For various reasons (concern about climate change, increased consumer awareness, technology change in energy, rise of social media, and the rise of energy policy as a political football, etc…) we’ve witnessed a huge increase in commentary about energy (and energy data) that is coming from all sorts of different corners of the sector. Ourselves, we have also added to this with the commentary we’ve been posting on WattClarity since 2008, or even before.

It’s probably fair to say that none of the commentary can be 100% correct about everything it covers. Of course we’re amongst those who make errors (I do hope we have been reducing the errors we make, over time, and dealing with them when we do).

However reading today Saturday’s piece in the SMH by Allen Hicks of the ETU was one of the more concerning pieces I have read in recent times, especially given its publication in a broadly read media outlet like the SMH. I would have thought there would have been some basic fact checking before publication – particularly the following (very erroneous) claim:

“Since the introduction of the National Electricity Market in 1996 the wholesale price of energy has risen dramatically.” (according to Allan Hicks at the ETU)

Now, leaving aside the fact that the NEM started in 1998 and not 1996 (though there were precursors to the NEM running just in Victoria from 1994, and NSW and QLD after that), this claim seems to somehow link the increase in the wholesale price of energy with the creation of the NEM. I’m calling bullshit on that claim (apologies for the colourful language).

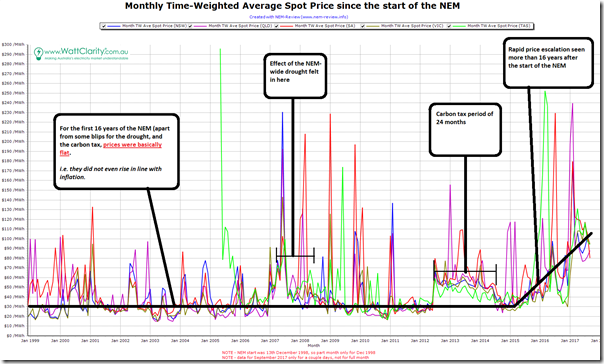

Using our NEM-Review software, I’ve generated the following trend of monthly time-weighted average prices over the entire history of the NEM:

For those who need some assistance, I have added two lines on the chart:

1) The first line (which runs for 16 years since the start of the NEM) is flat. Most monthly averages over that entire range were around $30/MWh (which, as an aside, might be long-run marginal cost only for a heavily depreciated legacy asset).

(a) There are the two big deviations highlighted for the carbon tax period, and the prior NEM-wide drought.

(b) There are also obviously regional deviations due to local supply/demand conditions, and so on.

(c) To be explicit, this flat line shows that wholesale prices did not even keep pace with inflation.

2) Then, we see the rapid escalation of prices from about the start of 2015 which clearly have nothing to do with the start of the NEM.

Let me be clear – prices have risen significantly in the past couple years – there is a train wreck in process, and it is really hurting energy users (particularly large ones), and it is happening for more than one reason (with each of these Villains contributing).

However to try to conflate “prices have risen dramatically” with a belief that this happened because of “the introduction of the National Electricity Market” at best reflects a very, very untrue alternate reality. I would have thought that the Electrical Trades Union would have had a better understanding of the history of our energy sector than that, and it does make me wonder why (it seems) they do not…

The cause of the problem is vertical market integration. Emergence of 3 giant gentailers killed the competition. There should have been some type of “cross media laws” in place which shouldn’t allow generators to buy retailers.

That has been a contributing factor (thanks Alex) but it’s far from the only one.

We all need to use caution when focusing singularly on the [INSERT HOBBY HORSE HERE] that we think has been the reason for the escalation.

After all, mergers were also happening in the first 16 years as well…

Hi WattClarity,

I have spent the past 73 years thinking and trying to understanding how things work on the basis of the facts and the truth. The notion of “truth’ goes back to at least the Greek thinkers but on and off for the next 2500 years a lot of people have thought that the truth was a worthwhile goal in life. After the Scientific Revolution or may be at the same time as the Industrial Revolution these ideal seem to have been part of progress. Then came the Post-Modernist period and now we have moved onto the Revisionist Period. The “TRUTH” has gone – one must be “progressive” all facts if they get in the way of a point of view can be “reviewed” and adjusted. Take careful note and listen carefully about the augments about why one should vote “YES”. This rot started many be 50 years ago with advertising. We let people tell us that they product was the best. They all said that. One brushed that aside on the basis it was only advertising what would one expect someone to to say about their product. But letting such talk go unchallenged was dangerous. Look where we have got to. You seem to think that if you can show someone to be wrong with facts you might win an argument. That was once true but we now live in very dangerous times and such arguments don’t now carry much weight any more. The Unions used to talk about “Direct Action” they knew how to win an argument. May be now words are no longer mightier than the sword!!

I recollect that in NSW in 1994-95 Pacific Power’s bulk supply tariff for energy delivered at transmission level was $60/MWh.

How does your weighted spot price average track against similar measures for gas prices in Australia?

In Ireland there is a very tight linkage between the wholesale average price and gas prices. Gas prices explain 80-90% of electricity price variations,

http://www.ey.com/ie/en/industries/power—utilities/ey-future-energy-and-consumers

It is regrettable that the energy price debate is inevitably tainted with loose statements. It is even more regrettable that “delivered energy” prices are discovering dizzy new heights. Having said that though, by my calculations, Australia CPI in that period is just shy of 2.5% p.a compared to an implicit 5% compounding increase in wholesale electricity prices. So the generalisation is not entirely untrue…

Hi WattClarity,

When someone asserts that something cause causes something almost always the logic is flawed. WC is correct to challenge Hicks in the SMH, however I would suggest the rebuttal is equally flawed. Correlations or lack of, are a good starting point in discovering how inputs alter outputs but one needs a good deal more than a positive or null correlation to draw a conclusion one way or the other. Hicks suggests the NEM caused the price rise while WC produces good figures to show many years passed after NEM was created before the price rose. But it is equally valid to ask were the NEM to have never been created in the first place would that have prevented the very recent rise? If the answer might be “yes” then it is not wrong to suggest that the NEM has caused the rise. Trying to analysis this matter any further one gets bogged down with the inadequacies of the English language to explain such matters in a few words. The single word “cause” without careful definitions in particular circumstances is always dangerous. Positive or null corrections are an interesting subject. Looking for the causes of tornadoes in the US, one might be impressed with the very high correction between a certain observable single parameter and the frequency of tornadoes. The number of tornadoes per year and this variable tack one another over a 5 to 1 range over the past 100 years. One could well conclude this parameter to be the cause. The variable was the number of successful persecutions per years for having illicit distillation apparatus. The reason for the close collection was that both were tied to US Federal spending. More money meant more Federal Agents and more small weather stations to record tornadoes. Corrections by themselves are dangerous, almost every different sort of food has been shown to be both bad for you and good for you with correlations of one kind or another.

I would suggest that the NEM can be blamed for many negative outcomes; however whether better outcomes might have come from a world without the NEM must be consigned to What If History.

Paul very interested to read your thoughts on why it has spiked after 16 flat years?

Do you have time in the next couple of weeks? This is a very important discussion relating to energy prices.