Recently I was asked by Ben Potter at the Australian Financial Review about the “free energy” prediction of others (including software industry luminary Mike Cannon-Brookes) leading to the news article noted here.

As I noted to Ben at the time (as quoted in the article) it is something we’ve been puzzling about for some time, with a number of questions buzzing around collectively in our broader organisation – including what our role might be if such a future should arrive. I’m interested in speaking with people who are also asking the same question (call me on +61 7 3368 4064).

For some of our readers, the following thought framework might be useful…

Q1) What Technology?

First point is not really a question but a statement – in our minds, we’re thinking about Distributed Solar and Storage (though for our purposes in answering the headline question of the article, it does not really matter – and we don’t really care, given we’re technology agnostic).

It is one reason, for instance, why we’ve started tracking the live generation mix for an expanding number of locations in our evolving LiveGen™ widget available here. We’re keen for your input on that one!

Q2) What’s the Total Cost of Energy Delivered?

As our knowledgeable readers will know, there are several components that go together in making up the cost of energy delivered in this future “free energy” world – here’s some brief thoughts on each of them:

2a) Cost of Operations

Let’s start by noting something that should be fairly well accepted – that the short-run marginal cost of generating electricity from an installed panel is close to $0/MWh.

It’s not exactly $0/MWh (as there are costs associated with maintaining the panels, with metering the output and with receiving the non-existent revenue, etc), but it’s close enough to zero that we’ll assume that it’s the case.

2b) Capital Cost

We’ve all, by now, seen the charts plotting on log scale the declining costs of solar panels (and of storage), and which various commentators have used to extrapolate into the future to guesstimate what the cost might be at some precise point in the future.

We’ve all also seen a number of commentaries by various people purporting to either support, or refute (or ignore) these forecasts. Our role is not to get into the detail of which is right, and which is wrong (as all forecasts will prove to be wrong, by definition).

I have made the general observation, however, that there seem to be two different types of perspectives here to be aware of:

(i) people with an energy-sector background and focus (which includes us, and also include many in the “new energy” space) tend to seem to obsess about a particular point in time where this Distributed Solar + Storage scenario achieves notional “Grid Parity” pricing point; whereas

(ii) people with a software industry background and focus (which also includes us) seem to be keen to extrapolate from experience in the IT sector to look past this “Grid Parity” point and see that if the trajectory continues, the capital cost will become low enough as to be effectively $0/MW installed.

… hence, I presume, the initial comment about “zero cost energy” that prompted the call from the FinReview.

2c) Cost of Matching Supply and Demand across Time

One of the shortcomings of comparing calculations of Levelised Cost of Energy (LCoE) is that such comparisons are not really apples-to-apples comparisons across technology types.

Some methods of electricity generation are controllable, and some are not and electricity consumption is not fixed – hence there’s a cost of matching supply and demand over time, which uncontrollable generation sources should be loaded with for a true apples-to-apples comparison.

(i) As we started to explore here, transient Demand Response is not going to be anywhere near sufficient enough to achieve this on its own right across the grid in a 100% solar+wind scenario.

(ii) However massive, routine load shifting, facilitated by large amounts of distributed storage, could well do – but this introduces another technology element for which there is currently significant capital cost, and non-negligible inherited operating cost (e.g. in terms of energy lost through imperfect efficiency).

For argument sake, in this Distributed Solar + Storage Scenario (notwithstanding these questions posed about its dispatch), we’re assuming that distributed storage will also drop close to zero in capital cost – hence meaning a scenario in which cost of energy generated, and matched to demand, is zero.

2d) Cost of Delivery

Given our up-front assumption of a Distributed Solar + Storage Scenario unfolding, we also see an important ancillary benefit in that the cost of delivery of this power is assumed (in this scenario) to be virtually zero as well.

Note that such a scenario (i.e. the disappearance of the grid) would not be without its challenges – some of which would be quite significant (and which are also outside the scope of this thought exercise).

Given we have conveniently already assumed that the capital cost of solar and storage have both, at this point, dropped to virtually nil, we can assume that there’s no cost in over-building to ensure sufficient local surplus of each at each consumption node across (what used to be) the National Electricity Market

Let’s conclude this second question by noting that it may be possible (though our readership will have a diverse range of views about how probable it is) that the cost of energy delivered from our solar + storage scenario might drop down close to zero …. at some point in the future.

Q3) What’s the Total Price of Energy Delivered?

It’s possible (given the right assumptions) that the total cost of energy delivered might drop to zero – it’s more likely that the total price of energy delivered to the (some, or all?) end consumer might drop to zero.

There’s a number of factors to consider in this distinction, which could be summed up by posing the question “Which parties would have an interest in subsidising the cost of energy delivered, such that the end-user pays nothing for the energy delivered?”

3a) Societal subsidies

Without re-entering the rabbit hole of the debate about who’s subsidies are larger on a $/MWh basis, readers will acknowledge that the price the owner of a solar panel receives for their energy generated is currently affected by current subsidies, a situation that looks set to remain for some years to come. Personally I know I’m a significant beneficiary of some very generous subsidies (and very grateful for receiving them as noted back in January 2014).

Under some scenarios, it is possible that the current level of subsidy provided to installers of solar PV might remain the same into the future – and under other scenarios (such as if it became accepted that roll-out of PV needed to be accelerated) the level of subsidy might even increase.

When coupled with the fact that the raw cost of solar PV is declining, if we assume that the layering of subsidised support will at least continue at current levels we can understand that the direct cost (to the consumer) of the subsidised panels will be continue to be below the declining unit cost of production – hence meaning capital cost of solar paid by the end user would approach zero sooner than would be the case if unsubsidised.

This lower cost might lead to higher volume sales and so drive down the cost curve, hence accelerating the transition … (economists amongst our readers might care to comment).

The above assumes the continuation of some form of subsidy at some sort of societal level. This scenario seems plausible – given the history, the concerns about climate change, and given the “distributed solar/storage owners are voters” political argument (witnessed, for instance, in the very effective grassroots campaign orchestrated by the Australian Solar Council and others that resulted in the RET Review quickly deciding that the SRES was sacrosanct).

In addition, there’s another scenario that we’ve been pondering…

3b) Corporate subsidies

We’ve been wondering under what conditions there might emerge a corporate entity (or more than one) that sees a commercial interest in subsidising a massive deployment of distributed solar + storage such that the energy user effectively pays NIL for the energy delivered.

On first brush, our readers might think that’s a crazy idea – but then again…

… we’ve already seen some big retailer tout a “free power weekends” or something of the sort – perhaps there is a reason (i.e. a new business model, a new way to make back their investment) why they might extend that to a “free power all the time” sort of offer. This might be partially backed by a declining cost of solar PV, and partially backed by some other commercial benefit.

What might that be, we wonder…

We could not help but note that some kind of pre-release launch of a particular electric vehicle being greeted by some consumers as akin to the launch of the Beatles lost album, or the second coming of the Messiah, or (after a bit of a wait) a Western Bulldogs flag …

… with the volume of investment funds apparently heading for the energy sector (looking for a home, given other sectors at the dogs) it would seem that there will be a few half-crazy ideas out there that will find the funds to soar – or fade into oblivion.

Q4) What would it be like, if it turns out to be (even close to) true?

This is the most important question we need to be asking ourselves.

Restating from above, we’re striving to remain technology neutral, and not get ourselves bogged down in discussion about factors that are really external to our core focus – which is making complexity understandable in the energy sector.

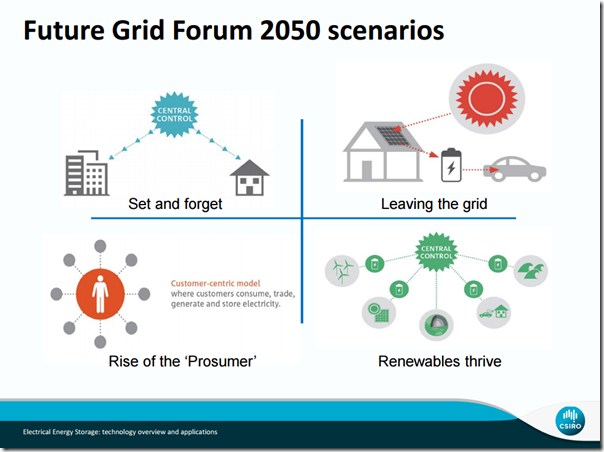

If it were to be true (that distributed solar + storage) massively wins the day, this would map to what the CSIRO described as the “Leaving the Grid” scenario in its Future Grid studies for the Energy Network Association (and others?) – or perhaps, if supply and demand are not quite balanced locally, a “Rise of the Prosumer”:

Under these scenarios (i.e. where the centralised worlds of “Set and forget” and even “Renewables thrive” don’t prevail), we’re asking ourselves what would result…

4a) Massive Stranded Investments would result

Should such a scenario emerge (or even just in part) what’s odds-on is that there will be massive write-offs of stranded investments.

(i) Written off would be all those investments in “big bad coal” and “out-of-touch nuclear” that a number of people on the green/left have been lobbying for for a decade or more. No tears for them, perhaps.

(ii) Written off also would be massive stranded investments in transmission and distribution network assets. Only yesterday I read these comments published on the other side of the country noting that the top of the market (in terms of a time to cash in on regulated asset base) might be now for the still Government-owned Powerlink business (and I would caution that this is only one scenario). Perhaps not many tears, either, from the green/left on this one.

(iii) Also caught up in the transition, however would be the value of all centralised large-scale generation assets – such as large-scale solar and large-scale wind, yesterday’s darlings all effectively stranded under this local supply scenario – should it emerge.

(iv) Additionally it should also be noted that collateral damage would also include other projects focused on scenarios such as (centralised) “renewables thrive” scenarios in the CSIRO diagram above – such as the ARENA-funded AREMI project, which would also turn into a white elephant (at a $3,180,000 project value, small bikkies in the scheme of things – though a personal hit for the people who were associated with the project).

(v) Finally (and closer to home) there are obviously questions for us about what might happen to our current “old energy” business, and the revenues attached to that, should such a future scenario evolve.

Should such a scenario emerge, it’s fair to say that there would be oodles of pain felt very broadly …

… but let’s move past all of these as “transitional adjustments” and think more about what that future might actually look like…

4b) Local dispatch would reign supreme

Under such a scenario, what role for a “National Electricity Market” and all the associated infrastructure? That’s one question we have been thinking through (as, I understand, have others at AEMO and AEMC, etc…)

With Localised Solar, Localised Storage and Localised Demand dominating, it seems plausible that what would be most in demand would be some form of simple dispatch algorithm – something even simpler than the Reposit system given a big plug on this Catalyst show a few weeks ago. What might this be?

4c) What other business models & business needs would emerge?

Something to ponder …

Q5) What would it mean for us?

… as noted to the AFR (and quoted here) this is what we’ve been puzzling about, as part of our scenario analysis for a business that’s been operating in the energy sector for 16 years and which has established some wins over the period.

If such a scenario should emerge, we’d like to have thought it through, and done some preparation (just one of a number of “game change” scenarios we’re exploring)

If you’d like to help us explore this question (and can avoid getting bogged in the detail of whether such a transition will, or should happen, or by when), I’d like to hear from you.

Please call +61 7 3368 4064.

Of course, for our other readers, we look forward to posting observations, commentary and other insights on WattClarity over the coming 16 years as the energy market continues its transition – whichever of the 4 broad scenarios described in the CSIRO image above emerges.

I think the work of Amory Lovins and RMI would be of use here; I’m thinking of “Small Is Profitable” and “Natural Capital”.

Small is Profitable covers off how distributed resources can add value to an existing network so maybe a bit off the end game. “Natural Capital” spends some time discussing the concept of energy as a service, which us how I would see a massively atomised electricity market playing out – even if the energy is free there is still a cost to managing it yourself and there will always be a capital cost. Its not realistic to think even the engaged prosumer will be across the technical details of managing and maintaining their energy source and storage system… there will be a big role for those who can provide the service, trouble free. Whether thats on a unit basis or flat rate like rent will depend on how these things scale.

Thank you for this interesting exploration, Paul.

Given that concerns about climate change were mentioned in 3a, I would propose a Q6 section: “Would it address the need for strong climate action?”

I’ve only been doing energy/climate for a few years but I’ve noticed a severe lack of analysis around the prevailing and near-totally unspoken assumption that intermittent renewable sources + storage = effective climate action. Emphasis is always on the liberation of the consumer or breaking the stranglehold of utilities, with perhaps mention of how clean it would be. Well, how clean exactly?

Earlier this year I finally found some work from Stanford. http://gcep.stanford.edu/pdfs/events/workshops/Barnhart_NEA%20Stanford%20April%202015.pdf As you can see on slide 27 the projected lifetime emissions intensity of solar power supported by the front-runner of distributed storage technologies – lithium ion – is pushing 200 gCO2/kWh (I think “kg” is a typo). There are examples of conventional national and regional electric grids which operate at far lower than this intensity.

So a “rapid decreased in lifetime emissions intensity of Distributed Solar and Storage” would ideally be added to the list of assumptions here.

An interesting question. I expect electricity won’t be “free” for many years, apart from short periods when there is excess from renewables, because there is too much market inertia in the system. A fully off-grid house needs access to sufficient sunlight for house power and probably to charge an electric car. Pay for an up-front capital cost, and the rest is “free”. Suitable for rural and some suburban areas, but there simply isn’t enough sunlight to do this for most apartments. There is little incentive for these sorts of investments in rental properties. Furthermore, residential demand is only about 20% of Australia’s total, so the real action is in the commercial, retail and industrial sectors. These have their own paradigms, and while there is already a good return on investment for solar panels within such businesses, most organisations aren’t set up with the internal investment structure and empowered internal proponents to make this happen. So I would expect a slow gradual decline in grid power demand.

Paul, on your comment re the possibility of corporate subsidies, here’s a link to how the arguments around that are playing out in Kenya:

https://www.greentechmedia.com/articles/read/Could-a-Solar-Giveaway-in-Kenya-Destroy-the-Countrys-Burgeoning-Off-Grid-S

Some of our readers will find this article by Blad Plumer on Vox Energy & Environment provides an excellent discussion of some of the factors that need to be kept in mind relating to forecasts for how much, and how quickly, solar PV costs will decline, as it gains market share.

A very important question and I wonder who has the most to lose and who has the most to gain?

I wonder if this is fair statement

Traditional suppliers/ Distributors = Big loss

retailers/customers/country = Big Win

I don’t know much about the energy markets but this seems like a likely equation. The question is what will the retail market look like, clearly it will need to be more IT savey.

The math is changing, larger wind turbines, can drive water turbines, to pump water uphill, for power storage and do it economically. If we look at the challenges, resource shortages, we can develop ways, of using more plentiful inputs, that’s how economies of scale work.

The cost per kWh, km, gram of protein, compared to a competing method is lower. An electric engine uses 1/5th as much energy, as an internal combustion engine. A solar panel can capture 10X as much energy as a natural plant.

Improve the cost factors, with research and mass production and the inherent physics advantages shine powerfully. Near worthless desert land, producing 10X the energy, of the best agricultural land. Vehicles using 1/5th as much energy, requiring 1/10th as much maintenance.

Moore’s law gave us the tech boom, 1997-2000, until market saturation, gave us the tech crash. Strange as it sounds, in a decade boom, most cars will be self driving electric, most power will be renewable.

But these vehicles will be low maintenance, as will be the solar transistorized power. At market saturation, we’ll need the basic minimum income. Not difficult, with cheap transportation and energy, as well as a doubling of assets, due to Clean Disruption.

A second roaring twenties, taking 3rd world countries, to second world standard of living. Second world countries to first world standard of living.

Solving pollution, noise, transportation, infrastructure problems, in the first world countries. It won’t be paradise, but people, will live to 110 years old.