In a recent edition of Wattclarity, Panos Priftakis of esaa shows how the electricity demand varies with ambient temperature and what the impact of a heat wave does to demand. The cause of this increase in demand is related to the use of cooling by residences and in commercial operations such as offices, shops and shopping centres. The outcome of these increases in demand tend to drive much higher prices for electricity in the wholesale market and networks closer to their maximum capacities.

In contrast, electricity demand by large energy users in the manufacturing sector varies much less because of their continuous operations; more importantly, their actions are more focused on reducing demand where possible because of financial pressures. Large electricity users are now being active in responding to the high prices seen in the electricity markets, especially in SA and Queensland. Market pressures and government action (in some cases inaction) are having a massive impact on the operations of larger energy using manufacturers and these have resulted in closures, downsizing and/or leading to little investment for new facilities. The drive for increased energy efficiency is impacting the manufacturing sector too.

Overall, these actions are also impacting the expected peaks in electricity demand, but in the opposite direction to those referred to by Panos in his article.

Without dwelling on the market pressures and government action/nonaction, large users are having to address the cost pressures imposed by the energy markets in a variety of ways.

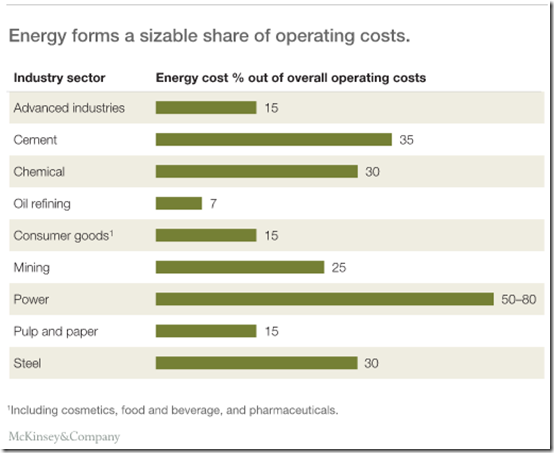

This recent report by McKinsey shows that energy is a considerable cost element for most larger energy users

Large electricity consumers have seen massive increases in their electricity costs in recent years and two of the more significant cost increases seen were in

- NSW when network charges for large electricity users doubled as a result of the 2009 network revenue reset review.

- SA where wholesale prices increased massively in the 2008-2010 period. A similar step increase is being forecast for 2016-2018 after more moderate prices in recent years.

If energy costs increase, large users have to find other sources of savings to offset the higher energy costs they are facing. Such methods include increasing productivity in all parts of the processes but, more generally, increased productivity is a must merely to maintain market share. So energy costs are still a core focus. There are three basic approaches used to keep energy costs under control.

- Buy cheaper. Options for this are addressed in more detail below

- Use less. In this, energy efficiency is the main driver and this is encouraged (enforced?) by governments such as through energy efficiency levies seen in Victoria (VEET) and NSW (ESS). These charges are levied on the energy usage and so provide an impetus to use less energy. The higher costs of energy and its delivery also drive the need to be more efficient in energy use.

- Find a different way to get the energy delivered. This can be achieved by finding lower costs for energy transport and/or accessing different forms of lower cost energy.

While buying cheaper doesn’t necessarily reduce the peak energy demands seen in the markets (although certain actions can result in this outcome), the other two basic approaches have a significant impact on the peak demands seen over time. What is important to note is that the different approaches can have short term or long term outcomes for the peak demands seen in the market.

Some examples of different approaches used to reduce energy costs in recent times are:

Immediate impacts.

This category includes actions that result in an immediate impact on the system demand

- Buy electricity on the spot market (either directly or via a retailer) and to load shed when prices rise as the prime tool to manage risk . While this approach used to be seen as a high risk strategy, firms are seeing that the rewards are significant and the risks can be managed, especially using the tools available to help manage this risk. Some large users can drop demand in a matter of minutes and even use the 5/30 dispatch/trading price separation to maximise the benefit of load shedding after a high price spike early in the trading period. Other users, with less ability to load shed quickly, look to the forecast prices to initiate controlled loading shedding. Some manufacturing processes are capable of quickly returning to productive operation but others less so. Overall, the losses in production are assessed to ensure that the savings exceed the cost of lost production through load shedding. This action is driven by the wholesale price of electricity, so unless the wholesale price rises, the load shedding does not occur. This means that such load shedding occurs mostly on working week days and not on weekends or holidays

- Some retail contracts include for a discounted supply price but with a requirement for load shedding, at the call of the retailer, usually because of expected high prices, but the timing and duration of load shedding can be uncertain. This problem of uncertainty as to the timing, duration and frequency of the call is concerning but to a degree this risk can be offset by requiring a notice period prior to the need to load shed. Third party aggregators offer a similar service. Load shedding at call is usually driven by the wholesale price, so no high price means no load shedding.

- Some networks offer a discounted transport price for load shedding at call. Again issues of notice and frequency are important for energy users, but commonly, the timing is related to expected loading on the networks which is usually well known some time ahead and related to weather conditions. This load shedding is not wholesale price driven, but there is an expectation of some correlation.

- All of these options provide an immediate response leading to a reduction in demand and the outcomes are seen in the regional demand that day

Longer term impacts

This category results in an overall reduction in the demand into the future, the timing of which might be measured in years

- Concern at forecast high prices for a considerable time ahead are addressed both by immediate actions (see above) and longer term solutions which might include closures and downsizing as well as a long term reduction.

- Outcomes from improving energy efficiency usually are seen incrementally but still impact the long term demand for electricity. Occasionally, large investments are made to build new processing plant which is more efficient than earlier models, with the older plant closed. An example of such a change in the paper industry is to provide more mechanical drying and less thermal drying, requiring more electrical energy and less thermal energy, but overall, less energy.

- Another approach is to introduce a more thermally efficient process – such as cogeneration or trigeneration. Such options require significant investment so careful balancing of capital costs and operating costs need to be assessed. These options tend to reduce the electrical load from the supply system but increase the need for thermal energy. One such process seen in recent times was the introduction of self electricity generation, using the high quality exhaust thermal energy for steam raising and the low quality thermal exhaust energy for drying. In this case, overall thermal efficiency rose from less than 50% to over 80% which provided a rationale for the capital investment.

So there are many approaches used to reduce the costs of energy which impact the system demands for energy but the impacts on the electricity markets are varied.

What is concerning is that whilst large energy users can see ways of addressing their energy costs and have the ability to devote time and effort to manage their costs, small users tend not to have the necessary knowledge or capital to be able to take appropriate actions and are essentially price takers. Commercial operators are less able to respond to immediate price signals (who wants to be in an office building or shopping centre unless it is cooled?) but do implement some of the longer term action plans to address their cost pressures.

Editor’s Note

This week we’re publishing a number of different perspectives of various factors contributing to what peak demand might be – NEM-wide, and for each region. Apart from being generally of interest (peak demand being a key driver of costs, in the energy market and on the network side) we’re providing another reason to be interested, this week.

Entries close this Friday (27th November) for your own chance to win one of 7 BBQs in WattClarity’s Peak Demand Forecaster Competition.

About our Guest Author

| David Headberry is the Public Officer of the Major Energy Users Inc in Australia.

The Major Energy Users Inc (MEU) represents some 20 large energy using companies across the NEM and in Western Australia and the Northern Territory. Member companies are drawn from the following industries:

MEU members have a major presence in regional centres throughout Australia, e.g. Western Sydney, Newcastle, Gladstone, Port Kembla, Mount Gambier, Whyalla, Port Pirie, Westernport, Geelong, Kwinana and Darwin. The articles of association of the MEU require it to focus on the cost, quality, reliability and sustainability of energy supplies essential for the continuing operations of the members who have invested $ billions to establish and maintain their facilities. . You can find David on LinkedIn here. |

Be the first to comment on "Price Response of Large Energy Users could Affect Peak Summer Demand"