This morning we noted that total wind production across the NEM had dropped below 200MW (as low as only 109MW at 4:15AM NEM time today).

In a very familiar pattern, this lull in wind production followed some periods (several days beforehand) when the wind was blowing strongly, and hence generation from wind peaked.

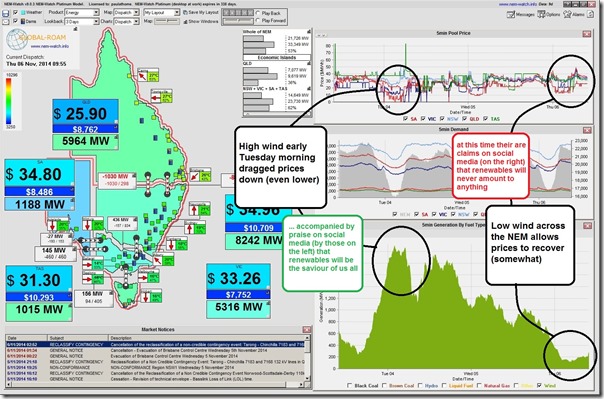

This can be seen in the following snapshot from NEM-Watch:

Amongst the noisy to-and-fro with the ongoing RET Review process, there’s been an argument circulating along the following lines:

Left Corner Argument) Wind power is seen to be suppressing spot prices – therefore it is concluded that building more wind farm capacity will automatically result in prices moving lower still when the wind blows.

It’s understandable:

(a) when looking at the correlation shown above in NEM-Watch, that this conclusion is drawn

(b) given the input assumptions made (as discussed here), that the modelling quoted with respect to the RET Review would also “prove” this.

(c) It’s also understandable, psychologically, that this argument seems to be in highest incidence on social media during the times in which the wind production is at a peak.

On the other side, the left corner stills and the right corner ramps up the volume on social media when the lulls in the wind inevitably happens – and we see the argument frequently made along the lines of:

Right Corner Argument) Given that there are times when the wind does not blow (and that this happens even though there is some geographical spread of installations), the value of these wind farms are severely discounted as some form of capacity is still required to be available to cover for when they (systemically) cannot operate.

Unfortunately we’re not finding as much time as we’d like to consider a real world path between both extremes – though we do at least have the frequent cyclical reminder that this challenge remains one that is yet to really be addressed with respect to the NEM (or elsewhere, to my understanding).

In both of the extreme cases wind is being punished; when it’s windy everywhere and price is low wind farms get paid less, when it’s not windy and price is high wind farms miss out on the super lucrative times.

Tom, “punished” is an emotive word that evokes thoughts of unfair treatment, but I wonder if that’s actually the case?

In the case of “low” prices

When it’s windy all generators who contributed to that low price (wind and thermal) are paid the low spot price. This means the wind farms that generate plus the thermal plant that still bid very low prices to run at least at minimum load.

It’s a separate commercial decision for each portfolio and it seems that, at least till now, portfolios continue to be “happy” to run at very low prices for transient periods rather than back off further, or shut down completely. This decision applies to wind farms, just like any other.

In the case of “high” prices

Why is it the case that a wind farm is “penalised” for being unable to generate when the market requires it (i.e. which, in this particular case in point, would be when every other wind farm is still)?

At times when the ability of groups of generators to produce is restricted, there is added opportunity to extract higher prices from the market – no matter whether this is due to lulls in the wind, or major technical problems at power stations, or unavailability of fuel for thermal stations.

One point that I notice on a weekly basis is that the limitation of wind, systemically, occurs far more often than it does for other groups of assets (no matter which other way I can think to group them) – this is the main point I make in the article (i.e. once a week, perhaps, for 2000MW wind to not perform, as compared with once every few years for a 2000MW station to not perform)

In this article 15 months ago, I was surprised to see a much stronger correlation between wind farm output at individual stations than perhaps I’d been led to believe, and noted that this highlighted an opportunity for:

(a) Wind farms in different parts of the NEM where the wind profile was very dissimilar (ideally inverse). Perhaps this would be in North Queensland – I am yet to see data to verify; and

(b) Of course, there is the argument for storage to level out the injections from individual plant – and to level out “market” demand, perhaps as well. However such storage would involve investing more money in a market that’s already oversupplied, with demand declining.

Another point to note is that the (relatively) high prices experienced when wind is low (say $35/MWh in South Australia) is commonly held to be still below a long-run marginal cost of operation for a large thermal plant with – and this seems to be an overlooked point – that long run marginal cost defined on an assumption that it achieves a capacity factor that might be higher than that which is being achieved at present. A lower actual capacity factor further increases LRMC required – hence widening the gap between what’s being achieved and what’s required.

A more neutral interpretation might be that the wind farms that have been constructed, to date, have not taken sufficient account of locational factors as they relate to the NEM (as distinct from how they relate to wind production volumes) and so are themselves achieving sub-optimal returns, and being part of the puzzle that’s driving returns lower for everyone else.

More generally

Finally, I recognise that your choice of “punished” might have been a spare-of-the-moment decision and that a more correct word might have been chosen to convey what you actually meant.

However in my limited use of social media there does seem to be a fair degree of victim mentality pervading the discussion on all “sides” of the debate. It seems to me that that’s not going to get us to a truly sustainable solution.

Yep, I didn’t mean wind is a victim, just that the value of production is self discounted. Given that capacity availability is rewarded through high spot prices, wind is not being overpaid for its capacity.

I definitely agree about the suboptimal geographical placement. Unfortunately SA average prices were and still are much better than VIC or TAS. And you’d be crazy to compete with Tas Hydro. No one wants their revenue to be defined by a competitor.

We are already getting close in SA where wind generation meets the regional demand. So one day I can see that wind farms will have to bid a realistic price for their output (rather than budding the minimum) in order for them to get their targeted return. At the moment they are depending on thermal generation to bid so that the spot price + LREC provides the return on capital the wind farms need. What would wind farms do if there is so much wind generation that the spot price is set by wind farms for many hours – presumably consumers get paid by the wind farms to use their output. Oh joy! Come the day

David, those would be strange days indeed – but somehow I don’t think that energy users will actually ever see that respite.

Trying to ascertain how wind farms should bid to maximise returns in an oversupplied market with declining demand (assuming no major closure of other capacity) would be a tricky challenge indeed, for reasons including:

(a) A fuel source that is uncontrollable, and very much aligned with the fuel source a sizeable number of your own competitors use (especially in South Australia); and

(b) The fact that you lose REC revenue, as well, if you choose not to generate.

A “Death Spiral” for wind generators, if you will?

It does seem that it will be necessary that strategies mature over time, unless we collectively invent other ways of socialising costs whilst privatising profits (e.g. by progressively raising the cap price for the REC to make up the shortfall + layering in some other support for storage).

The “saving grace” for wind farms in South Australia is the interconnector to VIC (or this problem would have been met years ago), so measures of % production from wind for any given region (or other sub-set of the interconnected NEM) are a bit of an academic nonsense, most times.

Two markets where the wind generators don’t sell into a low market are Tasmania and NSW. In Tasmania the load balancing is from hydro (which has its load factor limited by river flows), and the 2 wind power stations are not highly correlated, one being exposed to westerly winds, the other to easterlies. In NSW wind is a such a small proportion of the market that these problems haven’t yet become apparent.

The upgrade of the SA-Vic interconnector will reduce the problems of low prices during high wind periods in SA, but could have the effect of passing these problems on to Victoria. The upgrade is only about 200 MW, so if an additional 200 MW of wind capacity were added in SA this would nullify its effect.

So where are the next wind farms likely to go ? My guess is Tasmania and NSW.

Thanks for this comment, Malcolm (and a couple others I have not had time to respond to either).

The surprising thing I found in this analysis was that all wind farms that existed at the time (across SA, VIC, NSW and TAS) were still reasonably in sync, meaning that there were still quite a number of whole days when production was close to zero .

It hasn’t hurt the generators outside of SA as much, in terms of driving spot prices significantly lower, but this would suggest that it’s only a matter of time, as new capacity continues to be added.

Personally, I’d really like to understand how similar (or dissimilar) a wind production profile would be as far away as possible in the NEM – say in North Queensland?

I am amazed that the proponents of wind project haven’t taken into consideration the effects of correlated wind speed of multiple sites on market prices in their business case. In the last few minutes I have tested a correlation between hourly wind speeds at Hamilton (close to the epicentre of Australia’s wind capacity, with MacArthur, Oakland and Portland wind farms in close proximity), and Armidale on the Northern Tablelands of NSW. This is about as far north in NSW as I have seen wind farms proposed. The two stations are positively correlated and the correlation is statistically significant, but the R-squared is only 4.5%. So for practical purposes they are not correlated. Armidale Airport has a mean wind speed at a height of 10 m of 4.6 m/s, and Hamilton is windier at 5.2 m/s, so it is easy to see why the Hamilton area was chosen first. The most favoured location near Armidale would be at the top of the Tablelands between Armidale and Glenn Innes, which coincides with the interconnector between NSW and Queensland.

Nearly all Australia’s wind capacity is within 100 km of a line between Port Augusta and the north-west tip of Tasmania. Most cold fronts almost exactly match the angle of the line, so nearly all the stations experience high winds together. Cathedral Rocks wind farm near Port Lincoln is a little earlier than the majority, and the NSW wind farms and Musselroe in Tasmania a little later.

Another consideration is the complementarity between wind and solar. Wind tends to predominate during winter and as lows pass over. Solar predominates in summer and when there are highs. While the right wing bloggers might chide wind for not producing at times, these are often the times when solar is producing extremely well. So an analysis of the volatility of renewables needs to include both wind and solar, and include consideration of the times of low demand at night when neither produce as much as during the daytime.

Hi Malcolm,

Market prices are definitely taken into account for the business case for a wind farm. Unfortunately production is the major driver as market prices are are not much better for sites with different profiles. For example if the wind speed at hub height scales for the Armidale and Hamilton sites you mentioned the Hamilton site will have 44% more energy available. Even the worst correlating wind profiles (for price) experience only a ~20% discount to average market price.

The wind speeds I quoted are from Bureau of Meteorology weather stations and Armidale and Hamilton Airports, both of which are located in exposed areas. The standard measurement height is 10 m. While the airport wind speeds are lower at Armidale, there are more local prominences along the top of the range between Armidale and Glenn Innes than there are near Hamilton, which could mean a well-located wind farm could be exposed to higher overall wind speeds than in the Hamilton area. For example, there is a range just west of Glenn Innes that is about 200m above the surrounding landscape. In the Northern Tablelands, the transmission line approximately follows the ridge line and therefore close to these promenances.

In calculating wind power, what consideration is there of (i) altitude and (ii) temperature? Some of the Northern Tableland sites are up to 1400m, so there could be some loss of power because of a thinner atmosphere. Frost and snow are also considerations for the mechanical operation of the wind turbines at this location. By contrast in the tropics, wind doesn’t feel it has to have the same “penetrating power” beyond the coast. Apart from cyclones I don’t recall the Queensland coast being particularly windy when I lived there. Is this anything to do with temperature thinning the atmosphere ?

I have lived in Armidale, Townsville and Hamilton, and Hamilton definitely feels windy more often.

Density does drop with altitude and humidity but not a whole lot. Usually the increase in wind speed with altitude is well worth the small drop in density. Colder temperatures at altitude also offset the pressure drop a little.

I also wouldn’t worry about frost. Armidale temperature goes positive every day [I used to live there too 🙂 ] so buildup of ice is not possible. Ice buildup is a problem with temperatures constantly very negative for weeks.

The Armidale region could be a decent location due to the excellent transmission but you’d have to find a good ridge. Hopefully the New England Wind Coop gets off the ground.

Paul,

Good post. I get the distinct feeling that your general references to ‘social media’ are really a specific reference to a tweet I posted recently that compared a single instance of wholesale pricing and wind energy penetration in the NEM:

https://twitter.com/KetanJ0/status/526871486481846274

Given the constant assertion that wind energy is driving up prices, a single instance of high wind penetration and lower-than-average prices is a demonstration that that’s not a rule you can apply, in general, to the genesis of wholesale electricity price.

I agree with the anonymous comment on that tweet that broader conclusions can’t be drawn from a single instance (I didn’t draw those conclusions, but that seems irrelevant to the critics). I’ve also included a comparison, over two years, of spot price vs wind output.

As I’m sure you share the same antagonism towards the presentation of single instances, surely one could asses the ‘left’ and ‘right’ corners of your post above together, and look at the net effect of both instances?

IE: Wind is either high, or low. The net effect is that it’s there, sometimes. Compared to a situation where it’s never there, ever, there’s a net decrease in wholesale electricity price.

Is this the middle ground you’re looking for, when both potentialities are considered?

Ketan

No, I don’t think that is the middle ground. At least not in the longer term. Adding more supply to a market has an impact on future investment (and perhaps disinvestment). So it’s not reasonable to assume that everything else stays the same. Over the long term, if there is more wind, there will be less of something else. This can then be expected to result in higher prices when there is little to no wind generation. Whether it will average out as lower prices overall is dependent on assumptions around demand and the timing of entry/exit of other generation. At high levels of intermittent generation, it becomes more likely that reliability settings such as the Market Price Cap will need to change to maintain reliability.

Other costs that may increase and feed through to end user prices include interconnector upgrades and ancillary services, let alone the certificate costs.

Higher end user costs is not necessarily the wrong outcome if the community wants more renewable energy. But this tradeoff is rarely acknowledged.

But I agree that cherry picking individual instances of high wind/low price or low wind/high price and extrapolating from them is not meaningful.

If you think it is relevant to state that adding wind, as long as nothing else changes, will decrease the wholesale price, then fair enough. But one could say the same about brown coal.

Hi Ketan

Thanks for the compliment.

Re cycles of wind in sync with social media:

No, I had not seen that particular tweet – there are plenty of others that celebrate the high wind times and (it seems) a number on the other side that note when wind is at its lowest. To me it just seems illustrative that there are two “sides” shouting at each other with neither really listening in return.

Re drawing a linkage between wind and low (or high) spot prices

You comment “Compared to a situation where it’s never there, ever, there’s a net decrease in wholesale electricity price.” is true on the assumption that all else remains the same, both in terms of:

(a) How all the portfolios bid; and

(b) How assets are made available in the market.

for that particular dispatch interval.

I think this is the point Kieran is making with his “one could say the same about brown coal.” comment – i.e. what would have happened if you added more brown coal production, instead of adding wind.

What I have been grappling with is the effect to which we might see changes in future – either

1) as a result of conscious decisions by portfolios to withdraw capacity from the market, or reprice it higher to earn a decent return – or

2) in a “doomsday scenario” if we have the same type of response thrust on us more randomly as a result of collective/systemic “run it into the ground” decisions taken with whole groups of assets not earning a return. Kieran notes the possibility of increasing the Market Price Cap further to provide a return for capital-intensive plant running lower capacity factors than designed, whilst others have talked of capacity payments. They won’t be the only two possible responses.

These types of inter-temporal questions were part of my comments here with respect to one of the main limitations of modelling done for the RET – including ACIL Allen’s official study. I’m not aware of anyone who’s really looked at this in detail? Even more-so, I am surprised to see that not many people even acknowledge it

This type of market-promoted feedback mechanism is also sorely lacking in descriptions of what’s become commonly quoted as “The Merit Order Effect”, despite the impressive graphics – i.e. it assumes that new capacity can continue to eat “someone else’s” lunch (socialising costs whilst privatising profits) with no competitive response in the market.

Paul

Thanks Paul and Kieran,

This is all really good stuff. I work as an advocate for clean tech like wind farms and solar so it’s pretty valuable to get a more nuanced and technical side of things from those in the know.

I’m having some difficulty grappling with one particular thing – Kieran’s comment that adding (say) 1 GW of brown coal capacity would have the same wholesale-price-depression impact as adding 1 GW of wind energy capacity (for instance).

My understanding is that wholesale price is lower due to the presence of energy in the lower end of the bid stack – pushing the ‘price-setter’ lower. Wind energy sits at the lower end because:

– High installation costs are offset by the LGC scheme

– Fuel can be extracted with near-zero costs

Am I wrong in thinking that these are the mechanics of what’s known as the ‘merit order effect’? If, in the above scenario, we simply had extra brown coal, wouldn’t that leave price at the same level, as we simply have more generator bidding in the same price band (as opposed to greater volume in lower price bands)?

Or is the point that brown coal is cheap, and as such, also serves the purpose of filling out the lower price bands (and therefore triggering a reduction in wholesale price)?

The question really comes down to: Are wholesale prices depressed due to some characteristic of wind energy, or the simple addition of megawatts of new generation of any kind?

If the second is true, would the creation of 1,000 megawatts of diesel generation decrease wholesale price, regardless of the frequency or magnitude of its dispatch? Or, the creation of 1,000 megawatts of gas?

Again, thanks for the replies – this is very informative.

cheers,

Ketan

(@KetanJ0 on Twitter)

Ketan

Reality is, oftentimes, more complex than any pretty animation (or any market model) can reflect.

A drop in price (i.e. Price A – Price B, comparing two scenarios for a dispatch interval with all else the same) occurs when added capacity in Scenario B is added below what the regional price is for that region in Scenario A. It mostly* does not matter how much below Price A the added capacity bids.

Hence for that hypothetical dispatch interval Price B would be identical, no matter whether the added 1MW of capacity was brown coal or wind.

However this is further complicated by thinking about:

1) What price the additional capacity bids.

2) The availability factor (capacity factor for wind) of the asset will also play a role (remembering that we’ve started to only look at a single hypothetical dispatch interval):

3) Timing of the availability:

Hope this helps?

Paul