It’s the first Tuesday every November when the Australian nation supposedly stops to watch some four-legged entertainment for a few minutes in the afternoon.

We were asked what effect this had on electricity demand and, not immediately knowing the answer, we set about to have a look. What follows is some preliminary analysis (please contact us – tel +61 7 3368 4064 – if you’d like the source data to crunch your own numbers):

1) Demand in Victoria

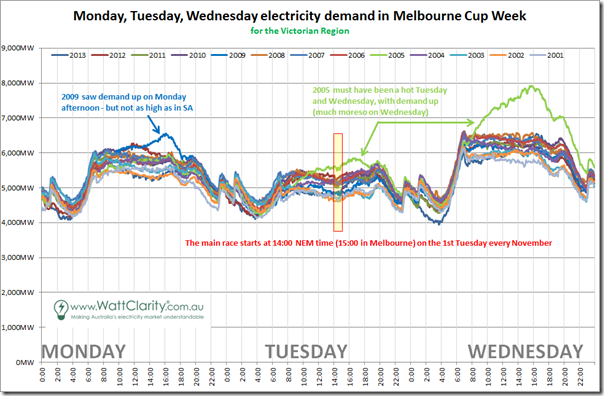

Starting in Victoria we step around each region to see what effect (if any) is discernable on the day – and at the time of the actual event.

The following chart shows the trend of demand over 13 years of history (up to and including 2013). Following tomorrow’s race, we’d be able to add another year, but it seems as if there’d not be a whole lot of change if the past 13 are anything to go by?

A few quick observations:

1a) Given that the Melbourne Cup day is a public holiday in most of Victoria, it was expected that we’d see demand lower on the day, compared with the days either side – however what was a little more of a surprise was the degree to which demand on Monday (i.e. supposedly a working day) almost matches that for Tuesday on each of the 13 years we looked at here. Does this suggest that there have been an awfully large number of people taking sickies today (or more legitimate holidays) to make it a long weekend?

1b) Comparing Tuesday and Wednesday, we see that the day-time demand is more than 1000MW lower on the public holiday (a significant percentage of actual demand).

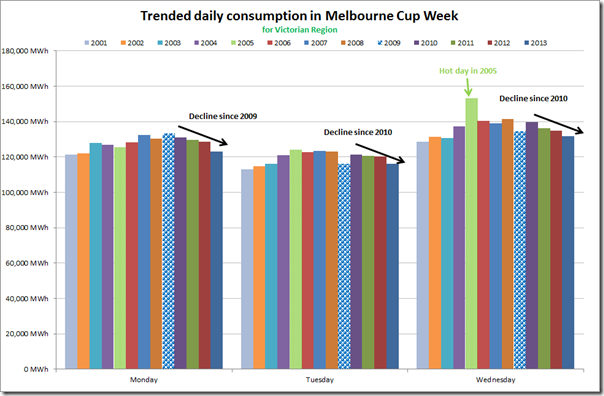

1c) Given the pattern of declining demand that we have discussed in numerous articles over a number of years on this site, we’re curious what pattern might have been shown on each of the three days above. To make this pattern clearer, we aggregated the 5-minute demand data to provide a view of total consumption over each of the days, and trended as shown. We see that the low demand in Tuesday & Wednesday 2009 appears an aberration (perhaps cooler than normal?), and that the pattern has been for daily consumption to decline since 2009:

1d) Finally, we do see (top chart) that there are some drops in demand around 14:00 (NEM time) on race day – which could be taken to mean that some production processes temporarily stop for the race – however, when seen in context to demand over the three days, it does not appear an out-of-the-ordinary drop.

2) Demand in NSW

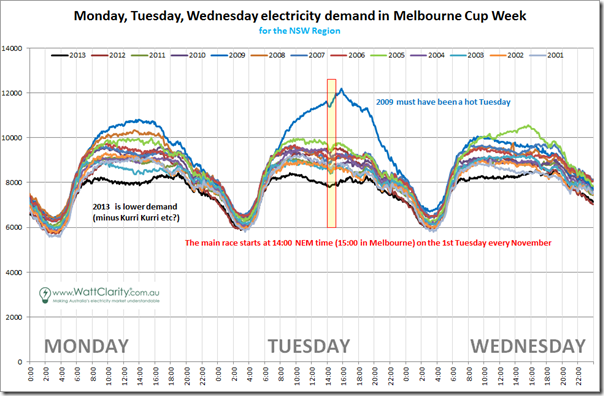

Heading north to the most populous state, we perform the same analysis to see what we find.

Again, some quick comments:

2a) What’s most striking in this chart is the shocking level of demand seen in NSW on the cup day in 2009, following a smaller blip on the Monday earlier in Victoria. A quick search finds this article that talked about a cool change forecast for that year’s race in Melbourne, so it seems to be temperature related.

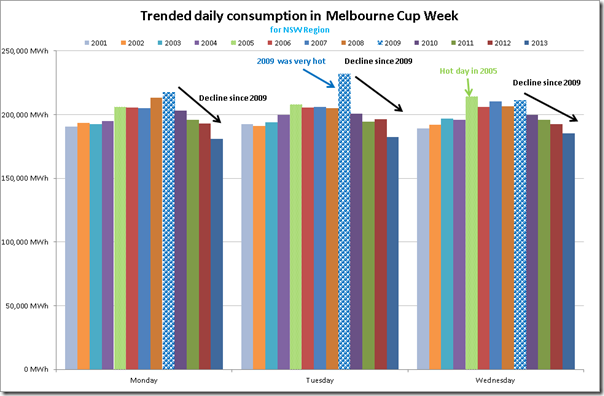

2b) Only slightly less striking, compared to what we see in Victoria above, is the much greater degree of variability seen in NSW demand across all years (whereas lines for Victoria lay much more on top of each other). When aggregating data across each of the three days and trending over time, this leads us to expect we might see more randomness – but the same type of pattern as in Victoria is seen here, with daily consumption declining since 2009:

2c) Compared with the same chart for Victoria, we see what looks like a much more significant drop in 2013 – with first suspicion being that this is the result of the closure of Kurri Kurri aluminium smelter.

2d) Finally, it is worth noting that the first chart for NSW shows clearly visible drops in demand around 14:00 – i.e. at the start of the race (presumably when everyday workers “downed tools” temporarily to engage in the national pastime of pretending to be horsing experts.

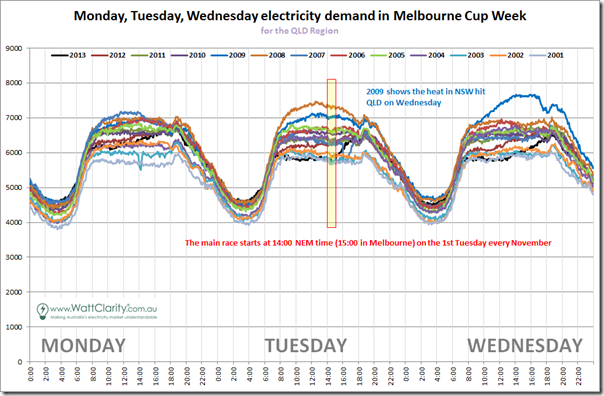

3) Demand in Queensland

At the top end of the NEM, we include the same chart for the Queensland region:

We’ve run out of time to analyse (or comment) in any particular detail, but suffice to say that any drop around 14:00 on Tuesday seems much less visible in the above.

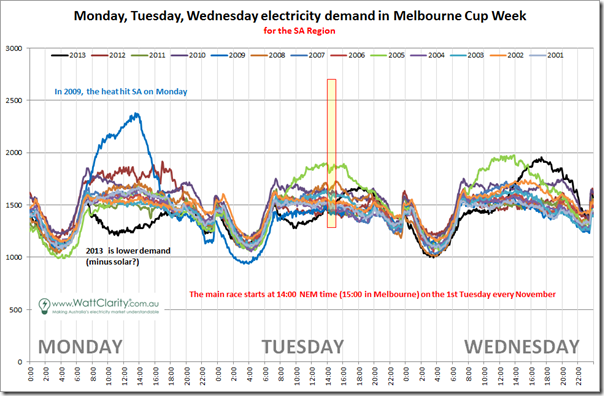

4) Demand in South Australia

Back down in the South-East we include the same chart for South Australia:

In South Australia we can see a drop for 2005 – partly because that (hotter) day stands out from the pack on Tuesday.

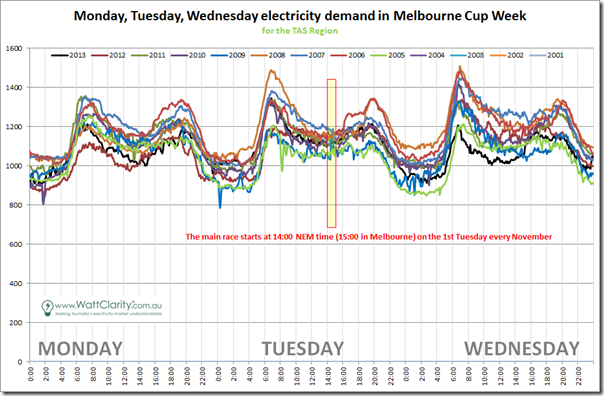

5) Demand in Tasmania

Here’s the same chart for Tasmania.

In Tasmania the compact clustering of the chart at 14:00 Tuesday makes it difficult to see anything in particular. What is more noteworthy, though, is the pronounced morning peak in demand.

All of this does leave the last question begging, however – which horse will win tomorrow?

If you found this article of some interest then you might appreciate these earlier pieces of analysis about how demand was affected by a State of Origin game in 2013, and through Earth Hour in some prior years.

Great post.

It’s good to see a website produced by an enquiring mind.

Same idea has been used by Peter Martin in The Age.

http://www.theage.com.au/comment/power-down-what-the-melbourne-cup-can-teach-us-about-fighting-climate-change-20141103-11fv8q.html

Another story of note recently occurred on Saturday afternoon (1 Nov) when there was a long period of sustained negative prices in South Australia. There was high wind power production (~1000 MW), low demand (~700 MW), probably because of a high solar contribution behind the meter, low thermal power production from coal (Northern ~250MW) and gas (Osborne ~150 MW, Torrens Island 50 MW), and maximal export to Victoria (~400 MW). Victorian prices were not much better at about $7/MWhr, with a high wind contribution (~900 MW) and maximal exports to Tasmania and NSW.

Tasmania is another interesting story. Prior to the abolition of the carbon tax, it consistently exported about 400 MW to Victoria. This was a deliberate strategy, and was achieved by running down its dam levels. Since the end of the carbon tax, Tasmania has instead been importing about 400 MW from Victoria. The strategy made $140m profit in 2012/13. Its dams are now at only one third of capacity, and winter inflows have been poor. I expect it will take several years for the dams to return to their normal supply levels, and I hope they have budgetted for the costs of importing power over that period.

http://www.themercury.com.au/news/tasmania/lower-rainfall-increased-power-generation-lead-to-fouryear-low-for-hydro-dam/story-fnj4f7k1-1226872669585

Thanks Malcolm

You bring up an interesting point – because of what some might see as a windfall gain for existing hydro plant coming from the carbon tax, hydro plant in Australia ran harder during the 24 months of the carbon tax – an entirely rational behaviour. We highlighted the first week in 2012 here.

That’s not the only opportunity for borrowing from the future to arbitrage time – another way has been to run hard one year and lean the next in order to generate above baseline production volumes and hence create renewable energy certificates (LGCs/RECs). I thought I had posted some analysis on this online, but could not find in a quick scan.

Paul

You got quoted today in the Melbourne Age. http://www.theage.com.au/comment/power-down-what-the-melbourne-cup-can-teach-us-about-fighting-climate-change-20141103-11fv8q.html

Paul, Cup Eve Monday is a very commonly scheduled RDO in many industries, as well as commonly taken as annual leave; the Monday reduced demand pattern is therefore not unexpected,and clearly predictable as you have shown.