Yesterday evening we posted briefly about ‘(Almost completely) out of the blue, an Actual LOR2 … in NSW on Monday 13th January 2025’ with respect to the short-notice ‘Actual LOR2’ condition for NSW on Monday 13th January 2025.

… already this morning (as Part 2 in a Case Study) we have posted ‘The ‘N::N_MNYS_2’ constraint equation and the ‘Actual LOR2’ in NSW on Monday 13th January 2024’ to follow on.

There’s been a bit of internal discussion on one of our Slack channels this morning, with one of our team members noting…

‘Notification in the office went off for LOR1 in the morning then I kept forecast convergence up of NSW/LOR to keep an eye on it

Was odd to see an LOR forecast start less than 12hrs out so was watching with interest’

(my emphasis added).

This team member has summed up why I chose the title of the first article as ‘(almost completely) out of the blue …’!

(A) Emergence of forecast LOR yesterday

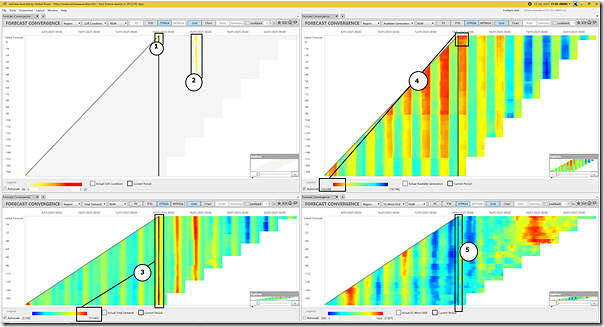

Again with ez2view time-travelled back to 17:50* (NEM time) on Monday 13th January 2025, I’ve copied in an image with a collage of ‘Forecast Convergence’ widgets to show what emerged

* This was the 5-minute dispatch interval within which (i.e. at 17:49:35) Market Notice 123176 (which we noted earlier) was published, notifying the market of an ‘Actual LOR2’ condition.

Remember that this widget allows one to ‘look up a vertical’ in order to ‘see that other dimension of time’.

With respect to the annotations, we see that:

1) At the time-travelled point (and looking back through ST PASA and PD PASA runs), we see that there’s a relatively short (and late) run of forecasts for LORx for Monday evening:

(a) The ‘forecast LOR1’ only emerged in the run for to 07:00 (NEM time) on Monday 13th January 2025

(b) The ‘forecast LOR2’ only emerged in the run for to 16:00 (NEM time) on Monday 13th January 2025

… i.e. under 2 hours prior to the ‘Actual LOR2’ notice.

2) In comparison, at this point looking forwards to Wednesday 15th January 2025 there is already a much longer time range of ‘Forecast LOR1’ for the NSW region on Wednesday evening (i.e. at the end of a hotter day).

… this is more like what we’d normally expect to see.

3) We see with respect to successive forecasts for ‘Market Demand’ in NSW, the level was decidedly modest (only ~10,500MW … so pretty ordinary).

4) With respect to Available Generation, we see that (from the run for 14:00 (NEM time) on Monday 13th January 2025) there’s a drop in aggregate Available Generation of ~550MW

(a) not shown in the image above, but I’ve subsequently filtered down to AvailGen just for NSW coal units in P30 predispatch and see that it drops from 6,580MW (at 13:30 run date) to 6,090MW (for 14:00 run date) … so down 490MW

(b) but I’ve not looked further at which units (or at non-coal units)

5) In the 4th copy of the widget, we see the forecast wind capability was quite modest.

(B) A longer-term view

In the latter editions of GenInsights Quarterly Updates (up to 2024 Q2*) we had added in a more statistical review along the lines of ‘Forecast Convergence’ for all half-hour periods in each quarter.

* due to increased demands on our business from a growing number of software clients (noted in this review of 2024) we’ve become unable to continue providing this service, at least for an interim period. Hence the edition for 2024 Q2 is the last we have produced.

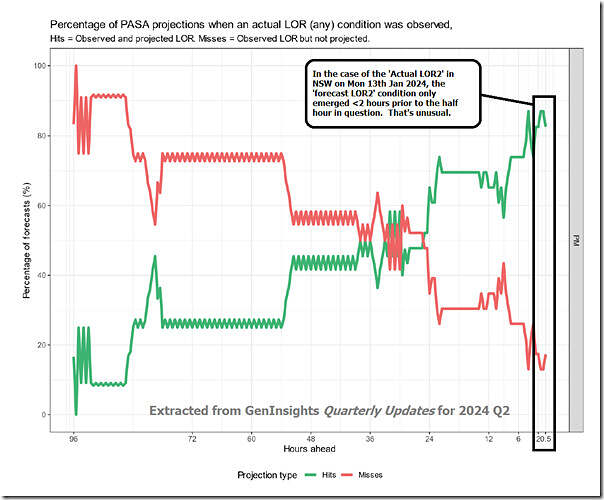

In Section 9.1.2 of Appendix 1 in the report for 2024 Q2 we included this review of forecast LOR2 for the NSW region, starting with this background:

‘It is reasonable to expect that projected LOR conditions will not necessarily eventuate as actual LOR conditions … because the projection is a market signal for an increase in supply availability.

With this in mind, we aim to understand how likely it is that an actual LOR condition is forecast in advance (a ‘hit’) and, the opposite, when the actual LOR condition is not forecast in advance (a ‘miss’).

We assessed hits and misses on an interval-matched basis. For example, a forecast LOR for the 17:30 interval would be a miss if only the 18:00 interval saw the actual LOR. The data is aggregated to NEM-level to dampen the influence of infrequent LOR events in any one region.

The data is split into AM (00:00 – 11:59) and PM (12:00 – 23:59) segments, based on the time-of-day differences in the actual LOR occurrences charted above.

Projections from the short-term PASA are appended to the projections from predispatch PASA to extend the analysis to longer outlooks (4 days). We include LOR1 conditions from the short-term PASA in our analysis, noting that AEMO does not declare forecast LOR events for LOR1 conditions in the ST timeframe.

The following chart presents hits and misses as a percentage of actual LORs (current focused quarter).

We see that the chart does not contain a panel for AM occurrences – there were none.

In the PM timeframe hits were more likely than misses only within 24 hours ahead. This is quite a strong margin and suggests that when LOR1 was forecast (this was the dominant level in the quarter)

there was less ability within the supply fleet to improve availability levels to resolve the reserve shortfall..’

… accompanied with this chart covering all regions:

In this chart, looking at the trend of ‘hits’ we see that 70% of instances were successfully forecast within 24 hours, and over 80% within 4 hours from the point of occurrence

… that’s another way of saying that experiencing an ‘Actual LOR2’ that was only forecast under 2 hours from the point of dispatch does not happen to often.

Whilst this analysis was prepared for 2024 Q2 (as distinct from the 2025 Q1 containing Monday 13th January 2025) we’ve not seen anything to suggest that the pattern has radically changed since that time.

Be the first to comment on "About the short-notice ‘Actual LOR2’ condition for NSW on Monday 13th January 2025 … Part 3 of a Case Study."