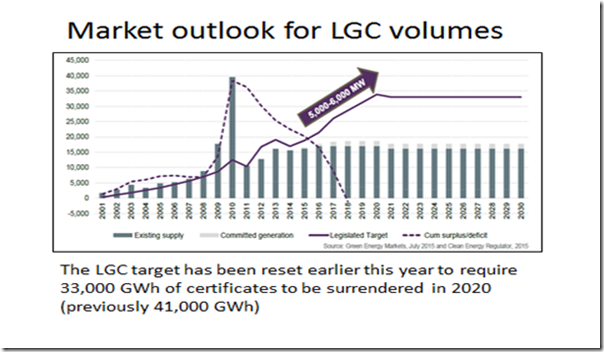

Australia’s Large-scale Renewable Energy Target (LRET) enshrines in legislation for a growing amount of electricity to be provided from renewable sources each year until 2020, and then a flat-lined annual target of 33,000 GWh until 2030.(1) The target is measured in Large Scale Generation Certificates (LGC’s), with each LGC equal to 1 MWh of eligible renewable electricity generation.

Wholesale buyers of electricity are liable for the obligation, by surrendering their required LGC amount to the Federal Government.

The 2015 target is 18,850 GWh (equal to 18.85m LGC’s), with annual step ups in the target quantity applying until 2020.

New capacity needed to achieve a growing target

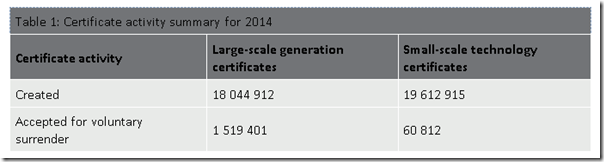

Published data from the Clean Energy Regulator (CER) indicates that eligible renewable generation for 2014 was approximately 18m LGC’s, of which approx. 1.5m LGC’s were voluntary surrender of certificates, typically associated with energy users committed to buying fully renewable electricity.

Accordingly, approximately 16.5m LGC’s were created in 2014 for use in satisfying the LGC target.

This means that substantial additional renewable generation above current annual output levels is required in order to achieve the 2020 target.

On the basis that wind energy would provide the vast majority of the additional renewable output, it is estimated that between 5,000MW and 6,000MW of additional capacity will be required in order to deliver another ~16m LGC’s and thus achieve the 2020 target. This range assumes capacity factors on the additional renewable output of approximately 30-35%, which equates roughly to typical capacity factors achieved on many wind farm assets in Australia’s eastern states.

The mix of new renewable investment between wind, solar and other sources will influence the overall capacity required to achieve the target, with solar PV capacity factors nearer to 20% and leading to lower overall capacity factors than if the future targets are achieved through wind energy alone.

An illustration of the estimated new build requirement is shown below:

How to deliver new renewable capacity of 5,000 to 6,000MW?

A series of questions arise about the requirement to build 5,000MW to 6,000MW of new renewable capacity. The most obvious of these is whether or not the required additional renewables will be built when required. An additional question is to consider how this might occur.

Initial glances at the historical growth in renewable generation shows that it has taken 15 years since the creation of the scheme to reach current renewable output levels around 18,000 GWh (as discussed above), and that a similar amount of new additional generation is now required within 5 years if the 2020 target is to be met. The necessary build rate between now and 2020 is around 1,000 MW to 1,200 MW each year over the 5 year period, to reach a 5,000MW to 6,000MW new build objective. Given the historical growth rate, this seems unlikely to be achieved.

The legislation driving renewable energy uses a ‘carrot and stick’ approach to achieving higher renewable energy penetration. The ‘carrot’ is the value of the certificate (LGC) that is created for each MWh of eligible renewable generation, which provides the revenue boost necessary to make renewable generation competitive against Australia’s non-renewable generation (mostly coal-fired power plus a range of other sources).

The ‘stick’ is the penalty price that is payable by liable parties (generally that’s electricity retailers) for any shortfall in the amount of certificates that they are required to surrender to the Federal Government each year, but are unable to do so. The penalty is a $65 fine for each certificate of shortfall, the payment of which is not tax deductible. This effectively means that Australia’s electricity retailers are able to pay up to ~$93 per LGC before being indifferent about either paying the penalty or buying the LGC.

The development of new renewable energy projects generally require a viable business case and a supportive banking sector that can provide adequate debt funding to support capital expenditure.

Banks seek strong confidence in the revenue streams available from new projects. For renewable projects, this means confidence in revenues from sale of both the wholesale electricity and the LGC’s. In the past, this has involved long term sales agreements with credit worthy buyers of the electricity and the LGC’s, underwriting project viability.

Traditionally, new power generation has been financed by:

- a recognised need to address forecast electricity demand growth, and the elevated wholesale pricing that would arise if new generation was not provided into the system; and

- a long term commitment by buyers to purchase power from the new asset that underpins revenues from the new generation and thus ensures bank financing for the development

In recent years, Australia has experienced higher levels of uncertainty in wholesale electricity (eg. solar panel penetration, demand growth flat-lining after many years of consistent growth, risks of carbon imposts, prospects of battery storage), and also higher levels of uncertainty in the pricing and the obligation level for renewable certificates, primarily due to the legislative uncertainty that has lingered over the RET scheme for many years.

This has meant that demand growth is not occurring in a way that requires new generation, and various factors have shortened the outlook for wholesale buyers (retailers and large industrial users) of energy away from long term deals.

In this market environment, how will future renewable projects proceed?

In recent years, major retailers have not sought large scale increases in their long term renewable energy purchases, either for electricity or LGC’s, driven by the uncertainty noted above. Some retailers have noted their strategy of only covering the liability of small use customers with locked-in LGC purchases, leaving larger consumers to manage cost exposure on LGC obligations arising from their consumption. This leaves open a question as to how the LGC obligations associated with larger consumers will be satisfied.

We have now reached a point whereby the number of years remaining before the RET Scheme concludes is 15 years. Each year that goes by before a project is built and brought into operation, means one less year for which LGC’s can be sold to support a project’s economics. This means higher LGC revenues (from higher LGC prices) are required each year until 2030 in order to deliver viable returns for each new project.

Current LGC spot prices are over $70, and medium term LGC forward contracts are approaching $80. Surely at these prices, new projects would find ample opportunities for long term LGC and energy sales agreements would find sufficient revenue certainty to underwrite new projects? That depends on how long retailers and other liable parties believe that they might be obligated under the current set of rules in the scheme, and who might be willing to commit an adequate future LGC purchase price and term to ensure a bankable project.

In the absence of firm longer term revenues for new renewable projects, an alternative is for equity funding of new projects, which would be expected to be at higher cost due to higher cost of capital associated with higher risk investment. Another prospect is for major industrial loads with LGC exposure to combine forces to drive their own joint development that secures LGC supply and avoids volatile LGC cost outcomes. Some recent support has come from state/territory Government-owned retail, which has led to committed projects feeding LGC’s to cover ACT liabilities, and Ergon (Qld) and Synergy (WA) recently announcing tenders/expressions of interest for accessing additional LGC’s.

What happens if the scheme fails to deliver the renewable energy target volumes, LGC price defaults to the $93 effective penalty, and the scheme is redesigned or scrapped by a future Federal Government? Various questions arise from such an event, including how does this expose parties who have committed to long term LGC purchases?

Options for the future

What options might there be if the scheme requires change in order to achieve Government policy objectives on renewable energy rollout?

One example is the UK experience, in which the Government acts as a market participant where required to buy Renewable Obligation Certificates (ROCs) and enforce obligations on retailers to buy the Certificates from them. This provides a Government backed revenue stream for renewable projects that reduces financing costs due to credit quality and fixed pricing. It also involves Government price setting that may be prone to inefficiency relative to a market-based arrangement.

Another scenario would be an extension to the RET Scheme, such that longer dated obligations on liable parties lead to greater confidence for buyers to purchase long-term LGC supplies.

A third scenario is Government involvement in financially encouraging further closure of non-renewable generation, such that new renewable capacity address demand requirements rather than adding to existing oversupply of generation within the market.

All these issues have diluted significance if the build rate ensures satisfaction of the 2020 target – but when does a Government decide that this will or will not be achieved (and then make further change)?………

About our Guest Author

| Andrew George is a former energy industry executive, who now manages energy advisory business Amanzi Consulting. Andrew is based in Brisbane and consults across Australia.

You can find Andrew on LinkedIn here. |

(1) Target for 2020 is 33.850m (33,850 GWh), but drops to 33m (33,000 GWh) from 2021 to 2030

Do these calculations include the impact of reduced Tasmanian hydro inflows on the supply of certificates ? We have now had 2 years of low inflows, and over the next 5 years or so the system will need to be run much more conservatively to allow storages to build up from their current 26%. It may mean that an additional ~500 MW of wind capacity (over and above the forecasts above) would be required simply to replace the missing hydro certificates.

Thank you Malcolm, that is a good point you’ve raised. The basis of the future requirement is calendar year 2014 data, which includes half a year in which carbon pricing encouraged strong hydro outputs.

It would be reasonable to assume lower future hydro outputs in the near term as you note; how it varies as we get nearer to the higher LGC targets in 2020 is unclear. If the 2014 performance is higher than long term hydro outputs, that would make the target more challenging and need further new capacity as you point out.

Regards

Andrew

What you say makes it even more challenging than I first thought. While the carbon tax was in operation, Tasmania typically exported about 400 MW of hydro power to Victoria on close to a 24/7 basis. This was achieved by running down their storages, particularly the Gordon Dam. I can’t remember what the net flows were between the end of the carbon tax in July 2014 and the end of the 2014 calendar year, but for simplicity of argument, lets assume the net flow was zero. So for the whole of 2014, this would be an average of 200 MW. Now Tasmania is importing about 400 MW from Victoria on a 24/7 basis. We therefore have 200 + 400 = 600 MW less hydro generation than in 2014. To make up for the reduced certificates from this hydro using wind with a 33% capacity factor would require 600 / 0.33 = 1800 MW of wind capacity over and above the new capacity foreshadowed in the article.

Snowy Hydro has also been generating less than normal because of low inflows, which may require further wind capacity.

I’m sure there are arguments with the HEC as to whether the reduced inflows are cyclic or a more permanent reduction through climate change, as has occurred for rainfall in south-west WA. There would now be an imperative of security of supply, guarding against the possibility of a further year of low inflows in 2016. Tasmania can only import about 40% of its electrical energy requirements on Basslink, 10% is from wind, and there needs to be enough water in storage to supply the remaining 50% for perhaps a 2-year buffer period. So I expect the high level of import from Victoria to continue for at least the next 2-3 years, resulting in a further a shortfall in certificates.

The ACT target of 90% renewables is only going to make it more difficult for everyone else. LGCs from the ACT’s PPA sponsored generators are to be passed to the government and then cancelled in the same way that green energy commitments are met. ACT retailers will still need to purchase a number of LGCs. Renewable energy activists in the ACT have made sure that the target was additional to the amount of renewable energy generated through the RET scheme. If for some reason the ACT doesn’t end up with sufficient sponsored generation the government intends to buy LGCs on the market to make up any shortfall and thus achieve its target. ACT electricity consumption will be about 2.8 million megawatthours in 2020. The target also includes that PV electricity generated within Canberra.