Firstly thanks Paul McArdle for the invite to be today’s guest author. My interest in Marginal Loss Factors (MLF) is because my view is the existing rules are outdated and not fit for purpose. I have proposed several suggestions for rule enhancements as the current rules are resulting in high inaccuracies and hence are distorting the market though inefficiencies in operational and investment decision making.

The rule changes are here on the AEMC website.

These can be summarised as follows

1. Currently the generators do not receive any allocation of the bucket of money left over each year called “Intra-Regional Settlements Residue” (IRSRs) that accrues due to MLF inaccuracies. Note don’t confuse this with “Inter-Regional Settlements Residue” which is the other bucket of money left over due to the difference between state pricing. The Intra bucket of money is handed entirely to the TNSP to give back to TUOS customers. I have proposed to share this bucket fairly with generators who are also paying dearly for inaccurate MLFs.

2. We should also reduce the size of the bucket of money every year by half by using average or compressed loss factors (and not Marginal) as these better represent true losses. True engineering losses on the grid are not marginal as this is an economic theory (and based on extremes) instead based on averages. Hence the current rule (aligned to marginal price setter) over-recovers.

The marginal loss calculation also uses the formula

Losses = Current ^2 X Resistance

This is fine for a simple DC circuit however using this calculation for losses in the NEM is simply bogus and defies reality. Our complex power transmission system is AC and flows two way. We should be measuring electricity in vs energy out at every point in the system to see actual losses.

Arguments over electrical losses aren’t new as good nerds know from the famous “war of currents” fought between Nickola Tesla (AC) and Thomas Edison (DC) over whose electrical system would power the world. Eventually Tesla won based on the fact his AC system had less losses. Today there is a similar but different “war of losses” being argued. I have argued over the past year that our current MLF framework is out of date and not fit for purpose. This is evident though the increase in the IRSR as a lagging indicator of the increasing inaccuracies. The IRSR can be thought of as the cumulative error that arises because actual losses (average) on a system are half marginal losses (MLF) by definition. The error also arises because actual generation and load patterns change from year to year yet MLF are static and forecast a year in advance. For example thermal generators may generate more or less as a result of changing fuel costs, market prices or unplanned outages.

Turning back the clock, it is also worth noting that as generation in the NEM is dispatched optimally based on marginal costing, so it’s understandable how economists win the argument that transmission should be costed marginally as well. However I do have an issue saying in one breath “Losses are real” and then pointing to our present economic construct based on a simple one way DC circuit law of physics.

When we strive for perfect information in every other aspect of the electricity supply chain to create economic efficiency, why neglect transmission? Why aren’t the actual AC transmission loss calculations (including my personal favourite – Corona losses) visible to market participants and who is best place to manage transmission loss risk? For true economic efficiency, risk should sit with those best placed to manage. Is this generators, TNSP or customers? Hence the war and starting to feel like a little bit of history repeating Edison vs Tesla.

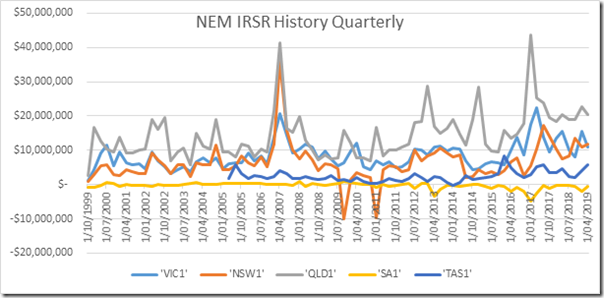

Enough of that, back to the IRSR which has been a significant and growing amount over the past few years, highlighting inaccuracy due to the current MLF process. For the last two years in QLD this has amounted to $82M per year with the trend rising in each region (excluding SA).

Negative IRSR generally will occur when there are extreme price event (high demand) in any region due to the asymmetric nature of spot prices (and windfall gains by generators relative to the market settlement). I can’t explain why the spikes in 07 however the spike in 17 seems to correlate to the forecast start of new renewable generation.

I am very interested to hear the views of other generators, TNSPs, retailers, customers, consultants and market participants regarding IRSR treatment and personally look forward to the AEMC rule change later this year.

——————————————-

About our Guest Author

|

Derek Chapman is Business Manager at Adani Renewables – hence has been actively involved in the development of both:

You can find Derek on LinkedIn here. |

Leave a comment