The overwhelming majority of Australians are able to enjoy a consistently reliable and safe source of electricity, whether they be consuming at day or at night, at home or at work. The importance of ensuring that the supply of electricity remains robust and secure cannot be overstated; Australia’s economic growth and its desire to encourage innovative technology and manufacturing industries is largely dependent on it.

Prior to 2010, the National Electricity Network (NEM) experienced steady growth in peak demand and energy consumption. The strain set to be placed on the network by the forecasted increase in peak demand and energy consumption, warranted continual high growth in capital expenditure, not only on the repair and maintenance of existing infrastructure, but also on the expansion of network capacity in growth areas to meet anticipated peak demand growth.

In addition, license conditions set by state and national regulators were raised to higher standards of safety and reliability over the same period, particularly in NSW. As such, capital investment was required to not only meet the needs of a growing population but also the increasingly rigorous license standards. These additional capital costs were paid for by consumers through significantly more expensive electricity bills. This in turn opened consumer’s eyes to the costs they were supporting for the provision of electricity services. The negative price-elasticity of demand kicked in, as consumers became more cost conscious, driving usage efficiency measures and exploration of alternative technologies.

The growth in electricity peak demand and energy consumption by consumers has tapered over the last 4-5 years after this prolonged period of growth. The fall resulted from a perfect storm of:

- the adoption of more efficient home appliances and lighting;

- widespread insulation and rooftop PV installation;

- improved heating, cooling and water efficiency in new homes;

- in-home demand-side management systems, and;

- a shift in the broader economy from manufacturing to service industries.

The tapering of current and forecasted consumer electricity demand has allowed network service providers to delay augmentation capital investment that was scheduled for the tail end of the recent regulatory period, and reduce augmentation for the following regulatory period. However, the requirements of maintaining and replacing elements of an ageing network subject to higher risks of failure remains, even as the number of consumers continues to grow while average consumption reduces.

The fact that consumers have become more sensitive to prices and price elasticity in this utility sector does matter. In addition, as competitive alternatives to network delivery of electricity have become more affordable (i.e. distributed generation from PV on households and small businesses), and consumer uptake of efficient appliances increases, continued downwards pressure on network energy throughput appears more likely.

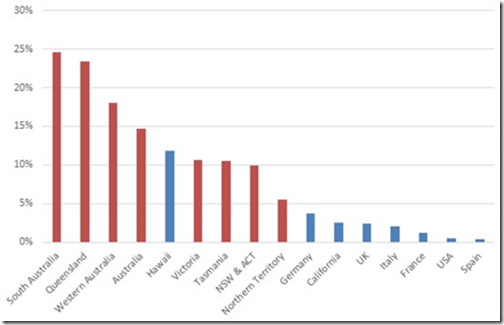

Figure 1 Annual energy forecasts for the NEM

Source: AEMO Forecasting Report 2015

Figure 1 illustrates that the current year-on-year forecasts in the AEMO’s forecasts. The marginal increase under each scenario incorporates some growth from the LNG plant openings in Gladstone, though there are now expectations that this will be somewhat offset by higher than expected uptake of solar PV and storage systems.

There have been a number of initiatives introduced by the government in order to keep final costs for consumers at a reasonable level. For example, feed in tariffs encourage consumers to install rooftop solar capacity, reducing their demand on the electricity network. However, peak solar output rarely lines up with peak network demand, which is often the most accurate measure in assessing the need for capital expenditure on the network. Moreover, the nature of the solar subsidies and feed in tariffs has resulted in households who did not install solar subsidizing those who did.

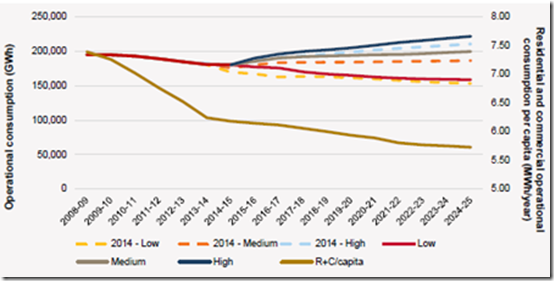

The large upfront costs of solar panels effectively acted as a barrier for entry for households lacking in disposable income. As such, the feed in scheme and PV subsidies had the undesired effect of facilitating a transfer of wealth from the lower to the middle and upper classes; a distinctly uneconomic outcome in this case. By the time these policies wind up, publications by the Grattan Institute estimate that households and businesses that have not installed solar PV will have subsidised Australians who have to the tune of $14 billion. This is comprised of subsidies from the Small-scale Renewable Energy Scheme (SRES), feed-in and network tariff structures (see Figure 2).

Figure 2 Aggregate net cross-subsidies from electricity consumers without solar PV to consumers with solar PV, $2015

Source: Sundown, sunrise: how Australia can finally get solar power right, Grattan Institute

A fresh approach to distributed generation and storage is necessary. The industry could implement dynamic tariffs (time-of-use tariffs) to shift some peak load and flatten peaks in electricity demand, leading to a decrease in the costs of running the electricity transmission and distribution networks.

Modelling described in the Smart Grid, Smart City report drafted by Arup suggested introducing mandatory dynamic tariffs for some consumers as a mechanism for reducing the cross-subsidisation effects within the current tariff structure. Such initiatives are being supported by changes in the NEM rules being pursued by the AEMC, but further jurisdictional support may be needed to drive such change.

The Smart Grid, Smart City report also showed that dynamic tariffs would accelerate the adoption of storage technologies. However, in a sign of the rate of development in storage technologies since the report’s publication in July 2014, the modelling suggested that under business as usual (BAU) conditions storage technologies would not become economically viable in the foreseeable future, and that even with dynamic tariffs there would be no economic deployment of distributed storage technology until 2024.

The report did comment on the importance of education within the Australian context. Although dynamic tariffs are commonplace in many developed countries, Australian residents are largely unsure of firstly what dynamic tariffs are, and more importantly what the impact on their bottom line would be. While Victoria mandated the roll-out of the advance metering infrastructure (AMI, and some would say ‘not so’ smart meters), other states are relying on competitive rollout of smart meters, which will in effect be paid for by the consumers considering new tariff arrangements, and therefore will be part of their economic decision. In Victoria, as this cost is effectively sunk, albeit already paid for in consumer’s bills, it will likely not factor into consumers decisions of new tariff adoption.

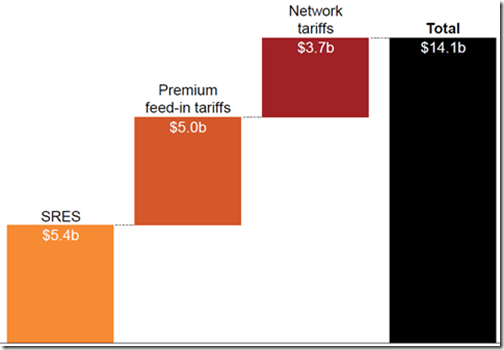

A combination of climate, policies and disposable wealth has resulted in Australia being the world-leader in PV penetration (refer Figure 3). This also means that – though the policies that got Australia to this stage might not have been ideal – we are now in a position to shape the PV and storage discussion given the strong synergy that PV has with energy storage, whether sized as distributed, embedded or grid-connected.

Figure 3 Proportion of households with PV

Source: Clean Energy Regulator; Energy Information Administration; Atlasole; French Ministry for Ecology, Sustainable Development and Energy’ Bundesverband Solarwirtschaft; Spanish Photovoltaic Association (UNEF); Eurostat; Electricity Gas Australia 2015, UK Department of Energy and Climate Change

The Smart Grid, Smart City report discussed the reluctance of network operators to invest in new smart grid capital developments given the lower than expected demand levels and the perceived short term impact on future pricing. Given this, the report suggests that has a role to play in encouraging targeted research and development funding for network operators in areas that could deliver the most significant economic benefits to consumers through more efficient network operation. But the AER is firmly of the view that “new investment in innovative technology should be supported by its own business case and not through the regulatory asset base” to avoid these research and development costs flowing into increased network prices.

This suggests new investment in innovation for increasing deployment of renewables into the grid will need to be funded from the business’ equity and will be ‘at risk’ to competition. Therefore, it should, in-principle, also be considered a .

The growth in smart grid technologies, particularly storage mechanisms, since July 2014 indicates that network operators would have easier access to developed smart grid technology which is trial-ready. However, in recent decisions the AER has shown its hand in significantly cutting capital and operational expense levels for network service providers (NSPs), without the financial support for the use of these new technologies. Consequently, NSPs may be reticent to approach the AER for research and development funding, and the AER unlikely to reverse its initial classification of these investments as non-regulated. Australian electricity networks are in a state of flux. Regardless of access to AER funding, it is becoming readily apparent to network operators that to remain financially viable in the long-run requires investment in new technologies.

It would appear that widespread adoption of dynamic tariffs in the short term, would likely not only reduce the cross subsidies of the current spread of renewable support schemes but would likely also encourage uptake of smart grid technologies by customers as well as NSPs. While this would lead towards a more economically efficient outcome, there would be winners and losers in the consumer space as cross-subsidies are unwound.

The next 12 months should see NSPs running further trials of storage technologies and dynamic tariffs under different business models to find how they can remain viable in an environment where their regulator is keenly watching short-term prices. The timing for when conditions become economically attractive enough for consumers to adopt their own storage technologies is a more open question.

Australian energy retailers are already teaming up with battery manufacturers to offer consumers and small businesses . In November 2015, the Alternative Technology Association found (in this report) that these packages are not yet economically viable in the Australian market, and are not likely to be so until 2020.

That is not to say there will not be any market at all for these small-scale storage solutions. There will always be early adopters and outlier groups where existing battery technology is viable. Indeed retail offerings using these technologies are appearing in the market place now and early adopters are taking these offerings, even though the economics may at this point be marginal for many Australian consumers. However, while the first movers on the supply side are the retailers, it is the reluctant NSPs who are seen as the sharks of the Australian energy market, who are likely to suffocate if they don’t get moving with offerings of their own which allow them to leverage network efficiency gains from these new technology bundles.

What should also be noted is that forecasting energy and peak demand in Australia has recently been fraught with uncertainty. What for years had been a steady and determined annual increase in electricity demand first flattened out before starting to reverse altogether across much of Australia. This had been forecast by approximately no one in the energy market industry. The new expectation of a return to growth, has yet to be proved out in publication of up-to-date data.

The regulatory incentives from the network price setting arrangements, underpinned by what later would be seen in changed circumstances as a generous capex determination by the AER, led to the NSW DNSPs to make investment decisions in network capacity resulting in the high network prices we see today as that extra capital is recovered.

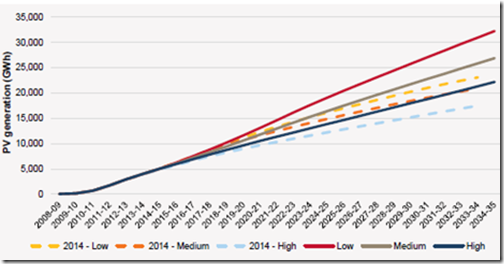

As recently as this year, the AEMO significantly increased its forecast for PV generation from its 2014 report, as prices of PV technology dropped by more than most had anticipated. See Figure 4 for comparison.

Figure 4 Comparison of rooftop PV forecasts

Source: AEMO 2015 electricity forecast

Key conclusions:

• There is a clear positive economic case for immediate deployment of dynamic tariffs in Australia (requiring smart meter infrastructure);

• If dynamic tariffs (and smart meter adoption) are voluntary, not all customers will adopt the offer, and the broader economic benefits will be muted;

• Without dynamic tariffs customers will be presented with a strong financial incentive to install larger distributed generation systems (both PV and battery storage), which will hinder rather than encourage better network efficiency;

• If block (or flat) tariffs (either inclining, declining or bundled in nature) are maintained in Australia it is unlikely that distributed storage will be widely deployed due to a lack of market based financial pricing incentives for consumers;

• NSPs need to run further trails of storage technologies and dynamic tariffs under different business models, to better understand how they can improve network management efficiency and hence reduce costs for a more sustainable network service provision;

• If policy makers prefer market mechanisms to determine the speed and diversity of the take-up of more PV (or renewable) generation and storage technologies (including distributed, embedded and grid connected solutions), governments need to ensure their decisions do not distort the market place, leading to uneconomic or inefficient solutions;

• At the same time governments and NSPs will need to be aware that those segments in society constrained by affordability issues, will need to be supported through existing mechanisms as new technology becomes more widely adopted; and

• With the potential of PV installation being followed by storage adoption as a significant grid disrupter, the industry stakeholders should be careful about overreliance on peak demand and energy consumption forecasts. Current forecasts, while improving in a dynamic environment, appear to continually lag actual outcomes, previously on the downside, and potentially now on the upside.

(1) The Australian Energy Regulator, the independent economic regulator for energy guided by the rules developed by the AEMC.

(2) Regulated electricity distribution services in Australia are called “direct control services”. These are divided into “standard control services” provided using the regulated asset base, and “alternative control services” whose assets are not included in the regulated asset base. “Negotiated services” are loosely regulated under a general price framework, and “unclassified services” are not regulated.

(3) See Origin’s partnership with Tesla and ActewAGL’s with Panasonic as examples, with newer partnering arrangements emerging on a monthly basis.

About our Guest Author

| David Dawson is Associate Principle in the Arup Economics business, which emerged following the acquisition of Strategic Economics Consulting Group (SECG) in May 2013.Through Arup Economics, consultants like David provide access to a broader engineering skill set, and opportunities to support clients with larger project aspirations. Arup remains strongly focused on regulated infrastructure issues.

You can find David on LinkedIn here. |

Thanks for sharing your thoughts, David.

You refer to the uptake of rooftop solar being a transfer of wealth from the lower to the middle and upper classes. It needs to be noted that it is the lower income households that are installing PV at a greater rate. Multiple reports/studies/actual statics analysing and comparing regions of PV uptake have found that it is the locations with lower income ratios that have the higher uptake of rooftop solar PV. Especially in recent years where there is low or no FiT for PV owners exporting surplus energy back to the grid, the transfer of wealth is actually the other way. These households pay $1,000s of their money for PV that has long payback in most cases, but has multiple positive externalities, e.g.social, environmental and economic benefits.

The increased supply of energy in the grid is contributing to maintaining a stable cost of energy, through negative pricing events and when aggregated and with large-scale RE generators have a depressing effect on wholesale prices -merit-order effect.

It is too simplistic to claim they are free-riding and having a (negative) wealth transfer.

I agree with the mandatory introduction of dynamic tariffs. How about making the transition attractive to home owners?

This could be done by mandating dynamic tariffs based upon coincident peak demand, instead of maximum site demand. Residential peak demand is less correlated to network coincident peak demand.

Or, by mandating that demand charges are uniform for all customers, e.g. 10 c/kW daily charge, irrespective of the site (residential, commercial, industrial)? The rate could be adjusted each year to ensure the networks make their regulated returns.

Or, by mandating that dynamic tariffs only be introduced if fixed (daily) charges are eliminated? This way, end-customers would be incentivised to install solar + storage systems that reduce their impact upon the grid. A reasonably efficient single family residence with a correctly sized solar + storage system could draw zero load from the grid during summer, and only 1 kW during winter (limited to off-peak times). The home owners could have a zero bill during summer, and an almost zero bill during winter. In the meantime, the contributors to coincident peak demand would pay for the grid, as they are the ones who determine how expensive the grid needs to be.