1) The NEM reaches 10

For those who are unaware, 13th December 2008 marked the 10th Anniversary of the inception of the NEM. We released a short review of NEM history on that day to commemorate.

Given the occasion, however, we thought it would be useful to have a look, in more detail, at what has happened over the past 10 years.

Taking a slightly different approach, we’ve opted to review each month at a time – hence, this is one of twelve articles posted on this site at the same time.

2) 10 years of March

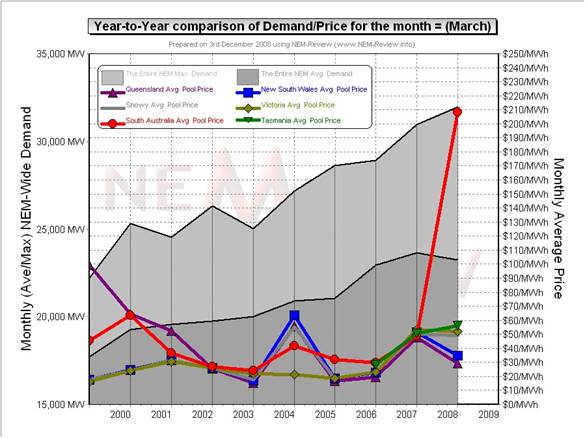

Through the NEM-Review software, we have prepared this illustration of how (average and peak) NEM-Wide Demand for electricity has grown over the past 10 years.

With respect to this chart, two things in particular need to be noted:

- Tasmania only joined the NEM in May 2005 – hence the data for March 2006 shows the effects of Tasmanian region demand for the first time.

- The measure of “demand” calculated in NEM-Review v5.3 is the (30-minute) Trading Demand Target, which is the time-weighted average of the (5-minute) Dispatch Demand Targets over the half hour:

- Hence, the demand shown here is an output from NEMMCO’s NEM-DE (Dispatch Engine) and not a metered demand. In most cases, the numbers will be very similar, but they will vary from figures quoted elsewhere for “maximum demand”

- This is further explained in the glossary on the NEM-Review portal.

3) Quick Links

As the following table is quite lengthy, we’ve included here Quick Links to each of the 10 years included in the table below:

- March 1999;

- March 2000;

- March 2001;

- March 2002;

- March 2003;

- March 2004;

- March 2005;

- March 2006;

- March 2007;

- March 2008

4) Each Year at a time

In the following table, we touch on the highlights of some of the March months that have passed, since the creation of the NEM.

|

March 1999 |

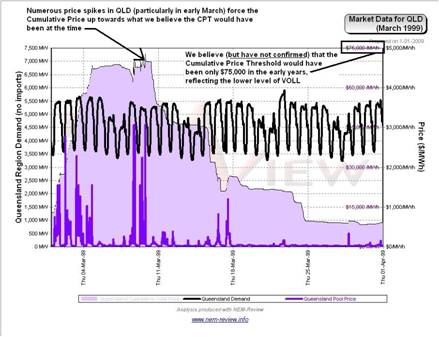

As highlighted in the diagram above, March 1999 saw prices in QLD higher than in the other regions of the NEM. The chart included above (from NEM-Review) illustrates that:

|

|

March 2000 |

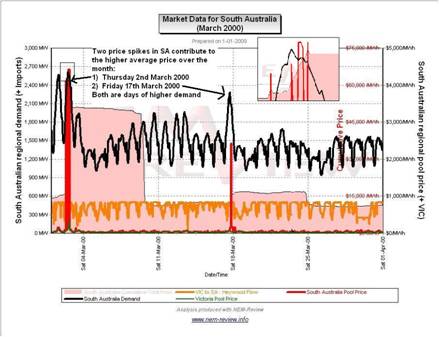

The main chart (above) illustrates that prices in South Australia had climbed higher in March 2000, whilst prices in the QLD region had fallen (coincidentally to around the same level). The chart included above (from NEM-Review) illustrates that two price spikes played a major role in the higher average price. In particular, the price spike on Thursday 2nd March saw prices greater than $1000/MWh for a total of 9 x 1/2-hour trading periods. Once again, in this instance we can see (in the inset on the chart) an indication of demand-side response (or embedded generation) active in the market, with a response of about 60MW shown. |

|

March 2001 |

March 2001 saw:

|

|

March 2002 |

As was also the case in January 2002 and February 2002, prices dropped considerably in March 2002 (compared to the previous year). These subdued prices were due to a number of factors, including:

|

|

March 2003 |

As noted in the chart above, prices were astonishingly low across all regions in March 2003. |

|

March 2004 |

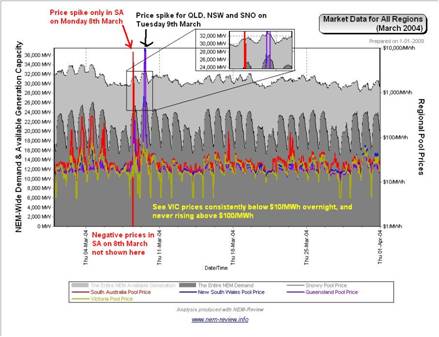

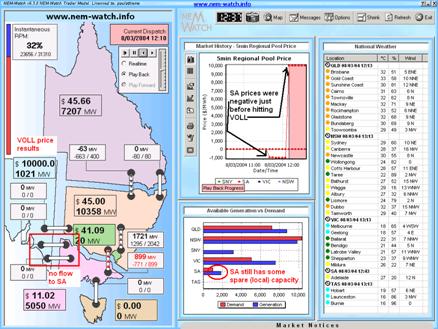

As shown in the main chart (above) prices in March 2004 were significantly higher than in the previous 2 years – in all regions but Victoria. The chart included above (from NEM-Review) illustrates that two price spikes played a major role in this situation for March 2004. 1) The case of 8 March 2004

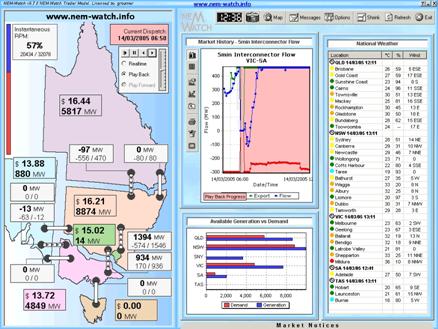

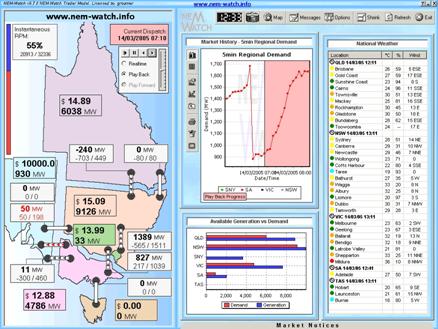

The following chart from NEM-Watch version 5 highlights what was happening in the market immediately after the event. As is seen in this illustration, the price has hit VOLL in South Australia as a result of the islanding of the region, and the loss of load. Note in this image that we had also prepared for Tasmania and Basslink, and also for the introduction of SNI (which did not eventuate). This event has been further reported, and discussed, in the following documents (amongst others):

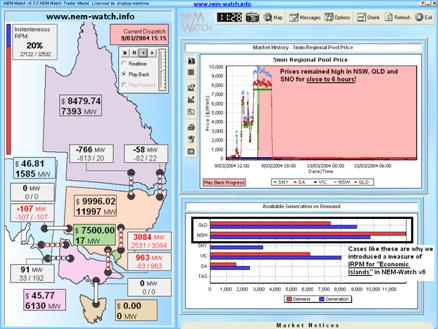

2) The case of 9th March 2004 As noted on the image, this instance illustrates why we have added (within NEM-Watch version 8) the real-time display of the IRPM of the “Economic Islands” dynamically created by constrained interconnectors. In this case, we see the NEM-Wide IRPM (pre-Tasmania) was a very reasonable 20% at the time. However, the surplus generation capacity shown to be present in VIC and SA could have no impact on moderating prices in NSW and QLD because of transmission constraints. With version 8, we calculate an IRPM for the NSW+QLD Economic Island (active for the dispatch interval above) as follows: “Local” Demand = 7393 + 11997 – 3084 = 16,306MW This number is lower than that for the whole of the NEM (understandably) but is still reasonably high – hence there must be other reasons (in addition to simply supply/demand balance) why the price was sustained at a high level for so long. |

|

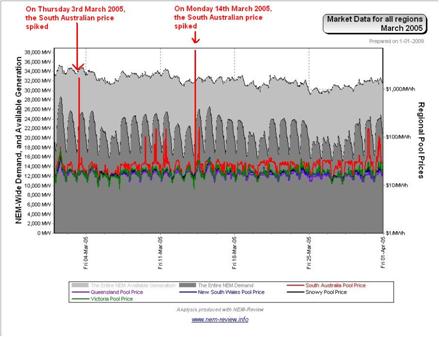

March 2005 |

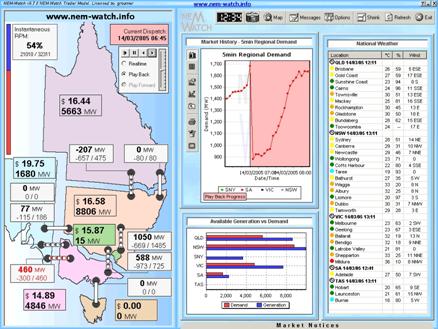

As noted in the chart above, prices were relatively subdued across all regions in March 2005. This was in spite of the fact that the NEM-wide demand (peak, especially) was considerably higher in March 2005 than in March 2004. The above chart (from NEM-Review version 5.3) clearly illustrates why South Australian prices were higher, on average, than those in the other regions for the month. The two price spikes were as follows: 1) The price spike of Thursday 3rd March 2005 2) The price spike of Monday 14th March 2005 From what we understand, the incident occurred when output from the Northern Power Station was automatically (and rapidly) wound back following a nearby transmission fault. Following from this incident, NEMMCO constrained down the flow allowed over the Heywood interconnector (imports to South Australia). As a result of this, prices jumped in South Australia. This situation can be seen through sequential snapshots, taken with NEM-Watch version At 06:45, we see the market in its last “normal” state before the loss of load, the interconnector limit reduction, and the price spike. Five minutes later (06:50) we see a number of significant events occur, as follows:

Twenty minutes later (at 07:10) we see the price at VOLL. Note in this screenshot, we see Heywood back to exporting at 11MW, whereas the flow limit is shown (in NEM-Watch) to be 460MW.

|

|

March 2006 |

As the main chart above shows, March 2006 showed very modest prices in all regions. |

|

March 2007 |

As shown in the main chart (above), prices in March were higher than in the 2 previous years, for reasons including the impact of the drought. This issue was discussed, in more detail, in the review for the month of April. |

|

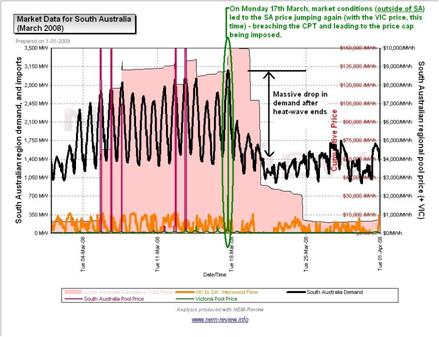

March 2008 |

South Australian’s won’t quickly forget the 15 straight days of extreme temperatures that they had to endure in March 2008. This caused significant issues in the NEM, including the Cumulative Price reaching the Cumulative Price Threshold for the first time in our memory, as shown here: Shortly after this time, we prepared this analysis of what was happening in the SA region over this period. As has been helpfully pointed out by “Apol”, a contributor on WattClarity®, this analysis does simplify some of what happened over the period (in particular with respect to constraints in and around the Snowy Region). |

Be the first to comment on "March in the NEM (a review of 10 years of history)"