As noted here yesterday, at 17:00 yesterday the AEMO announced (via Market Notice) its intention to possibly dispatch Reserve Trader into the market, and hence trigger Intervention Pricing.

Today turned out to be quite an interesting (and challenging) ride. Through the day I posted a number of images on Twitter here which I’m not going to copy into this post (so refer to the link if you want to see more).

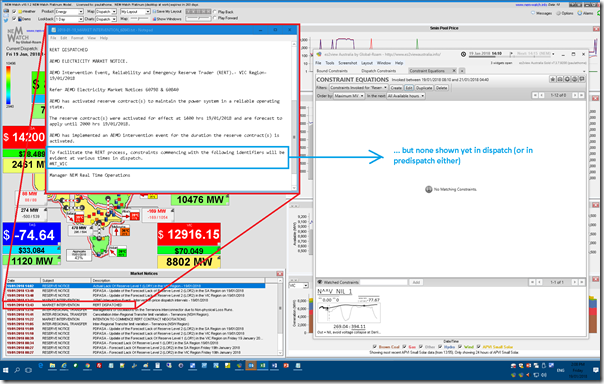

As one of a number of developments in the market, at 13:43 today the AEMO announced (again via a Market Notice, which is copied in the following image mash-up (combination of NEM-Watch and ez2view screenshots) that the Reserve Trader Contracts were activated:

In the Market Notice AEMO indicated to watch constraints with an identifier or “#RT_VIC”, and we did with the “Constraint Equations” widget within ez2view. However we did not see anything – hence suggesting that AEMO did not actually have to dispatch any response (though it will have incurred costs for having it on standby because of the Availability payments).

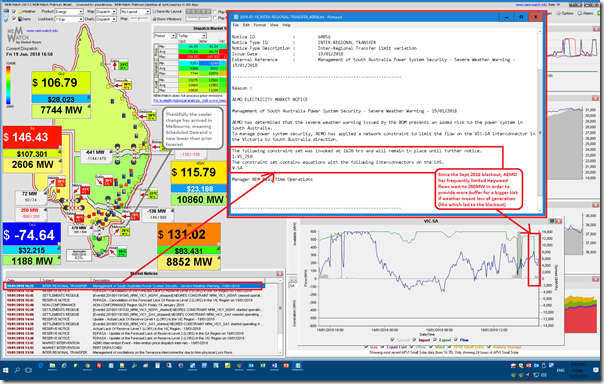

We might have time to dig more next week, but just want to also flag that (at 16:25) the AEMO had to add another layer of complexity into the mix, in limiting flows west on Heywood (i.e. VIC to SA) to provide more of a buffer in the SA region resulting from the BOM’s Severe Weather Warning for the state. This is one of the measures implemented following the Blackout of September 2016 (an occasion where additional headroom on the interconnector might have been enough to provide a bigger kick when the wind farms simultaneously tripped out to avoid the system black).

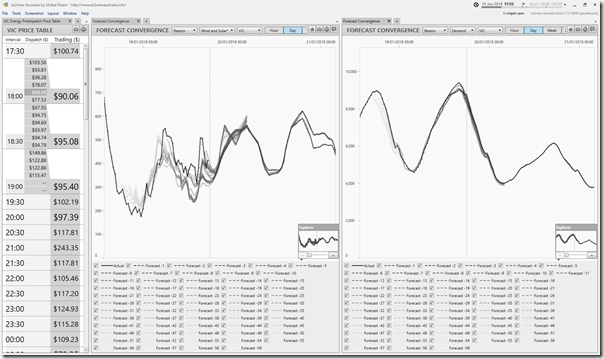

Thankfully the cool change has come through Victoria at this point, meaning that levels of Scheduled Demand had begun turning out lower than the AEMO had initially forecast them to be – as shown in the snapshot here from ez2view:

More later, if time permits…

Leave a comment