As noted on the weekend, demand remained high and, by virtue of this and a number of other factors, Queensland’s spot prices remained consistently high for many daylight hours.

Memory is such a fickle thing – but we could not recall any other time when prices exhibited such a pattern (in particular, prices in the range of $200/MWh to $700/MWh for hours on end). Especially in the light of how prices have been depressed for many months, this makes the current volatility all the more remarkable.

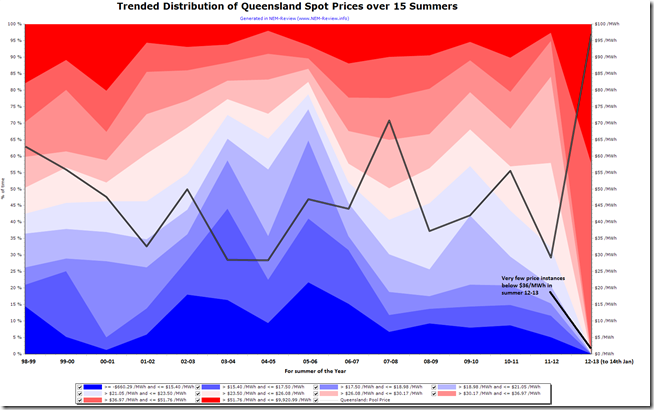

To see whether we were remembering correctly, we opened up NEM-Review and generated the following colourful trended distribution charts:

From this chart, we can see that there have been almost no instances of prices below $36/MWh, whereas in each of 14 prior summers there has been significant instances. The advent of the carbon Tax from July 2012 has meant a shift in the short-run marginal cost of almost all of the generation fleet in Queensland.

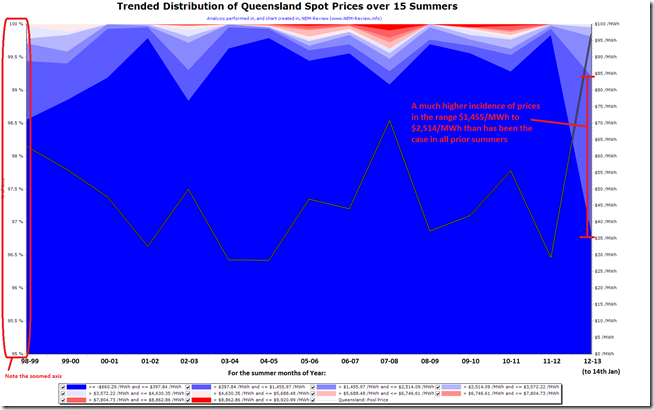

We returned to NEM-Review and adjusted settings to utilise 10 price bands of equal range – and then zoomed into the top 5% of prices, as shown in the following chart:

From this chart, we can see that (in addition to the lower prices disappearing, as shown in the first chart) the incidence of prices towards* the top end of the range is up significantly in the summer period (to date) compared to 14 prior summers.

* however note that there’s no colours above the blue range in summer 2012-13, indicating no prices have exceeded $4,630/MWh.

As such, it does appear (on this high-level analysis) that the patterns we are seeing now are truly exceptional.

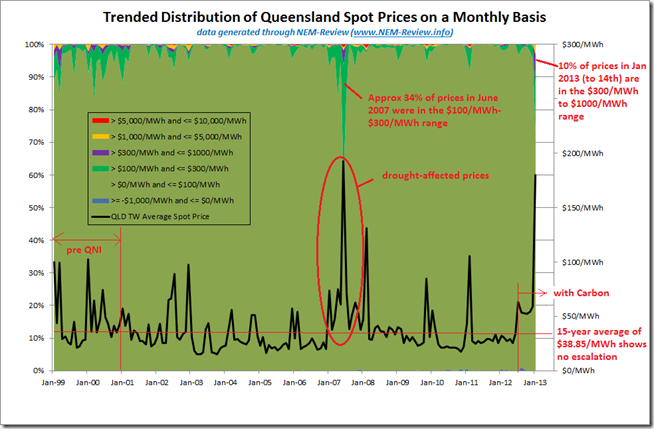

But it is not until we analyse data on a month-by-month basis, across the whole of the year, and use 110 price buckets (each of $100/MWh gradations – again through NEM-Review) that we’re able to see how exceptional these prices really are. The chart below has been generated outside of NEM-Review with the price buckets aggregated together for greater clarity in viewing:

As we can see, there was one other time (June 2007) where the monthly average price was around the same level – and, on this occasion too, the incidences of prices above $100/MWh was significantly greater than at other times. This was a period where there was significant disruption to the “normal” patterns of operation due to the national drought.

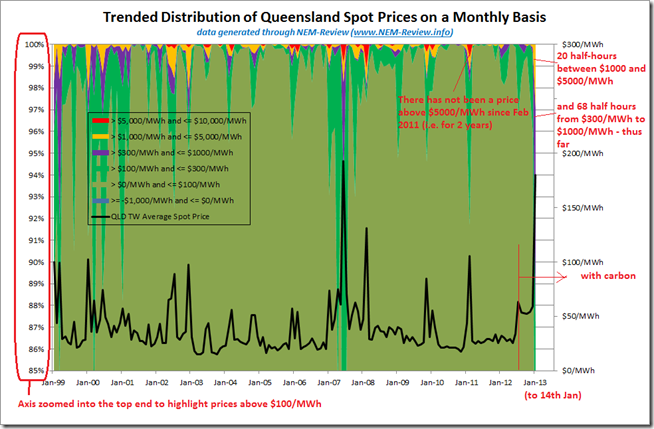

To see in more detail, we zoomed into the top 15% of price instances, as seen here:

We see a significant similarity between the patterns of prices seen in January (to 14th January) and the patterns seen through June 2007 – and also in some early months in the Queensland region, prior to interconnection with NSW.

In June 2007, as well, available supplies were affected by the withdrawal of capacity from the Queensland market, and new bidding approaches for other capacity (especially hydro in other regions) – on that occasion due to the drought.

In summary – whilst it is true that recent price excursions are remarkable, they are actually not unprecedented.

Also of interest is the point made on the final chart – that there has not been a single instance of a Queensland trading price being above $5000/MWh since February 2011 (i.e. for two years, now).

Paul

Thanks for the analysis. You note that the current prices are not unprecedented and were seen when the drought was on in 2007 and generators withdrew capacity because they had limited cooling water. Why would prices reflect drought conditions when there is no drought?

I saw with interest the Courier Mail report http://www.couriermail.com.au/news/queensland/energy-firms-playing-games/story-e6freoof-1226553917675 which makes more sense to me and reinforces my view that generators have market power when there is congestion in the transmission system and withdraw capacity to increase prices.

This is why we introduced a rule change to stop this happening

Regards

David

Hi David,

The courier mail article was a very one sided view to stir up public opinion. The QLD generators have been losing money for most of the past 16 years – that “lost money” ends up subsidising the private retailers with generation capacity rather than the QLD government. So all Queenslanders are worse off than the states who have sold their assets. The oversupply of generation has been suppressing prices along with a carbon price that makes some generating units uneconomical. The idea of the carbon price was to make it expensive for coal generation so that they would eventually shut down and be replaced with generation with less carbon – ie gas. You would think with all the profits from the Carbon Tax that most of it would be put to creating cleaner energy funded by the federal government – like a national Solar or Thermal program.

Hi David

Likewise – thanks for the comment, which is really three in one:

1) You ask ”Why would prices reflect drought conditions when there is no drought?”.

2) You note that Paul’s subsequent article ”makes more sense to me and reinforces my view that generators have market power when there is congestion in the transmission system and withdraw capacity to increase prices.”.

3) You also reference the MEU’s Rule Change proposal, which follows from your perspective above.

Does this help?

Will post more analysis when I have a bit more time…

Paul

Some sensible arguments Paul. You might like to highlight that it was not just the drought affecting AGL hydro, Snowy hydro and QLD generators but also bidding behaviour in Q2 2007. Interestingly, NSW which was less affected by the drought than other regions usually had the highest spot price in most dispatch periods. The ETEF (Electricity Tariff Equalisation Fund) was still in place and the surplus was large (incentivising generators to increase spot prices). Also, the price sat around $90/MWh for most of that quarter until the last week, when it was continuously around $200-$300/MWh. Noticeably, on July 1, prices returned to historic normal levels. Given trading bonuses are based upon financial years and there wasn’t a drought breaking storm on July 1 maybe there were other factors at play…

Paul

Thanks for the further clarifications. Addressin your and other comenst in order

1. I accept that generators are having a hard time and I personally beleive that the energy only market has a flaw and that a capacity market would be more equitable and stable. I also agree that if there is a reduction in demand, the logical solution is that some generators will shut down, reducing available generation and that this should increase prices offered by generators.

What I don’t accept is that some generators can use their market power (a la AGL TIPS in SA during 2008 2009 and 2010). It is inequitable that some generators can have this market power but others don’t. Using network constraints to drive up power prices is not how a competitive market should operate as it is inefficient and creates significant other problems. Basically generators shpould bid their underlying costs becasue this results in the most efficient dispatch

2. I guess the difference between the iron ore example and electricity is that if i don;t like the price from RTA I can buy it from someone else and I know the price before I buy. In the case of electricity, I have used the electricity before I know the price and I don’t have the option of another source. I accept I can pass the risk to a retailer but the fundamantal issue still underlies the cost to my retailer and I pay it to accept that risk.

You comment that we have a market so we should accept market outcomes. I accept that but what I don’t accept is that some generators use market power to reduce the competitive pressures that ensures an efficient outcome. When bananas were high priced, many consumers didn’t buy bananas. When electricity is high priced I have no option but to pay the price. In today’s environment electricity is an essential commodity – bananas and iron ore are not – without elecricity the whole country stops.

To use market power to drive an inefficient price outcome is not what a market is about. Eminent economists Newbery, Tirole, Joskow all agree that using makret power is not efficient and have advocated various ways of preventing it

3. Whilst the MEU response to the draft decision not to make the rule change is quite definite, the response from the AER who have objected to the use of market power in the electricity markets is equally damning of the AEMC position.

So the debate about generator market power rages

Regards

David