It would be no surprise to readers that, at the EUAA national conference last week, that Eraring was a topic of conversation.

(A) The rumours … starting in the Guardian?

The day before the conference (on Tue 30th April 2024) I’d noted how ‘The Guardian writes about possible extension to Eraring ‘for as long as four years’’ … so was not surprised (as I’d expected) to see it discussed over the following days.

(B) Eraring currently in the market

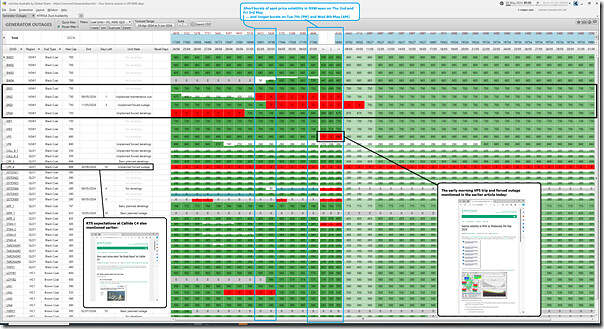

On Wednesday (morning 8th May 2024) when writing about ‘Sunrise volatility in NSW on Wednesday 8th May 2024’, I had noted the following view in the ‘Generator Outages’ widget in ez2view:

It’s taken me all day to finish this article (with plenty of distraction, including with the ongoing run of prices in NSW), and in the meantime Dan has noted some similar things here. This image has been annotated with reference to both:

1) The first article today about sunrise volatility in NSW, in which we noted about the VP5 unit trip; and also

2) The third article today about return to service expectations for Callide C4 amongst other things.

With respect to the image above …

B1) Three Eraring units experiencing unplanned outages recently

However in this article I’d like to highlight the 4 rows for each of the Eraring units, showing that:

1) Only ER01 has performed with high availability for each day over the prior 2 weeks, whilst

2) From Thursday 25th April 2024 we see ER02 running at only partial availability before coming off line for ‘Unplanned maintenance outage’ into Thursday 2nd May 2024 … and which (in the image above) looks set to return soon.

3) We see ER03 coming off for an ‘Unplanned forced outage’ into Friday 3rd May 2024, with return to service perhaps (i.e. being stale data) for Saturday 11th May 2024

4) ER04 is operational currently, but we see if was on an unplanned outage up until Wednesday 1st May.

B2) One factor in recent volatility in NSW

In other articles we’ve written about:

1) A short burst of volatility on Thursday evening 2nd May 2024 … when the EUAA national conference had closed for the day; and

2) Another short burst of volatility on Friday evening 3rd May 2024;

3) A longer burst of volatility yesterday evening, Tuesday 7th May 2024; and also

4) This morning’s burst of volatility – Wednesday 8th May 2024.

5) And plenty of volatility this evening as well.

No doubt there were others, but one common factor across all of these periods of volatility was the unavailability of one or more units at Eraring!

So very topical in the light of rumours of possible extensions.

(C) A refresher on Risk

At this point, worth reminding readers of what we wrote here in 2019 … that Risk is a function of both Probability and Consequence (and that each are somewhat independent).

It’s also important to note that each person’s perception of, and Appetite for, Risk can be different. Makes it difficult when looking for an entirely ‘rational’ explanation of someone’s response to risk … even if they are an Energy Minister!

(D) Responses to the rumours

As noted in this original article, there were a number of media reports at different locations that responded to the rumours. I’d just like to highlight three relevant pieces.

(D1) With reference to the Grattan Report

I’d previously noted that ‘The Grattan report ‘Keeping the lights on’ is worth a read’.

… following that article (including with some attendees at the EUAA national conference) I’d been asked more specifically what I meant by the fact that it was ‘thought-provoking’, so will provide more details as time permits.

Specifically with respect to coal closure, by my read the Grattan Report essentially noted two key things:

D1a) Two eras

In the report they write…

‘The way forward lies in recognising that two distinct eras lie ahead for Australia: the coal closure era, and the post-coal era. The challenges in each of these eras are different, and require different approaches.’ (p3/45)

and paraphrasing (my sense of) what follows with respect to the coal closure era is that the need for Government involvement is high (i.e. don’t worry too much about Rule Changes specifically focused on coal, as they take too long and would be too dependent on the changing appetite for risk at the Government).

‘Given the time imperative, governments and industry should accept this as a period of muddling through’ (p32/45)

Their term ‘muddling through’ is used several times in the report.

Accept it will be messy.

D1b) Coordinate coal unit closures (by direct Govt intervention), as a form of insurance

In the report they write…

‘Use direct mechanisms with coal generators to provide insurance against early or delayed closure that creates major risks of blackouts and price spikes, or uncertainty for renewables investors. These mechanisms should maintain momentum on emissions reductions and avoid shifting excessive risks from operators to governments and consumers, while being clear and transparent to the market.’ (p4/45)

… and also

‘Ensuring the lights stay on requires getting timely entry of enough new capacity of the right type. Ideally, new assets (renewables, gas, and storage) need to be in place before old ones (coal) exit, so there is no gap in supply. But the current NEM design does not encourage entry before exit. And these new assets need to be able to efficiently connect to the grid in order to dispatch their energy. An added benefit of coordination is that it prevents an extended period of high wholesale prices, such as we saw in the late 2010s. The current market design makes such coordination difficult. ’ (p15/45)

… and also

‘Some form of closure insurance seems likely and it might be a pragmatic, if blunt, solution. Whatever the model, it should avoid shifting excessive risk from operators to governments, and its operation should be transparent to the market. It should also avoid creating perverse incentives for coal-fired power station owners to bring their closure dates forward in order to get subsidies.’ (p35/45)

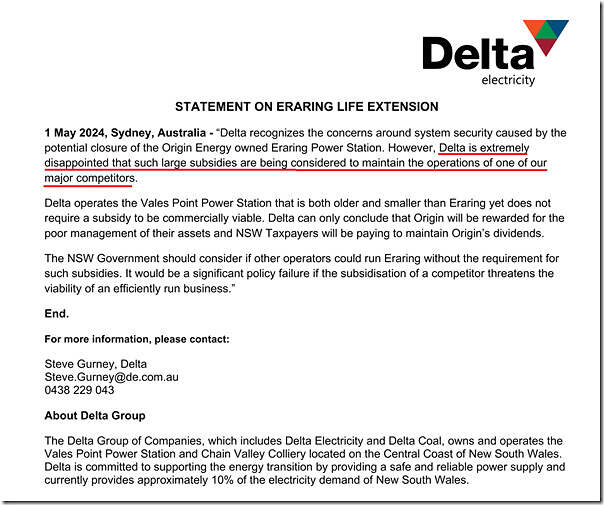

(D2) Response from Delta Electricity

Well, what Grattan has written (in terms of facilitating orderly exit of coal) might sound easy if one reads it quickly, however last week we saw an early example of why the reality is going to be more complicated … and why ‘muddling through’ is going to be the codeword for this ‘coal closure era’.

Roughly 24 hours after rumours surfaced in the Guardian, another NSW-based coal fired generator (Delta Electricity) posted this response on social media:

This response from Delta was reported by Colin Packham in the article ‘NSW-backed extension of Eraring is reward for Origin’s mismanagement, Delta Electricity says’ in the Australian on Wednesday afternoon 1st May.

… and was probably noted elsewhere as well.

Same sorts of responses to that noted in March 2021 when news broke about the confidential ‘safety net’ provisions to keep Yallourn operating till mid-2028.

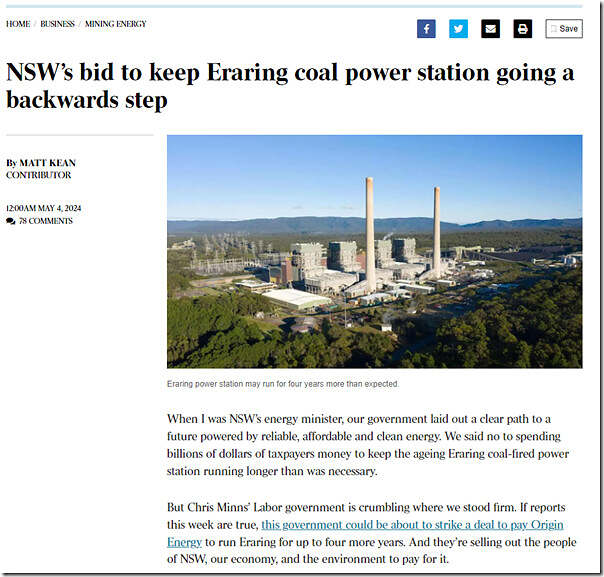

(D3) Response from Matt Kean

Amongst the many other responses to the Eraring extension rumours, I’d like to highlight one other piece – being the response ‘NSW’s bid to keep Eraring coal power station going a backwards step’ by former NSW Treasurer Matt Kean:

For those who have access, the article is well worth the read. Amongst the other things Matt has written, he says this:

‘The independent advice I received as energy minister was that if we delivered the Waratah super battery, and several other projects, we could keep the lights on without slugging taxpayers for the cost of propping up Eraring.

If the situation is different now, then the very least the Minns Government could do is come clean to NSW taxpayers about what has changed, rather than negotiating in secret with Origin Energy.’

Whilst I have some concerns (perhaps more than Matt) that everything will go smoothly if Eraring closes all 4 units as currently indicated in August 2025:

1) I do agree that it would be very much desirable that the advice on which any decision to extend is made should be made public (along with the method of support)

2) Though I am also doubtful that either will be released in the public domain.

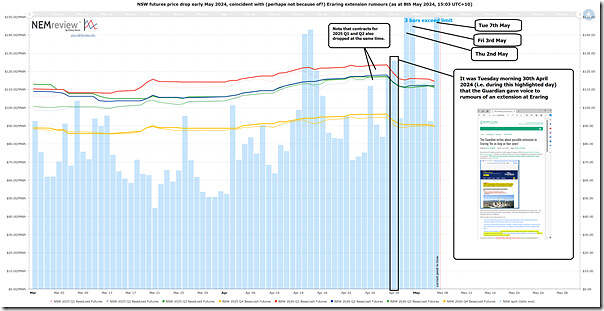

(E) Spooking the futures market?

I’ve a recollection that someone at the EUAA national conference last week also mentioned that the futures market had marked down NSW Base Load contracts on the back of the rumours of an extension to Eraring … but can’t recall who that was.

Out of curiosity I used NEMreview v7 to put the following trend together:

Those with their own licence to the software can open their own copy of the query here.

There certainly does seem to be a drop in all of the 8 x Base Load contracts I have selected that is coincident with the rumours being published at the Guardian, and hence circulated on WattClarity and elsewhere.

However I wonder if this was the only trigger … as we see that Base Load contracts for 2025 Q1 and 2025 Q2 also dropped at the same time?

Given Eraring was always assumed to be available on those quarters, I don’t immediately understand why news of an extension to operation through 2025 Q3 and beyond that would have fed into the futures market (though never say never, as it does trade on sentiment, amongst other things!).

(F) Watch this space

More to come soon, it seems …

Leave a comment