Not everyone is on holidays, it seems.

Some people are busy preparing their entries for our summer competition, whilst other investment bankers are earning their Christmas bonuses by finalising the sale of Delta Electricity’s Colongra peaking power station to the (larger and larger) Snowy Hydro. This was reported yesterday (in the Oz and the SMH amongst other places).

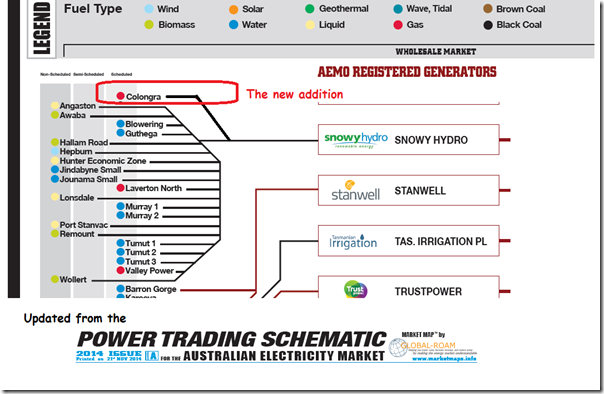

To illustrate how the growing Snowy would currently look, we’ve taken the recently released update to our popular “Power Trading Schematic” Market Map and added in the Colongra acquisition to highlight the wholesale supply side of the equation as follows:

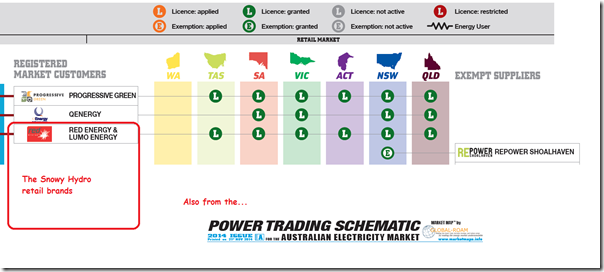

On the retail side, we have the business trading through Red Energy and the acquired Lumo Energy brand as follows:

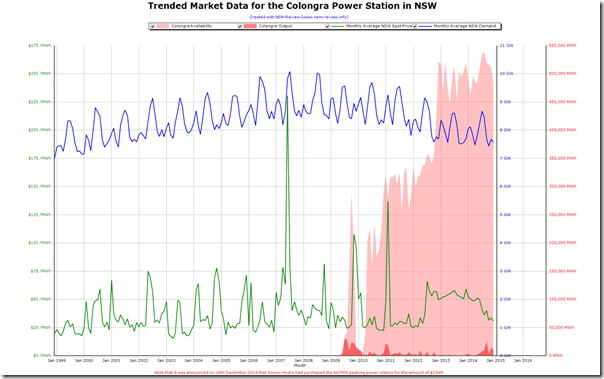

Powering up NEM-Review and trending back to the start of the NEM, we can see the commissioning of Colongra in 2009 and its (very limited) operations since that time:

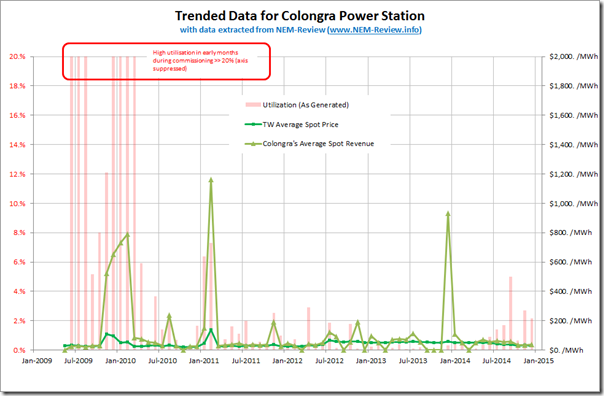

Taking the output and availability data a step further, the second chart below charts the trend of utilisation over time – along with the average spot revenue earned from operations at Colongra to-date (compared with the time-weighted average spot price for the same months):

As we can see, the plant has run at less than 2% utilisation for most of the months that have occurred since its initial commissioning – but, because of the way in which it runs, it has secured a premium to spot prices on most occasions when it has run.

Implications of (low) sale price

It was noted here in a Delta brochure that the plant was constructed at a cost of $500M ($574M in this Auditor-general’s Report), so the reported sale price of $234M would represent a large 60% discount on asset value.

This is reflective over the general oversupply of capacity that exists in the NEM that has “capped” the price of Caps in the market and discounted the potential benefits of other reform efforts (such as the proposed establishment of the Demand Response Mechanism – previously discussed here and here).

What’s next, for Vales Point?

Reading between the lines of media mentions, I gather that the Vales Point power station is fairly unloved at this point in time – and, if so, I wonder what’s the Plan B being exercised (perhaps this one, though the smaller portfolio size might even affect the valuation here?)

Our thoughts are with the remaining employees of Delta who will be left behind in this transaction, having to wait patiently (still more) to learn of their future… (though, in the current environment, there’s very few people in this industry who have “certainty” over their future).

Be the first to comment on "About Snowy’s purchase of the Colongra peaker"