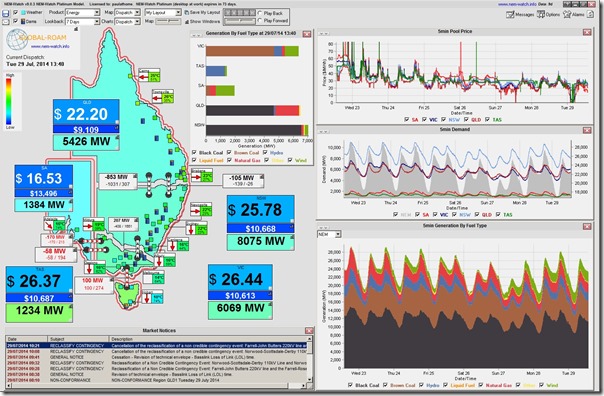

A quick marker from NEM-Watch this afternoon to highlight the low prices (sub $30s) we’ve been seeing throughout the day – providing some indication that spot prices have reverted to the levels we’d become accustomed to see over most of the NEM history, prior to the 2-year-long carbon pricing experiment which ended this month:

Note also that there’s more than 2,500MW of wind contributing to the grid at present (reversing what we saw a week ago), plus a very sizeable (1,600MW+) contribution from gas-fired plant in Queensland at prices that some struggle to see as economic.

All of this, in an over-supplied market, is depressing prices to the consternation of all existing generators.

As noted before, the market’s oversupplied because of the double-whammy of:

(a) declining demand, coupled with

(b) the impact of the ongoing introduction of new generation – subsidised through the MRET currently (and through aggressive feed-in-tariffs and the Queensland 13% gas scheme in the past).

The pace of new development might have abated somewhat, pending the outcome of the RET Review, but the trend for declining demand appears to continue.

Some numbers I have seen indicate there is a lot of dumping of gas, with generation from the Darling Downs up significant despite warmer winter. I wonder if the other combined cycle plants are lifting production in Queensland. Is this not short term at least until the LNG plants clear the surplus.

Thanks, Ian

Yesterday there was certainly a sizeable volume of gas generation in Queensland – as I noted.

What I noticed, but did not include in the post, was that the spot price for gas in the Brisbane hub was below $2/GJ – and again today ($1.88/GJ) which provides one reason why it’s being burnt in volume. See GasWatch for more.

Paul