As highlighted in Paul’s original article, windfarm output in South Australia reached an all-time record of 1,541 MW just before midnight on Tuesday last week (25th April), during a windy 24 hour period. In this followup I’ll look a bit more closely at this event and some of the actions taken by AEMO to maintain system security in South Australia.

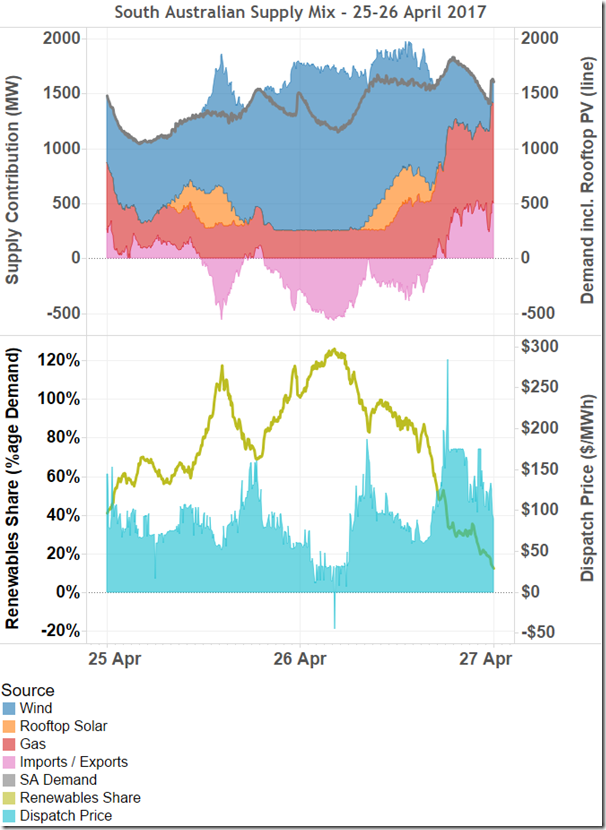

Here’s an overview of the supply mix in SA over the two days, including AEMO’s estimates of rooftop PV production:

Production from renewable sources – large scale wind and small-scale PV (while a number are under construction or planned, no large scale PV plants are operating yet in SA) – dominated the supply mix throughout much of this two day period, with the the renewable contribution to local SA demand above 80% from about midday on Anzac Day through to mid afternoon on April 26 (except for a few hours in the evening peak), and at times exceeding 100%.

The interconnectors between SA and Victoria were therefore mostly exporting power from SA to Victoria over the period, at combined levels of up to 570 MW. Despite these levels of export, overall capacity across the Heywood and Murraylink interconnectors was high enough to ensure that there were virtually no constraints on overall SA to Vic flow, while prices in South Australia remained positive except for a single dispatch interval, and there were no material restrictions on windfarm output (via the “semi-dispatch” process in which AEMO can instruct windfarms to produce at lower than available capability, either to manage network constraints or because prices fall below levels at which those windfarms have offered to produce – generally negative).

However as flagged in Paul’s article, with high wind output and relatively low levels of online thermal generation AEMO did have to take a number of steps to maintain system security.

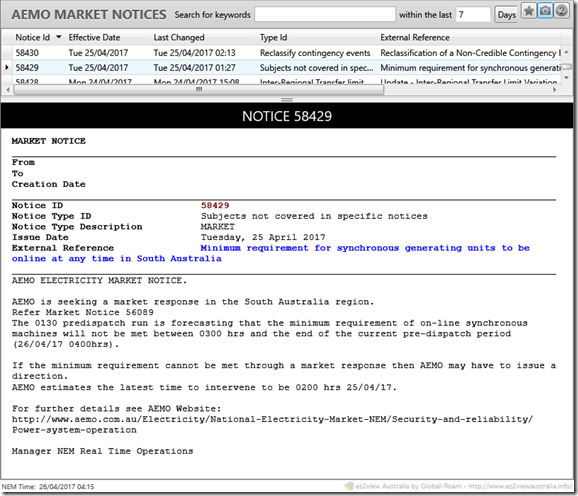

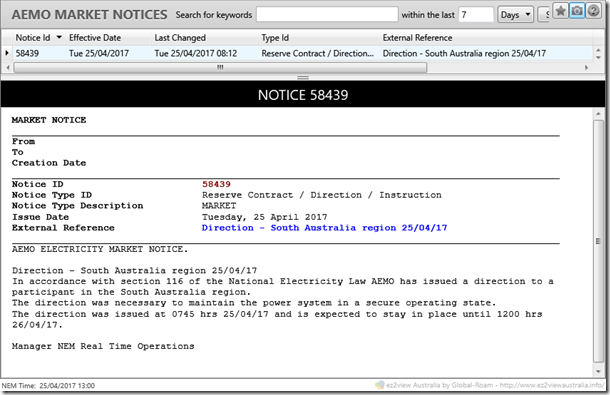

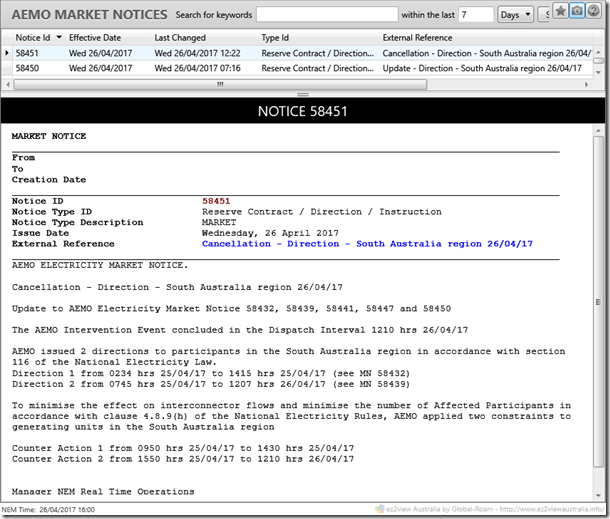

This was first flagged in a Market Notice issued very early on Tuesday morning:

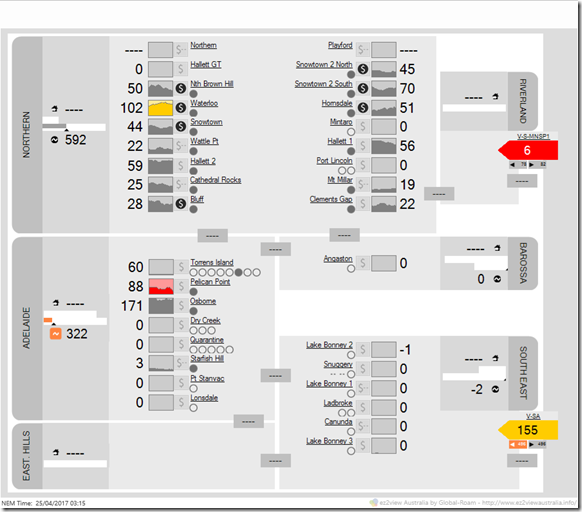

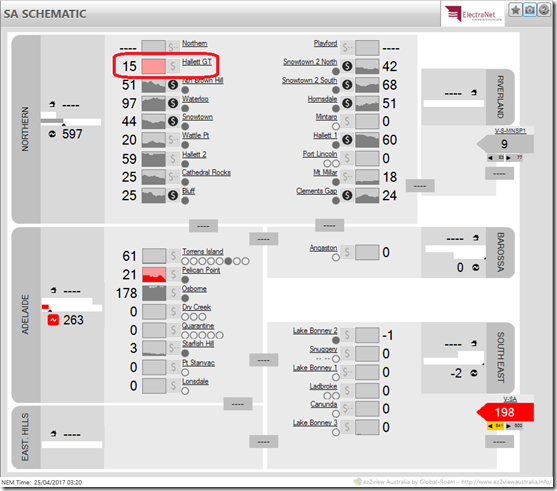

This ez2view schematic view of South Australia for the Dispatch Interval 03:10-03:15 (DI 0315) shows the situation AEMO’s notice was highlighting:

The only thermal units in operation here are one Torrens Island B unit, Pelican Point, and the Osborne cogeneration facility. Pelican Point was in the process of running down before going offline a few dispatch intervals later, in accordance with its previously lodged bids, and had bid itself out of the market for the next “bid day” commencing at 4am, citing the outlook for high wind generation and relatively low spot prices.

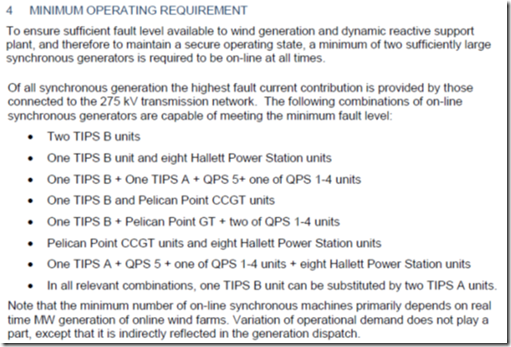

AEMO’s requirements for minimum thermal generation levels in South Australia are quite complex, and related to a technical characteristic of the power system called “system strength” (reflected in what are known as “fault levels”) – you can read all about these requirements in this AEMO document, but the key is this section:

With only one Torrens Island B unit in operation, Pelican Point about to go offline, and Osborne not in the above list (due to its lower connection voltage of 66kV), these requirements were about to be breached. With no response to its call for a ‘market response’ to the impending breach, AEMO directed gas turbine units at Hallett Power Station to start, in accordance with the second configuration in the list above. The result is shown in this schematic for the next DI:

(Although Hallett is offered into the market as a single “aggregated unit”, the station actually comprises 13 physical gas turbines. Eight of these dispatched to minimum load of 2 MW each produce the output shown above and satisfy AEMO’s minimum thermal generation criterion).

The reason for AEMO calling for startup of Hallett, rather than say a second Torrens Island B unit, is that the former are fast-start units capable of coming online at short notice (typically 5-10 minutes), whereas it can take several hours or longer for slow-start units like those at Torrens Island to synchronise to the system. Having called for a market response to the predicted breach of the minimum thermal generation requirement, AEMO’s protocol is to wait as long as possible for that response, then to cover an imminent breach via Direction to fast-start units like those at Hallett.

Hallett continued running at this level until early afternoon on Tuesday 25th April. In the meantime, AEMO had made a Direction to AGL to start up a second Torrens Island B unit:

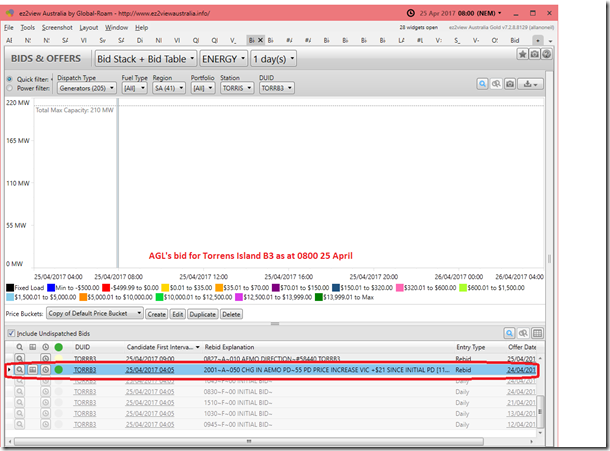

AEMO’s market notice does not specify the Directed party, but the effect of the direction can be seen in ez2view’s ex-post analysis of bids for Torrens Island Unit B3 showing first the bid in place prior to direction, with no output offered:

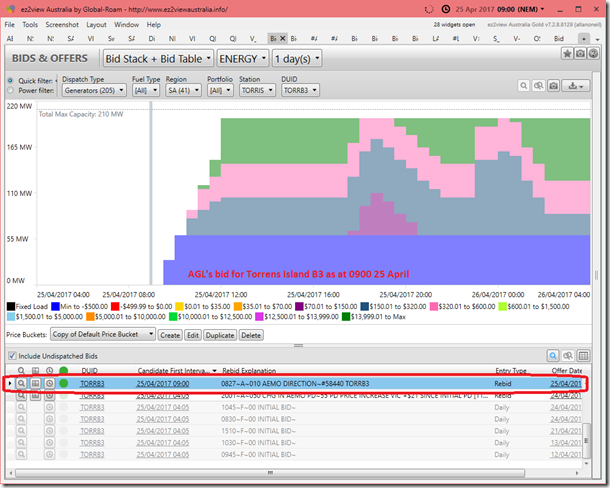

whereas by 9am AGL had lodged a rebid showing the unit coming online from 10am and citing the AEMO Direction (the actual notice of Direction was made at 0745, as shown in AEMO’s Market Notice):

Ultimately it took quite a few hours longer than expected for this second Torrens Island B unit to start and synchronise, hence Hallett continued operating until 14:25.

AEMO’s Direction to AGL remained in place for the rest of Tuesday and was finally lifted at 12:07pm on Wednesday (by which time Pelican Point had come back into the market and AGL had synchronized a third B unit at Torrens Island):

Throughout the period where Directions were in place, AEMO was also limiting output on other South Australian thermal units (at Ladbroke Grove and Osborne) and running a mechanism called “Intervention Pricing” to determine market prices, but the complexities of that topic will have to wait for another post.

About our Guest Author

|

Allan O’Neil has worked in Australia’s wholesale energy markets since their creation in the mid-1990’s, in trading, risk management, forecasting and analytical roles with major NEM electricity and gas retail and generation companies. He is now an independent energy markets consultant, working with clients on projects across a spectrum of wholesale, retail, electricity and gas issues.

You can view Allan’s LinkedIn profile here. Allan will be regularly reviewing market events here on WattClarity. Allan has also begun providing an on-site educational service covering how spot prices are set in the NEM, and other important aspects of the physical electricity market – further details here. |

An excellent article Allan, makes it a lot clearer to the casual market observer like myself. I’d be interested to understand the impact of the intervention pricing on generators, I assume if AEMO constrains them they would be compensated?

Glad you found the article helpful, Ian.

Intervention pricing attempts to calculate what the market price would have been in the absence of AEMO’s direction(s), and is the basis for the prices actually settled financially with spot market participants.

Participants who are directed by AEMO are entitled to be compensated under the market rules, which also contain provisions for adjustments to settlement amounts for other participants whose dispatch was (indirectly) affected as a result of a direction. The details of how these amounts are calculated are complex, to say the least.

Allan