Day 2 of the Carbon Tax and it was certainly a more dynamic and volatile place to be than was the case yesterday.

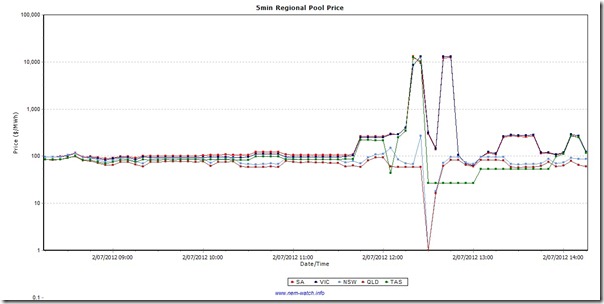

The following chart (taken from NEM-Watch) highlights how prices ran the full range of possible scale – from the new level of the Market Price Cap ($12,900/MWh) to the floor price (-$1,000/MWh – not shown on the chart because of log scale) and everywhere in between:

What was the cause of this volatility?

Given we were fielding phone calls today from a number of our clients (including several large industrial energy users who use our deSide® product to facilitate their demand side response in the market, we did a bit of digging to find out, with the data we had readily available.

Here are some of the observations we made:

1) It was not because of demand

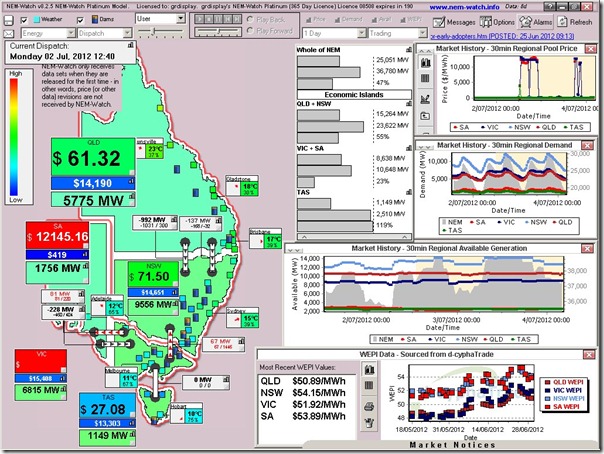

As we can see in this screenshot from NEM-Watch * we see that the NEM-wide demand had barely scraped over 25,000MW at the 12:40 dispatch interval, so a full 10,000MW below the all-time maximum set in summer 2008-09.

* we have a copy of NEM-Watch running 24×7 in the office, configured with a wide range of Local Alarms and saving screenshots so that we can use them in posts like this from time to time.

We also see in NEM-Watch that the NEM-wide available generation capacity is shown to be more than 36,000MW – meaning a 47% Instantaneous Reserve Plant Margin (IRPM), which is an excessively large number.

Hence we can conclude that there was easily more than enough capacity to meet the demand requirements – so we have to dig further to find out what were the contributing factors…

2) Wind capacity did not deliver

It is ironic that, on the 2nd day of a carbon pricing mechanism designed to incentivise a cleaner mix of generation, the fickle nature of the wind meant that wind farms across SA and VIC were almost entirely becalmed for the day.

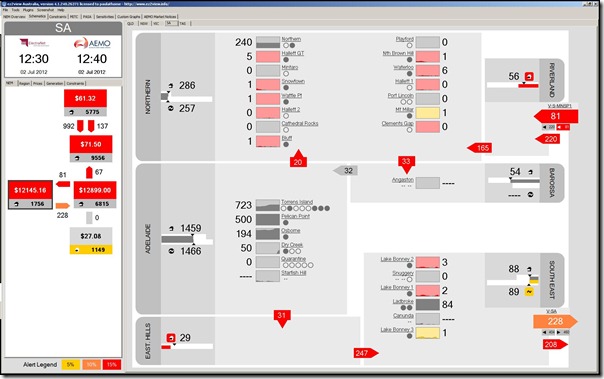

This is shown in the following snapshot from ez2viewAustralia:

In this image, the output of every station in South Australia is shown as a trended capacity factor chart, with 2 hours of history.

It’s clear to see that almost all of the demand in South Australia is being bet by output from:

Northern – Alinta’s brown coal station (240MW output)

Torrens Island – AGL’s gas-fired plant (723MW output)

Pelican Point – Internationalpower’s gas-fired CCGT (500MW output)

Osborne – the CCGT cogen plant (194MW output); and

Ladbroke Grove – Origin’s gas turbine (84MW output).Missing in action today is the following listing of wind farms in the Northern zone, as defined by ElectraNet:

Output at 12:40

Registered Capacity

Capacity Unused

North Brown Hill 1MW

132MW

Waterloo 6MW

111MW

Snowtown 1MW

99MW

Hallett 1 0MW

95MW

Wattle Point 1MW

91MW

Hallett 2 0MW

71MW

Mt Millar 1MW

70MW

Cathedral Rocks 0MW

66MW

Clements Gap 0MW

57MW

Bluff 1MW

53MW

TOTAL in NORTHERN 11 MW at 12:40

845MW capacity

834MW unused

Also missing in action were the following wind farms in the South-East zone:

Lake Bonney 2 3

159MW

Lake Bonney 1 2

81MW

Canunda (scada reading error)

46MW

Lake Bonney 3 1

39MW

TOTAL in SOUTH-EAST 6MW at 12:40

325MW capacity

319MW unused

Hence, in total South Australia was short of approximately 1,180MW of wind capacity that did not produce when the region needed it most to keep prices down. For information about who owns each of these wind farms, and trades their output in the NEM, please see our “Power Supply Schematic” and “Power Trading Schematic” Market Maps.

It was a similar (though slightly less stark) story in Victoria for the wind farms there, as can be seen from the other screenshots in this post.

3) Basslink fell offline

From the 12:25 dispatch interval through until 13:45, we see that the Basslink sub-sea DC link to Tasmania fell offline – this was also shown in the NEM-Watch screenshots above, and in the regional screens for VIC and TAS within ez2viewAustralia.

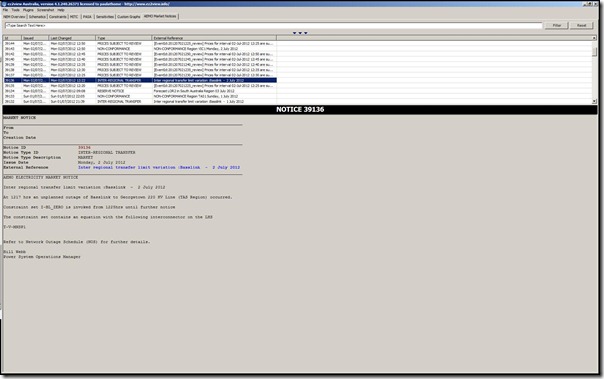

Further information was provided in this Market Notice:

As a result of this occurrence, the surplus capacity in Tasmania could not be called on to supply into the high-priced regions of VIC and SA.

4) Transmission constraints in Victoria

To exacerbate the issues caused by the inaccessibility of supplies from TAS, and the lack of wind farm output across VIC and SA, transmission constraints were also imposed to limit the amount of power that could flow south from NSW.

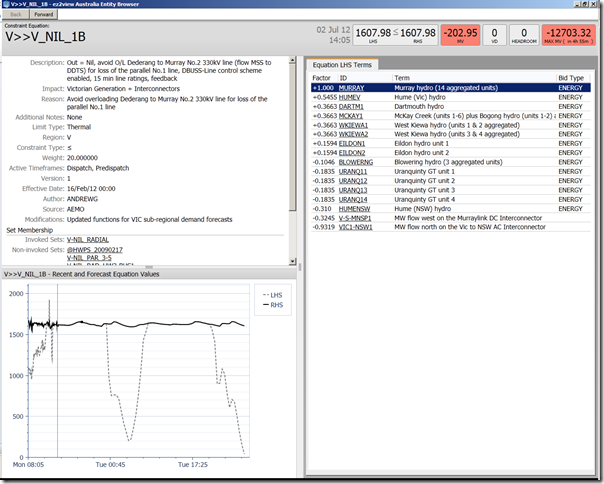

The following is a detailed (drill-in) view of the particular constraint equation that was the main cause of the constraint, accessed from the main window of ez2viewAustralia:

As noted in the description field, AEMO limited the power flow south to protect the security of the system from a possible trip of one of the lines from Dederang to Murray.

5) Some Victorian generators reduce output

As a result of all of these other limitations, Victorian generators had more local market power than would normally be the case.

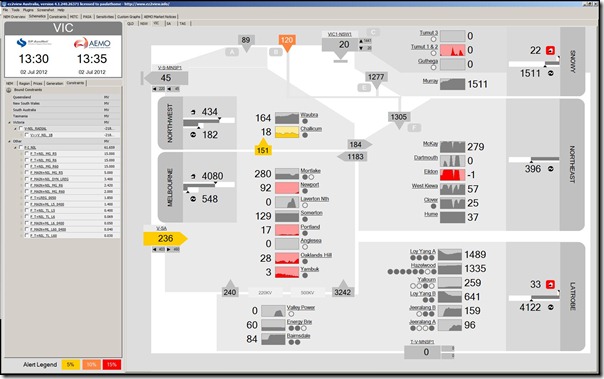

We can see in the following screenshot from ez2viewAustralia that it appears that some of these generators utilised this opportunity to adjust bidding behaviour to maximise the profit potential of this opportunity:

Of particular interest, we see:

(a) Low output from some of the Victorian wind farms (Waubra being a notable exception).

(b) The Murray station running heavily loaded for Snowy Hydro, but the stations on the NSW side of the region boundary (Tumut and Guthega) running sparingly.

(c) Yallourn still running on only one unit because of problems with coal supplies following recent rains.

(d) Loy Yang A station, recently acquired by AGL, reduced its output around 11:30.

This does not appear dissimilar (see clarifying note below) to the approach taken by a number of generators over the years to change bidding behaviour in the light of changed market circumstance in order to maximise profit potential. It is doubtful that the Carbon Tax had any real bearing on this particular behaviour.

(e) Internationalpower’s Loy Yang B station is also seen to reduce its output as well – whereas Hazelwood is seen to run consistently on 7 of 8 units.

Editor’s Update on 26th Nov 2012:

One of our readers has kindly pointed out that the rebid reasons for Loy Yang A and Loy Yang B (which speak of issues in coal supplies for this day) provide clarification for why Loy Yang A and Loy Yang B output declined. These rebid reasons were not publicly available until the day after the 2nd July, hence were not apparent when this post was first made.This update provides another illustration of the complexity of interactions occurring in the NEM.

Please give us a call (07 3368 4064) if you’d like to learn more about how you would be able to review generator bidding behaviour in ez2view.

In summary, a number of coincident factors combined to make Monday 2nd July a dynamic and volatile day in Australia’s National Electricity Market (NEM). Despite the coincidence, with the carbon pricing regime having commenced only a day beforehand, it does not appear that carbon had much to do with these price spikes.

Was the new MPC effective from 1st July? I couldn’t find any info from AEMO’s website. Any link or news about the change? Thanks.

Hi Ray

Yes it was effective from 1st July. We were surprised to see it, too – there was probably an update from the AEMO or the Reliability Council, but we missed it…

Paul

We most of the SA wind farms not producing because of wind ….. Or because they were off line? My hair was ruffled by a breeze in Adelaide yesterday!

Have not had time to look at this one, Mike, but will try to remember to do so, next time I open up NEM-Review.

Regards

Paul