Yesterday I posted a short article about the “wind correlation penalty” that’s been sending prices negative in South Australia over the past few days – and speculated (based on the only data visible in real time) that some wind farms appeared to be responding by shifting volume to higher priced bands in order to avoid the financial damage caused by the negative prices.

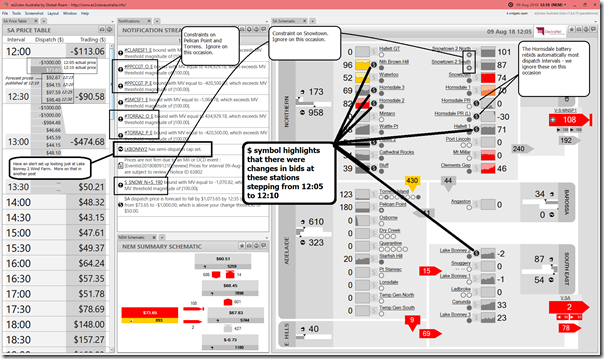

This comment yesterday from Allan O’Neil (guest author on WattClarity and independent consultant) prompted me to have a quick look this morning at what actually happened. I’ve included two snapshots from ez2view wound back to 12:10 yesterday via the “Time Travel” functionality to see what happened with the South Australian wind farms in response to negative prices in the 12:00 dispatch interval (dropping the 12:00 trading price below zero) and the 12:05 dispatch interval (suggesting, at that time yesterday, the trading price would also be below zero).

In the first image, we see the $ symbols light up on the schematic to indicate that a number of plant rebid in the 12:10 dispatch interval:

Even with the effect of the rebids (which shift the 12:10 dispatch price back above zero) the estimated trading price for the 12:30 trading period is still down at –$90.58/MWh.

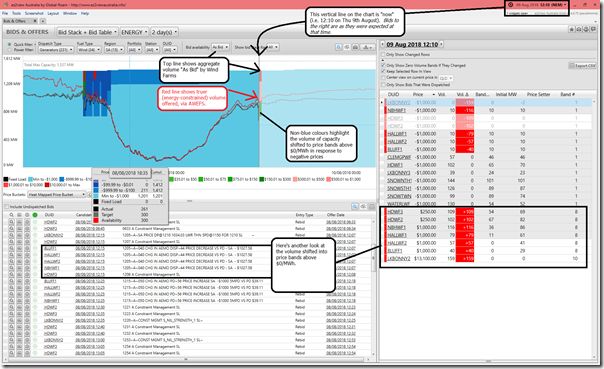

In the second image we take a quick look at more of the bid data for wind farms across South Australia:

We see that there were 662MW of wind farm bids across 7 stations and 3 portfolios (roughly half of the total volume offered) shifted from –$1,000/MWh into higher priced bid bands in response to the drop in dispatch price in the 12:05 dispatch interval.

To follow a couple conversations for new entrants recently, operating Semi-Scheduled plant in the NEM is not a passive role – not now, and certainly not in future as things like the “wind correlation penalty” and the “solar correlation penalty” begin to bite harder.

Why were they bid in at $-1000 in the first place if they are not covered in some other way like a PPA? Is there some technical reason that wind turbines cannot increase or decrease their output on demand, such that the owner would be prepared to take such a hit?

Wind farms will bid in at -$1000 for two reasons:

1. PPA covered all risk, as you mentioned.

2. When there are too much wind in the region, AEMO issues a constrain to all wind farms, and WF with the most expensive bids would be curtailed out of the market. WF would typically bid low to stay in the market because prices are still likely to be profitable for them – that is until the -$1000 hits.

With 130km/hr winds and severe chill forecast across the southern States we may be about to live in interesting times again, especially with the NEG up for debate.

If I were a wind generator, I would bid in at -$1000 to ensure you get dispatched for most of the time and take it on the chin when prices a negative for a number of negative dispatch intervals. Almost all of the time wind gets dispatch at positive prices and unless they have a ppa, I would prefer to take pool risk.

Speaking of power risk it’s claimed the scalp of another PM who’s tried to marry reliable affordable power with Green energy and on that note another interesting resignation-

https://reneweconomy.com.au/agl-boss-andrew-vesey-steps-down-immediately-96485/

All in the too hard basket gentlemen?