On Friday afternoon we noted briefly about a ‘(Mysterious and) Large drop in NSW ‘Market Demand’ late afternoon Friday 31st January 2025, prompting questions … part 1’.

Over the weekend several readers have weighed into the mystery, with:

1) With Andrew Wearmouth suggesting it might not be a data error.

2) But HR10 proposing that it was a data error. In particular, it’s worth copying in this comment from HR10 published at 10:56 today (NEM time) as follows:

‘It is a data error – go plot the frequency vs demand. Over-frequency sitting at edge of PFR band from 16:35 when NSW demand starts going crazy, breaks through PFR band around 16:55… and then starts dropping back to normal over course of 17:15 -> 17:20. Ie AEMO had a data/forecasting error such that they were over-procuring generation earlier in the afternoon, and the -1000mw demand drop was taking it back in line with actual demand – over that dispatch interval the surplus generation situation reverts to normal, with frequency dropping back to ~nominal.’

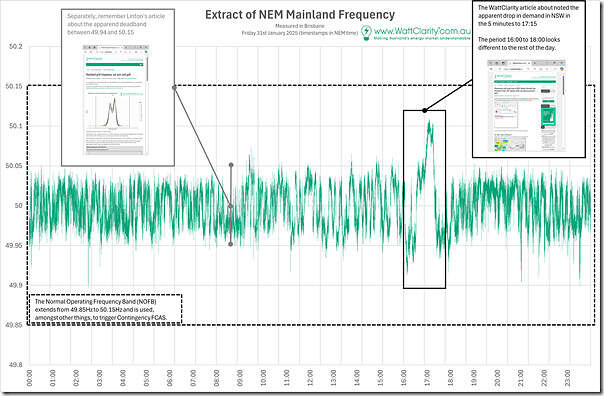

Whilst I’ve not done what HR10 was suggesting (or at least, not yet) I did extract the frequency data from our data logger for the whole of the day (Friday 31st January 2025) and have included here:

With respect to this trend, note that:

1) It’s understandably busy, given the data is at a 100ms timestep – so 864,000 data points just in the day shown above.

2) There are essentially three times of frequency band implicitly at work in the NEM these days:

(a) As noted on the image, throughout the day the frequency did not proceed outside of the Normal Operating Frequency Band in either direction.

(b) As such, it went nowhere near the (larger) Contingency Frequency Range

(c) Also as illustrated on the image, there are plenty of cycles inside what’s effectively a new deadband created by the current implementation of Primary Frequency Response …

i. Linton wrote about this on 11th December 2024 in ‘Mainland grid frequency, cat ears and golf’ …

ii. … which followed his article on 15th November 2024 about ‘NEM Mainland frequency patterns – historical overview from 2024’.

3) If we look past that noise, there’s a distinct difference in pattern that looks to be (by eyeball) from 16:00 to 18:00 (NEM time) on Friday 31st January 2025.

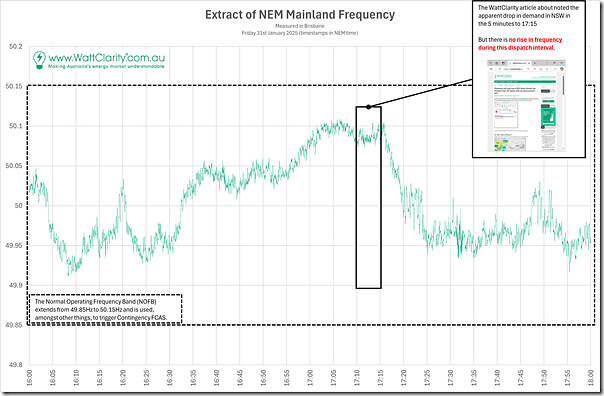

So we zoom into that 2 hour window and see the following:

Now, there are other things that we’ll look into, if we can find the time – but it does appear to me* that there can’t have been an ‘actual’ drop in demand in NSW of that size noted in the first article wholly within that 5 minute dispatch interval (i.e. –937MW in the 5 minutes to 17:15).

* on the assumption that I have lined up the timestamps correctly!

Further:

1) The reason why I think that is that I would have thought that such a large drop (i.e. roughly 3.8% of the total demand on the NEM) in that five minute period would have resulted in a spike in frequency

… with the speed and height of the spike related to the speed of he drop in demand

2) Instead, my new hypothesis (seeing the second chart above) is that there was some sort of data glitch:

(a) Which might have commenced around ~16:30:

i. at which point the AEMO began to see ‘phantom’ demand increase that was not there

ii. hence dispatching more supply than was necessary

iii. hence leading to the rise in frequency

(b) But from 17:15 a correction was made:

i. The phantom demand was removed

ii. The ‘not needed’ supply was ramped back, and frequency reverted to ~50Hz.

3) I note that this is not perfectly aligned with what HR10 suggested in their second comment, but (without delving deeper) seems quite similar.

So that’s where I will leave this article for now…

Leave a comment