in the Generator Report Card (i.e. to ascertain whether the content we have completed will assist in answering the questions posed online for those who have arranged access to the Report Card):

1) There’s this article “Wind and solar plants hit by massive de-ratings in congested grid” on RenewEconomy, though to be clear readers should note that it’s not particularly that the grid is congested that MLFs have changed but because losses are high (congestion is, related, but also a whole other can of worms, and another metric we are assessing ).

2) On Twitter I noted a number of exchanges (particularly this exchange started by Kane Thornton + its many tangents like this one), but there are bound to be many others.

3) On LinkedIn there were also a number of exchanges (this one started by Dan Brown and this one by Glenne Drover) but it’s likely there will be others as well.

If our readers know of other worthwhile discussions going on that we should be aware of, please add them in as comments below – or, let us know directly/privately via our feedback form (or just call us on +61 7 3368 4064).

(C) Some information provided by the AEMO

For those who want to know more straight away, a great place to start would be these AEMO reference documents:

“Treatment of Loss Factors in the National Electricity Market” from 1st July 2012 … paying particular attention to sections 4 and 5.

“Forward-Looking Transmission Loss Factors” from 8th February 2017 … see section 5.

It’s also worth noting that the AEMO clearly cautions on page 27 of the document “Draft Marginal Loss Factors: FY 2019-20” from March 2019 that:

“As more generation is connected to electrically weak areas of the network that are remote from the regional reference node, then the MLFs in these areas will continue to decline.”

(with my emphasis added)

I have not checked to see if a similar warning was clearly provided in the documentation in mid 2018 – however now that this warning has been so clearly provided here surely no-one can claim surprise in future (e.g. come mid 2020, when the updates are released and a range of MLFs for remote power stations continue to decline – including the possibility of significant drops in northern Queensland?)

(D) Rule Change Proposals at the AEMC

Two rule change proposals submitted to the AEMC in recent times that are related to the current concerns about MLFs (and both submitted by Adani Renewables) are as follows:

On 5th February 2019, Adani Renewables submitted an application to change from a marginal loss factor framework (intra-regional) to an average loss factor framework. Details are here under AEMC Reference ERC0262.

On 7th December 2018, Adani Renewables submitted an application to change the allocation of Inter-Regional Settlement Residues that accrue due to MLF inaccuracies to ensure generators are also able to receive allocations. Details are here under AEMC Reference ERC0251.

(E) Explanatory Article at the AEC

Also worth noting that Ben Skinner at the Australian Energy Council has (on Thursday 14th March) provided this article explaining some of the underlying logic for how MLFs are calculated and why they are used.

Worth reading for context.

——————–

That’s all for now – it’s back to the Generator Report Card…

When will a MLF, get applied to rooftop solar??? Bit of a elephant in the room that one.

What is often overlooked is that end users see massive swings in their MLFs and have done so since the NEM began. What is even harder for consumers is that the MLFs are driven not only by generator locations but by their bidding pattern as well.

What we have also seen is that MLFs consistently over recover the actual losses incurred but the reallocation of the residual back to consumers does not reflect the amounts each consumer paid.

Generators have never been interested in minimizing consumer MLFs so I find it a bit hard to be all that sympathetic to the current out-pourings of being hard done by

A bit more from one side of the debate

https://reneweconomy.com.au/new-solar-wind-projects-may-stall-in-face-of-network-bloodbath-49402/

Paul-Can you or anyone here tell me what the role of the existing and augmented grid will be once almost all or perhaps ALL present grid customers…households and some business…are largely independent of the grid …ie with rooftop solar and batteries formed into VPPS orchestrated by aggregators…as AEMO urges?

Who will be paying for the even more expensive grid then…with no regular customers?

Solar and wind farms will be in the AEMO-designated Renewable Energy Zones presumably with their own microgrids.

Who but big industry will take and therefore PAY for power from the grid,,,and will they be enough to sustain it.

The whole ongoing costs of the grid would surely be a huge impost on industry and ultimately on all of us….and especially on Australia’s competitiveness.

Can you or someone here give us an overview of who will take power from the grid and who will be the regular customers of it in the DER Australia that AEMO hopes for please?

That’s an interesting question, because governments are actively promoting policies that reduce grid demand – rooftop solar, batteries, demand management and efficiency measures – while at the same time incentivising large scale intermittent sources that require massive investment in networks.

It is all starting to get exciting.